THE PLACE is hopping with Water Rabbit Lunar New Year Treats from hotels around the city, with many of the dishes and the rituals promising a bit of luck for the new year.

THE PENINSULA MANILA

The Peninsula Manila is ready to unveil a wealth of experiences and treats for sharing good fortune and blessings, including a Dragon and Lion Dance at the lobby on Jan. 22 from 10:30 to 11:30 a.m. On that day as well, Escolta offers a limited-time only Sunday Champagne Lunch Buffet showcasing auspicious ingredients such as fish and oysters, believed to bring good luck, and classics including glutinous rice dumplings that symbolize reunion. This Sunday buffet costs P4,500 for adults, P7,000 for the Champagne brunch, and P2,250 for children ages six to 12, from noon to 3 p.m. For an evening of fun, check out Salon de Ning’s alternative Chinese New Year celebration with an interactive improvisational show by SPIT Manila: Shanghai Nights, From Madame Ning with Love (A Chinese New Year celebration laced with Dance, Danger, and Desire) on Friday, Jan. 20. The two-hour melodrama set in 1920s Shanghai on the eve of the Chinese New Year, will have the guests help decide the fate of lovers as they dance to the music of the Jazz Age, sip cocktails, and have their fortunes read by a three-headed oracle. There will be a special appearance by Galaw.Co Dance Theater. There will be a door charge of P888 (inclusive of taxes and one drink). Doors open at 7 p.m. and the show starts at 8 p.m. The hotel also has a special room package available on Jan. 21, which includes a stay in a Deluxe Room, buffet breakfast for two adults and two children below 12 in Escolta restaurant the next morning, and front row seats to The Lobby’s annual dragon and lion dance on Jan. 22. For inquiries and reservations, call 8887-2888 (ext. 6691 or 6694 for Restaurant Reservations), mobile +639175578014, or email diningpmn@peninsula.com.

NEW WORLD MAKATI HOTEL

The hotel has gifts and special menus for the Lunar New Year celebration. Delight those that mean most with Jasmine’s best-selling handcrafted nian gao (also known as tikoy), which come in the koi fish and classic round shapes, priced at P1,188 and P1,088 net, respectively. Bulk orders get a 20% discount with a minimum of 50 boxes, and Club Epicure members receive a 10% discount. Meanwhile, The Shop offers a tangy and sweet combination in its Mandarin Cake, consisting of vanilla cremeux white chocolate mousse cake filled with orange jelly mandarin disk and orange segments, finished in red shiny glaze. The cake costs P1,388 net. A 48-hour lead time for orders is needed. There are more gifts available, such as one of three Chinese New Year hampers. The Premium Chinese New Year hamper contains items that can be used for Chinese New Year celebrations and more, such as dried scallops, dried black mushrooms, Chinese sausage, Jasmine’s XO chili sauce, sweetened cashew nuts, salted espresso cookies, fortune cookies, and a bottle of wine (P9,888 net). Hampers with the Mandarin Cake or nian gao come with fortune cookies and wine, and go for P4,288 and P3,888 net, respectively. Meanwhile, Jasmine highlights its premium Chinese cuisine befitting the Lunar New Year celebrations with two set menus offering dishes that signify prosperity, longevity, and happiness for the coming year. Set Menu 1 starts with the Salmon Yu Sheng salad, also known as the Prosperity Salad, and includes Steamed Fish Fillet in Superior Sauce, among its many dishes, ending with Hot Cream Red Bean Soup and Lotus Seeds and Glutinous Rice Dumpling with Milk Chocolate. It comes with one box of nian gao. Set Menu 2 also begins with the Prosperity Salad and features Braised Assorted Seafood in a Fish Maw Broth, Steamed Live Garoupa in Superior Soy Sauce, among many dishes, and ends with two desserts plus one box of nian gao. An a la carte selection of best-selling items will also be available under the Chef’s Recommendations menu. Jasmine’s all-you-can-eat dim sum buffet will be on offer as well, featuring all of the restaurant’s well-loved dishes. Set Menu 1 is offered at P10,888 net per table of four guests, while Set Menu 2 is offered at P13,888 net per table of four guests. All-You-Can Eat Dim Sum is priced at P1,688 net per person. For inquiries and reservations, guests can call 8811-6888 or e-mail events.manila@newworldhotels.com.

MARCO POLO ORTIGAS

The hotel is hosting a 2023 forecast reading with Feng Shui Master Joseph Chau at noon on Jan. 20, at Lung Hin. Lung Hin is also offering a Lucky Rabbit Chinese New Year Set Menu until Jan. 22. The 10-course menu, which includes Braised Calmex Mexico Abalone and Hong Kong-Style Roasted Duck is offered at P52,888 for 10 people and P26,888 for five people. The hotel has four variants of the traditional nian gao: Double Gold Bar Nian Gao (P2,598); Double Flavored – Red Dates Sugar and Fortune Orange (P2,598); Red Dates Sugar Round Tikoy (P1,898); and Fortune Orange Round Tikoy (P1,898). Rounding up the festivities will be the grand Lion and Dragon dance on Jan. 22. For more information and updates, visit marcopolohotels.com. For reservations, call 7720-7777.

GRAND HYATT MANILA

Reunite with family and friends and indulge in an epic Chinese New Year celebration at the Grand Ballroom on Jan. 22 at 11:30 a.m. to 2:30 p.m., complete with Chinese cuisine featuring a live cooking show by Chinese master chefs, a prosperity toss, and a lion dance performance. The Chinese New Year set menu at the Grand Ballroom starts at P25,888 net for six persons. Meanwhile, savor Chinese specialties at the hotel’s restaurants: No. 8 China House, The Grand Kitchen, and The Lounge. No. 8 China House features Chinese New Year set menus starting at P14,880 net for four persons, available on Jan. 21 and 22 for lunch and dinner. The Grand Kitchen offers a special Chinese New Year buffet on the eve of Jan. 21 and for lunch on Jan. 22 at P3,488 net per person. The merienda cena at The Lounge will also serve traditional Chinese delicacies to pair with tea, coffee, or free-flowing rosé available from Jan. 20 to 22 from 2:30 to 6 p.m. at P1,950 net. Grand Hyatt Manila’s Chinese New Year specialty cake and signature nian gao in traditional brown sugar flavor are available in Florentine and through Dine at Home from Jan. 13 to 22. For inquiries and reservations, call 8838-1234 or e-mail manila.grand@hyatt.com.

SHERATON MANILA BAY

Bring luck, wealth, and prosperity to your homes with Sheraton Manila Bay’s Auspicious Chinese Hamper, priced at P3,200 net per set inclusive of a chocolate rabbit, dried fruits, peanut sesame brittle, pineapple bun, mung bean cake, and a lucky rabbit stuffed toy. There are other goodies at the Lobby Kiosk, including a chocolate rabbit box, peanut sesame brittle, pineapple bun, moon cake, mung bean cake, a set of dried fruits and Chinese chocolate coins, and tikoy box set. On Jan. 21, the hotel will hold auspicious activities including a Chinese Dragon and Lion dance and the traditional dotting of the eye ceremony to be performed at the hotel lobby from 10 a.m. to noon. Complete the tradition with a celebratory drink with family and friends at &More by Sheraton with their special Coffee of the Month, Shanghai Lungo, for P250, which is available until Jan. 31. For reservations, call 5318-0788 or e-mail reservations.manilabay@sheraton.com.

CONRAD MANILA

Conrad Manila ushers in the auspicious Chinese New Year of the Water Rabbit with indulgent offerings such as the traditional Yee Sang Prosperity Toss, nian gao, and a set menu at its award-winning restaurant, China Blue by Jereme Leung. The restaurant’s set menu features traditional favorites and signature highlights such as: Steamed live sea lapu-lapu with black garlic, Shredded assorted mushrooms in superior soy sauce; Stir-fried king prawn with creamy garlic chili sauce; and a Golden roast US duck with barbeque sauce, among others. This menu starts at P48,888 net for a table of 10 diners. Patrons may also share the blessings of the season by bringing home a box of nian gao shaped in koi fish and mini gold bars that represent good fortune and prosperity. China Blue by Jereme Leung’s Special Nian Gao Gift set is priced at P2,388 and is available until Jan. 27. For reservations and inquiries, call 8833-9999 or e-mail conradmanila@conradhotels.com.

CROWNE PLAZA MANILA GALLERIA

Crowne Plaza Manila Galleria celebrates Chinese New Year at Xin Tian Di daily until Jan. 23 with special selections in an a la carte menu and special set menu. On Jan. 22, Crowne Plaza Manila Galleria will host Dragon and Lion Dances starting from 11 a.m. onwards. This will be accompanied by the traditional eye dotting ceremony and exchange of gift ceremony. Make reservations through 98790-3100, fandb.reservations@ihg, or 0927-163-0128.

EDSA SHANGRI-LA MANILA

Edsa Shangri-La, Manila welcomes the Year of the Water Rabbit with its special nian gao collection, available daily at Summer Palace and the Lunar New Year lobby counter until Feb. 5. Choose from a selection of flavors featuring tea, taro, and radish; go big with the ninko fish-shaped nian gao; and court good fortune with a gold bar nian gao, all available in limited edition Lunar New Year gift box sets. Rates start at P1,688 net. The Bakeshop sweetens up Lunar New Year celebrations with two offerings: a Mandarin Chocolate Torte and a Water Rabbit Carrot Cake at P1,650 net per whole cake. Share the gift of prosperity with the Fortune Rabbit Prosperity hamper which include the Infinity nian gao, assorted sweets and savories, and a bottle of red wine available at P5,600 net. Enjoy flavourful reunions with a feast of Cantonese specialties with Summer Palace’s set menus for groups or families of 10 people. Guests can choose from the selection auspiciously named: Wealth Set Menu priced at P23,880++, Prosperity Set Menu at P33,880++, and Longevity Menu at P53,888++, available from Jan. 21 to Feb. 5. Summer Palace’s Lunar New Year set menus include a Prosperity Salmon Yee Sang to usher in good fortune through a flavorful toss with family. For inquiries, visit the Lunar New Year counter at the main lobby of Edsa Shangri-La, Manila, call 8633 8888 local 8803, or e-mail restaurantrsvns.esl@shangri-la.com

CITY OF DREAMS

Until Jan. 29, Crystal Dragon highlights its festive lunar new year menu which is available for lunch and dinner. For the traditional dinner table yu sheng toss ritual, the salad is offered with a twist: Prosperity Roasted Duck is included in lieu of herring or salmon, with jellyfish, crispy vegetables, and plum dressing. This is available for five people at P1,600. For more abundance, Crystal Dragon offers Steamed duo flavor live grouper with signature tofu and Roasted crispy spring chicken with supreme soy sauce, the Crispy taro and new year cake pillow. Other auspicious Crystal Dragon specialties to welcome the new year are: Buddha Jumps Over the Wall; Braised sea cucumber and pork trotter with black moss and brown sauce; Wok-tossed creamy prawns with fragrant shredded coconut; and Wok-fried fragrant glutinous rice with Guangdong cured pork. Meanwhile, Singapore’s TungLok Signatures also highlights the quintessential Chinese New Year staple fare. Tung Lok’s yu sheng salad — prepared with salmon, a medley of fresh vegetables, fruits, and other ingredients (P2,888) — is available until Jan. 24 and can be shared by a group of six to eight people. Red Ginger offers five auspicious dishes symbolizing fortune, longevity, prosperity, happiness, and harmony. The ala carte dishes are: Fortune Lao Sheng, a chicken salad with plum dressing; Longevity Noodles, consisting of egg noodles with crispy pork belly, and quail eggs; braised Prosperity Pork Knuckle with king mushrooms; Happiness Prawn and Squid, a medley stir-fried in curry XO sauce; and, for dessert, Harmony Coconut, a mix of coconut jelly and ice cream. These are available until Feb. 5. For inquiries and reservations, call 8800-8080 or e-mail guestservices@cod-manila.com. For more information, visit www.cityofdreamsmanila.com.

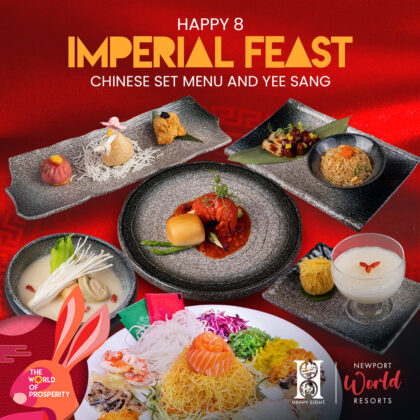

NEWPORT WORLD RESORTS

Grand celebrations and lavish feasts are in store to usher in the Year of the Water Rabbit with an abundance of luck and good fortune for all this January at the Newport World Resorts’ hotels and restaurants. The Happy 8 restaurant is offering the Imperial Rabbit Feast, a Chinese set menu and Yee Sang featuring wok fried lobster tail in chili sauce with crispy mantou, pan fried prime rib eye beef in red wine sauce with king oyster mushroom, and a salmon yee sang with plum sauce. For P5,088 net per person, feast with the whole family and toss the Yee Sang for prosperity. The Imperial Rabbit Feast is available from Jan. 15 to Feb. 15 at Happy 8, located at the Third Floor Gaming Area of the Newport Garden Wing. A Feast of Fortune awaits diners at the Hilton Manila’s Hua Yuan Brasserie Chinoise. Reunite with loved ones with an authentic dining experience with rates starting at P18,888++ daily until Jan. 25. Marriott Hotel Manila’s Chinese Fine Dining restaurant, Man Ho, is celebrating with a Poon Choi for Good Fortune at P29,888 net for a group of five diners, featuring abalone, prawns, roasted duck, and more. The restaurant is also serving up a Lo Hei for Prosperity with salmon, carrots, white radish, golden crackers and more, for P8,888 net for a group of five. Man Ho’s Lunar New Year offers are available until Feb 5. Sheraton Manila Hotel’s Oori Korean restaurant offers traditional new year comfort food. Tuck into a steaming bowl of Homemade Dumplings and Rice Cake Soup or Korean Clam Soup for P1,300 net and P1,250 net respectively until Jan. 31. Hotel Okura Manila’s Yamazato is serving a special Lunar New Year Bento for lunch at P2,700++ from Jan. 22 to 31. Continue the Lunar New Year celebrations with the Lunar New Year Room Packages that include daily breakfast at Yawaragi, with rates starting at P17,000 net per night, with a booking period until Jan. 31 for a stay period between Jan. 15 to Feb. 10. Meanwhile, get a personal reading from various experts at Newport World Resorts’ Psychic Fest. For P800, guests may avail of one psychic reading from a selection of experts, from tarot card readers, oracle, reiki, chakra scanning, and more. The Psychic Fest will run from Jan. 20 to 22, 4 to 8 p.m., at The Plaza. Make the most of the lucky stars this year with the Newport Mall-seum Zodiac Forecast Exhibit at The Grove which is ongoing until Jan. 31. For more information, visit www.newportworldresorts.com and follow @newportworldresorts on Facebook and Instagram, and @nwresorts on Twitter.