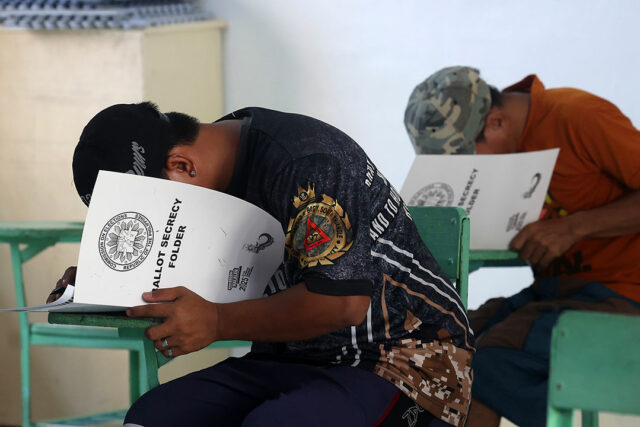

It’s all in the numbers! My good friend, Dr. Corina Gochoco-Bautista of the UP School of Economics sent me a resibo showing that it was not the members of the ruling dynasties in key areas in the National Capital Region that topped the senatorial elections. It was Bam Aquino. Kiko Pangilinan was not far behind. And if I may add, fighting against all odds with limited resources and exposure, Heidi Mendoza and Luke Espiritu proved that issues-based political campaigns are making some initial breakthroughs in the mindsets of the Filipino electorate.

Progressive thoughts have an audience.

As we wrote in our recent report for GlobalSource Partners, a quick assessment of the results of the Philippines’ May 12 mid-term elections demonstrates that the Filipino electorate has started repudiating movie stars and game show hosts, political dynasties, deadwood, and those suspected of plunder and corruption. The formula of name recall, political machinery, and using public money to win elections, or whatever drives survey after survey, does not seem to hold much water anymore, or at least is no longer as deterministic.

Pulse Asia’s voter preference survey in early May indicated nine out of President Ferdinand “Bongbong” Marcos, Jr.’s 12 senatorial candidates were likely to land in the “magic 12,” including six current and former senators (Pia Cayetano, Ping Lacson, Lito Lapid, Imee Marcos, Bong Revilla, and Tito Sotto), a current city mayor and former congresswoman (Makati’s Abby Binay), and two current members of the Lower House of Congress (Camille Villar and Erwin Tulfo). Only two of former President Rodrigo Duterte’s candidates (Senators Bong Go and Bato de la Rosa) and one radio and TV personality and public service host (Ben Tulfo, running as an independent) completed the magic 12 in the survey. In general, many similar surveys predicted a rerun in the Senate.

But did these surveys’ results really reflect the popular vote on who finished among the top 12 in the senatorial elections?

As of 10:14 p.m. last Tuesday, partial and unofficial results seem to be telling us a different narrative.

Of the nine Marcos’ candidates in the Pulse Asia survey’s winning 12, two were edged out with the most surprising surge of former Senators Bam Aquino (2nd place) and Kiko Pangilinan (5th). Go and De la Rosa kept their positions among the Top 5. The number of Duterte candidates actually rose from two in the surveys to three, with Party-list Rep. Rodante Marcoleta coming in strongly at the expense of the Administration bet Binay and the independent Ben Tulfo.

This mid-term electoral exercise is also a referendum of how President Marcos Jr. is faring in his first three years in Malacañang. The Filipino electorate does not appear to be impressed by his economic management. True, inflation continues its downtrend, but prices remain elevated especially food commodities. Such a downtrend may not be sustained because it was achieved by extending the food subsidy, which is good only for several months. Reducing tariff duties on rice imports could also impinge on government revenues and, obviously, this measure was expedient for political reasons. Previous Supreme Court hearings disclosed that public health and public education have been invariably de-prioritized. More funds were allocated to so-called critical infrastructure consisting of road widening and river dredging for flood control. The budget continues to bloat, and National Government debt now stands at over P16.6 trillion. Unconditional transfers were authorized to win votes, but they turned out to be a big, big turn off especially for young voters. They are now likely going for issues-based campaigns and platforms.

Senators, after all, are elected to make laws, rather than learn to make laws when they are already elected.

This mid-term senatorial election is inarguably a numbers game, but much more so when the new Senate convenes, organizes itself, and prepares for the possible prosecution of Vice-President Sara Duterte for the alleged culpable violation of the Philippine Constitution, betrayal of public trust, graft and corruption, and other so-called high crimes. Based on Senate President Chiz Escudero’s pronouncement, Sara Duterte’s impeachment proceedings could start by end-July.

Based on partial and unofficial election results, anti-impeachment senators will definitely include Senators Go and De la Rosa who are assured of reelection. Along with incumbent Senator Robin Padilla, Sara Duterte would have three solid supporters. Marcoleta could be the fourth. If their refusal to sign the articles of impeachment in the House were to be a guide to their prospective position in the Senate should they win, Erwin Tulfo and Villar could be the sixth and seventh votes against impeachment.

It is also possible that the Cayetano siblings (Pia and Alan Peter) plus Imee Marcos could tilt the balance in favor of the Vice-President. Alan Peter Cayetano was President Rodrigo Duterte’s running mate in 2016 and his first Foreign Affairs Secretary, and, later, House Speaker.

Unless Malacañang flexes it muscles and mobilizes all the resources at its disposal, the Vice-President stands a good chance of keeping her office. Nothing else seems to stand in the way of her taking Malacañang in 2028.

But before anyone rejoices and concludes that such a turn is a certainty, we should sober up and take to heart one commentary about the possible dissipation of the Duterte magic.

It claims that while the Dutertes won Davao City, they lost the rest of the big Davao Region which consists of five provinces: Davao de Oro, Davao del Norte, Davao del Sur, Davao Oriental, and Davao Occidental. The results show either Marcos Jr. allies or independent families and groups are set to dominate the five provinces of the region. As the commentary concluded: “The Dutertes may rule in Davao City. But it looks more like a walled city surrounded by an unfriendly political landscape.”

Between now and 2028, we should not rule out the emergence of a promising young leader, with great competence and ability, full of integrity and honesty, and, despite his youth, with experience and an unassailable track record. He could be one in stark contrast to what Sara Duterte stands for. He could be one who will not fail to speak for the people, against foreign countries with deepest intent to usurp Philippine sovereignty in the West Philippine Sea, against plunder and corruption. The political dynamics in 2028 could still follow a different trajectory.

In fact, one other possible scenario could also happen. If the Vice-President as well as Go and De la Rosa are arrested by the International Criminal Court, having been impleaded at The Hague, the Senate impeachment could still proceed and oust Sara Duterte. If the Senate rules allow remote testimony and hearing, a conviction will disqualify her from running for the presidency in 2028. In her absence and that of the former president, it would be rather difficult to muster the same level of support in the Senate and push back conviction. The May 12 midterm elections affirm the public’s growing demand for accountability.

Meanwhile, President Marcos Jr. will have to outdo himself and focus more on building a legacy of good economic, political, and social governance by pursuing strategic policy and structural reforms in order to invest the Philippine economy with greater potential and resiliency. Rooting out corruption in public offices is a must to assure the Filipino electorate his candidates in 2028 are worth voting for. Otherwise, the President could kiss goodbye his desire to rewrite history and absolve the Marcos family from various charges of plunder and mismanagement. This is a wake-up call!

For the progressive segment of the population — and I would include here politically aware faith-based organizations including churches and church groups — it is clear to them that the election results continue to favor political dynasties, political machinery, and political myths. But some breakthroughs have become more evident, and, to reiterate, progressive thoughts have an audience.

1Sambayan and the recent coalition of the religious and the citizenry for good governance, a broad alliance of forces from left to right, against both the ruling families, could be the start.

Uniting against the Administration’s budget scandal and the Davao camp’s violation of human rights and the rule of law, for a start, should be easier to consider in order to establish inclusiveness. There should be no room for what some would describe as “political purity” because the imperative of the moment requires massive support for justice, righteousness, and the people’s access to both political and economic power.

It’s about time that we asserted the centrality of moral choices to human dignity.

They have three years starting now to build their political base and machinery, widen their network, and deepen their roots. It is this kind of spade work that wins, rather than loses, electoral exercises for the sake of the people and the country.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.