By Kyle Aristophere T. Atienza, Reporter

THE Philippines, United States, Japan and Australia need a stronger economic message and should boost their ties beyond defense and security to sustain their partnership amid an increasingly belligerent China, according to analysts.

The Philippine-US-Japan-Australia “Quadrilateral” is still in its infancy, but it has the potential to develop into a more formal “minilateral” grouping, said Jeffrey Ordaniel, director for maritime security at the Pacific Forum and an associate professor of international security studies at the Tokyo International University.

The four nations may have to bring tangible benefits to the Indo-Pacific region including economic prosperity through trade, and start initiatives in infrastructure investment, regional supply chain connectivity and energy security for their ties to be meaningful and believable.

Mr. Ordaniel said the emergence of several minilateral groups in the Indo-Pacific region, such as the possible new Quad, was due to the Association of Southeast Asian Nations’ (ASEAN) “inability to manage geopolitical and security challenges involving China and the US.”

“ASEAN’s consensus-based approach is inhibiting meaningful actions on issues such as the South China Sea,” Mr. Ordaniel said.

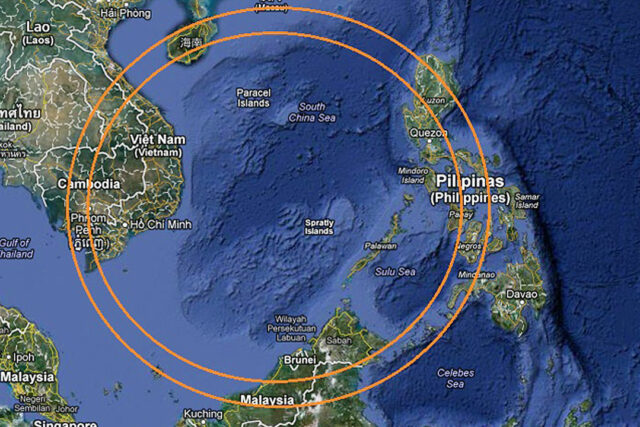

The US, Japan, Australia and the Philippines last year started a quadrilateral security dialogue in the face of an aggressive China, which claims the South China Sea almost in its entirety.

The US, Japan, Australia and the Philippines last year started a quadrilateral security dialogue in the face of an aggressive China, which claims the South China Sea almost in its entirety.

The four allies, especially the US, have also expressed concern over China’s aggression toward Taiwan, which Beijing regards as a renegade province.

“These are some of the largest economies in the region and if they get their act together, they can have a strong impact,” Joseph Herman S. Kraft, former chairman of the University of the Philippines Political Science Department, said in a Viber message.

The US and China have been locked in a trade war since 2018, when former President Donald J. Trump slapped investment controls and tariffs on hundreds of billions of dollars worth of Chinese products due mainly to alleged unfair trade practices by Beijing.

US President Joseph R. Biden, Jr. who is running for his last reelection, has kept the tariffs and imposed more restrictions. He has called the US-China conflict “a battle between the utility of democracies in the 21st century and autocracies.”

The US has been at the forefront of international condemnation of China’s intrusions into the exclusive economic zone of the Philippines, a much smaller nation that has been seeking more economic and security partnerships.

“The US is the largest economy in the world, but it is beset by a growing domestic preference to be less internationally engaged,” Mr. Kraft said.

“Yet, within the region, increased access to markets is the preferred economic direction,” he said. “Unless the US goes in a different direction, the economic prospect of this new Quad is going to be limited compared to what China brings to the table.”

Last month, a high-level delegation of US companies led by Commerce Secretary Gina Raimondo pledged to invest $1 billion in the Philippines spanning electric vehicles, digitalization and green energy.

The Philippines is rich in critical minerals that “are more important than ever,” Ms. Raimondo said as she cited a US plan to double the number of semiconductor factories in the Southeast Asian nation.

Despite China’s show of force at sea, its economy seems to be in shambles. Forecasts from the International Monetary Fund showed its growth will slow to 4.6% this year from an estimated 5.4% last year.

China’s economic growth last year was driven by the resilience of its high-tech and service sectors, “while challenges came from declining property investment, debt risk and weak consumption growth,” according to the East Asia Forum.

“The fear is that China’s economic challenges may actually accelerate its expansionist agenda,” Raymond M. Powell, a fellow at Stanford University’s Gordian Knot Center for National Security Innovation, said in an X message. “Beijing may sense that its window of opportunity for bold action will start to close once its fiscal and demographic problems really start to bite.”

Tensions between the Philippines and China have worsened in the past year as Beijing continues to block Manila’s resupply missions at Second Thomas Shoal in the South China Sea using water cannons.

A Chinese envoy said in January relations between the two countries were at a crossroads.

The Philippines in November scrapped a $4.9-billion funding deal with China, the world’s second-biggest economy, for three rail projects after Beijing failed to respond to funding requests.

China was the largest source of Philippine imports last year at $29.38 billion. It was followed by Indonesia ($11.51 billion), Japan ($10.26 billion), South Korea ($8.48 billion) and the US ($8.41 billion).

But the US was the largest destination of Philippine products at $11.54 billion or 15.7% of the country’s exports. It was followed by China ($10.86 billion), Japan ($10.45 billion), Hong Kong ($8.84 billion) and South Korea ($3.53 billion).

The Philippines’ total trade with Australia hit $4.06 billion, exporting $561.8 million of Philippine products and importing $3.497 billion of Australian goods.

The US, Japan and Australia are “more than enough to fill the void left by China, including projects that may be canceled in the event of worsening relations with Beijing over the West Philippine Sea,” Terry L. Ridon, a public investment analyst, said in a Facebook Messenger chat.

“Tokyo is our largest official development assistance partner, with its aid agency involved in the most important infrastructure projects such as the Metro Manila Subway,” he pointed out.

‘CLOSER TO REALITY’

Mr. Marcos flew to Melbourne last March 3 for a three-day special summit between Australia and ASEAN, days after a state visit to Canberra where he told Australia’s Parliament that the Philippines is on the frontline of a battle for regional peace.

The Philippine leader at the special summit on March 6 said his country hopes to benefit from Australia’s pivot to Southeast Asia, which he described is an important growth driver in the Indo-Pacific region.

The Philippines and Australia transformed their relationship into a strategic partnership in September 2023, and a month later, the Southeast Asian nation and Japan committed to quicken their talks for a status of forces of agreement.

“The Strategic Partnership agreement in September last year reflected the growing relations between Australia and the Philippines,” Aushaz Irfan, an intelligence analyst at United Kingdom-based risk management firm Healix, said in an e-mail. “It notably comes amid Australia’s recent push for a more focused foreign policy approach toward Southeast Asia.”

He expects the two countries to boost ties in emerging technologies and digital industries.

Mr. Irfan noted that Japan’s foreign policy approach to Southeast Asia has changed in recent years, resulting in increased maritime and infrastructure cooperation with the Philippines.

“The quadrilateral dialogue is here to stay, and it’s geared toward deterring China’s revisionist goals and calibrating net security goals so that countries might contribute to the developmental goals of the rules-based order,” Joshua Bernard B. Espeña, vice-president at the Manila-based International Security and Development Center, said via Messenger chat.

The four nations recently held joint military drills within the Philippines’ exclusive economic zone in the South China Sea.

China likely sees the new grouping as a threat, which could mean “more vessel harassment, diplomatic slurs, disinformation warfare and soon economic sticks like sanctions over the balance of trade.”

“Nevertheless, this might result in more action-reaction chains between them until the other capitulates,” he said. The Philippines needs more than a dialogue soon — “a workable coalition to collectively deter China’s revisionist goals,” he added.

Mr. Espeña said the US-led Indo-Pacific Economic Framework for Prosperity (IPEF) is still in a grueling stage of implementation. “Working within a minilateral trading bloc across goods, services, intellectual property, investments, research and development might be the way forward to make the counter-narrative against China closer to reality.”

He urged the security grouping to boost intelligence exchange and pursue a counter-narrative campaign as Beijing is likely to work with their citizens and business elites to dissuade Quad members from mobilizing their economies for a stronger collective security posture.

Mr. Marcos, Mr. Biden and Japanese Prime Minister Fumio Kishida are set to meet on April 11 for their first-ever three-way summit, where they will discuss ways to advance their economic and climate goals, apart from keeping peace in the Indo-Pacific region and around the world.

While many have welcomed the summit, some have raised questions on the future of the emerging Quad.

“Where is Quad?” former Japanese envoy to Canberra Shingo Yamagami asked in an X post, citing a vow by Australian Prime Minister Antony Albanese in May 2022 that his country’s commitment to the four-way grouping would not change.

“We need to keep on pedaling the bicycle of Quad.”

China last month dropped tariffs on Australian wine, a decision Canberra said validates its “calm and consistent approach” with Beijing on a series of trade disputes.

Mr. Ordaniel expects the Philippines to keep its security cooperation with the US, Japan and Australia beyond the Marcos administration.

“Geopolitical and security realities are hard to ignore that even a leader like Rodrigo R. Duterte would find it hard to justify more accommodation of China at the obvious expense of the Philippines’ long-term interest.”

The US, Japan, Australia and the Philippines last year started a quadrilateral security dialogue in the face of an aggressive China, which claims the South China Sea almost in its entirety.

The US, Japan, Australia and the Philippines last year started a quadrilateral security dialogue in the face of an aggressive China, which claims the South China Sea almost in its entirety.