Fed review in spotlight as market looks for leads

PHILIPPINE STOCKS may trade sideways in the coming days after ending a seven-week winning run as investors look ahead to the policy meeting of the US Federal Reserve.

On Friday, the benchmark Philippine Stock Exchange index (PSEi) dropped by 2.09% or 145.64 points to close at 6,822.32, while the broader all shares index fell by 1.39% or 50.28 points to end at 3,560.46.

Week on week, the PSEi retreated by 1.73% or 119.89 points from its 6,942.21 close on March 8.

“A Friday sell-off caused the local market to end in the red territory last week, snapping its seven-week gaining streak. In the process, the bourse fell below its 10-day and 20-day exponential moving averages,” Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco said in a Viber message.

“Last week’s drop opens doors for bargain hunting opportunities. However, a strong rally could be difficult amid tempered hopes of a rate cut by the Fed following the above-expected US producer price index (PPI) inflation. Hence, the market may only move sideways,” Mr. Tantiangco said. “Aside from this, investors are also expected to watch out for the remainder of the fourth quarter and full-year 2023 corporate results.”

The Fed will hold its policy meeting on March 19-20.

The US central bank held its target rate steady at the 5.25-5.5% range for a fourth straight time at its January meeting after raising borrowing costs by 525 basis points from March 2022 to July 2023.

US government data released last week showed that its inflation rate accelerated to 3.2% in February from 3.1% in January.

A report from the Labor department showed the producer price index for final demand rose 0.6% in February after advancing 0.3% in January, Reuters reported. Economists had forecast the PPI would climb 0.3%.

In the 12 months through February, the PPI shot up 1.6% after advancing 1% in January. The report followed news on Tuesday that consumer prices increased strongly for a second straight month in February.

“The markets would be anticipating the upcoming Fed rate-setting meeting and decision, as well as the updated Fed dot plot, as source of new market leads on March 20,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort likewise said in a Viber message.

Online brokerage firm 2Trade-Asia.com put the PSEi’s support at 6,800 and resistance at 7,000.

“Brace for price gyrations in tandem with macro headlines as markets remain interest rate sensitive,” 2TradeAsia.com said.

Meanwhile, Mr. Tantiangco placed the PSEi’s support at 6,700 and resistance at 7,000, and Mr. Ricafort put its immediate major support at 6,340-6,470.

“Major resistance over the past two years is at 6,840 levels, for any consistent breach above which would lead to further upside potential towards the 7,100-7,500 levels for the coming months,” Mr. Ricafort said. — R.M.D. Ochave with Reuters

Peso to move sideways vs dollar

THE PESO could trade sideways against the dollar this week as the market awaits the policy meeting of the US Federal Reserve.

The local unit closed at P55.53 per dollar on Friday, weakening by 13 centavos from its P55.40 finish on Thursday, Bankers Association of the Philippines data showed.

Week on week, however, the peso strengthened by four centavos from its P55.57 close on March 8.

The peso weakened on Friday following the release of US producer price index (PPI) and retail sales data, which resulted in a general stronger dollar and higher US Treasury yields, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Retail sales rose 0.6% last month, the Commerce department’s Census Bureau said, Reuters reported.

They increased 1.5% on a year-on-year basis in February.

Meanwhile, another report from the Labor department showed the producer price index for final demand rose 0.6% in February after advancing 0.3% in January.

In the 12 months through February, the PPI shot up by 1.6% after advancing 1% in January.

For this week, Mr. Ricafort said the market will monitor the Fed’s March 19-20 policy meeting for leads.

Mr. Ricafort sees the peso ranging from P55.30 to P55.80 per dollar this week. — A.M.C. Sy with Reuters

PEZA pharma locators eyed for expedited-permit scheme

PHARMACEUTICAL companies and makers of medical devices who operate in economic zones are being considered for green-lane treatment, entitling them to an expedited process for obtaining permits from drug regulators, the Philippine Economic Zone Authority (PEZA) said.

In a statement, PEZA said the proposal was discussed in a meeting with the Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA) and the Food and Drug Administration (FDA) last week.

“The high-level discussion centered on actionable steps to enhance the ease of doing business for both domestic and export-oriented drug and medical device manufacturers by addressing certain non-tariff barriers, particularly in permitting and licensing,” the investment promotion agency (IPA) said.

PEZA Director General Tereso O. Panga told BusinessWorld that the parties agreed to update the memorandum of agreement (MoA) signed in 2014.

“For this new MoA with the FDA, we agreed to consolidate two MoAs where the cooperating parties will provide a green lane for PEZA-registered business enterprises (involved in) pharmaceutical and medical device manufacturing,” Mr. Panga said in a Viber message.

The new MoA also aims to come up with guidelines for the registration of pharmaceutical industrial parks to provide a one-stop shop for FDA facilitation of permits and clearances and review policies to attract more pharma companies to the Philippines.

Mr. Panga said the goal is to encourage local production to lower the cost of drugs and medical devices, by reducing the turnaround time for pre-assessment activities they are subject to.

On Thursday, PEZA and the FDA unveiled their medical device economic zone initiative.

“We are committed to working in unison with the OSAPIEA and PEZA to simplify business operations in our country,” FDA Director General Samuel A. Zacate said.

“By refining our policies and collaborating with PEZA, we aim to gain a better understanding of the concerns of locators. These initiatives are expected to elevate the local drug supply and reduce costs to competitive generic levels, akin to those in India,” he added.

As of December, PEZA hosted 26 companies manufacturing of pharmaceutical products and medical equipment, accounting for P25.49 billion in investment and 19,000 direct jobs.

“Moreover, PEZA is reviving talks with the leading Filipino companies into pharmaceutical-related activities, such as Lloyd Laboratories, Pascual Laboratories, and United Laboratories, Inc., for the establishment of a modern pharma park,” the IPA said.

“PEZA is also in talks with Royal Cargo Pharma Logistics, the first Good Distribution Practices (GDP)-certified logistics service provider in the Philippines, to complement the proposed pharma-zone ecosystem,” it added. — Justine Irish D. Tabile

Wearables industry exports decline in Jan.

WEARABLES exports dropped in January and are expected to remain weak this year, the Confederation of Wearable Exporters of the Philippines (CONWEP) said.

“Industry performance continues to shrink and we foresee an overcast horizon ahead of us for 2024,” CONWEP Executive Director Ma. Teresita Jocson-Agoncillo said via telephone.

Exports by the wearables industry posted -19% growth in January to $82.4 million.

Apparel exports contracted 13% to $44.34 million, travel goods shrank 25% to $32.38 million, and footwear exports declined 16% to $5.67 million.

Apparel exports accounted for 0.7% of total exports in January. The leading exports were electronic products and semiconductors, which accounted for 58.2% and 45.5% respectively.

The trade-in-goods deficit shrank 24% to $4.22 billion in January.

Slower global demand, external conflicts, and regional competitors continue to put pressure on wearables exports, Ms. Jocson-Agoncillo said.

“Buyers would tend to be a little more careful in placing their orders to supplier countries like the Philippines, because they would need flexible sourcing that can promise low cost, are quick-to-market, and fully adhere to international laws… tied to sustainability issues and human rights,” she said.

Tensions between China and the US, the Russia-Ukraine war, and conflict in the Middle East have been disrupting the wearables supply chain, Ms. Jocson-Agoncillo added.

CONWEP has said a major foreign brand pulled out from the Philippines and transferred operations to Vietnam after that country signed a free trade agreement with the European Union.

The wearables industry could also suffer more job losses if Philippine legislators go ahead with a wage hike law, according to CONWEP.

“A wage increase at the moment is a major factor in maintaining competitiveness as a sourcing hub for apparel products from the Philippines,” Ms. Jocson-Agoncillo said.

Foundation for Economic Freedom President Calixto V. Chikiamco said the government should prioritize infrastructure catering to the movement of goods to boost trade in the coming months. These include airports, seaports, shipping services, warehouses, roads and transport links to key trade hubs.

“(President Ferdinand R. Marcos, Jr.) should promote foreign investment in shipping now that the Public Service Act has opened the sector to 100% foreign investment,” he said in a Viber message.

Mr. Chikiamco also urged lawmakers to pass a law separating the regulatory and operating functions of the Philippine Ports Authority to address port congestion.

Meanwhile, investment pledges recently gained by the Philippines should help establish the country as a semiconductor hub in the region alongside South Korea and Taiwan, public investment analyst Terry L. Ridon said.

“Government should follow through with the investment commitments in the recent US trade mission and Berlin official trip, in which the country is positioning itself as an alternative to China in the manufacturing of semiconductors and similar products, amid the rising competition between the US and China,” Mr. Ridon, convenor of think tank InfraWatch PH, said in an e-mail.

Last week, Mr. Marcos tallied $4 billion in foreign investment pledges from German companies in manufacturing, information technology, and agriculture. Several US companies are also set to invest about $1 billion in the Philippines, US Commerce Secretary Gina Raimondo said.

Semiconductor growth must come hand-in-hand with reduced red tape and corruption, Mr. Ridon added. — Beatriz Marie D. Cruz

Czech company expresses interest in PHL electronics, infotech, defense tie-ups

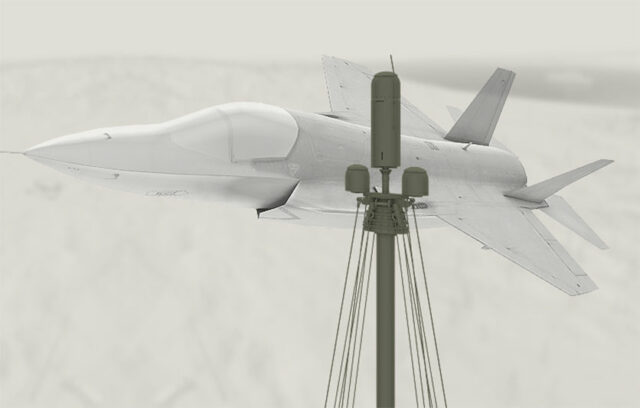

THE Department of Trade and Industry (DTI) said it received expressions of interest from a Czech technology to engage in Philippine partnerships in electronics manufacturing, information technology and business process management (IT-BPM), and defense.

In a statement, the DTI said that it met with representatives of ERA, a surveillance and reconnaissance technology company, which plans to establish a presence in the Philippines.

“ERA’s plans align perfectly with the Philippines’ strategic vision for economic development,” Trade Secretary Alfredo E. Pascual said.

“We’re excited about the immense potential for collaboration and technological knowledge transfer between ERA and other leading industrial players,” he added.

ERA has said it hopes to tap the Philippine electronics industry, which includes over 1,000 companies and employs 3 million workers.

The DTI also said that ERA also finds the Philippine IT-BPM industry talent pool attractive.

“(This provides) a reliable pool of talent for companies like ERA seeking to expand their operations in the Philippines,” the department said.

ERA also expressed interest in military and civilian security ventures in the Philippines.

On Saturday, the DTI also reported that the Philippine delegation signed three partnership deals at the Philippine-Czech Business Forum in Prague.

One of the agreements was signed between the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. and the Electrical and Electronic Association of the Czech Republic.

The second memorandum of understanding was signed between the IT and Business Process Association of the Philippines, Inc. and the Confederation of Industry of the Czech Republic.

The last deal was between the Philippine Chamber of Commerce and Industry and the Confederation of Industry of the Czech Republic. — Justine Irish D. Tabile

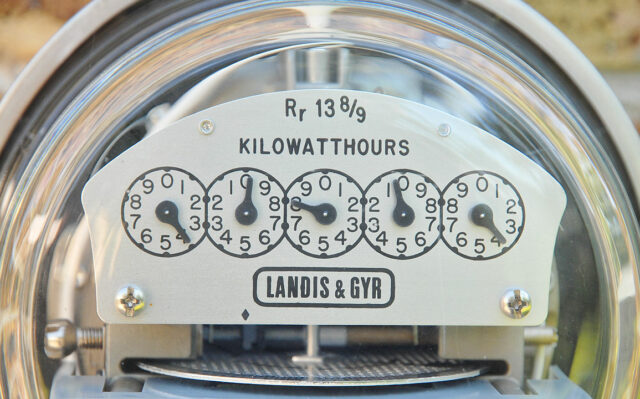

ERC raises power generation caps for grids

THE Energy Regulatory Commission (ERC) said it set new caps for installed generating capacity (IGC) and market share for the main power grids in 2024.

The national grid’s IGC rose to 25.57 million kilowatts (kW), or 25,567.27 megawatts (MW) from last year’s 25.47 million kW or 25,471.04 MW, according to a resolution dated March 12.

For Luzon, the allotted IGC for 2024 is 17.96 million kW (17,961.72 MW); the Visayas 3.42 million kW (3,417.17 MW); and Mindanao 4.19 million kW (4,187.84 MW).

The IGC is the maximum capacity of the generation facilities connected to a transmission system or distribution system, which are part of a particular grid.

The ERC sets the caps for IGC annually.

Under Republic Act No. 9136 or the Electric Power Industry Reform Act of 2001, no company or related group can own, operate or control more than 30% of the IGC of a grid and 25% of the national IGC.

“The base (total installed capacity) has increased; that is why the cap was adjusted proportionate to the base,” ERC Chairperson Monalisa C. Dimalanta said in a Viber message.

“Larger base reflects new capacities added to the system in 2023,” she said.

For 2024, the national grid’s market share limit is set at 6.39 million kW (6,391.92 MW), against 6.37 million kW (6,367.76 MW) a year earlier.

Power companies cannot own facilities with installed capacities exceeding 5.38 million kW (5,388 MW) in Luzon, 1.03 million kW (1,025 MW) in the Visayas, and 1.26 million kW (1,256 MW) in Mindanao. — Sheldeen Joy Talavera

Home Credit sees strong demand for e-bike, air conditioner loans

CONSUMER finance provider Home Credit Philippines said it is experiencing strong loan application volumes for customers seeking to purchase electric bikes (e-bikes) and air conditioners on credit.

In a briefing, Sheila A. Paul, chief marketing officer of Home Credit, said that customers use the e-bikes for their businesses, while new air conditioners are being bought for sustainability reasons.

“Our up-and-coming product, actually, ever since the pandemic, was laptops. And this year, our up-and-coming products are e-bikes and air conditioners,” Ms. Paul said on Friday.

However, she said that this does not include motorcycles, which are still not eligible for Home Credit loans.

“But if ever we go into it, it would be (one of our) highest-value items. Because if you compare, some iPhones cost as much,” she said.

The top product in terms of financing applications remains mobile phones, followed by televisions.

In 2023, the company acquired 1.1 million new customers, which brought its total customer base to 10.4 million, with more than half of them women.

Ms. Paul said that according to a study conducted by the company, wives and mothers are the main purchasing decision-makers in families.

“We found out that in the segment we’re targeting, the decision-makers are really women. So it’s either the wives or the mothers who are consulted on these kinds of purchases,” she added.

She said the average amount borrowed from Home Credit ranges from P15,000 to P20,000.

“And then we actually ask for a 20-30% down payment, so you can imagine the prices of the products they are purchasing through us,” she added.

Asked about the company’s outlook this year, she said that: “Actually, for us, 2023 was a good year. But we want to be conservative for 2024. Because there’s still so much happening globally.” — Justine Irish D. Tabile

DoE considering new norms for energy-efficiency compliance

THE Department of Energy (DoE) said it is considering new energy-efficiency standards for privately owned buildings.

“Maybe in a couple of years, we’ll be coming out with a building energy efficiency index, a benchmark (based on) the particular activity of the private company,” Patrick T. Aquino, director of the DoE’s Energy Utilization Management Bureau, told reporters last week.

Mr. Aquino said that the DoE is also considering a fleet fuel efficiency standard, equivalent to the corporate average fuel economy standard for vehicle manufacturers.

He said the team studying the new standards is currently in the data-collection stage.

“That’s something that we will ultimately have in place, but we will not put that in place until we’ve collected sufficient data,” Mr. Aquino said.

In a memorandum circular issued in 2020, the DoE requires designated establishments to submit an annual energy utilization report and annual energy efficiency and conservation report.

“What we’re monitoring in terms of compliance in their reports is their own set targets. So, the government is not yet mandating them to, with a specific target in mind, but they have to set their own targets at this point,” Mr. Aquino said.

In January, President Ferdinand R. Marcos, Jr. issued Administrative Order No. 15 to accelerate the implementation of the Government Energy Management Program (GEMP).

GEMP is aimed to reduce the government’s electricity and fuel consumption by at least 10% through energy efficiency and conservation initiatives.

“The DoE, through monitoring teams, will be doing spot checks to determine compliance,” Mr. Aquino said in relation to GEMP. — Sheldeen Joy Talavera

GOCC subsidies down in 2023, PhilHealth top recipient

SUBSIDIES provided to government-owned and -controlled corporations (GOCCs) declined to P163.535 billion last year, with the Philippine Health Insurance Corp. (PhilHealth) receiving nearly a third of the total.

The Bureau of the Treasury reported that budgetary support to GOCCs fell 18.4% in 2023.

In December, subsidies dropped 67.3% to P10.485 billion. Month on month, they rose 55.7% from November.

The government extends subsidies to GOCCs to help cover expenses that are not supported by their revenue.

In 2023, PhilHealth received P50.746 billion in subsidies or 31% of the total. However, this total was down 36.6% from its 2022 total.

Subsidies to the National Irrigation Administration (NIA) stood at P40.738 billion. They also inched up 0.2% from a year earlier.

The National Housing Authority (NHA) took in P18.273 billion, up 6.7% from a year earlier.

This was followed by the National Food Authority (P10.182 billion), the Power Sector Assets and Liabilities Management Corp. or PSALM (P8 billion), the Philippine Crop Insurance Corp. (P4.634 billion) and Bases Conversion and Development Authority (BCDA) (P4.411 billion).

The Philippine Fisheries Development Authority (P3.685 billion), Philippine Children’s Medical Center (P2.408 billion), and the Philippine Heart Center (P2.168 billion) were also among the top recipients.

In December, PSALM received the most subsidies at P3 billion. This was followed by the NIA (P2.304 billion) and the BCDA (P1.501 billion).

GOCCs that did not receive budgetary support during the month were the National Electrification Administration, the Aurora Pacific Economic Zone and Freeport Authority, the Civil Aviation Authority of the Philippines, the Center for International Trade Expositions and Missions, the Philippine Crop Insurance Corp., PhilHealth, the Philippine Institute for Development Studies, Philippine Postal Corp., the Small Business Corp., and the Sugar Regulatory Administration.

John Paolo R. Rivera, president and chief economist at Oikonomia Advisory & Research, Inc., said that the decrease in subsidies last year was due to limited fiscal space and the government’s consolidation strategy.

“The decline in subsidies may be due to a decline in availability of government funds due to declining revenue or cash flows. It is also possible that an increase in GOCCs’ earning capacity was seen making them revenue-generating, warranting reduced subsidies,” he said in a Viber message.

The Finance department has reported that dividends generated by GOCCs rose 46% to P99.98 billion in 2023.

“This can also be due to the government’s fiscal consolidation plan of a more streamlined spending and prudence in providing grants,” Mr. Rivera added.

The government is hoping to reduce its debt-to-GDP ratio to below 60% by 2025 and deficit-to-GDP ratio to 3% by 2028. — Luisa Maria Jacinta C. Jocson

Multipolarity and de-risking: Navigating geopolitical uncertainties

First of two parts

IN BRIEF:

• Major shifts in the global market along with rising geopolitical tensions may propel organizations to adapt and rethink their strategies.

• According to the EY 2024 Geostrategic Outlook, organizations will need to consider two critical concepts as they plan for geopolitical disruptions: multipolarity and de-risking.

• Uncertain relationships between powers like the US, EU, and China, and growing influences of smaller states and actors highlight the theme of multipolarity.

The world faces an era of unprecedented change, and the geopolitical landscape is anticipated to be volatile and unstable in 2024. These major shifts in the global market along with rising geopolitical tensions may propel organizations to adapt and rethink their strategies. According to the EY 2024 Geostrategic Outlook, organizations will need to consider two critical concepts as they plan for geopolitical disruptions: multipolarity and de-risking.

The EY Geostrategic Outlook is an annual report by the EY Geostrategic Business Group (GBG) that analyzes the global political risk environment and selects the top geopolitical developments for the year. The GBG conducts a crowdsourced horizon scanning exercise with subject matter resources to identify potential risks. The scan encompasses the four categories of political risk in the geostrategy framework — geopolitical, country, regulatory and societal — throughout all regions of the world. The GBG then conducts an impact assessment to narrow down the top geopolitical developments that are both highly impactful and highly probable for global companies.

In this first part of the article, we discuss the evolving multipolarity in geopolitics, where a greater number of powerful actors shape an increasingly complex global system. Uncertain relationships between powers like the US, EU, and China, and growing influences of smaller states and actors highlight this theme. It underscores the need for economic diversification and resilient supply chains due to increased geopolitical disruptions.

THE GEOPOLITICAL MULTIVERSE

According to the report, the growing influence of players seeking to change the status quo will create a more complex geopolitical multiverse. On top of tensions from US, EU and China influencing global dynamics, actions by geopolitical swing states (meaning countries that are not specifically aligned with any major power) will play more important roles in driving geopolitics this 2024. In particular, countries with resources across the energy value chain, such as Saudi Arabia, the UAE, and Brazil, are expected to play key roles in their respective regions.

In 2023, even as the Ukraine war persisted, the BRICS (Brazil, Russia, India, China, and South Africa) and G20 (Group of Twenty) welcomed significant new members, hoping to expand their influence in global affairs. In Northeast Asia, Japan and South Korea restored bilateral diplomacy. These developments and others discussed in greater detail in the report show that geopolitics has become a multiverse of increasingly complicated mixes of alliances and rivalries, with overlapping bilateral, regional and various other institutions and groupings.

AI

The 2023 EY CEO Outlook Pulse study shares that nearly all their CEO respondents (99%) plan to invest in artificial intelligence (AI). On the other hand, governments have been grappling with how best to regulate AI as technological advances increase its significance to national security and geopolitical competition. In 2024, the dual race to innovate and regulate AI will see an accelerated shift toward geopolitical blocs.

Domestically, governments want to foster innovation to compete geopolitically, simultaneously seeking to regulate it before the technology outpaces policymakers. While seeking to capture the promise of the technology, such as advancements in national security, improved healthcare outcomes, and enhanced economic productivity, governments will also try to design AI regulations to reduce the likelihood of macro risks. These risks include increases in political instability due to misinformation campaigns, the potential for social and economic dislocations as AI takes on more job functions, heightened national security, and cybersecurity risks. While AI will not necessarily reshape the global balance of power in the year ahead, it will increasingly become a significant arena of geopolitical competition.

DOMESTIC CHALLENGES IN THE US AND CHINA

The US and China, the two biggest economies in the world, are facing major domestic challenges of their own for various reasons. These challenges will continue to raise political risks within each market, will have significant implications for geopolitics, and pose downside risks to the global economy this year. Such downside risks will likely have significant implications for emerging economies such as the Philippines.

The 2024 US election will heighten societal tensions and policy uncertainty. With the partisan divide in American trust in various news sources, there is a potential increase in risk of some population segments questioning the legitimacy of the election, in turn possibly perpetuating policymaking challenges. On the other hand, China faces a challenge stemming from whether their official policy mix will effectively address potential financial and macroeconomic weaknesses that may come about. Cyclical challenges in their real estate market and their high municipal government debt levels will likely persist, and may result in policymakers introducing periodic, targeted actions to reduce the risk of financial crises.

OCEANS

Recent events such as the destruction of the Nord Stream 2 pipeline and more frequent freedom of navigation exercises highlight growing geopolitical tensions. With almost half the global population living within 100 miles of the sea, competition over access to and control of the world’s oceans will intensify in 2024, with implications for data flows, food supplies, supply chains, and energy security. As much as 90% of global goods trade is shipped through maritime routes, and many of the busiest maritime transit paths are at risk of political disruption. At least 95% of global data flows through undersea cables. The Luzon Strait is strategically located between Luzon and Taiwan, connecting the South China Sea and the Western Pacific, and as such, is important for global commerce and cable communications.

Competition for essential commodities

The war in Ukraine, climate change, and the energy transition are shifting global supply and demand dynamics for various essential commodities. This leads to more intense geopolitical competition in 2024 to secure supplies of three key commodities in particular: critical minerals, food, and water.

The most visible area of commodity competition will be for minerals that power EV batteries and the broad energy transition. Food instability and insecurity remain a top concern from the 2023 Geostrategic Outlook, with climate change continuing to affect food production and crop yields. Lastly, water may become a subject of commodity competition due to significant changes in precipitation levels, potentially escalating tensions in water-stressed regions.

In the second part of this article, we will discuss the theme of de-risking, with governments increasingly combining economic policy with national security to stimulate domestic production of critical products in sectors such as semiconductors, telecommunications, renewable energy, electric vehicles, and biotechnologies. This trend, more prevalent in 2024, indicates a shift in policy focus towards national security over pure economic considerations, possibly fueling inflation and hindering global innovation due to increased government intervention in supply chains and investments.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views and opinions expressed above are those of the author and do not necessarily represent the views of SGV & Co.

Noel P. Rabaja the Strategy and Transactions (SaT) service leader of SGV & Co.

Marcos likely to embrace more allies in West amid worsening Chinese ties

By Kyle Aristophere T. Atienza, Reporter

PHILIPPINE President Ferdinand R. Marcos, Jr. is expected to further embrace western nations as China steps up its expansionist activities to boost its sluggish economy, political analysts said at the weekend.

Mr. Marcos returned to Manila on Saturday from his trips to Europe with $4 billion in investment pledges from Germany and the Czech Republic.

The Philippine leader has also secured the support of Berlin and Prague for the Philippines’ bid to have a free trade agreement with the European Union (EU).

“The momentum surrounding Manila’s economic ties with Europe offers a chance for the Philippines to strengthen alternative means of commercial activity amidst Chinese belligerence,” Don Mclain Gill, who teaches international relations at De La Salle university, said in a Facebook Messenger chat.

The investment pledges that Mr. Marcos got during his European trips covered renewable energy, manufacturing, innovation, business process outsourcing, mineral processing, agriculture and aerospace, his office said in a statement on Sunday.

On top of these, the Philippine leader also unveiled a plan by Lufthansa Technik to build a second hangar in Clark north of Manila worth $150 million.

Among the German companies that had a meeting with Mr. Marcos during his Europe trip was Siemens AG, which announced a plan to put up a Healthineers Training Center in the Philippines amid growing demand for advanced healthcare services among Southeast Asian nations.

He also had a meeting with German aerospace company Airbus, which committed to work with the Philippines’ Transportation department in extracting carbon energy from Philippine landfills for use in the aviation sector.

Airbus also vowed to help the Philippines build its defense capabilities and take its joint venture partnership with the Philippine Aerospace Development Corp. to the next level.

China was the first country Mr. Marcos visited last year, bringing home P22.8 billion in investment pledges from Chinese investors.

Philippine-China relations have worsened since then amid Chinese attempts to block resupply missions to Second Thomas Shoal in the South China Sea, where the Philippines deliberately grounded a World War II-era ship in 1999 to assert its sovereignty.

Mr. Marcos said before leaving Manila for Germany the Philippines should step up economic ties with “like-minded nations.”

The Philippine Foreign Affairs department has filed almost 150 diplomatic protests against China since Mr. Marcos assumed office in July 2022, and a Chinese envoy said earlier this year the two countries’ relations were at a crossroads.

“His recent trips to Germany and the Czech Republic cemented the Philippines’ legitimacy as a trusted friend of the West,” said Chester B. Cabalza, founder of Manila-based International Development and Security Cooperation.

“Many of the modern military materiel possessed by the Armed Forces of the Philippines for its aerial, terrestrial and naval arsenals came from Europe,” he said in a Facebook Messenger chat.

‘FALLOUT’

In his visit to Belgium last year, Mr. Marcos outlined his vision of greater cooperation with the West to increase trade, protect Filipino seamen and promote a rule-based order in the South China Sea, Mr. Cabalza said.

“Manila is showing Beijing that it can withstand China’s hostility,” he said. “A strong Philippine economy is a natural deterrence against China’s aggression amid Chinese economic recession.”

Chinese President Xi Jinping earlier this month called on his country’s armed forces to coordinate preparations for military conflicts at sea and help in the development of China’s maritime economy.

The International Monetary Fund expects China’s growth to slow to 4.6% this year from about 5.4% last year.

Chinese growth last year was driven by the resilience of the high-tech and service sectors, “while challenges came from declining property investment, debt risk and weak consumption growth,” according to the East Asia Forum.

“Manila’s attempt to optimize its partnership with the EU is mutually necessary given the structural changes in the international system,” Joshua Bernard B. Espeña, who teaches international relations at the Polytechnic University of the Philippines, said via Messenger chat.

He said the EU has been diversifying its sources of economic partnerships as it tries to de-risk from China and Russia, which has a war with Ukraine.

“Meanwhile, the Philippines also wanted to go beyond the US and China as the only major sources of its trade,” he said. “Not to mention that Manila provides a large source of seafarers needed in European shipping companies in post-COVID production to boost the global supply chain.”

The Philippine Transportation department and its German counterpart last week signed a deal to enhance their cooperation at sea.

Manila and Prague, meanwhile, signed a joint communique on the establishment of labor consultation mechanisms.

Prague also said it would increase its quota for Filipino workers from 5,500 to 10,300 yearly starting May.

The Philippines should boost trade and maritime cooperation ties with the EU regardless of the state of its relations with China, said Terry L. Ridon, an investment analyst and convenor of InfraWatch PH.

“The employers of millions of Filipino seafarers are European firms, and improving our relations with Europe is of paramount national interest to maintain our competitive advantage in the global maritime industry,” he said via Messenger chat.

The Philippines in November scrapped a $4.9-billion funding deal with China for three rail projects after Beijing failed to respond to funding requests.

During a high-level trade mission to the Philippines last week, US Commerce Secretary Gina Raimondo unveiled plans to invest more than $1 billion in the Philippine technology sector.

“Geostrategically, the Philippines needs to gather all possible allies and partners to reap economic benefits as much as possible to absorb the shocks of the fallout of future conflicts that may affect the Philippines,” Mr. Espeña said.