By Jonathan Best

Book Review

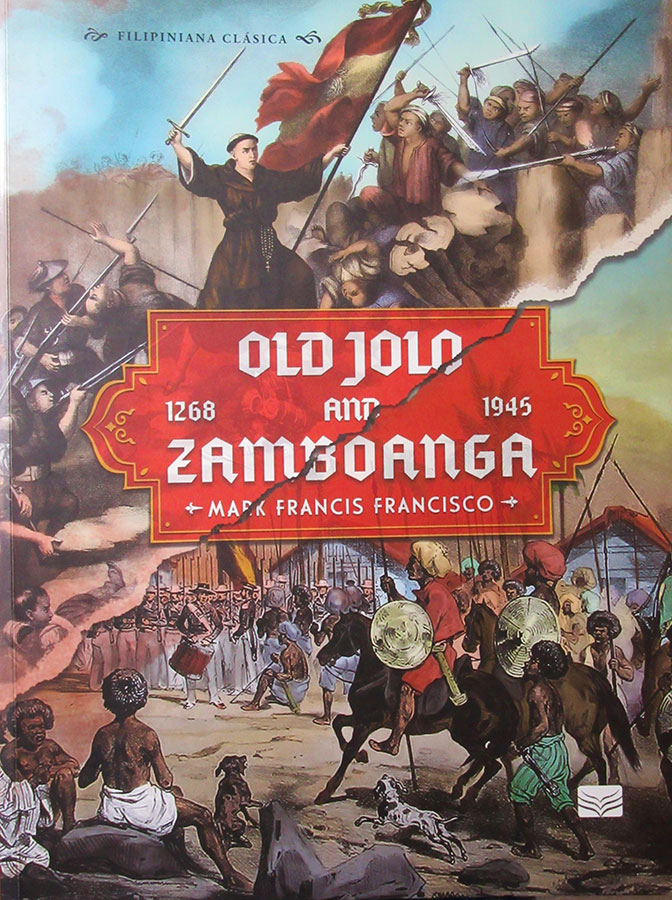

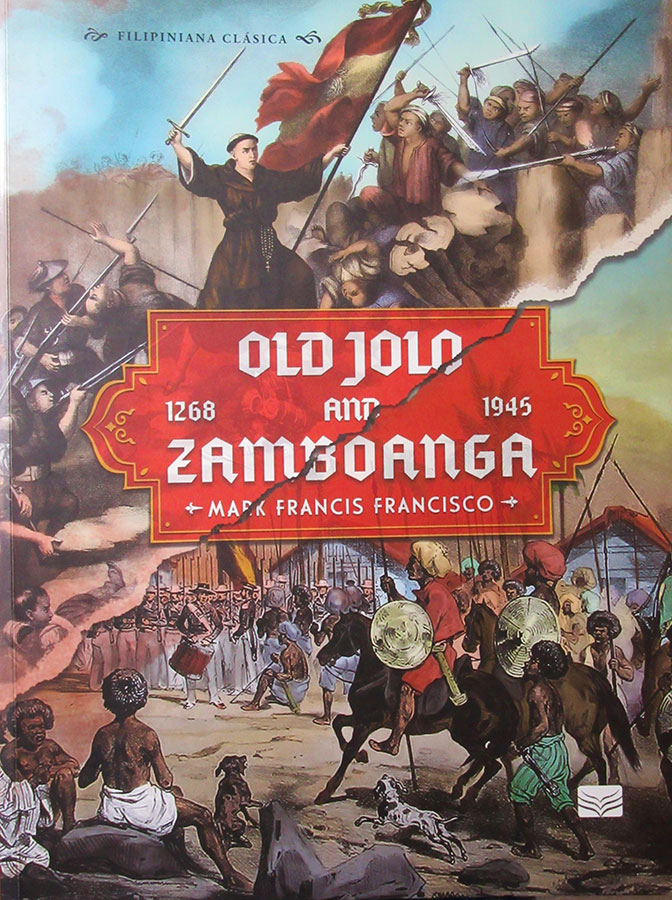

Old Jolo and Zamboanga 1268 – 1945

By Mark Francis Francisco

Vibal Foundation, Inc.’s Filipiniana Clásica series, 2024

MARK FRANCIS FRANCISCO must be congratulated for researching, organizing and documenting the extremely complex and oft times obscure and neglected history of the southernmost regions of the Philippines. The “Sulu Zone,” as labeled by the noted Southeast Asian historian James F. Warren, extends from Zamboanga at the southwestern tip of Mindanao through the Sulu Archipelago to Sandakan on the north coast of Borneo. Over the last thousand years or more, this region has seen a continuous flux of people, both indigenous and foreign, Lumad, Muslim, Christian, and possibly Hindu, moving from place to place and claiming various degrees of sovereignty.

MARK FRANCIS FRANCISCO must be congratulated for researching, organizing and documenting the extremely complex and oft times obscure and neglected history of the southernmost regions of the Philippines. The “Sulu Zone,” as labeled by the noted Southeast Asian historian James F. Warren, extends from Zamboanga at the southwestern tip of Mindanao through the Sulu Archipelago to Sandakan on the north coast of Borneo. Over the last thousand years or more, this region has seen a continuous flux of people, both indigenous and foreign, Lumad, Muslim, Christian, and possibly Hindu, moving from place to place and claiming various degrees of sovereignty.

As Francisco points out early on in his loosely chronological narrative, the region has been principally defined by inter-island and foreign trade from time immemorial. The land dwellers would provide goods such as staple foods, gold, honey, cloth, tropical hardwoods, spices, etc. while the sea dwellers (the Sama-Dilaut or sea Badjao) would trade dried or fresh fish, pearls, and other products of the sea throughout Southeast Asia to locals and Chinese and other foreign buyers. Neither group lived exclusively on land or sea, but a profitable economic system connected by the sea lanes existed for many centuries.

It may shock the modern reader to realize one of the most lucrative commodities for centuries were slaves who were captured throughout the Philippine archipelago and Borneo. Jolo was the main entrepôt for this profitable trade until it was finally suppressed, first by the Spanish in the late 1800s and then terminated by the Americans in the early 20th century. As with any controversial cultural traditions, it is important to keep in mind the moral context of a particular era. Slavery had existed worldwide since ancient times and was still a common practice in North and South America to the middle of the 19th century and even well into the 20th century in the Islamic Middle East, rationalized by racism in the Americas and religion in the Muslim world. There was nothing uniquely Filipino about slave trading.

However, it did play an important role in the political and economic development of this region as the author points out on numerous occasions. The city of Zamboanga originated as a fortress built by the Spanish to try to block the passage between Mindanao and Basilan which pirates and slave raiders coming up from the south used to attack the Visayas and as far north as Luzon. The initial fort, built in 1663, failed to deter raiders but three generations later the Spanish tried again and this time Fort Pilar, named after the Christian Lady of Pilar, miraculously survived and became the focal point of the multicultural city that Zamboanga is today; a mix of Yakan, Samal, Sama-Badjao, Sama-Dilaut, Subanon, Tausug, Chinese, and Spanish settled there and created their own unique Chavacano-Zamboangueño dialect derived from mestizo Spanish and Filipino languages and now with a sprinkling of English words.

Francisco carefully recounts the movements of the people and the outstanding political, military, and cultural events that unfolded in Zamboanga over the centuries. The city was a surprisingly homogeneous community considering the conglomeration of different groups that settled there.

To the south Jolo and its adjacent islands, Tawi-Tawi, Sitanki and numerous others had their own unique development dominated by a variety of Islamic sultanates interacting with the Spanish Philippines to the north, other sultanates in southeast Asia and at times European governments. Sometimes Jolo prospered in conjunction with Zamboanga and sometimes literally was at war with the Spanish, American, and even Filipino governments that were based in Zamboanga and Manila.

Both cities in their heydays were celebrated as charming garden cities of flowers, gracious living, and with mild weather below the typhoon belt. The land was fertile, and the sea provided plenty of food and the Philippines’ famous genuine natural pearls. Unfortunately, Jolo was repeatedly burned to the ground as the sultanates resisted domination by the Christian northerners. The sultan’s lands were divided by dubious European treaties and sporadic guerrilla warfare. The end of the slave trade and the popularity of Japanese cultured pearls left Jolo and the Sulu Zone a forgotten backwater in modern times.

Mark Francis Francisco’s book is a fascinating reconstruction of the history of both Zamboanga and Jolo. He has extensively researched existing texts from European, American, Filipino, and even ancient Chinese sources. The Ming Dynasty court records extensively document the trade mission of Sultan Paduka Batara of Jolo, with his large entourage of relatives and advisers, to the Chinese Emperor Young Lee in 1417. They clearly show the high level of trading and diplomatic expertise of the rulers of the Philippine “Sulu Zone” centuries before the Europeans appeared on the scene. Philippine gold, pearls, and exotic tropical wood were exchanged for Chinese silk, porcelain, and metal ware and artifacts.

Francisco cites Magellan’s chronicler Antonio Pigafetta from the 16th century, Fr. Francisco Combes SJ from the 17th century and numerous other sources from the Spanish period and even more from the American administration such as Najeeb M. Saleeby, right up to well-known contemporary Filipino historians such as Teodoro Agoncillo, Cesar Majul, Resil B. Mojares, Horacio De La Costa, and many others. The American historian James Francis Warren, who has written extensively on the history of Southeast Asia, is one of his major sources.

The book is lavishly illustrated with beautiful vintage photographs, color prints, and antique maps. Additional easy-to-read modern maps would have been helpful given the complex geography of Zamboanga, Basilan, Jolo and the innumerable islands stretching all the way southwest to the coast of Borneo and beyond. Given the name changes over the years, even knowledgeable Filipinos have trouble pinpointing exactly where historical sites, islands, towns and settlements are located today. What is left of the remaining sultanates of Jolo and western Mindanao still claim portions of Sandakan and North Borneo which was dubiously leased from them and then given to Malaysia by the once powerful British Empire.

Being a native son of Zamboanga gives Francisco an advantage over non-native historians who have written about this complex region. His descriptions of social life in Zamboanga and Chavacano social life have an appealing familiar touch. The book is the result of six years of meticulous research started soon after he graduated from college. He earned a BS in social studies from Ateneo de Zamboanga University and later a master’s degree from Ateneo de Manila. As the author’s biography page states, he has specialized in Mindanawon studies and particularly in the culture of the Subanon people and Sama-Badjao people of Sulu. He is active in the academic community of his hometown and also has participated in the implementation of the Bangsamoro Organic Law and in local community development.

Mark Francis Francisco’s book is a valuable contribution to researchers and the average reader wishing to learn more about the southern Philippines’ convoluted and fascinating history. As young Filipinos seek out and discover their Asian roots, so often obscured during the centuries of Western colonial occupation, this book will be exceedingly helpful in their studies.

![BSP_3822-1024x683 [BW file photo]](https://www.bworldonline.com/wp-content/uploads/2024/04/BSP_3822-1024x683-BW-file-photo-640x427.jpeg)