Nostalgia the focus of this year’s Japanese film festival

NOW ON its 27th year, the Japanese Film Festival (JFF) presents a selection of 14 full-length films from a variety of genres to “make audiences feel nostalgic for their own fond memories,” said its festival director.

The annual film festival is organized by the Japan Foundation Manila and will run from Feb. 1 to March 2 at the Shangri-La Plaza cinemas in Mandaluyong City, the University of the Philippines’ (UP) Film Center in Quezon City, and in several cities across the country: Baguio, Cebu, Iloilo, and Davao.

The JFF will kick off at the Shangri-La Plaza from Feb. 1 to 11.

“I sometimes hear that the culture of watching movies has already changed during the pandemic, but we really want JFF to be a chance for many people to remember the joy of coming to the theaters,” Yojiro Tanaka, JFF’s festival director, said during the press launch on Jan. 23.

This year, he said, the goal is to attract 30,000 Filipinos to watch Japanese films in the cinemas. Yearly, the JFF is able to attract at least 25,000 audience members.

“That’s why we really wanted to bring in the Voltes V titles. Our theme is about the past and the now, so when we encountered that The First Slam Dunk was also available, we thought it was another thing to bring back,” he added.

Hence, the festival’s opening film is Takehiko Inoue’s The First Slam Dunk (2022). It is a partial adaptation of the popular Slam Dunk basketball manga, which spawned an animé franchise of the same name.

Mr. Tanaka said that the manga is widely regarded as one of the most popular in Japan. In the Philippines, the anime adaptation was a favorite among Filipino fans of both animé and basketball in the 1990s.

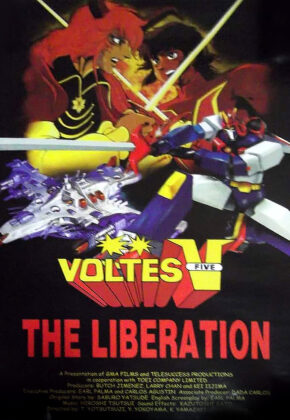

Keeping the ball rolling is the four-episode conclusion to the Voltes V animé series from the 1970s. Though the conclusion was barred from airing during the Philippines’ martial law period — disappointing a generation of children — the episodes were combined into a movie titled Voltes V: The Liberation in 1999 and this will now be shown in the country through the JFF.

Meanwhile, Voltes V: Legacy (2023), the live-action Filipino take on the popular 1970s animé will also be screened. It marks an important collaboration as the Filipino production gives its spin on TOEI Studios’ property.

Audiences can also look forward to seeing a certain iconic high-school detective on the big screen. The Detective Conan movies (The Time-Bombed Skyscraper from 1997 and The Private Eyes’ Requiem from 2006) will be part of the lineup.

For cinephiles, the JFF will screen the classic masterpiece Tokyo Story (1953), by Japanese auteur Yasujiro Ozu.

Meanwhile, hopelessly romantic Filipinos can look forward to the unrequited love story set in high school, And Yet, You Are So Sweet (2023), and the heart-wrenching drama We Made a Beautiful Bouquet (2021) that star popular Japanese celebrities Masaki Suda and Kasumi Arimura.

The comedies Not Quite Dead Yet (2020) and Mondays: See You This Week! (2022) will allow audiences to laugh at absurd takes on family deaths and office culture respectively.

Then, the animated film Gold Kingdom and Water Kingdom (2023) can keep children entertained and enlightened through unique Japanese traditions, while biopic Father of the Milky Way Railroad (2023), starring veteran actor Koji Yakusho, gives adults a glimpse into one of Japan’s most beloved authors.

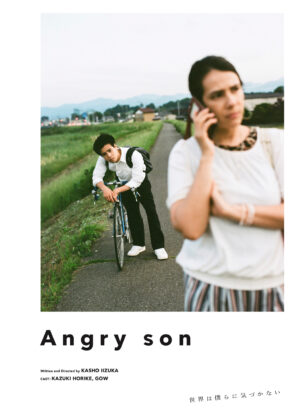

Rounding off the lineup are recently released, critically acclaimed “serious” films — A Man (2022) starring dramatic actor Satoshi Tsumabuki who is at the heart of a dark mystery; and Angry Son (2022) by director Kasho Iizuka, which follows a Japanese-Filipino teen discovering his identity and sexuality. The latter will have a post screening Q&A with the director.

“We hope that the wide range of films will entertain long-time festival goers and those who are already fans of Japanese films. We also welcome newcomers to enjoy the JFF,” said festival director Mr. Tanaka.

Admission is free for all screenings. Guests can simply visit their preferred participating theaters and queue before each screening of their chosen movie.

“Last year, we charged P100 but this year we decided not to. We thought it would greatly affect the number of audiences, and our purpose is to welcome as many people as possible,” Mr. Tanaka said.

The JFF will run at the Shangri-La Plaza mall cinemas from Feb. 1 to 11, at SM Seaside City Cebu from Feb. 16 to 25, at SM City Baguio, Iloilo, and Davao from Feb. 23 to March 3, and the UP Film Center in Quezon City from Feb. 22 to March 2.

For the full screening schedule and screening dates for other cities, visit the JFF Facebook page. — Brontë H. Lacsamana