ECCP: PHL to attract ‘billions’ after easing investment caps

THE European Chamber of Commerce of the Philippines (ECCP) is expecting the Philippines to attract “billions” worth of investments after various industries were cleared to receive up to 100% foreign ownership.

ECCP President Lars Wittig said at a launch of event in Makati City on Thursday that the group is expecting “billions of dollars” worth of foreign direct investment into industries like renewable energy (RE).

The ECCP said investment will be unlocked by the Department of Energy’s green light to relax foreign ownership caps in RE, as outlined in Department Circular No. 2022-11-0034, as well as the amendments to the Foreign Investment Act, Retail Trade Liberalization Act, and Public Service Act.

Mr. Wittig said that there should be an increased efforts to create green and resilient infrastructure, and to prioritize the wellness and education of the workforce.

Mr. Wittig made the remarks at the launch of its investment guide, “Doing Business in the Philippines 2023,” prepared in partnership with attorneys from DivinaLaw.

The guide updates the previous edition released in 2020.

“The Doing Business in the Philippines publication gives vital information to investors seeking to expand in or enter the Philippine market,” Mr. Wittig said.

“As a valuable resource for businesses interested in exploring opportunities in the country, this booklet aims to arm potential investors with knowledge of the Philippine business environment as well as relevant laws and procedures, empowering businesses to make informed investment decisions,” he added.

Mr. Wittig called for the maintenance of a “sound regulatory environment” and to streamline government processes.

“The ECCP has actively advocated for the development of physical and digital infrastructure for investment facilitation, as well as the creation of a competitive fiscal incentives regime, further economic liberalization, and the strengthening of the sanctity of contracts. Such reforms are imperative to attain a more competitive, fair, and more inclusive business climate in the country,” Mr. Wittig said. — Revin Mikhael D. Ochave

‘Hot money’ flows turn net positive in 2022

FOREIGN portolio investment funds entering the Philippines outweighed those exiting in 2022, the Bangko Sentral ng Pilipinas (BSP) said on Thursday, representing a turnaround from the net outflow posted in 2021.

Foreign portfolio investments registered with the central bank through authorized agent banks (AABs) posted a net inflow balance of $886.7 million last year, against the net outflow of $574.46 million in 2021.

Foreign portfolio investment is known as “hot money” because of the ease with which they can enter or exit a jurisdiction, as opposed to foreign direct investment, which is considered stickier and less fickle.

The net inflow was the largest since the $1.2 billion posted in 2018. However, it missed the BSP target of $3.5 billion for 2022.

“Hot money inflows were supported by the better economic outlook at the end of last year,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

“(Easing) inflation in the US led to expectations of smaller rate hikes in 2023, providing a much-needed boost to the US equities market,” she said.

She also noted that Philippine Stock Exchange (PSE)-listed securities registered gains following corresponding international market movements.

The US consumer price index (CPI) slipped 0.1 percentage point month on month in December, the first decline since May 2020 and following a 0.1 percentage point rise in November. Year on year, the CPI rose 6.5%, easing from the 7.1% posted in November.

The Federal Reserve raised borrowing costs by 425 basis points (bps) last year, which brought the Federal funds rate to 4.25-4.5%. The Fed will hold its first policy review for this year between Jan. 31 and Feb. 1.

In December, the Philppine hot money balance was a $92.95 million net inflow, much lower than the $488.75 million inflow in November. A year earlier, hot money posted a $4.38 million net outflow.

Gross inflows in December amounted to $1.092 billion, down 17.9% year on year, but up 3.6% from November.

Over the full year, gross inflows declined 9.4% to $12.34 billion.

Gross outflows in December totaled $999.12 million, down 25.2% year on year and up 76.6% from November.

This brought the full-year gross outflow to $11.46 billion, down 19.2%.

Five countries accounted for 80.5% of short-term foreign investments in December — the UK, Singapore, US, Luxembourg, and the Netherlands.

Some 74% of their investments went to PSE-listed holding firms, telecommunications, banks, property companies, food producers, as well as beverage and tobacco makers. The remaining 26% was invested in government securities.

“Investors were possibly more bullish on emerging economies as the monetary tightening cycle is about to end for most economies. Risk-on sentiment was observed not just in the stock market but also in the foreign exchange market,” Ms. Velasquez said.

“The sudden reopening of China will be positive for hot money in 2023,” she added.

The BSP hiked its key policy rate by 350 bps to a 14-year high of 5.5% in 2022.

BSP Governor Felipe M. Medalla is looking at more rate increases in the first quarter to ensure that inflation falls within the 2-4% target by the second half.

Headline inflation rose to 8.1% in December from 8% in November, bringing average inflation in 2022 to 5.8%, the highest in 14 years.

The BSP expects hot money to post a $5 billion net inflow in 2023. — Keisha B. Ta-asan

Galunggong imports below quota as end of closed season nears

IMPORTS of round scad, known as galunggong, topped 25,000 metric tons (MT) as the closed fishing season neared its end in northern Palawan, the main fishery for the species.

Imports of 25,056.27 metric tons (MT) amount to over half of the target volume during the closed season, according to the Bureau of Fisheries and Aquatic Resources (BFAR).

The BFAR said imports were authorized starting November, as a measure to keep prices from rising while domestic fishing was suspended.

Regulators periodically shut down fisheries in order to allow fish stocks to regenerate.

The BFAR did not discuss why the import target was not met.

Galunggong is widely eaten as a source of protein by low-income families, and high prices of the commodity are deemed politically sensitive.

The BFAR said actual imports of frozen galunggong, bigeye scad, mackerel, bonito, and moonfish for wet markets have been within the volumes authorized when the Certificates of Necessity to Import (CNI) were issued.

CNIs were issued by the Department of Agriculture on Nov. 10 and are good until Jan. 31 this year.

The three-month closed fishing season was implemented annually since 2015 to “give the species time to reproduce and grow during its spawning season and to ensure sufficient supply of galunggong in the country.”

“Despite the on-going implementation of the closed season, the price of galunggong remains stable with local galunggong valued at P280/kilo while imported galunggong ranges from P220/kilo to P240/kilo,” BFAR said.

Palawan accounts for 89% of the galunggongs catch landed at Navotas Fish Port Complex last year.

Separately, overall volumes of fish unloaded at fish ports rose 41.33% from a month earlier to 45,355.24 MT in December, even as half of all fish ports reported declining volumes.

The Philippine Fisheries Development Authority said only two of the eight regional fish port complexes posted volume gains while volumes at two more were flat.

The other four posted declines due to bad weather or the closed fishing seasons.

The Navotas Fish Port Complex serving Metro Manila landed 15,493.89 MT in December, up 86.56% from a year earlier.

Volumes at the General Santos Fish Port Complex rose 7.61% year on year to 25,531.63 MT. The month-earlier total was 17,900.32 MT.

Volumes reported by the Lucena Fish Port Complex and Iloilo Fish Port Complex were flat year on year at 1,510.38 MT and 1,339.339 MT, respectively.

Posting declining volumes year on year were the Zamboanga Fish Port Complex (676.235 MT from 806.54 MT); Bulan Fish Port Complex (438.48 MT from 1,201.13 MT); Davao Fish Port Complex (310.72 MT from 371.61 MT); and Sual Fish Port (54.53 MT from 206.08 MT). — Sheldeen Joy Talavera

Meat processors confer with DA to review border inspection rules

MEAT processing companies said they met with the Department of Agriculture (DA) to review the import inspection process and whether to adopt the international system for classifying regions where livestock diseases have broken out.

In a statement, the Philippine Association of Meat Processors, Inc. (PAMPI) said its representatives met with Senior Undersecretary Domingo F. Panganiban and other officials to go through the policies affecting the industry.

They reviewed the rules on first border inspection of imports ahead of the establishment of the long-delayed Cold Examination Facility for Agricultural goods, the first of which is expected to rise at the Subic Bay Freeport.

The two sides discussed the potential adoption of the World Organization for Animal Health’s guidelines for zoning regions suffering from outbreaks of animal disease.

“The (DA) can help us with science-based food safety and inspection systems, access to safe and nutritious meat materials from both local and global sources, and constant collaboration to further refine food safety standards,” PAMPI told reporters on Thursday.

PAMPI promised to help keep processed meat products affordable for consumers.

“As we represent 85% of the country’s meat processors and food chains, we are committed to provide safe and affordable meat protein to the vast majority of consumers,” the association said.

Mr. Panganiban said he has directed the Bureau of Animal Industry (BAI) and National Inspection Service (NMIS) to address the industry’s concerns. No further details of the discussions were given.

Other officials at the meeting were Assistant Secretary for Operations Arnel V. De Mesa, BAI Director Paul C. Limson, NMIS Director Clarita M. Sangcal, and PAMPI Vice-President Jerome D. Ong. — Sheldeen Joy Talavera

ADB approves PHL loan worth $500M to spur job recovery

THE Asian Development Bank (ADB) has approved a $500 million for the Philippines to aid in the government’s efforts to effect a recovery in employment.

“With the economy slowly moving towards a sustainable growth path, it is important to ensure private enterprises are supported with policies that make it easier for them to do business and generate employment,” ADB Senior Public Management Economist Sameer Khatiwada said in a statement on Thursday.

“This program is expected to help create jobs, get businesses back into action, and pave the way for displaced workers, youth, and women to return to the labor market by enhancing their skills through training and linking them to good quality jobs,” he added.

The “Post-COVID-19 Business and Employment Recovery Program” aims to help the government address the impact of the COVID-19 pandemic on jobs, livelihoods, and the labor market, the ADB said.

Under the program, the ADB will assist the government in creating “a more liberalized business and investment environment to encourage the private sector to grow and create more jobs.”

“The program also supports government initiatives to expand labor market programs that address skills mismatches and promote training to reskill and retool workers to meet new demands in the post-pandemic jobs market,” it added.

The ADB said that the Philippines had one of the steepest declines in employment in Southeast Asia in 2020.

“While the unemployment rate declined to 4.2% in November 2022 from 6.5% a year earlier, labor market recovery remains uneven. For example, wage employment in private establishments remains lower than pre-pandemic levels. Similarly, informal employment remains higher, even though it has declined in recent months,” the bank said.

In 2021, the government launched a national employment recovery strategy to improve access to jobs and support the private sector in creating sustainable work opportunities.

“The new loan program will help the government implement the recovery strategy and achieve its targets to raise employment by 2025. ADB assisted the government in facilitating dialogue with key industry stakeholders on designing the recovery strategy,” it added. — Luisa Maria Jacinta C. Jocson

Davao ICT industry targets doubling of BPM workforce

DAVAO’s information and communications technology (ICT) industry is planning to double the current business process management (BPM) workforce in the region to 150,000 by 2028.

Xavier Eric B. Manalastas, president of the ICT-Davao, Inc. industry association, said this was the region’s commitment to the IT and Business Process Association of the Philippines, whose own target for the national workforce is 2.5 million in five years.

Mr. Manalastas, founder and chief executive officer of NEXT BPO Solutions, Inc., said the industry is boosting alliances with educational institutions and government agencies to prepare more people for information technology and business process management work.

“The 150,000 will not be filled or can be achieved in Davao City alone but throughout Davao Region,” he said in a media forum.

“We are currently working with different agencies in the government and we are also working closely. As mentioned, the challenge is talent, with the universities, higher education institutions and state colleges,” he said.

Discussions with schools focus on aligning courses and the curriculum to ensure that graduates can immediately be hired.

Mr. Manalastas also said ICT-Davao is working closely with the Technical Education and Skills Development Authority for the creation of a Metro Davao ICT Industry Board and to tap the agency’s scholarship programs.

“We hope to be able to train more unemployed or employed or underemployed in the Davao Region for them to get the skills they need or to upskill and to be absorbed in the industry to fill the gap,” he said.

On the employer side, he said two companies recently opened and another is expected to come in this year, adding to the more than 50 already operating in Davao.

The three new entrants are expected to employ up to 4,000.

“We are among the most resilient industries and we have experienced growth with the (re)opening of the economy,” Mr. Manalastas said. — Maya M. Padillo

Marcos backing for RCEP premature, think tank says

PRESIDENT Ferdinand R. Marcos, Jr.’s declaration of support for the Regional Comprehensive Economic Partnership (RCEP) is premature pending the resolution of the agriculture industry remaining unresolved, a think tank said.

Policy research group Focus on the Global South said that the RCEP agreement is awaiting the Senate’s concurrence, where the trade deal is being studied by experts appointed by the foreign relations committee.

The committee, chaired by Senator Maria Imelda Josefa Remedios R. Marcos, has thrown the matter to a technical working group (TWG) amid objections to the trade deal raised by the agriculture industry.

“But the TWG met only once and it focused on hearing the same arguments for RCEP from the Department of Trade and Industry (DTI) and against RCEP from the (agriculture) stakeholders,” Joseph M. Purugganan, the think tank’s program coordinator, said via chat.

“In other words, if they push for concurrence after only one TWG meeting then it casts doubt on the sincerity of the Marcos administration to address the concerns of stakeholders,” he said.

The Senate failed to ratify RCEP last year, with senators citing the lack of safeguards for agriculture.

The free trade agreement involves the 10 members of the Association of Southeast Asian Nations (ASEAN) and dialogue partners China, Japan, South Korea, Australia, and New Zealand.

“The agriculture stakeholders put forward in good faith concrete conditions — on the need to address smuggling, transparency in the agriculture budget, protection of sectors that will be exposed to threats, and the need for a concrete action plan to minimize these threats and maximize the projected gains,” Mr. Purungganan said.

“None of these conditions has been met.”

Raul Q. Montemayor, chairman of the Federation of Free Farmers, said the Department of Agriculture (DA), which is currently headed by Mr. Marcos, has failed to “formally” consult his group and other industry associations on the ratification proposal “even as it has joined other agencies in endorsing RCEP.”

Mr. Montemayor was among those who participated in a Senate hearing on RCEP in December.

“It was our understanding that the government, in consultation with the private sector, will draw up a list of things to do to prepare the sectors and the country for RCEP. A TWG was created, but it did not focus on drawing up this list,” he said via Viber.

“The concerns of the agriculture sector remain unaddressed,” he added.

During the campaign, Mr. Marcos called for a review of RCEP to ensure the agriculture industry is adequately protected.

Mr. Montemayor said Mr. Marcos failed to deliver on his campaign promise to conduct the review.

Earlier this week, the DTI asked the Senate to ratify RCEP before the end of the first quarter, saying that the Philippines is already missing out on the deal’s benefits.

The Senator has “the whole of February to conduct hearings,” Trade Assistant Secretary Allan B. Gepty told reporters late Tuesday. “And then there’s March. Basically, two months. I hope it gets finished because we are already delayed.”

Mr. Purugganan of Focus said the push is ill-timed, especially because the country “continues to be in the midst of an agriculture crisis.”

RCEP ratification would only worsen the situation because the Philippines has resorted to bringing in more imports amid prices costs, he said. “Unfortunately, the government’s response to the crisis is import, import, import.”

“RCEP will not reverse this but rather will make things worse for agriculture.”

Agriculture accounts for about a 10th of gross domestic product (GDP). Agriculture output contracted by 0.1% in 2022, missing the DA’s 1.2-1.5% full-year growth target.

RCEP is viewed as a means for China to minimize US influence in the region. As a counter, the US has offered the Indo-Pacific Economic Framework, a bid to achieve greater economic integration.

Advocates of trade liberalization have been pushing for the adoption of RCEP, saying it complements the government’s economic agenda.

“It provides continuity to the country’s liberalized foreign trade regime, consolidating and regionalizing market access within ASEAN+, other major Asian markets like China, Japan, Korea and even New Zealand and Australia,” Benvenuto N. Icamina, vice-president and chief operating officer at The Wallace Business Forum, said via Viber.

“Bilateral agreements already exist between ASEAN and many of these countries, so it will be a matter of taking the next step of expanding trade opportunities through regionalization,” he added.

Under a trade liberalization regime, the Philippines should not just focus on products but also services “where the Philippine appears to have some competitive advantages,” Mr. Icamina said. — Kyle Aristophere T. Atienza

Organics industry touts waste reduction approaches to mitigating climate change

THE organics industry said it advocates minimizing waste as a response to climate change, an approach that requires food waste to be minimized and plant-based diets to be embraced.

At the Organics Fair on Thursday staged by the Mother Earth Foundation (MEF), MEF said it aims to promote “positive ripple effects in catalyzing action for food waste reduction, sustainable food consumption, healthy plant-based diets, and organic agriculture.”

“This is to mainstream organics management here in the Philippines and also promoting the repair-refill-reuse program of Mother Earth Foundation. Also, to collaborate with fellow advocates — to show to the public that we can manage our organic waste,” Rannie M. Lebria, MEF program officer, told BusinessWorld.

Over 22 micro, small, and medium enterprises exhibited their organic products at the fair, including food and bamboo-based hygiene supplies.

The fair also featured demonstrations of composting techniques.

Senator Loren B. Lagarda, who heads her chamber’s committee on the environment, said in a statement: “We need to correct our behavior and mindset when it comes to single-use plastics by adopting more sustainable practices to mitigate their detrimental effects on our environment, health, and climate.”

The event was staged in collaboration with the Environmental Management Bureau office in the National Capital Region, the Climate Change Commission, community engagement group Alagang Ayala Land, Global Alliance for Incinerator Alternatives Asia-Pacific and UMI Fund.

The Organics Fair runs until Jan. 27 at the Ayala Malls Trinoma Activity Center. Hours are between 10 a.m. and 8 p.m. — Sheldeen Joy Talavera

Peso rises to new 7-month high on GDP

THE PESO climbed to a new seven-month high against the dollar on Thursday as the Philippine gross domestic product (GDP) growth was above target in 2022.

The local currency closed at P54.40 versus the greenback on Thursday, rising by 23 centavos from Wednesday’s P54.63 finish, data from the Bankers Association of the Philippines showed.

This is the peso’s best close in over seven months or since it finished at P54.265 on June 21, 2022.

The peso opened Thursday’s trading session at P54.50 per dollar. Its weakest showing was at P54.58 while its intraday best was at P54.39 against the greenback.

Dollars traded dropped to $730 million from $1.02 billion on Wednesday.

The peso was supported by data showing strong GDP growth in 2022, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

“The peso appreciated after the full-year Philippine economic growth for 2022 was reported at 7.6%, surpassing the government’s target of 6.5%-7.5%,” a trader likewise said in an e-mail.

The 2022 GDP growth print was the best annual performance since 1976. It was faster than the 5.7% in 2021 as well as the 7.5% median estimate of 23 economists in a BusinessWorld poll last week.

In the fourth quarter of 2022, the economy expanded by 7.2%, slower than the 7.6% in the third quarter and 7.8% in the same period a year earlier.

For Friday, the trader expects peso to appreciate further against the dollar on expectations of weaker US economic growth last quarter.

The trader sees the peso moving between P54.25 and P54.50, while Mr. Ricafort gave a forecast range of P54.30 to P54.50 per dollar. — A.M.C. Sy

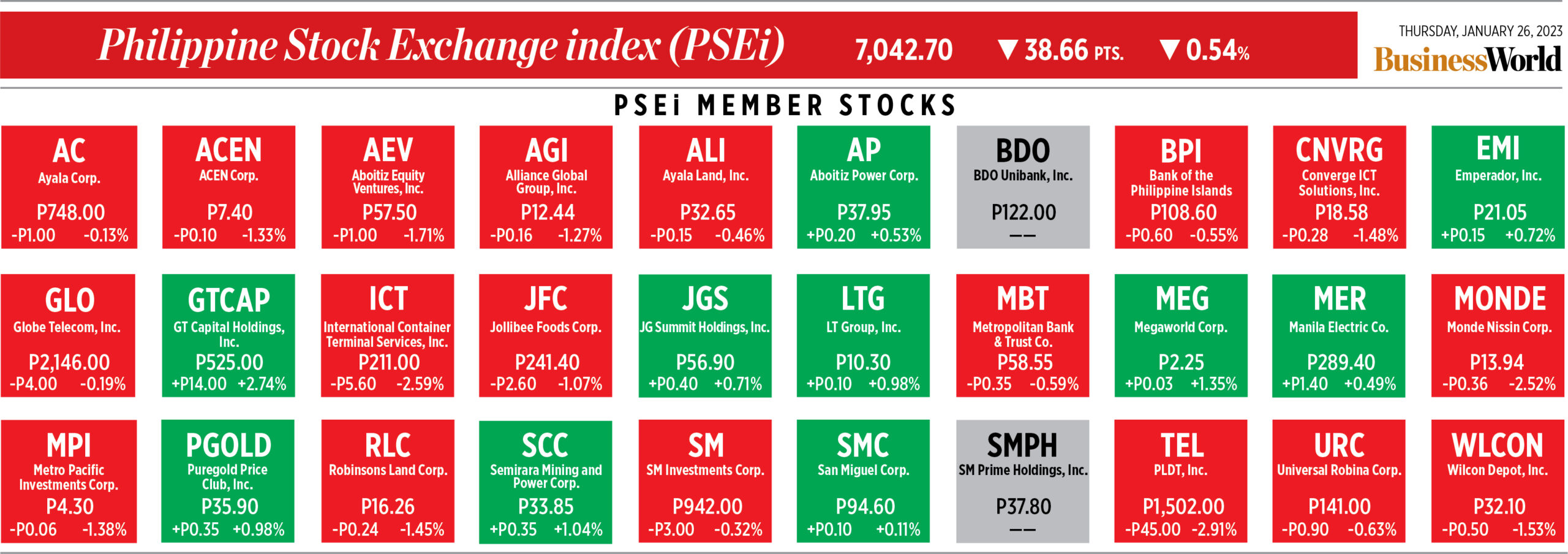

PSEi down on profit taking after GDP, trade data

SHARES dropped on profit taking after the release of full-year 2022 Philippine gross domestic product (GDP) and trade data.

The benchmark Philippine Stock Exchange index (PSEi) went down by 38.66 points or 0.54% to close at 7,042.70 on Thursday, while the broader all shares index lost 9.87 points or 0.26% to end at 3,692.89.

“The PSEi inched down on Thursday amid profit taking as investors widely expect the strong fourth-quarter and full-year 2022 Philippines’ GDP performance. On a positive note, the robust Philippine GDP growth report supports the sideways movement of the PSEi just above the 7,000 level,” Unicapital Securities, Inc. Equity Research Analyst Neil Andrew L. Maderaje said in a Viber message.

The economy expanded by 7.6% in 2022 amid robust domestic demand despite rising inflation, preliminary data from the Philippine Statistics Authority showed.

This exceeded the government’s 6.5-7.5% target for the year and was faster than the 5.7% GDP growth in 2021.

This was also slightly better than the 7.5% median estimate of 23 economists in a BusinessWorld poll last week.

In the fourth quarter alone, GDP expanded by 7.2%, slower than the 7.6% in the third quarter and 7.8% in the same period a year earlier.

Investors were also waiting for more catalysts, such as the US Federal Reserve’s policy meeting next week and the start of the corporate earnings season next month, Mr. Maderaje said.

“The local market inched down this Thursday as investors worried over the decline in the Philippines’ exports last December 2022, which somehow reflects the challenging global economic environment due to several headwinds offshore such as the ongoing Russia-Ukraine war, China’s economic slowdown and the tight monetary policy in the US,” Philstocks Financial, Inc. Research and Engagement Officer Mikhail Philippe Q. Plopenio said in a Viber message.

The value of merchandise exports contracted by 9.7% year-on-year to $5.67 billion in December 2022 versus the 7.3% growth in the same month in 2021 and the 13.2% expansion recorded in November last year.

All sectoral indices closed lower on Thursday. Services declined by 29.51 points or 1.64% to 1,764.61; mining and oil lost 79.75 points or 0.68% to end at 11,516.64; industrials dropped 61.77 points or 0.62% to 9,883.77; holding firms went down by 20.02 points or 0.29% to 6,864.51; financials retreated by 4.74 points or 0.26% to 1,806.47; and property decreased by 4.07 points or 0.13% to 3,116.19.

Value turnover went down to P5.11 billion on Thursday with 1.34 billion shares changing hands from the P5.75 billion with 1.86 billion issues traded on Wednesday.

Advancers outnumbered decliners, 107 versus 99, while 49 names closed unchanged.

Net foreign buying climbed to P519.19 million on Thursday from P237.29 million the previous trading day.

Unicapital Securities’ Mr. Maderaje said they see the PSEi’s strong support at 6,900. — J.I.D. Tabile

Marcos wants to beef up maritime security duties of PHL Coast Guard

PRESIDENT Ferdinand R. Marcos, Jr. wants the Philippine Coast Guard (PCG) to go beyond its sea rescue mission and maritime patrol duties to strengthen the country’s territorial defense, according to the presidential palace.

Members of the PCG should become “frontliners ready to confront whatever threats are coming through the country’s coastlines,” Mr. Marcos said during an oath-taking ceremony for coast guard personnel in Malacañang on Thursday.

The PCG, a uniformed armed service, is under the Department of Transportation and is not part of the military.

Mr. Marcos said many duties of the Philippine Navy have been transferred to the PCG but it remains a non-threatening unit as it is not technically part of the armed forces.

“The reason for this is very simple: We do that so that we will not raise the tensions by putting in units and assets of the Philippine military into the area. Also, we are saying that these are not military vessels, they are coast guard,” he said.

“But as many of the incidents have started to show over the past few years, that mission has become more, shall we say, intense,” he added. “Now you are expected to defend not only the coastline, but to defend our nationals.”

The coast guard’s primary mandates include maritime search and rescue, maritime safety, marine environmental protection and maritime security.

The PCG used to be under the Department of National Defense before it was transferred to the Office of the President on March 30, 1998 through an order issued by the late President Fidel V. Ramos.

Less than a month later, Mr. Ramos eventually transferred the PCG to the Department of Transportation and Communications, which was split into two separate agencies in 2016 through a 2015 law signed by then President Benigno S.C. Aquino III.

At the ceremony, Mr. Marcos also cited the importance of upgrading the agency’s facilities and equipment, saying it is “critical to the safety” of Filipinos.

“It is critical in the defense of the Republic,” he added. “It is critical to the defense of our territory.” — Kyle Aristophere T. Atienza