Now’s the time to welcome new beginnings at SMDC’s Dawn Residences

Start fresh and start now to maximize investment returns

Property consulting firm, Colliers Philippines, signaled optimism on the recuperation of the real estate industry, expressing its hope of a gradual “V-shaped” recovery expected to take off this year.

The group anticipates a bounce-back in residential demand on the strength of rising vaccination rates, macroeconomic recovery, and sustained remittances from Filipinos working abroad, among other factors. Supporting the rosy outlook is the Bangko Sentral ng Pilipinas’ Residential Real Estate Price Index, which showed an uptick in the price of residential formats, attributed to “stronger consumer demand, particularly [for] townhouses and condominium units.”

What this all adds up together is the perfect time to start tapping into properties positioned to yield lucrative returns. A prime example is SM Development Corporation (SMDC)’s newly launched development in Laguna, Dawn Residences. An idyllic vertical garden community, Dawn Residences presents residents and investors a chance at a new beginning, and a lease on a new life: the ‘Good Life.’

Capture a wide rental market with first-rate city offerings, and endless employment or business opportunities

When it comes to sustainable living, SMDC raises the bar with master-planned integrated communities that posit a convenient, low-carbon footprint lifestyle. Situated between “The Enterprise City of the Philippines,” Cabuyao, and “The Lion City of South Luzon,” Santa Rosa, Dawn Residences offers abundant employment and business opportunities, along with the much-coveted 15-minute city living.

Driving one’s kids to school in Santa Rosa, for instance, or reporting to work in Cabuyao for industry giants like Nestle and Procter & Gamble, are both quick 15-minute drives. Fifteen minutes, too, is what it takes to access South Luzon Expressway to either catch a flight at the Ninoy Aquino International Airport, or go to the beach for that much-awaited weekend with family.

With tons of career, livelihood, and social opportunities, in both Santa Rosa and Cabuyao, SMDC’s Dawn Residences is not only an agent of personal growth. It also unlocks a wide rental market that includes everyone — from established families to local upgraders.

Turn a new leaf at a promising location

The role of infrastructure development in the overall growth of a community cannot be overstated. Better infrastructure comes easier pathways to doing business, which drives economic development and, in turn, improves the locality’s quality of life.

Investors at SMDC’s Dawn Residences are set to benefit from Laguna’s manifold infrastructure projects in the pipeline. One of which is the Laguna Lakeshore Road Network Project on the western shore of Laguna de Bay, set to unlock more convenient connections between the southern areas of Metro Manila and Laguna.

The new road network is expected to provide a faster alternative to motorists, and likewise boost the economies of Laguna, Rizal, Quezon and Batangas. The project will have interchanges in Sucat, Alabang, and Tunasan in Muntinlupa, as well as in San Pedro, Biñan, Calamba, Santa Rosa, and Cabuyao in Laguna.

A new dawn rises with sustainable investment

SMDC’s expertise, unwavering commitment, and vision of a sustainable world founded on the three pillars — social, economic, and environmental — have, all together, made it an undisputed authority on community building. For Dawn Residences, this translates into features that pay importance to life’s smallest joys.

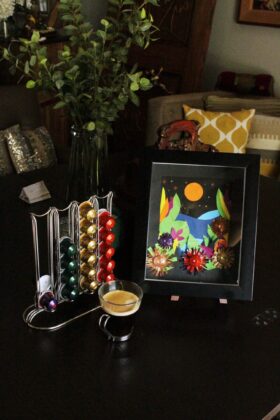

For one, the buildings’ thoughtful and nature-friendly design allows natural light and airflow to permeate throughout the development, providing residents a fresh and very comfortable life in their community.

Clear waters in the resort-style swimming pools invite you to refresh as the sunlight filters through the trees.

Sports and recreation amenities, on the other hand, give families opportunities to bond after a busy week.

Top that off with a vast expanse of greeneries, linear parks, and the rustic charm of Laguna — all entrancing residents, both young and old, to a realm that soothes the spirit and strengthens the mind and body.

With minimal capital investment and huge returns – especially as property prices rise, and pandemic-induced record-low interest rates surface – buying a home at Dawn Residences right now presents a fortuitous start. Its premium location, along with it being a complete and connected development, will surely command exceptional value and capital appreciation over time.

True to the title they hold, PropertyGuru Philippines Property Awards Best Developer, SMDC, provides comprehensive property management services and end-to-end leasing services to give you a worry-free investment experience.

Whether you decide to have your unit leased, to convert it as a serviced apartment, or to make it your new home, you are assured that it’s an investment to witness the many, many beginnings you have yet to have throughout the course of your life.

Follow SMDC on Facebook, Instagram, YouTube, and Twitter, or visit the SMDC website to learn more about Dawn Residences.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.