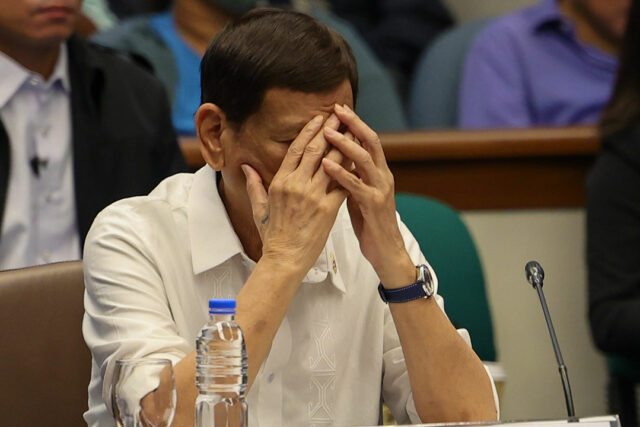

Shooting oneself in the foot is an idiomatic expression that means foolishly putting oneself in trouble. Then presidential candidate Rodrigo Duterte said at a rally in April 2016, “I’m used to shooting people.” But he shot himself in the foot during the House of Representatives Quad committee hearing last Wednesday.

Former senator Antonio Trillanes was testifying that money generated in drug trade was deposited multiple times in the Bank of the Philippine Islands account of Duterte and his daughter Sara.

Duterte butted in, “If it is true, even if only one (referring to any deposit), I will sign a waiver. All banks.” The bank secrecy law prohibits the disclosure of or inquiry into deposits with any banking institution. A bank waiver lifts the prohibition.

Deputy Speaker David Suarez, who was presiding at that point, asked Duterte if he was willing to sign a bank waiver.

“Just so that we could put to rest the issue of waivers, because it’s been going back and forth, will the former president be okay that if we draft the waiver now that it will be signed today instead of tomorrow? Will you be fine with that, Mr. President?” Suarez said.

“In exchange for what, sir, I will slap him in public?” responded Duterte. “There is no such thing, sir,” Suarez replied, suspending the hearing immediately after saying that.

The impression the incident left was that Duterte was bluffing about a bank waiver. His bluff in turn left the impression that Trillanes’ allegation is true.

It is not the first time the issue has been raised. During the presidential campaign in 2016, Trillanes alleged that then-presidential candidate Duterte had unexplained wealth. In February 2017, by which time Duterte was already president, Trillanes pressed him to publicly release details of his bank accounts to disprove allegations that he had large sums of undeclared money.

Trillanes dared Duterte in April that year to meet him at the Bank of the Philippine Islands branch on Julia Vargas, Pasig City where he was alleged to have a large sum of money, but it was lawyer Salvador Panelo who showed up with a special power of attorney from Duterte. Panelo said bank officials told him it would take seven days to study the request. Trillanes said the account was never opened to scrutiny.

In May, Trillanes distributed to journalists copies of documents he said were given to him by a “concerned citizen.” The documents supposedly showed lists of bank accounts owned by the Duterte children — Paolo, Sebastian, and Sara — and Duterte’s common-law wife, Honeylet Avanceña. The documents supposedly showed that a total of P2.4 billion flowed into the Dutertes’ various bank accounts from 2006 to 2015, representing alleged unexplained wealth.

Duterte refused to sign a waiver that would allow the scrutiny of his alleged bank accounts. He said that he had already signed a waiver when the allegation that he had a large amount of money kept in the Bank of Philippine Islands (BPI) branch in Julia Vargas first surfaced. It was not a waiver he signed, it was the power of attorney to Panelo.

So, when he offered to sign a bank waiver last Wednesday, he shot himself in the foot. He didn’t expect his bluff to be called. He must have assumed he would be accorded the same reverence and indulgence the members of the Senate Blue Ribbon Committee rendered him. But he was forewarned.

In his opening statement, Rep. Benny Abante, chairman of the House Committee on Human Rights, said:

“We are not here to give you obeisance, we are not here to submit to you. We are here as equal members of this House, Mr. Former President. You are now a private citizen. And I hope and pray that you will give equal respect as we give you equal respect today.”

I discerned from Abante’s use of the word “obeisance” the subtle message to Duterte that the members of the Quad committees would not sit meekly as he dresses them down like what happened when Duterte appeared before the Senate Blue Ribbon Committee. And in sharp contrast to the Senate Blue Ribbon Committee proceedings, which was more of a Duterte seminar on governance, the horrific consequence of the illegal drug trade, and the role of the police force in the war on drugs, the Quad hearing was more of an inquiry into extra-judicial killings.

And what the Senate Blue Ribbon Committee neglected to do, the Quad committees did to a large extent last Wednesday. They picked up where the senators left off.

The first to question Duterte was Rep. Arlene Brosas. She opened her interpellation by quoting what Duterte said before the senators, that he takes full legal responsibility for what the police did. Then she asked, “Can the former president looked them (families of innocent victims of extra-judicial killings present in the hearing) in the eye and say once more ‘I take full, legal responsibility for the death of their love ones’?”

Duterte answered, “Correct, very correct. When I was president, there was, there still is, a drug problem. I had to issue or make a policy statement about drugs. All that happened pursuant to my order to stop the drug problem in this country is mine, all mine. I was the one who gave the order. What they did, legal or illegal, that is mine.” Former president Duterte’s executive secretary Salvador Medialdea, who was seated right behind Duterte, jerked forward upon hearing the word “illegal.” Duterte just shot himself in the foot — the first time that day.

When Brosas also asked if he is willing to cooperate with the International Criminal Court (ICC), Duterte said, “I am asking the ICC to hurry up, and if possible they can come to start their investigation tomorrow and if I am found guilty I will go to prison and rot there for all time.”

Next to question him was Rep. Dan Fernandez, chairman of the Committee on Public Order and Safety. He got Duterte to admit that many of those killed in the drug war were collateral damage, that reward money was given to policemen who killed drug pushers. He asked Duterte if it is true what he (Duterte) said in an interview in 2016 that he planted evidence during his time as a fiscal. Duterte denied it repeatedly. Then Fernandez played the video of the interview that showed Duterte saying, “We planted evidence, we arrested persons but we released them,” Duterte said, “That’s true.”

To Rep. Jeffrey Khonghun’s question if he takes responsibility for the collateral death of 21 children, Duterte answered, “Yes, I take full responsibility.”

In answer to Rep. Raoul Manuel’s question if it is okay with him for the ICC to investigate, Duterte said, “The ICC does not scare me a bit. They can come anytime. I will welcome them… Whatever I did I did it for my country… No excuse, no apology.”

Rep. Gerville Luistro said that Duterte’s war on drugs never complied with the requirements of due process. She suggested that the Quad committees recommend the filing of the necessary action in court for crimes against humanity or at least murder charges against Duterte. Asked if he is willing to submit to the ICC if his trip to The Hague is sponsored, Duterte said, “Yes, I will slap them. If they come here, I will slap them as well.”

Rodrigo Duterte is not only used to shooting people, he is inclined to slapping people. The Nov. 13 hearing of the Quad committees ended with Duterte’s rude offer to sign a bank waiver in exchange for slapping Trillanes.

All throughout the 13-hour session, the former president tried to intimidate the Quad people. He barked at Brosas for asking questions like an investigator. “But this is an investigation,” asserted Brosas. He raised his voice when answering Fernandez’ question. Fernandez told him to tone down his voice. When he kept on interrupting Fernandez, Stephen Paduano, co-chairman of the Quad committees, ruled Duterte out of order. By the way, Fernandez and Paduano were among the many congressmen who acceded to then President Duterte’s prompting to deny the renewal of ABS-CBN’s franchise.

Rep. Ace Barber, overall chairman of the Quad committees was too lenient to the disrespectful conduct of ordinary citizen Duterte.

Oscar P. Lagman, Jr. has been a keen observer of Philippine politics since the late 1950s.