In a column about eight years ago, I argued that the Philippines lived not in a true democracy, but in a nominal one. We continue to see elections and similar democratic rituals on the surface, but elite power plays underneath still determine outcomes.

People do not truly vote for leaders they want; they perpetuate and legitimize the continued rule of a select few from the governing elite. The so-called choice is largely limited to members of political dynasties and recycled career politicians.

Not much has changed since. In Freedom House’s latest Freedom in the World report, we scored 58/100 and were rated “Partly Free.” The Philippines posted 25/40 on political rights and 33/60 on civil liberties, which are far from ideal. At best, we have a stagnant democracy that tilts toward erosion.

Freedom House notes: “The Philippines hosts a vibrant political landscape, and elections are free from overt restrictions. However, established political elites benefit from structural advantages, and problems including highly organized disinformation campaigns and widespread vote buying have undermined fair competition. Corruption is endemic, and anticorruption bodies struggle to uphold their mandates.”

I based my assertions regarding Philippine democracy, back then and now, on Larry Diamond’s four tests: free and fair elections, genuine participation, protection of rights, and the rule of law. Diamond is one of the world’s foremost scholars of democracy studies. For decades, he has examined democratic transitions and breakdowns across continents.

His framework, those four tests, has become a touchstone for measuring not only formal political systems but also the lived quality of democracy. Diamond has warned of a “democratic recession” since the mid-2000s, a global trend that places countries like the Philippines squarely in the struggle between institutional resilience and creeping authoritarianism.

In my view, we continue to fail the Diamond test. And one major reason our democracy is further constrained now is the shift in its medium. Opinion, information, and consent have moved from direct engagement and traditional media to online spaces, where the loudest megaphones can be faked, bought, or outsourced locally or abroad.

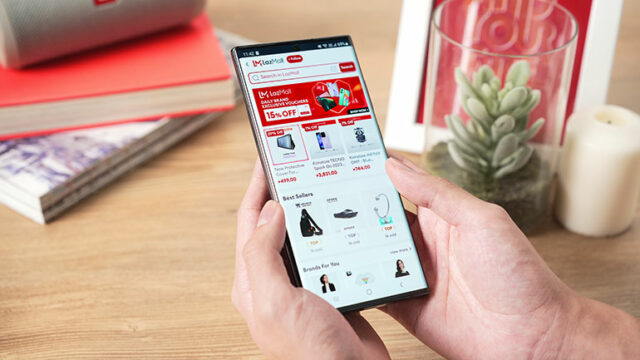

Gone are the days of political rallies, podium speeches, live media engagement, and public debates. Today, the battlefield is digital, especially with an estimated 91 million social media “user identities” in a country of about 120 million people.

There have been documented cases of coordinated manipulation in this digital arena by both domestic and foreign actors. Fake accounts now drive a substantial share of posts on political issues, simulating consensus rather than fostering honest debate.

These networks amplify curated narratives and exert significant digital influence during elections. This environment has produced a procedural democracy where the act of voting becomes the end-all and be-all. We obsess over process, not outcome. We focus on the election, not the choices and the result.

Deliberation and choice are shaped upstream by troll farms and micro-targeting by unscrupulous parties. Real politics now happens where the algorithms are. Gone are the days when a candidate’s track record and performance, political discourse, and actual voter engagement mattered.

Our elections still appear credible. Turnout remains relatively high. But the information environment is degraded by the risks and vulnerabilities of online discourse. Opinions are manufactured and presented as consensus long before votes are cast.

This is especially alarming as more digital natives become voters who rely primarily on online sources for information. Fake news remains rampant, and disinformation grows as traditional media loses audience share. Media and the press may “freely” express opinions, but credibility across all platforms is constantly questioned.

Democracy is not only about ballots; it is also about the distribution of voice. In a deeply unequal society, money buys amplification, especially of disinformation. If even half of online discourse around critical events is synthetic, then those who can afford manipulation enjoy a louder voice.

Fixing our democracy begins with cleaning up the information space. Otherwise, we will continue to mistake noise for voice, and spectacle for substance. The challenge now is not only disinformation, but AI-generated deepfakes and dark money in digital political operations.

We must strengthen legal mechanisms to combat disinformation and hold malicious actors accountable. But this raises the dilemma of decriminalizing libel and cyber-libel: How do we combat manipulation without infringing on fundamental freedoms?

Governments justify regulation in the name of public order and national security, but such tools can easily suppress dissent and control narratives. This is why I support decriminalizing libel, and at the same time oppose creating a government body to police “fake news,” identify troll farms, or require registration of social media accounts.

These measures risk government overreach. They can suppress dissent, shape narratives, and normalize censorship. We instead need to review libel laws carefully to strike a balanced approach. And we need to decide how else to penalize purveyors of misinformation that threaten our democracy.

Crucially, we must empower voters to distinguish between disinformation and legitimate discourse. Media literacy is essential. Citizens must learn to verify sources, analyze information, and develop habits of discernment. Critical thinking is now a democratic necessity.

This is easier said than done, but every gain protects our democracy. Government must study this issue carefully, consult stakeholders, and craft solutions that fight and severely penalize disinformation without compromising democratic values.

If we fail to rein in disinformation, we will drift further into a democracy of simulations where noise masquerades as consent, impressions replace convictions, and public opinion is engineered rather than earned. Democracy will be shaped not by citizens, but by platforms, algorithms, operators, and the funding sources behind them.

In this digital era, democracy demands a new vigilance. The threats are subtler than a coup and quieter than martial law. It is no longer about armed men, but about trends; not shutting down media, but drowning it out; not banning speech, but overwhelming truth with the speed and volume of disinformation.

The cure for disinformation cannot be to hand government the power to decide what is true. Instead, we must strengthen civic education, rebuild trust in institutions, support independent media, promote transparency in digital political advertising, and demand accountability from platforms that profit from users while disclaiming responsibility for consequences and outcomes.

The real delusion is believing democracy survives without effort. Democracy is measured not only by who wins elections, but by who shapes the truth that voters see before they vote. Today, the battle for democracy is fought not on election day, but long before it — in the unseen machinery of the mind, influenced and manipulated online.

Marvin Tort is a former managing editor of BusinessWorld, and a former chairman of the Philippine Press Council

matort@yahoo.com