Starting and continuing conversations for the business community

By Jomarc Angelo M. Corpuz, Special Features and Content Writer

BusinessWorld has been a vanguard of Philippine business journalism since its establishment in 1987. By keeping true to its core values of accuracy and innovation, the oldest business paper in Southeast Asia has grown to become a leading authority in economic and financial reporting as well as a uniting figure for the Philippine business community.

The publication has evolved from a traditional print-based outlet to a trusted multimedia platform accessible through different mediums such as print, online, social media, and podcasts. Beyond these channels, BusinessWorld extends its role into a venue for high-level dialogue that seeps into boardrooms, policy discussions, and strategy sessions across corporations in the Philippines.

Foremost of these community-gathering fora are the Economic Forum and the Forecast conference held every May and November, respectively, coupled with Insights fora held throughout the year.

At BusinessWorld’s Economic and Forecast fora, leaders and decision-makers from both the private and public sectors are brought together to confront economic realities, as well as the gap between the Philippines’ long-standing potential and the progress that has yet to materialize.

“The theme of how to make that promise happen is the common thread of all our BusinessWorld events. Our country has also been tagged internationally as the next big thing, but midway through the 2020s it has never happened. That’s why our intent to push for economic factors to happen is the conversation of this to take the front seat,” BusinessWorld Executive Vice-President Lucien C. Dy Tioco said.

Vice-President for Sales and Marketing Jay R. Sarmiento added that these fora’s key themes consistently focus on the most pressing issues for the Philippine economy and the business community.

“While specific topics vary from year to year, some standout and recurring themes were: digitalization and technology; sustainability and the environmental, social, and governance (ESG) standard; economic resilience and recovery; green economy; and the transition to clean energy,” she explained.

She also emphasized the two fora’s ability to address the most pressing and relevant issues facing the economy, saying that stakeholders’ feedback often points to the discussions being “intelligent and thoughtful” and providing a “deeper analysis” of critical issues.

“A recurring theme in the feedback is the forum’s role in ‘bridging the gap’ between the private and public sectors. The events are valued for providing a venue where policy makers and business leaders can have a direct dialogue, identify pain points, and work together to push for solutions. This collaborative environment is highly appreciated by attendees who are keen on contributing to national development,” she said.

“The caliber of our high-level and influential speakers is the key differentiator… as they provide a rare opportunity for attendees to hear directly from and engage with the people who are shaping policy and business strategy in the country,” Ms. Sarmiento added.

This year’s Economic Forum, carrying the theme “Unlocking Philippines’ Potential,” gathered policy makers, economists, top executives and business leaders to discuss how the Philippines moves from potential to performance, and from promise to permanence.

The forum was headlined by Department of Economy, Planning, and Development Secretary Arsenio M. Balisacan, who delivered a keynote address regarding “The Philippines at An Inflection Point;” ASEAN+3 Macroeconomic Research Office Country Economist for the Philippines Dr. Andrew Tsang, who offered an external perspective on this current inflection point; and Special Assistant to the President for Investment and Economic Affairs Frederick D. Go, who emphasized points for optimism in the Philippine economy despite all the challenges facing the global economy.

Other topics discussed during the event included “Building an Inclusive and Resilient Future for the Philippines,” “Elevating Energy Transition in the Philippines,” and “Tariffs, Trade, and Trump: How a Second Term Could Hit the Philippines.”

Besides Economic and Forecast fora, BusinessWorld has also captured the attention of the business community, industries in particular, through its regular BusinessWorld Insights events. Recent editions of the series had topics that tackled the country’s healthcare system, stock market outlook, and energy prospects.

Last January, the Insights forum on healthcare featured Emmanuel R. Ledesma, Jr., president and chief executive officer of the Philippine Health Insurance Corp. (PhilHealth), as keynote speaker. Executives and health advocates from Philippine Alliance of Patient Organizations, The Medical City, mWell, Alaga Health, Romlas Health Group, and UP Manila Standards & Interoperability Laboratory were among the panelists.

Last January, the Insights forum on healthcare featured Emmanuel R. Ledesma, Jr., president and chief executive officer of the Philippine Health Insurance Corp. (PhilHealth), as keynote speaker. Executives and health advocates from Philippine Alliance of Patient Organizations, The Medical City, mWell, Alaga Health, Romlas Health Group, and UP Manila Standards & Interoperability Laboratory were among the panelists.

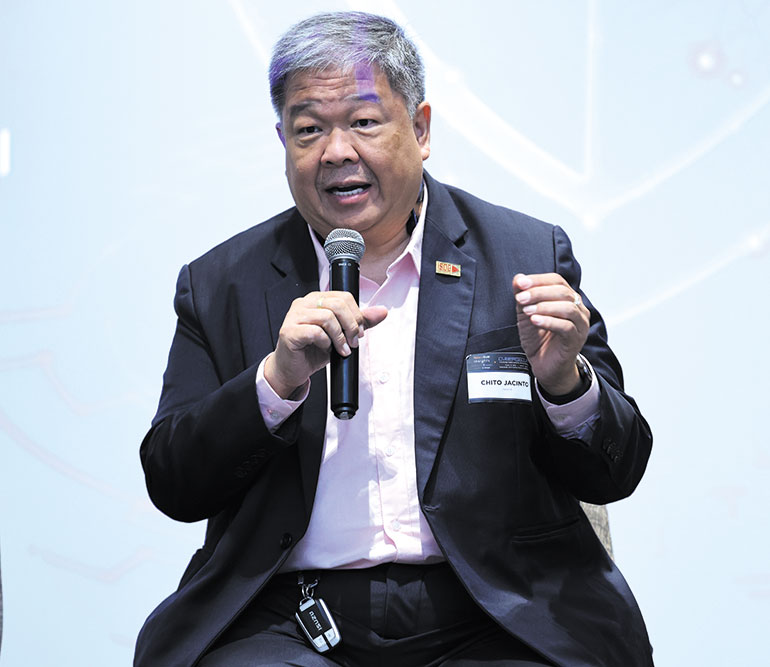

In February, the Insights event on the Philippine stock market welcomed Department of Finance Assistant Secretary Neil Adrian S. Cabiles, who delivered a keynote address on “Strengthening Market Resilience in the Pursuit of Growth in 2025.” Experts from COL Financial Group, Sun Life Investment Management and Trust Corp., First Metro Securities Brokerage Corp., Unicapital Group, and BDO Securities Corp. shared their outlooks and insights into the local bourse.

Meanwhile, the April installment emphasized that efficiency and conservation are crucial to attaining energy security. National Electrification Administration Administrator Antonio Mariano C. Almeda and Deputy Administrator for Technical Service Engr. Ernesto O. Silvano, Jr. discussed the challenges and opportunities in the energy supply chain. Chiefs from the Philippine Energy Efficiency Alliance and Meralco PowerGen Corp. further explored the aforementioned topic.

Last August, BusinessWorld Insights kick-started its three-part Cybersecurity Series with a discussion on how organizations can foster a security-first culture to thrive in today’s high-risk digital environment. Through this series, which will culminate into a Cybersecurity Summit next year, BusinessWorld underscores that safeguarding information, individuals, and organizations in the digital world is just as critical as securing economic growth.

“It needs attention because cybercrime has been increasing year on year which can threaten big and small businesses and eventually the economy. BusinessWorld wants to start the conversation in securing a cybersafe environment with the active involvement of private, government, and the consumer,” Mr. Dy Tioco said.

Building on this urgency, the next phases of the series will gather key voices from both the public and private sectors to dive deeper into the nation’s cybersecurity landscape.

This November, meanwhile, the upcoming Forecast 2026 forum seeks to shed light on the global challenges the Philippine business community should brace for and the prospects to optimize for the year ahead.

This November, meanwhile, the upcoming Forecast 2026 forum seeks to shed light on the global challenges the Philippine business community should brace for and the prospects to optimize for the year ahead.

The forum intends to help attendees make sense of the shifts that businesses currently undergo — from digital disruption and green transition to demographic shifts among the workforce and consumers.

Top executives are invited to discuss the future of Philippine industries and new opportunities for growth in the midst of disruptions, while industry experts and thought leaders are expected to take deep dives into the macroeconomic outlook, artificial intelligence, the local legal space, and the country’s trade landscape, among others.

As the Philippine business community navigates an ever-changing and often-disruptive landscape, BusinessWorld continues to serve as a reliable guide not only in print or online but on ground.

“Always, BusinessWorld reasserts its mighty clout within the business community, and its unparalleled business intelligence is stronger than ever,” Mr. Dy Tioco said.

Set up your laptop in an open-air space at the resort, where the fresh island breeze and panoramic ocean views boost your creativity. Whether you are attending virtual meetings or racing against deadlines, you will find that the resort’s poolside loungers and pristine beachfront transform work into a delightful experience. For those moments when you crave tranquility, retreat to the resort’s lush garden and soak in the stunning views all around you.

Set up your laptop in an open-air space at the resort, where the fresh island breeze and panoramic ocean views boost your creativity. Whether you are attending virtual meetings or racing against deadlines, you will find that the resort’s poolside loungers and pristine beachfront transform work into a delightful experience. For those moments when you crave tranquility, retreat to the resort’s lush garden and soak in the stunning views all around you. If you prefer cozy and luxurious space, the exquisitely designed rooms and suites at Astoria Boracay are perfect for you. Each accommodation offers stable internet, spacious desks, and modern amenities tailored for today’s professionals.

If you prefer cozy and luxurious space, the exquisitely designed rooms and suites at Astoria Boracay are perfect for you. Each accommodation offers stable internet, spacious desks, and modern amenities tailored for today’s professionals. When it is time to collaborate, Astoria Boracay’s meeting spaces are equipped with modern facilities that cater to both hybrid and in person gatherings. Choose from three function rooms: Cerulean Ceylon, Cerulean Blue, and Ceylon Blue. Each room is equipped with audio-visual technology and offers flexible seating options to suit your needs. Host your team meetings in comfort, accommodating groups of 30 to 80, and ensure that productivity remains a top priority.

When it is time to collaborate, Astoria Boracay’s meeting spaces are equipped with modern facilities that cater to both hybrid and in person gatherings. Choose from three function rooms: Cerulean Ceylon, Cerulean Blue, and Ceylon Blue. Each room is equipped with audio-visual technology and offers flexible seating options to suit your needs. Host your team meetings in comfort, accommodating groups of 30 to 80, and ensure that productivity remains a top priority. After wrapping up your day’s work, let the charm of Boracay’s water sports draw you just outside the resort. If

After wrapping up your day’s work, let the charm of Boracay’s water sports draw you just outside the resort. If  Wind down with a hearty buffet of international and local fresh cuisines at

Wind down with a hearty buffet of international and local fresh cuisines at