By Andrea C. Abestano, Researcher

SCROLLING THROUGH social media means more than merely about likes and shares today. It has become an instrument for financial literacy for many Filipinos.

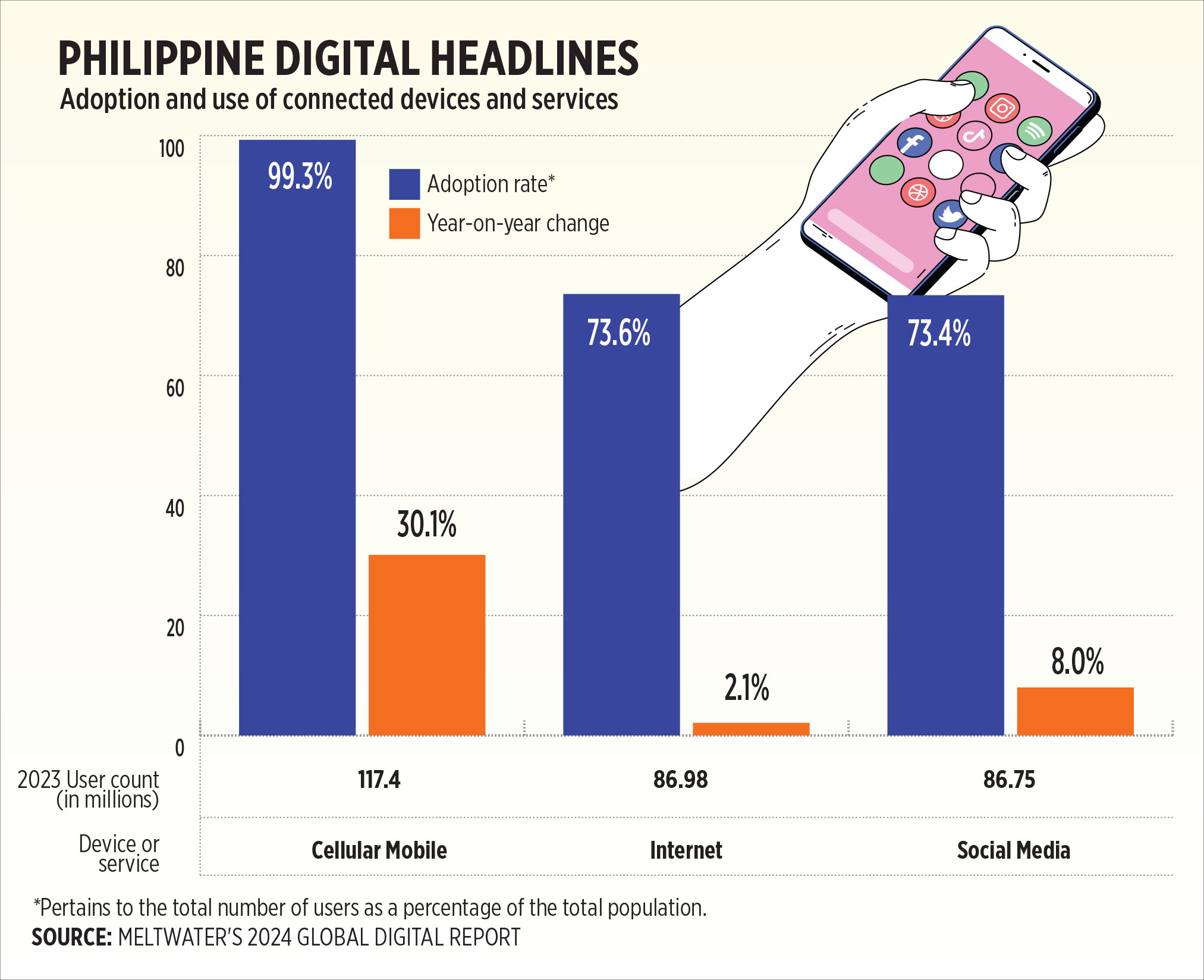

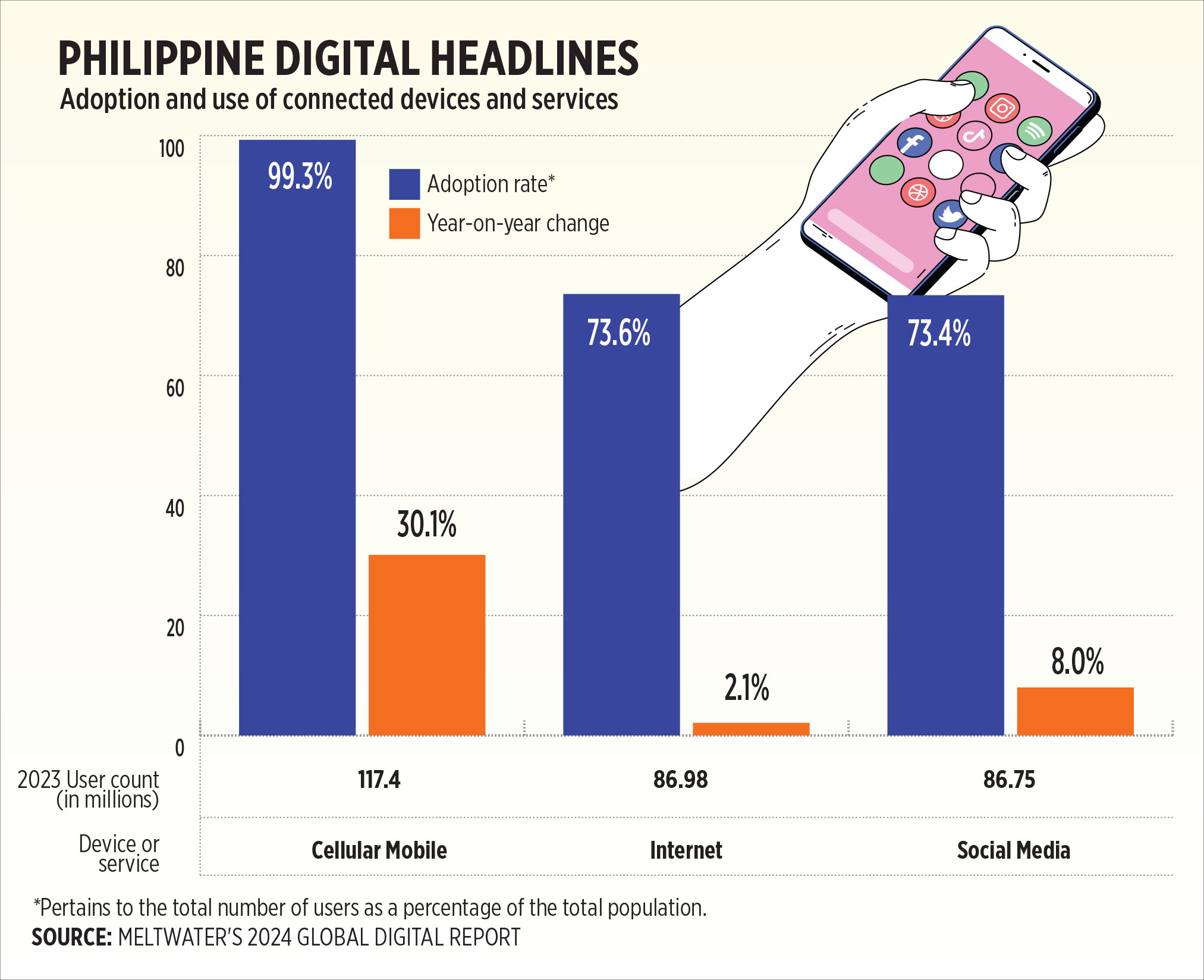

As of January, almost 73.6% of Filipinos had access to the internet, of which 73.4% were connected through one or more social media platforms spending four hours a day on average. This was the highest daily consumption across all Asian countries included in Meltwater’s Global Digital Report.

Interweaving digital influence and consumer behavior, social media has become a key player in spreading information in the country.

In an era where digital connectivity has become a dominant aspect of Filipino lives, banks and financial institutions have also begun to acknowledge its importance and utilize it.

All banks in the country have built a dedicated social media page across various platforms in which consumers can connect with the banks.

The 2024 Global Digital Overview showed that 34.2% of internet users utilize the web for information on finance and savings, inching up from 33.7% in 2022. For the country, almost 42.3% of the population turn to social media for finding content and information.

Similarly, based on the 2021 Financial Inclusion Survey (FIS), 32% of Filipinos rely on these platforms for financial-related information.

“Statistics show that social media has been a source of financial information and has influenced financial decision-making,” the Bangko Sentral ng Pilipinas (BSP) said in an e-mail interview.

“Social media has transformed financial literacy for the youth by offering easily comprehensible content on topics like financial planning, credit, and investing, often with humor,” said the BSP.

Inclusivity in the younger generations saw an uptick in 2021 as more than a fourth of individuals aged 15-19 had formal bank accounts, almost four times higher from 7% in 2019, according to the central bank’s latest Financial Inclusion Dashboard.

Similarly, almost half of the older adults owned a formal account, an improvement from 32% in 2019.

The ease of accessing information, captivating content, and the convenience of customer support were the key factors on social media that contributed significantly to the improvement of literacy.

Johann C. Uy, a member of Facebook (FB) groups focused on investment talks, said that social media helped him be a part of the “banked” population.

“When I opened my first savings account, what I did was look up suggestions on social media groups and communities and read up on [comment] threads to determine which bank is crypto-lenient and would fit my needs,” he said in phone interview.

Ease of information allowed them to compare products, services, and financial approaches across social media pages and posts.

“In finding which car loans would be perfect for my new car, I had to compare across the pages of different banks and the experiences of content creators until I had decided on which one to go with,” said Beverly A. Arevalo, a member of finance-related FB groups, in a phone interview.

On top of the accessibility, how the topic was discussed also helped the consumers digest and remember the information.

“The new audience is the millennials, the aggressive ones, if they see [finance-related] information, they see it as boring or not interested in it. People are more engaged if they see the information in entertainment or as funny content and something they would spend time browsing,” said Joel Khristopher S. Cabugos, cofounder of KasKasan Buddies, an FB group focused on credit card hacks promos and other financial topics.

“Relatability is a big factor as to why people watch videos and content on social media about finances. Particularly in content creators, you see their struggles and relate to it then you see their success and try to replicate their money handling,” said Randy A. Arevalo, consumer of TikTok clips on financial topics.

Based on the January 2024 Meltwater data, 43.9% of Filipinos follow influencers and other experts on social media.

Kimberly C. Soriano, manager at a financial institution and consumer of money-handling topics on Facebook, said that “social media offers simpler and more engaging content which makes learning finances fun and easier to remember.”

Similarly, content creators and social media influencers saw that today’s generation is more likely to learn the information by making it more interactive and less technical.

“I can see that a shift has occurred in recent years as creators made financial information more available and less intimidating for Filipinos,” said Prexel Parnacio, owner of the Millionaire in Progress (MIP) academy coaching program and TikTok finance influencer.

For KasKasan Buddies’ Mr. Cabugos, content creators promote financially literate Filipinos by giving them a space to discuss topics that they may be afraid to ask their bank about such as credit card usage.

“Our goal [as creators] is to make the information as simple and engaging as possible so we can slowly onboard the majority of Filipinos in proper finance handling,” Mr. Cabugos said.

Banks have also noticed today’s reliance on social media for customer service interactions.

The central bank sees these platforms as an avenue for BSP-supervised financial institutions (BSFIs) to interact with customers, address concerns, and foster brand building.

The availability of chatbots and case resolution services via the banks’ social media platforms helps consumers deal with their finances better than the old-school customer service calls and bank visits.

“For simple issues and concerns, I would prefer online services like chatbots and chats with customer service,” said Ms. Arevalo. “If the banks had services for more complex document processing requests, I would prefer to do it online as well instead of having to schedule to go onsite. It is a time hassle.”

APPROACH

Amidst this digital landscape, it is no surprise that banks and institutions have leveraged platforms like YouTube, Facebook, and Google to engage with consumers through them.

Banks employ various approaches including organic ad reach and internet campaigns to inform users about product offerings and services.

“The algorithm of social media works like this: if a post on a specific product or topic caught your interest and you interacted with it, expect to see the same product or topic appearing on your feed in the future,” Mr. Cabugos of KasKasan Buddies said.

Audience engagement with bank products on social media, ranging from credit cards to high-interest savings accounts, shows the importance of targeted marketing strategies.

Development Bank of the Philippines (DBP) President and Chief Executive Officer Michael O. de Jesus said in an e-mail that “through [this] strategic analysis of audience interactions and feedback, the bank gains insights into the preferences and priorities of its online community, enabling more targeted and effective outreach efforts.”

Although external link advertisements remain a common tool in banks’ marketing, data by Meltwater showed a 19.6% decline in external link traffic shares attributable to organic social media in the past 12 months.

On the other hand, the Philippines leads as the top consumer of vlogging content creators with a significant 55.6% of daily vlog consumption, 60.4% of which uses online video as a source of learning.

Keeping up with this trend, both Maybank Philippines, Inc. and DBP had altered their marketing approach to meet the current consumption habits.

“Our content [has adapted to] using informative short videos or stories to drive the messaging. However, we do still maintain presence in traditional media, and throw in events into the mix,” Maybank said in an e-mail.

BSP, on the other hand, launched campaigns that aim to make “friendlier” contents such as #BSPExplained, which releases definitions of terms of technical concepts in the local language, and PisoLit which releases creative and funny cartoons focused on saving, personal finance, and fraud prevention.

In handling customers via social media, BSP, Maybank, and DBP utilized chatbots and dedicated teams online.

While Maybank leverages both automated responses and real-time responses, DBP utilizes automated responses focused on frequently asked questions.

The BSP also launched a dedicated chatbot by the name BSP Online Buddy or BOB in FB Messenger to make it more accessible to financial consumers.

Banks have also tapped into collaboration with content creators for social media marketing and awareness campaigns.

Both TikTok coach Ms. Parnacio and KasKasan Buddies’ Mr. Cabugos have had numerous collaborations with banks.

“I have had partnerships mostly with banks and other institutions to create awareness campaigns on how to avoid being a victim of these fraudsters as well as what to do if you become a victim,” Ms. Parnacio said.

Similarly, Mr. Cabugos cited his experience in working with banks for credit card campaigns.

“Once, we partnered with RCBC in credit card applications, and the process got delayed due to the massive volume of applicants,” he said.

“If it was not for the collaboration, we would not have been able to coordinate the experience of the users to the banks and the banks would not have been able to respond via announcement to the users.”

“Collaborations allow the users to have their voice heard by the institutions,” Mr. Cabugos said.

RISKS AND DANGERS

Despite the opportunities available in using social media as a platform of financial literacy, challenges such as fake news and fraud remain.

For content creators, a common issue experienced is the rise of fake accounts that copy them and swindle their followers.

“I am not sure how they do it, but they copy my account from contents to pictures to texts then they contact my followers asking for money,” Ms. Parnacio said.

“This was detrimental for both the followers and the creators who might lose their credibility because of such events,” she added.

Mr. Uy, an employee who follows creators focused on trading and finances online, said that he experienced the same situation but was able to evade it by taking time to discern and research the page.

“I noticed that the like count is unusually lower than the original page and when the creator started subtly asking for my money, I knew something was up. However, if I had not become vigilant, I might have been scammed,” he said in a phone call interview.

Additionally, there is also data permanence, a problem felt by both banks and users. Once an information, comment, or post has been released on social media, copies of it may remain even if the information — be it good or bad — has been removed or deleted.

“What goes on social media, stays on social media,” said Maybank.

Alongside creators and users, banks also advocate for vigilance and due diligence in researching the person you follow and the content you digest online.

LEVELING UP

Looking ahead, social media is bound to stay as part of the marketing mix for banks and an influencer on consumer decisions.

For the consumers, speed in conflict resolution as well as a wider range of customer service transactions are factors that the banks can still improve on their social media utilization.

More engaging and gamified contents were recommendations by the social media personalities.

“More collaborations with creators and banks would help users be more at ease with grasping concepts. However, financial institutions should be careful of who they partner with,” said TikTok coach Ms. Parnacio.

KasKasan Buddies’ Mr. Cabugos, on the other hand, said that gamified contents would help gather the personalized feedback of the users on the banks.

“Generate more gamified financial literacy content that people can participate and get involved in. The more involved the person is, the higher the chance of the content being shared across their peers,” he said.

“Banks will have to recognize social media overlaps. People have multiple accounts that they log into [and to keep up with this] banks and content [should] not live on one channel only, it travels across,” said Maybank.

BSP expects wider utilization of these platforms in the future as “it can provide access to previously untapped segments for financial education and integration.”

As social media evolves and more people rely on it for financial insight, the responsibility to remain critical in the spread of information relies on every member of the financial sector — banks, financial institutions, content creators, and users.