By Kyle Aristophere T. Atienza and Ashley Erika O. Jose, Reporters

THE PHILIPPINES is banking on the multibillion-peso makeover of its major international airport — one of the worst in the world — to boost the economy through increased flights and tourism receipts, according to President Ferdinand R. Marcos, Jr.

“This undertaking is not just about revenues that will be remitted to the Treasury alone,” he said in a speech during the signing ceremony in Malacañang on Monday. “It is an investment in our future.”

The upgrade of the aging and congested Ninoy Aquino International Airport (NAIA) is part of the Marcos government’s push to tap the private sector in improving the nation’s major infrastructure and ease the state’s fiscal burden.

The P170.6-billion public-private partnership (PPP) project, which took a record-breaking six weeks to be awarded to the consortium led by San Miguel Corp. (SMC), will increase the airport’s capacity by 77% to 62 million passengers yearly.

“But we did not sacrifice scrutiny for speed,” Mr. Marcos said. “It was fast, but it was also fastidiously examined at every step of the way. It was open, transparent, and competitive.”

The consortium, composed of San Miguel Holdings Corp.; RMM Asian Logistics, Inc.; RLW Aviation Development, Inc.; and Incheon International Airport Corp. has been given a 15-year concession that can be extended for another 10 years.

The National Government expects to earn P900 billion from the project in those years, or P36 billion a year. This is 20 times bigger than the P1.17 billion remitted by the Manila International Airport Authority annually in the 13 years through 2023, according to the Transportation department.

Efforts to rehabilitate NAIA had been stalled by various issues, denying the Philippine economy in tourism receipts, said Mr. Marcos, citing “bureaucratic inertia, political turbulence, [and] legal wranglings.”

“The reputation of this airport has been shredded, and let us be frank about it, not by bad press, but by its actual poor state,” Mr. Marcos said, noting that “the postponed improvement of the airport has resulted in delayed and reduced number of flights.”

He lamented that NAIA has been operating beyond its capacity for almost a decade.

“And since that is the case, the restoration of this airport should go beyond its physical design and structure,” he said, calling for a “major overhaul.”

Mr. Marcos cited the need to rehabilitate the passenger terminals and airside facilities, develop commercial assets and utility systems, and put up intermodal and inter-terminal transport facilities.

Finance Secretary Ralph G. Recto hopes the upgrade will finally help NAIA move from the “list of world’s worst airports to one of the best.”

“[It] aims to address the longstanding challenges of undercapacity, congestion, and underinvestment in the country’s main gateway,” he said in a speech.

The landmark deal, the fastest PPP project to progress from submission to an investment coordination committee for approval to concession agreement signing, sets a precedent for future initiatives between the state and the private sector, PPP Center Executive Director Ma. Cynthia C. Hernandez said in a speech.

NEW TERMINAL

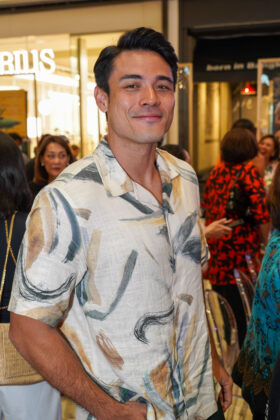

Meanwhile, SMC President and Chief Executive Officer Ramon S. Ang said the consortium, now known as New NAIA Infrastructure Corp., has already secured funds for the NAIA project.

“We have separate funding [from SMC]. The funding has already been committed by the bankers and we have shown the bankers that we are fully financed, fully underwritten,” he said at a media briefing on Monday.

Mr. Ang said the funding source for the project “should not be considered a problem” as banks, particularly the Sy-led BDO Unibank, Inc. have committed to provide funding.

New NAIA Infrastructure is planning to build a new passenger terminal building with a total capacity of 35 million passengers per year as part of its commitment to decongest the airport.

“In the future we will decongest the airport. Eventually when we build a new passenger terminal and a new multipurpose building with a carpark all of those offices can be relocated to this multipurpose building and it will add 30% more space in our existing terminals,” Mr. Ang said.

Mr. Ang said the proposed building, which will be constructed within three years after the approval of the Transportation department, will feature concourses and boarding bridges to allow seamless and efficient passenger transfers.

“With that signing, the consortium will be able to implement infrastructure projects, reform in the operations, which will redound to the benefit of the riding public,” Transportation Secretary Jaime J. Bautista said.

New NAIA Infrastructure will take over the operations of the airport by September.

“From September to next year, in March, I guarantee there will be no vehicular traffic. The Terminals 1 and 2, will be much easier to rehabilitate, starting September it will be under full maintenance,” SMC’s Mr. Ang said.

Analysts said the much-awaited NAIA upgrade will help boost the Philippines’ efforts to attract more tourists, especially as the airport has been consistently ranked among the worst in the world.

“The public is indeed frustrated with the state of our main airport, so any effort to rehabilitate both its services and image would be a major shift in perspective,” said Emy Ruth Gianan, who teaches economics at the Polytechnic University of the Philippines.

“A more efficient airport would give us an advantage alongside our competitive tourist spots,” she said in a Facebook Messenger chat.

Tourism accounted for 6.2% of the Philippine economic output in 2022, and the government hopes it will be a key driver of the country’s growth goals.

The Southeast Asian nation recorded 5.45 million international visitors in 2023, hitting the 4.8-million target but accounting for only 66% of total arrivals.

Regional airports may follow suit after the Marcos administration’s deal with the SMC-led consortium, said Terry L. Ridon, convenor of InfraWatch PH.

“We are expecting the same fast and efficient processing times in respect to the other regional airports around the country as well, particularly relating to the unsolicited proposal process currently being undertaken by a private proponent,” he said in a Facebook Messenger chat.

However, he noted there could be an increase in terminal fees.

“We are more optimistic that reasonable fees will be imposed during the NAIA concession given that an overwhelming share in revenue will be taken by the government,” he said.

If it happens, the government should delay any price hikes in travel expenses, “first as “compensation” for bad public service and second as a means to generate further interest in domestic tourism,” Ms. Gianan said.

A recent study by British business finance researcher BusinessFinancing.co.uk based on travelers’ accounts ranked NAIA as the fourth-worst airport in Asia for business travelers.

NAIA had been hounded by brownouts in recent years, and a severe power outage on the first day of 2023 jolted its air-traffic control and disrupted over 200 flights.

“The stability, development, and security of an airport represents how capable a country is in positioning itself in an increasingly globalizing world,” said security expert Don Mclain Gill, who teaches international relations at De La Salle University.

A modernized airport should have an “efficient security system that can adapt to emerging threats,” he said via Messenger chat. “This means that a modernized airport security must adopt a risk- based screening and the utilization of advanced technology to ease certain deficiencies in manpower.”