Yields on gov’t debt drop

YIELDS on government securities (GS) traded in the secondary market fell last week following Tuesday’s auction of fresh 10-year bonds.

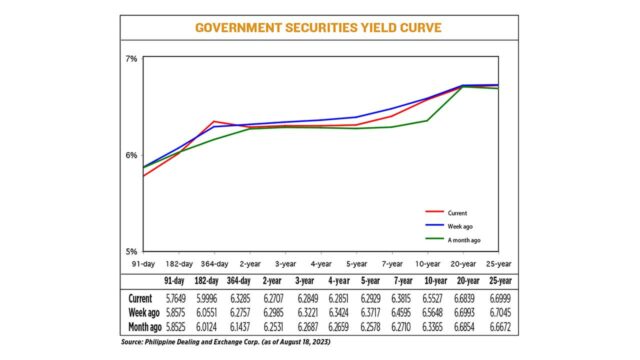

GS yields, which move opposite to prices, dropped by 3.7 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Aug. 18 published on the Philippine Dealing System’s website.

Rates were mixed across all tenors last week as yields on the 91- and 182- Treasury bills (T-bills) declined by 9.26 bps and 5.55 bps to 5.7649% and 5.9996%, respectively. Meanwhile, the 364-day T-bills went up by 5.28 bps to fetch 6.3285%.

The belly of the curve went down as yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) fell by 2.78 bps (6.2707%), 3.72 bps (6.2849%), 5.73 bps (6.2851%), 7.88 bps (6.2929%), and 7.80 bps (6.3815%), respectively.

At the long end, the rates of the 10-, 20-, and 25-year debt papers inched down by 1.21 bps (6.5527%), 1.54 bps (6.6839%) and 0.46 bp (6.6999%), respectively.

Total GS volume traded on Friday amounted to P10.68 billion, higher than the P4.65 billion seen on Aug. 11.

“Yields declined over the week as the new 10-year bond issuance auctioned last Aug. 15 saw strong market participation garnering over [twice] the demand oversubscription into the Bureau of the Treasury’s (BTr) P30-billion bond offering,” Lodevico M. Ulpo, Jr., vice-president and head of Fixed Income Strategies at ATRAM Trust Corp., said in an e-mail.

Yields declined last week following a recent bond maturity, a bond trader said, adding that the latest central bank decision did not have an immediate effect on the market.

Last week, the BTr fully awarded the new 10-year bonds it auctioned off as total bids amounted to P66.824 billion.

The bonds were awarded at a coupon rate of 6.625%. Accepted yields ranged from 6.4% to 6.625% for an average of 6.558%.

Meanwhile, the Bangko Sentral ng Pilipinas (BSP) kept benchmark interest rates steady for a third straight meeting on Thursday, but signaled it is prepared to resume tightening if needed amid risks to inflation.

The Monetary Board left its overnight reverse repurchase rate unchanged at a near 16-year high of 6.25%, as expected by 13 economists in a BusinessWorld poll. Interest rates on the overnight deposit and lending facilities were maintained at 5.75% and 6.75%, respectively.

The BSP has raised borrowing costs by 425 basis points (bps) from May 2022 to March 2023 to tame inflation.

“Post the BSP action, we anticipate markets to focus on global economic data and market movements as medium-term disinflation expectation by the BSP is tempered by near term inflationary risks on food, climate, and energy,” Mr. Ulpo said.

He added that global curve’s steepening may temper the persistent demand for duration, but this may be temporary as the market looks forward to better global and local monetary conditions in 2024 and 2025.

“We expect demand for bonds and duration to persist albeit at specific yield levels given broadly anchored front-end yields,” he said.

For this week, Mr. Ulpo said the 15-year bond reissuance will likely test the market’s resolve.

On Wednesday, the BTr will offer P30 billion in reissued 20-year papers with a remaining life of 15 years and five months. — A.M.P. Yraola