By Luisa Maria Jacinta C. Jocson, Reporter

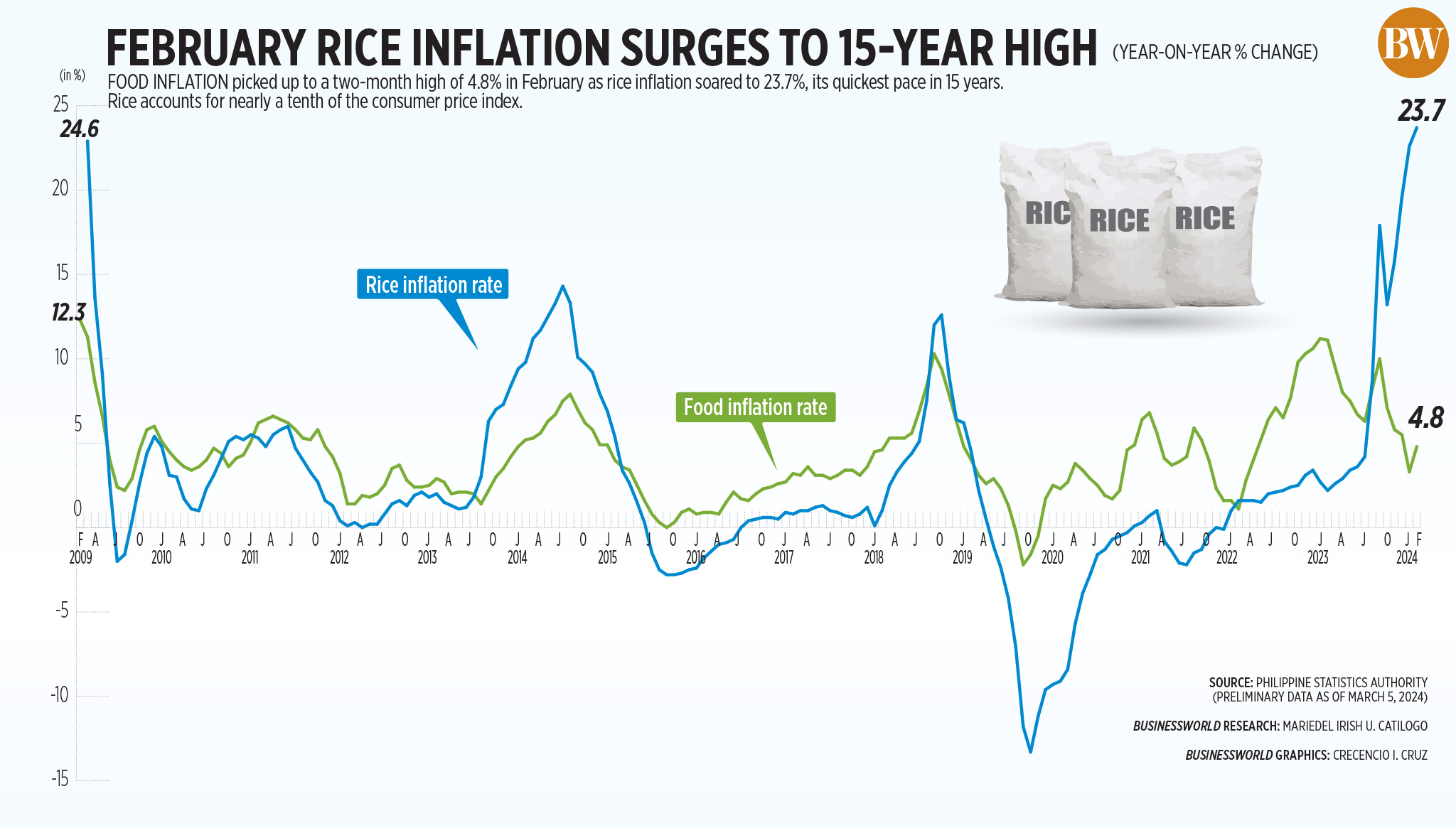

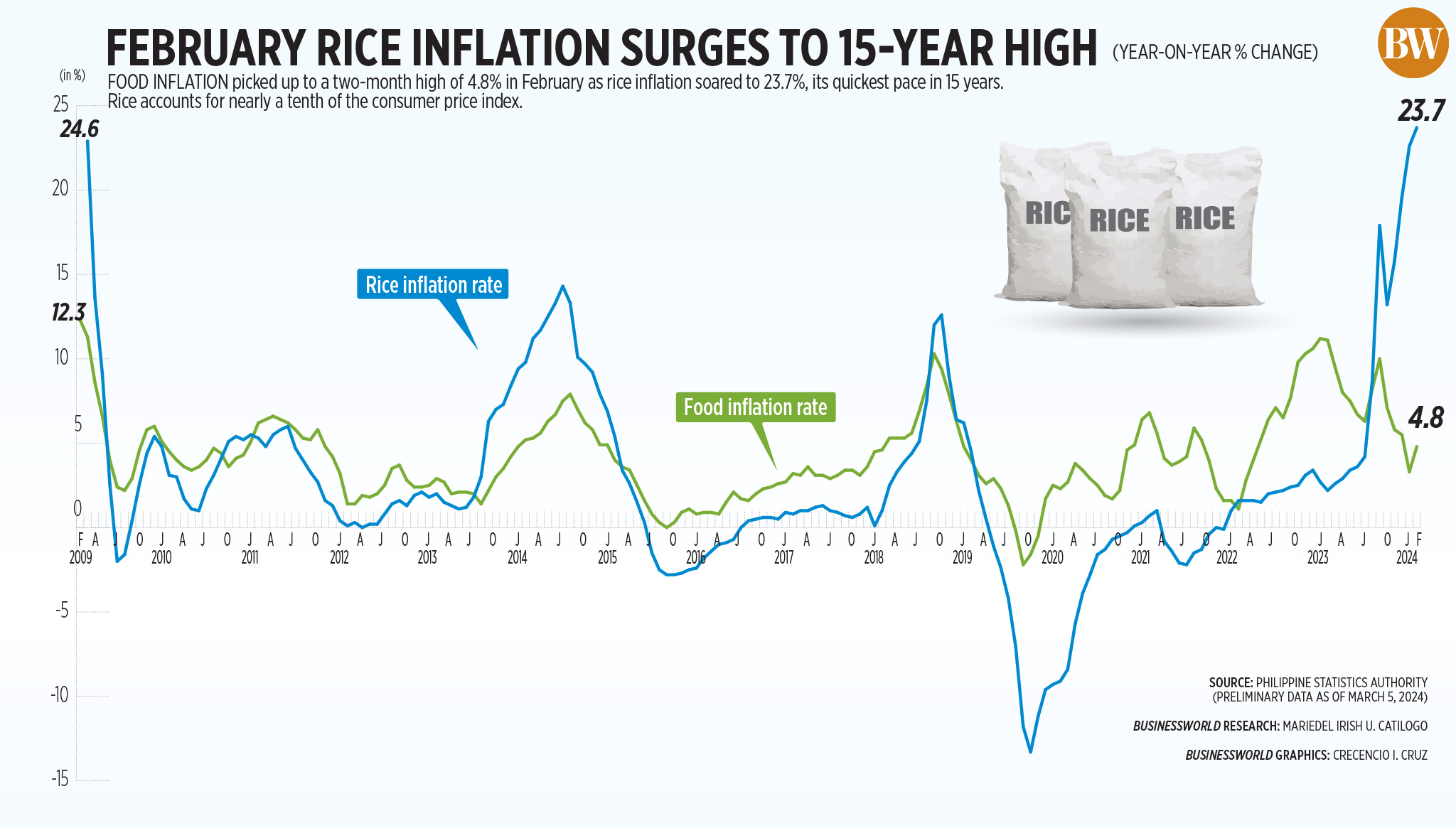

HEADLINE INFLATION accelerated for the first time in five months in February as prices of food, particularly rice, rose faster than expected, according to preliminary data from the Philippine Statistics Authority (PSA).

Data released by the PSA on Tuesday showed that the consumer price index (CPI) quickened to 3.4% in February from 2.8% in January but slower than the 8.6% print a year ago.

The February print was above the 3% median estimate in a BusinessWorld poll of 16 analysts conducted last week.

However, it settled within the Bangko Sentral ng Pilipinas’ (BSP) 2.8-3.6% forecast for the month and marked the third straight month that inflation was within the 2-4% target range.

Month on month, inflation quickened by 0.6%. Stripping out seasonality factors, month-on-month inflation rose by 0.9%.

For the first two months of 2024, headline inflation averaged 3.1%. This was lower than the BSP’s 3.6% full-year baseline forecast.

“This inflation outturn is consistent with the BSP expectations that inflation will likely remain within the target range in the first quarter of 2024 due largely to negative base effects,” the central bank said in a statement.

“However, inflation could temporarily accelerate above the target range in the second quarter 2024 due to the adverse impact of El Niño weather conditions on agricultural production and positive base effects,” it added.

Core inflation, which excludes volatile prices of food and fuel, rose by 3.6% in February year on year. This was slower than 3.8% in the previous month and 7.8% a year ago.

National Statistician Claire Dennis S. Mapa said February inflation was mainly driven by the faster annual increase in the heavily weighted index for food and nonalcoholic beverages.

The index accelerated to 4.6% in February from 3.5% in the previous month but was slower than the 10.8% clip a year earlier.

Food inflation alone quickened to 4.8% from 3.3% in January, mainly driven by rice. However, this was slower than the 11.1% logged in 2023.

RICE PRICES

“Rice inflation, just to give you an idea, contributed 1.6 percentage points of the 3.4% (headline inflation), so that’s about 47%. Almost half of our inflation is from rice,” Mr. Mapa said.

Rice inflation surged to 23.7% in February from 22.6% in January and 2.2% in the same month a year ago. It also marked the fastest print for rice inflation since the 24.6% recorded in February 2009.

“This is the major contributor to overall inflation and inflation of the bottom 30% income households,” Mr. Mapa added.

Prices of regular milled, well-milled and special rice also saw faster price increases on a year-on-year and month-on-month basis, according to the agency.

The average price of a kilogram of regular milled rice rose to P50.44 in February from P49.65 in the previous month and P39.65 a year earlier; well-milled rice increased to P55.93 from P54.91 a month ago and P43.99 in the previous year; and special rice averaged P64.42 from P63.9 in January and P53.89 a year ago.

Mr. Mapa said rice inflation continued to quicken due to tight supply and continued high prices in the world market as well as base effects.

Manulife Investment Management and Trust Corp. Head of Fixed Income Jean Olivia De Castro said rice prices may continue to spike in the coming months.

“While lower tariff rates, an increase in rice imports, and the harvest season should help cap the continued rise in prices, we expect them to remain elevated as export restrictions remain from India, the world’s biggest supplier, and as importing countries increase purchases to combat the effects of El Niño, which could last until midyear,” she said in a commentary.

The acceleration of food inflation was also overall driven by the cereals and cereal products index, which jumped to 17% from 16.3% in the previous month and 5.2% a year ago.

Meanwhile, inflation of vegetables, tubers, plantains, cooking bananas and pulses saw a 11.1% decline during the month from the 20.8% drop in the previous month. In 2023, the index accelerated by 33.1%.

The index for meat and other parts of slaughtered land animals inched up to 0.7%, slower than the 6.5% print a year ago.

“One of the contributors to this inflation is the price of pork. Last month, the index posted negative inflation and now there is positive inflation,” Mr. Mapa added.

PSA data showed that transport inflation also contributed to the uptrend in February inflation.

Transport inflation rose to 1.2% during the month from the 0.3% decline in January but was much slower than the 9% print in the year prior.

Mr. Mapa said this was driven by an uptick in the operation of personal transport equipment, which includes fuel and toll facilities, as well as passenger transport services and purchase of vehicles, namely motorcycles.

In February alone, pump price adjustments stood at a net increase of P1.05 a liter for gasoline, P1.55 a liter for diesel and P0.35 a liter for kerosene.

Inflation for housing, water, electricity, gas and other fuels also rose to 0.9% in February from 0.7% a month earlier but was slower than the 8.6% a year ago.

Manila Electric Co. (Meralco) earlier said that the overall rate for a typical household rose by P0.5738 to P11.9168 per kilowatt-hour (kWh) in February from P11.3430 in the previous month.

Bank of the Philippine Islands in a commentary said that the increase in the cost of utilities and transport has been “marginal” as global oil prices have remained stable in recent months.

Meanwhile, the inflation rate for the bottom 30% of income households rose to 4.2% in February from P3.6% in the previous month. However, this was slower than the 9.7% a year ago.

In the first two months, the inflation rate averaged 3.9% for the bottom 30%.

In the National Capital Region (NCR), inflation quickened to 3.2% in February from 2.8% in January. Inflation in areas outside NCR accelerated to 3.5% from 2.8%.

POLICY SIGNALS

With the uptick in February inflation, the BSP said it sees the need to keep policy settings steady in the near term.

“Looking ahead, the Monetary Board deems it appropriate to keep the BSP’s monetary policy settings unchanged in the near term amid the improvement in inflation conditions,” it said.

The BSP has kept its benchmark rate steady at a near 17-year high of 6.5% in February for a third straight meeting. The central bank has raised borrowing costs by 450 basis points (bps) from May 2022 to October 2023.

BSP Governor Eli M. Remolona, Jr. earlier said that any policy easing moves in the first semester may be “too soon.”

BPI said that the acceleration in February inflation affirms the BSP’s hawkish stance in the past months.

“While inflation has gone down recently, there are lingering risks on the upside. Maintaining a hawkish tone is crucial in order to temper inflation expectations and prevent a cycle of rising prices, especially considering ongoing supply issues affecting rice,” it said.

The central bank may keep rates steady for the first half before possibly cutting rates by the second semester once inflation is firmly within target, it added.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said that February inflation will likely prompt the BSP to extend its pause.

“Mr. Remolona has been telegraphing an eventual rate cut towards the latter half of the year, likely waiting for inflation to show ‘convincing’ signs of staying well within target,” he said in a note.

“If inflation manages to stay relatively subdued and the Fed finally starts to ease, we expect the BSP to likewise begin its easing cycle to give economic growth added support in the face of challenging global headwinds,” he added.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris Dacanay said that if inflation quickens or risks to inflation materialize in the second quarter “there is a risk that the BSP will instead cut after the Fed, keeping the BSP rate at 6.5% for a longer period than we expect.”

During the event, BNI Elite also showcased a powerhouse of experts among their members who shared invaluable insights. At the forefront were Atty. Joana Pasion of Prime Meridian HR Consulting, Rob Soliman of Rocketship Designs, Ern Ynion of HSY Consulting Services and Solutions, and Joy Sy of Digital Hog, each shedding light on key facets of startup success.

During the event, BNI Elite also showcased a powerhouse of experts among their members who shared invaluable insights. At the forefront were Atty. Joana Pasion of Prime Meridian HR Consulting, Rob Soliman of Rocketship Designs, Ern Ynion of HSY Consulting Services and Solutions, and Joy Sy of Digital Hog, each shedding light on key facets of startup success. For businesses seeking an unparalleled network that goes beyond traditional boundaries, BNI Elite is the answer. Elevate your business by becoming a part of BNI Elite — where referral power meets innovation.

For businesses seeking an unparalleled network that goes beyond traditional boundaries, BNI Elite is the answer. Elevate your business by becoming a part of BNI Elite — where referral power meets innovation.