China goes ape over culture-boosting Black Myth: Wukong video game

BEIJING — Chinese state media threw its back behind China’s most successful single-player video game to date, saying its adaptation of the Ming dynasty epic Journey to the West would force Western players to learn more about the country’s culture.

Black Myth: Wukong, based on a mythical monkey king from a Chinese literary classic who can shape-shift into humans, animals, and inanimate objects, was being played on Wednesday by 2.2 million concurrent players on Steam, a major online gaming platform, a day after its release.

“Chinese players in the past have gone through this process of cross-cultural understanding, now it is the turn of overseas players to learn… and understand Chinese traditional culture,” China Central Television wrote in a blog.

Drawing heavily on the story of the beloved magical monkey, Sun Wukong, who acquires supernatural powers by practicing Taoism, Black Myth: Wukong can only be enjoyed if players are familiar with the plot of the 16th century classic, the national broadcaster said.

The PC/console-based game was launched on Tuesday by Game Science, a Tencent-backed startup, to much fanfare on Chinese social media. Hashtags on the video game accumulated 1.7 billion views on China’s X-like microblog Weibo.

“This release marks a bold foray by Chinese game developers into a market long dominated by Western triple-A titles,” the official Xinhua news agency wrote in an editorial on Wednesday.

“With this breakthrough, the default language of a triple-A game is no longer English, but Chinese,” it added.

Black Myth: Wukong would “attract more global players to pay attention to domestic games,” said analysts at Shanghai-based Topsperity Securities, adding that companies across a wide range of sectors could expect to profit off intellectual property tie-ins.

Ride-hailing firm Didi, Lenovo Group and Luckin Coffee are incorporating elements inspired by Black Myth: Wukong into their promotional campaigns.

Black Myth: Wukong was widely lauded as China’s first AAA game — high development costs, long production cycles, and immense investment, with industry analysts viewing its sudden fame and popularity as marking an inflection point for China’s PC/console gaming sector.

Pre-sales, which began in June, had reached 400 million yuan ($56 million) as of Tuesday when the game was launched, according to Citi.

Feng Ji, founder of Game Science, told Xinhua in an interview that the global attention has surpassed his initial expectations and that his team would develop more of such games.

“We see signs that the government is recognizing the industry’s potential value for exports and culture, notably the interview of Game Science’s founder by state media Xinhua agency ahead of its game launch,” Goldman Sachs wrote in a note.

Goldman added that it expected more Chinese AAA games to enter the global market in the future.

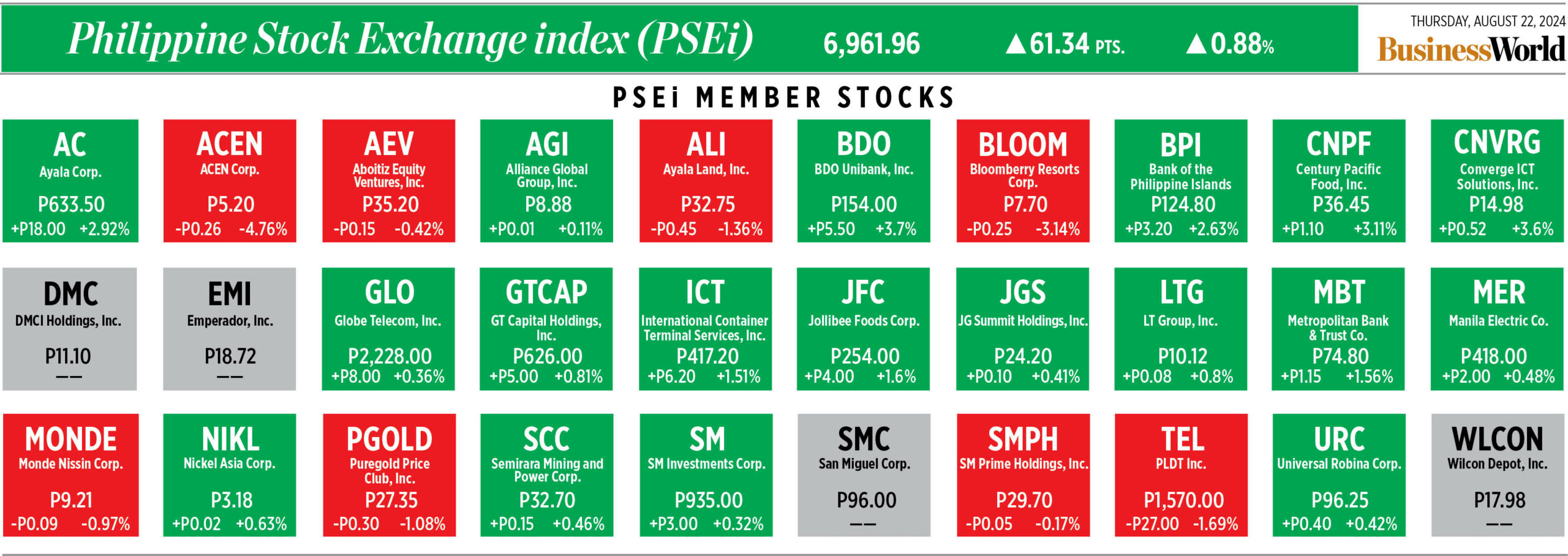

Be that as it may, gaming stocks were unchanged on Wednesday, with concept stocks linked to the game’s development down after having risen considerably over the past month.

Unlike other Chinese games that are played on mobile devices and involve endless in-game micro-transactions, Black Myth: Wukong is a one-time purchase with a price tag of 268 yuan ($37.58) for the standard version and 328 yuan for the premium.

“It is unclear whether Black Myth: Wukong’s business model can bring more profits… the important thing… is that China is finally getting it’s own AAA game that can excite the world,” state-owned tabloid Global Times cited an industry insider as saying.

“Global players will be able to get a deeper understanding of traditional Chinese culture while having fun,” Global Times declared. — Reuters