PEPE Diokno’s historical drama GomBurZa got the most nods — 12 — as the Manunuri ng Pelikulang Pilipino released the list of nominations for the 47th Gawad Urian on May 10.

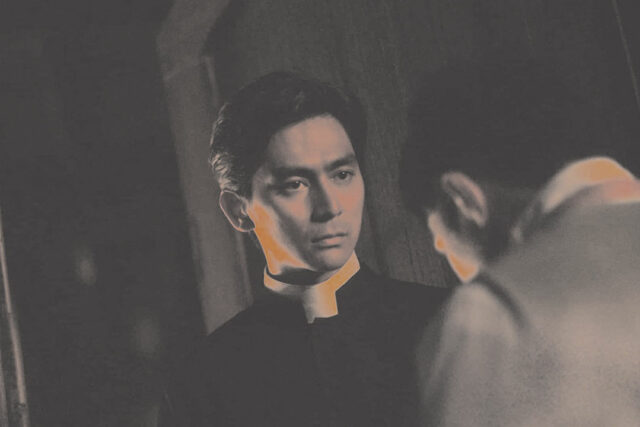

The film was nominated in almost all the categories: Best Picture and Best Director, Best Actor (Cedrick Juan), Supporting Actors (Dante Rivero, Piolo Pascual, Enchong Dee), Screenplay, Cinematography, Production Design, Editing, Music, and Sound.

Also nominated for Best Picture are the psychological thriller About Us But Not About Us by Jun Robles Lana, social drama Ang Duyan ng Magiting by Dustin Celestino, children’s adventure Firefly by Zig Dulay, animated film Iti Mapukpukaw by Carl Joseph Papa, and realist love story Third World Romance by Dwein Baltazar.

Jun Robles Lana, Zig Dulay, Pepe Diokno, Carl Joseph Papa, and Dwein Baltazar also received nominations for Best Director. The sixth nominee is Sheron Dayoc for his dark coming-of-age film The Gospel of the Beast.

The 47th Gawad Urian awarding ceremony will be held on June 8, its venue yet to be announced.

The annual Gawad Urian Awards are presented by the Manunuri ng Pelikulang Pilipino, an organization of film critics, writers, and scholars. — Brontë H. Lacsamana

The full list of nominees for the 47th Gawad Urian Awards are:

BEST PICTURE: About Us But Not About Us, Ang Duyan ng Magiting, Firefly, GomBurZa, Iti Mapukpukaw, Third World Romance

BEST DIRECTOR: Jun Robles Lana, About Us But Not About Us; Zig Madamba Dulay, Firefly; Jose Lorenzo Diokno, GomBurZa; Carl Joseph E. Papa, Iti Mapukpukaw; Sheron Dayoc, The Gospel of the Beast; Dwein Ruedas Baltazar, Third World Romance

BEST ACTOR: Romnick Sarmenta, About Us But Not About Us; Paolo O’Hara, Ang Duyan ng Magiting; Euwenn Mikaell, Firefly; Cedrick Juan, GomBurZa; Jansen Magpusao, The Gospel of the Beast; Carlo Aquino, Third World Romance

BEST ACTRESS: Kathryn Bernardo, A Very Good Girl; Gabby Padilla, Gitling; Max Eigenmann, Raging Grace; Charlie Dizon, Third World Romance

BEST SUPPORTING ACTOR: Epy Quizon, Firefly; Dante Rivero, GomBurZa; Piolo Pascual, GomBurZa; Enchong Dee, GomBurZa; Ronnie Lazaro, The Gospel of the Beast

BEST SUPPORTING ACTRESS: Agot Isidro, Ang Duyan ng Magiting; Dolly de Leon, Ang Duyan ng Magiting; Frances Makil-Ignacio, Ang Duyan ng Magiting; Alessandra de Rossi, Firefly; Jorrybell Agoto, When This is All Over

BEST SCREENPLAY: Jun Robles Lana, About Us But Not About Us; Angeli G. Atienza, Firefly; Rodolfo C. Vera and Jose Lorenzo Diokno, GomBurZa; Carl Joseph E. Papa, Iti Mapukpukaw; Dwein Ruedas Baltazar and Jeko Aguado; Third World Romance

BEST CINEMATOGRAPHY: Neil Daza, Firefly; Mycko David, Gitling; Carlo Canlas Mendoza, GomBurZa; Theo Lozada, Huling Palabas; Rommel Andreo Sales, The Gospel of the Beast

BEST EDITING: Lawrence S. Ang, About Us But Not About Us; Benjo Ferrer, Firefly; Benjamin Tolentino, GomBurZa; Benjamin Tolentino, Iti Mapukpukaw; Lawrence S. Ang, The Gospel of the Beast; Maria Estela Paiso, When This is All Over

BEST PRODUCTION DESIGN: Josiah Hiponia, Ang Duyan ng Magiting; Kenneth Kevin Villanueva, Firefly; Ericson Navarro, GomBurZa; David Esguerra, Huling Palabas; Benjamin Padero and Carlo Tabije, In My Mother’s Skin; Eero Yves Francisco, Third World Romance

BEST MUSIC: Firefly, GomBurZa, Iti Mapukpukaw, Third World Romance, When This is All Over

BEST SOUND: Armand de Guzman, About Us But Not About Us; Andrea Teresa T. Idioma and Nicole Rosacay, Ang Duyan ng Magiting; Albert Michael M. Idioma, Jannina Mikaela Minglanilla, and Emilio Bien Sparks, GomBurZa; Lamberto Casas, Jr. and Alex Tomboc, Iti Mapukpukaw; Jon Clarke, Michael Haines, and Chad Orororo, Raging Grace

BEST DOCUMENTARY: Baon sa Biyahe, directed by James Magnaye; Ghosts of Kalantiaw, directed by Chuck Escasa; Maria, directed by Sheryl Rose Andes; Nitrate: To the Ghosts of the 75 Lost Philippine Silent Films (1912-1933), directed by Khavn

Experience the benefits of smarter cold room solutions firsthand, optimizing operations, reducing costs, and promoting environmental sustainability.

Experience the benefits of smarter cold room solutions firsthand, optimizing operations, reducing costs, and promoting environmental sustainability.