Europe’s deindustrialization and opportunities for the Philippines

Last week, on June 21, the country’s economic team held another Philippine Economic Briefing (PEB) in Tokyo, Japan. The speakers included Finance Secretary Ralph G. Recto, Budget Secretary Amenah F. Pangandaman, Economic Planning Secretary Arsenio M. Balisacan, Special Assistant to the President for Investment and Economic Affairs Secretary Frederick D. Go, and Bangko Sentral Deputy Governor Francisco G. Dakila, Jr.

Before that, on June 19 and 20, the economic team also held meetings with Japanese business leaders from companies like Marubeni Corp., SMBC, and Rating and Investment Information, Inc.

According to various reports, Mr. Recto made a powerful announcement to the Japanese business leaders, saying, “The Philippines has a stable political environment and an investment landscape that has never been as open and liberalized. We are committed to working non-stop until the good becomes better and better becomes the best for business.”

Ms. Pangandaman underscored the economic and spending priorities contained in the Philippine Development Plan 2023-2028, especially in agriculture and infrastructure. “Another sector that we’re going to push for in the coming years is of course digitalization, to ensure efficiency in the National Government and so that it will be easier for businesses to enter the country,” she said.

I support the economic team’s aggressive investment promotion activities because we need more foreign capital, technology, and management innovation to create more jobs in the country — and because there is growing trend of deindustrialization and degrowth in developed countries, especially in Europe.

Last week, the UN Conference on Trade and Development (UNCTAD) released the World Investment Report (WIR) 2024. I checked the foreign direct investment (FDI) flows in Asia and Europe and found several good and surprising developments.

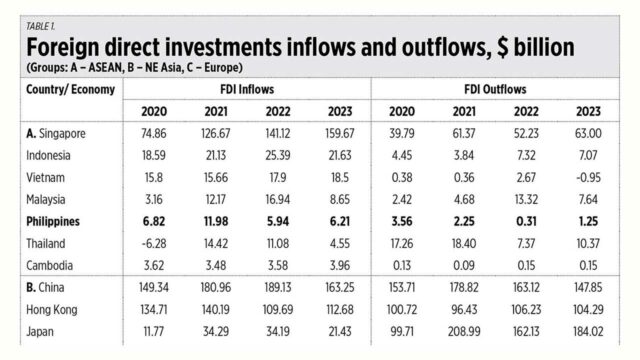

First, FDI inflows to the Philippines are now comparable with those in Malaysia, Thailand, and Taiwan, and it is not true that Cambodia will “soon overtake” the Philippines in getting FDIs. But Philippine multinationals investing abroad — our FDI outflows — are not significant yet.

Second, South Korea, Japan, and Taiwan are net exporters of capital — their FDI outflows are larger than inflows. China may soon join them.

Third, many countries in Europe are experiencing negative inflows, particularly Italy, Switzerland, Ireland, the UK, and the Netherlands. Russia also experienced having FDIs fly out, but only in 2022 when many multinationals exited as part of the economic sanctions by the West after Russia’s invasion of Ukraine.

Fourth, those European countries that escaped negative inflows have experienced slowdowns, especially in 2023, including France, Germany, Spain, and Sweden. But their exports of capital, their FDI outflows, are rising (see Table 1).

The trend of rising FDI outflows is, I think, an indicator of more companies leaving those countries and investing somewhere else, especially in Asia.

What pushed those European companies to move elsewhere? I checked 10 countries’ economic growth and inflation rates over the past four years. All of them, except Spain and Russia, have had growth of below 1% or have had contractions. And they have had high inflation rates of above 5%. This suggests a trend of degrowth and deindustrialization (see Table 2).

Developed and industrial economies are not supposed to have high inflation because they can mass produce, then mass transport and distribute many things within their countries or amongst themselves. But high inflation has remained for the past two years already. Their climate and energy policies, and foreign and finance policies (like shunning cheap oil and gas from Russia), are now backfiring.

I am proposing two measures to the economic team.

One, that they go back to Europe, particularly three or four of these financial centers — Frankfurt, Paris, Rome, Amsterdam, Stockholm, London, and Dublin — and tell the investors there that they should consider the Philippines in their FDI outflow strategy.

And two, the Philippines should not follow the climate and energy policies of these European countries which primarily caused their trends towards degrowth and deindustrialization. We should focus on saving the economy and jobs, not saving the planet as the planet does not need any saviors.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.