By Kyle Aristophere T. Atienza, Reporter

President Ferdinand R. Marcos, Jr. has resigned from his additional role as Agriculture secretary and named a fishing tycoon to take over during a time of high food prices.

In a press conference on Friday, Mr. Marcos announced the appointment of Francisco Tiu Laurel, Jr., president of Frabelle Fishing Corp., as the new secretary of the Department of Agriculture, with the responsibility to “gain control” of the prices of agricultural goods.

Mr. Laurel, 56, will also prioritize efforts to make the agriculture sector resilient in the face of climate change and rise of animal diseases such as swine and avian flues, the President said.

He will work on government efforts to reduce production costs and modernize the agriculture sector, Mr. Marcos added.

He said the new Agriculture leadership will study the agricultural practices of the Philippines’ neighbors such as Thailand, Indonesia, and Vietnam.

In 1985, Mr. Laurel, at the age of 28, took on the role of president at Frabelle Fishing Corp., a company established in 1966 that was then a modest-sized trawling enterprise.

VARIOUS ROLES

Mr. Laurel also has important roles in several companies. He is the president of Frabelle Shipyard Corp., chairman of Westpac Meat Processing Corp., director of Frabelle Properties Corp., president of Markham Resources Corp., and both chairman and president of Diamond Export Corp.

At the same time, he is the president of Bacoor Seafront Corp. and chairman of the Bukidnon Hydro Energy Corp.

Mr. Laurel, a member of Mr. Marcos’ Private Sector Advisory Council, currently chairs the World Tuna Purse Seine Organization.

Some stakeholders in the agriculture industry have welcomed the new appointment but warned of the big challenges facing the sector.

Jayson H. Cainglet, executive director of SINAG, urged Mr. Laurel to prioritize local producers over foreign players.

“Importation [should only be the] last resort and not the principal policy,” he said in a statement, asking the new agriculture leadership to “reject, much more to support, all proposals to reduce tariffs on all agricultural commodities.”

“Qualifications or merits are not guarantees of good performance,” he said. “Our judgment will rest on his performance as DA secretary.”

Fisherfolk group Pamalakaya said Mr. Laurel should also prioritize reforms for the fisheries sector, which it said needs to be strengthened in the face of rising imports.

“The fishers are giving a standing order to the new DA Secretary to strengthen local food production by renouncing liberalization policies of importation of agricultural and fisheries products,” it said, noting that it has monitored more than 200, 000 metric tons of various pelagic fishes imported from other countries like China and Taiwan from from 2018 to 2022.

“This is an insult not only to us being an archipelagic country but also to millions of Filipinos involved in the fishing sector.”

The DA Secretary should know that opening floodgates for imported fishery products poses drastic impacts on the livelihood of local fisherfolk. Cheap and inferior quality imported fish causes further price drop of local fishery products. For instance,

Every time the Philippine government allows the importation of tens of thousands of metric tons of round scad (galunggong), the farm-gate value of the fish product drops to as low as P50 from P70-P80 per kilogram, posing “drastic threats” to the livelihood of Filipino fishermen.

“Cheap and inferior quality imported fish causes further price drop of local fishery products.”

The group also urged the new leadership to ensure that Filipino fisherfolk are able to fully utilize the country’s marine and aquatic resources within its territorial and traditional fishing grounds.

Mr. Laurel should also prohibit “all forms of conversion and reclamation of coastal communities and fishing grounds that cause displacement of fisherfolk and irreversible destruction of marine and aquatic resources.”

The Meat Importers and Traders Association said Mr. Laurel brings with him a wealth of “experience and understanding covering the livestock and fisheries sectors,” as it looks forward to working with the new secretary.

Geny F. Lapina, a professor at the University of the Philippines Los Baños’ Department of Agricultural and Applied Economics, noted that the President was clear from the start about his intention to eventually appoint a secretary for the DA.

“I think it would have been unsustainable for him to continue holding that position. Therefore, it is good he is finally letting someone else take over,” he said in an email.

Mr. Lapina said that while many sectors, especially those in the private sector, are expected to throw their support behind the new Agriculture leadership with the expectation that Mr. Laurel might have a better grasp of how to modernize the local agriculture sector and enable it to compete better in the global market, “others would be concerned with conflicts of interest since he may have difficulty balancing the private interests of his company with those of the public interest.”

“His company might have an advantage on policies that might be pursued,” he said. “Regardless, the new DA Secretary will be expected to pursue policies that help bring down the prices of food.”

‘TOUGH ASSIGNMENT’

He said the appointment will be a tough assignment given the local and global challenges hounding the agriculture and food sector.

“Let us see if this will mean a more liberalized policy that makes use of trade to help boost the overall food supply or a more protectionist stance that favors local production but not necessarily lower prices of food,” he said.

Citing Mr. Laurel’s strong industry experience, agriculture expert Roy S. Kempis said one could surmise that he possesses a set of behaviors “toward more production, productivity, and profitability in an industry ecosystem that demands logistics efficiency and effectivity — knowing that fish is highly perishable.”

“We know that the fishing industry, while important to our food needs, has not received the attention of the degree similar to crops like rice, livestock like pork, poultry like chicken and eggs,” he said in a Viber message. “And yet fish in the countryside serves as an affordable source of protein especially along and nearby coastal areas.”

Mr. Marcos took charge of the Agriculture department in July last year, promising to boost the country’s food security amid rising prices spurred by Russia’s invasion of Ukraine.

Over a year has passed, and the country is still facing increasing prices, with rice inflation hitting a 14-year high last month.

Mr. Marcos enforced a rice price ceiling on Sept. 5, limiting the commodity’s price to P41 a kilo for regular milled rice and P45 for well-milled rice.

The ceiling was lifted on Oct. 4, and critics have said it did not help bring down prices.

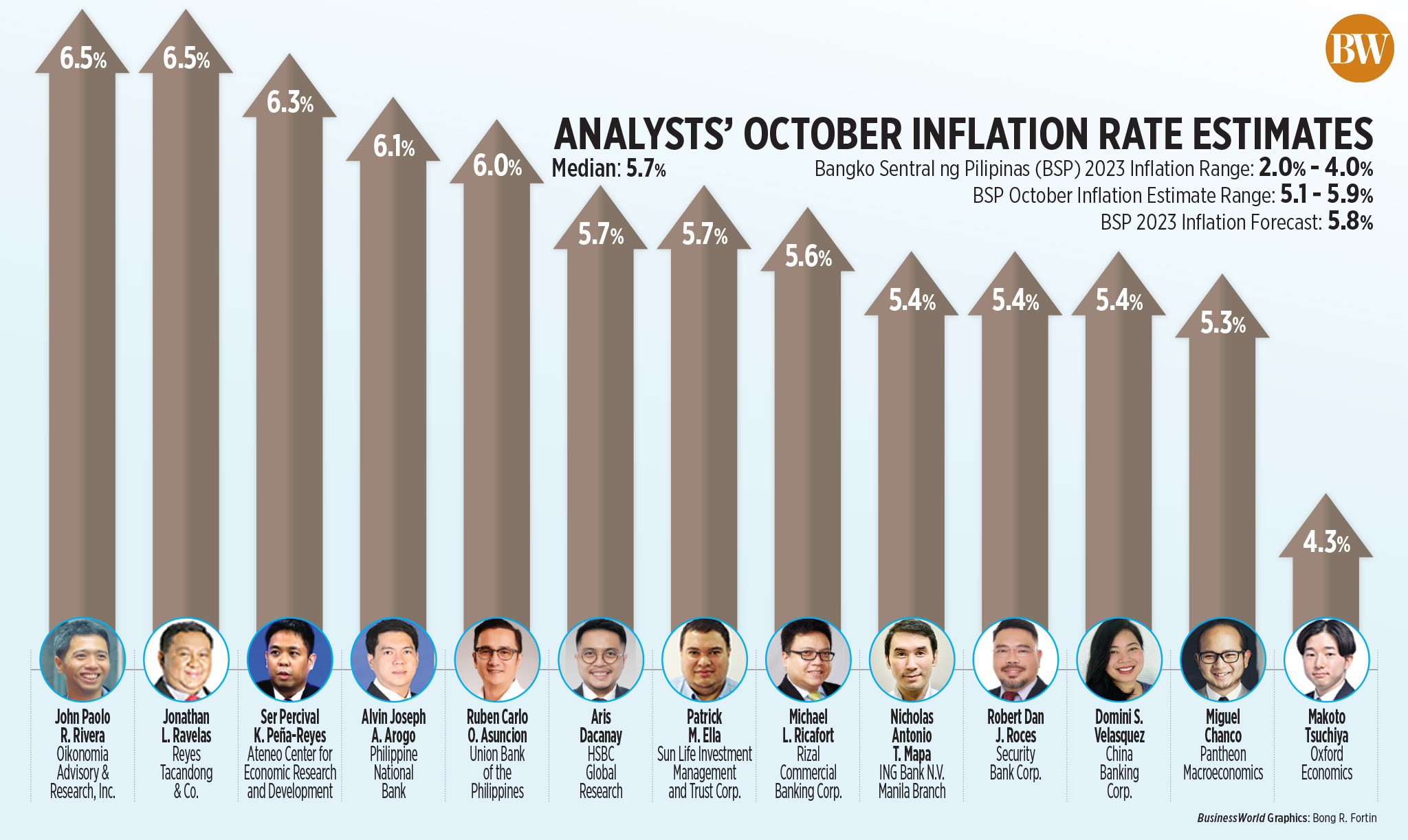

Philippine inflation rose to 6.1% in September from 5.3% in August amid a double-digit increase in rice prices.

Soaring commodity prices have weakened public support for the administration, with Mr. Marcos facing a double-digit decline in his approval and trust ratings in a recent Pulse Asia Research, Inc. survey, according to experts.

The President’s trust rating fell by three points to 73% in the third quarter from a quarter earlier, the Octa Research Group said on Monday. His approval rating also declined by 6 points to 65%.