(Part 6)

Can the Philippines still be a major exporter of manufactured exports like the East Asian tigers? With all due respect to the contrary opinion, my answer is no.

Because of the serious mistake that we made at the beginning of our efforts to industrialize in the last century, it is too late in the day for us to compete with the Asian Tigers, which now include China, in the export of such manufactured products as airplanes, steel, cement, vehicles (especially the electric varieties), computers, smartphones, air-conditioning units, home appliances, and others. By lingering too long at the stage of import substitution, we failed to develop the needed support facilities and infrastructure for manufactured products, such as low-cost energy, highly skilled factory workers, and efficient logistics, among others.

It does not mean, however, that we cannot have a thriving manufacturing sector based on selling to the very lucrative domestic market resulting from our demographic dividend.

As our per capita income transitions from high-middle income to high income ($5,000 to $15,000) in the next 20 years, together with more efficient logistics and lower energy costs, such inward-looking industries like food manufacturing, chemicals, pharmaceuticals, construction materials (steel, cement, wood), and other consumer and intermediate goods will become competitive with imports (with the help of some reasonable tariff rates to protect the domestic market from the dumping of goods). I forecast that as we reach the stage of a high-income economy, our manufacturing sector as a percentage of GDP will attain what is now the average of the developed countries in Asia today, which is 20-25%.

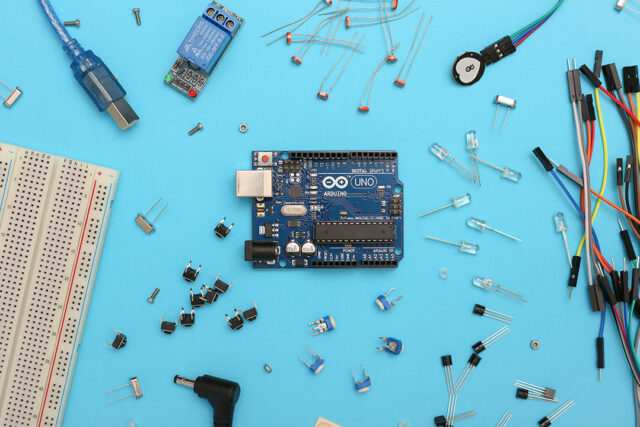

An exceptional sector in which we can be a major exporter of manufactured goods is the chip industry. According to recent reports from the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. (SEIPI), the exports of their industry may possibly hit $110 billion in five years. That is quite a figure, considering that our total merchandise exports in 2024 were just $73.21 billion. This bullish projection is based on the reality that the industry’s growth will be driven by new and emerging technologies related to what is called Industrial Revolution 4.0 (Artificial Intelligence, Robotization, Internet of Things and Data Analytics). The drivers of growth for the electronics industry will be new devices and new technologies in such sectors as automobiles, digital devices, cellphones, computers, data centers, and renewable energy.

Under the roadmap developed by SEIPI, the industry is targeting to make the Philippines a consistent and reliable global partner for packaging $70 billion worth of semiconductors, assembling $40 billion worth of electronics, and providing globally recognized integrated circuit (IC) design services five years from now. There is also a determined move of the industry to graduate from low-value to high-value chip manufacturing. None other the Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA), formerly headed by Secretary Frederick Go, is proactively assisting the industry to move from traditional assembly, test, and packaging (ATP) to a more advanced stage in manufacturing in the next five years.

Again, this is where the private sector, the Government, and academe have to work together to reskill, upskill, and retool the workers in the industry through some form of enterprise-based learning.

According to OSAPIEA Undersecretary Ma. Angela E. Ignacio, there will be a five-year workforce development program for the industry to be implemented by an Advisory Council. The target is to generate 128,000 new jobs across the whole semiconductor and electronics industry. According to Ms. Ignacio, there are three technical working groups working on this. An important part of the workforce development strategy is not only to have the active participation of the enterprises in the skills development process, using the famous German dualvoc system popularized by the Dualtech Training Institute in Canlubang, Laguna. There must also be close coordination between the engineering schools and the TESDA-type training institutes so that the role of engineers and the technical workers in the industry can be clearly differentiated. Engineering graduates are usually ineffective on the shop floor. The electro-mechanical workers trained in technical schools like Don Bosco, the Meralco Technical Institute, Dualtech, and CITE in Cebu are generally more apt for factory work in the semiconductor and electronic component industry.

A niche in which the country can increase the value added to our exports of electronic components and semiconductor devices is in lab-scale wafer fab. SEIPI has long been urging the government to build a $10-million facility to increase the localization of electronic exports. Unfortunately, funding is still an obstacle. The industry has made some progress in this regard by producing some P130 million worth of localized parts. This still too puny considering what the country is importing. By just targeting producing 1% of the materials imported, there can be P15 billion worth of local production with the subsequent increase in jobs created. This is a perfect job for OSAPIEA.

The good news is that despite the very unfortunate situation involving widespread corruption among our legislators and some departments of the Executive branch, especially the Department of Public Works and Highways, foreign investors in the industry have not demonstrated a reluctance to expand or to start new operations. Given all the increased tariffs being imposed by the Trump Administration on exports to the US, the Philippines is at the low regime and may actually attract some of those who are leaving higher regime countries like China, Taiwan, and Vietnam.

Over the medium term, a geopolitical factor that may enable the Philippines to significantly increase its share of electronics and semi-conductor components to the US is the increasing worry of some American officials that their country is risking a dangerous dependence on Chinese chips. As very convincingly argued by Mike Kuiken in an article in the Financial Times, Beijing is quietly cornering the market in so-called foundational chips that power everything from cars, to medical devices, to defense systems. According to Mr. Kuiken, a visiting fellow at the Hoover Institution in the US and national security adviser in the US Senate, China already accounts for close to 40% of global chip capacity — a trajectory that points to even greater dominance by the late 2020s. Such dependence also applies to Japanese products. It is, therefore, a prudent move to try to relocate some of these China-based factories to other countries more friendly to the US-Japan alliance. The Philippines, with its unique still young and growing labor force, is obviously one of the possible relocation sites.

For this reason, there is a joint plan of the US and Japanese governments to help build what is called the Luzon Economic Corridor, an area that extends from the Batangas Bay all the way to the coasts of Bataan. If this industrial corridor is endowed with first class infrastructure and adequate energy, water, and telecom facilities, it can attract the manufacturers of higher-value electronic components and chips away from China. The close military alliance between the United States and the Philippines can be leveraged to enable our country to take a quantum jump in its exports of higher-value chips to the US.

Needless to say, another major industrial export of the Philippines will come from the mining industry. To remove the usual obsession with manufacturing of some of our policy makers, I keep on reminding them that “industry” goes beyond manufacturing and includes mining, together with construction and public utilities. That is why an industrial policy should include a strategy to develop to the fullest the mineral resources of the country, which is one of the most mineralized in the world. We will discuss this in another article.

Bernardo M. Villegas has a Ph.D. in Economics from Harvard, is professor emeritus at the University of Asia and the Pacific, and a visiting professor at the IESE Business School in Barcelona, Spain. He was a member of the 1986 Constitutional Commission.

bernardo.villegas@uap.asia