Privatize assets to cut debt

There have been some good reports on the Philippines’ fiscal situation early this year. See these recent stories in BusinessWorld: “Debt service bill falls by 22% in Feb.” (April 22), “Budget deficit narrows in March” (April 25), and “NG gross borrowings fall in March” (April 29).

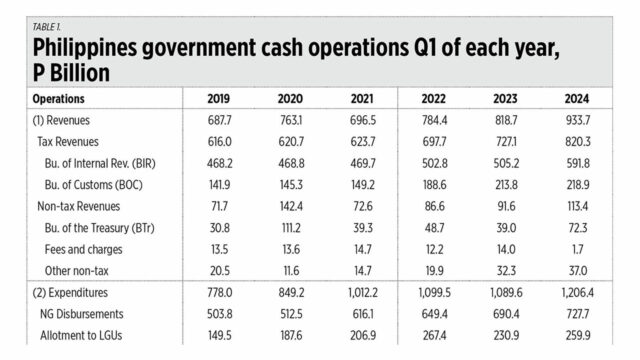

I checked the cash operations report released last week by the Bureau of the Treasury (BTr) for the first quarter (Q1) of 2024, then compared it with first quarter data of 2019 to 2023. Here are some of the highlights.

HIGHER REVENUES, DECLINING DEFICIT

1. For the first time, revenues have breached the P900 billion mark this year. The Bureau of Internal Revenue (BIR) collected nearly P600 billion, but the Bureau of Customs has been a laggard, with a nearly flat performance as in 2023.

2. The interest payment is high at nearly P200 billion, no thanks to the huge public debt stock of P14.97 trillion as of end-2023 and P15.18 trillion as of February this year, and the high interest rate policy of the Bangko Sentral ng Pilipinas.

3. The budget deficit was flat at the 2023 level, which is good as the deficit/GDP ratio should be lower. Again, thanks to the high revenues.

4. Financing or borrowing has dipped to below P800 billion, and this is good (see Table 1). In non-crisis years, borrowings should be kept to a minimum and higher revenues should be devoted to reducing the public debt and not creating new spending, like the lousy proposal to buy submarines, new battleships, and other paraphernalia of war.

In a social media post, Budget Secretary Amenah F. Pangandaman emphasized the role of fiscal transparency and discipline, the priority expenditures on human capital, infrastructure development, and digitalization of government transactions to improve our people’s productivity, government spending efficiency, and ease of doing business in the country.

When social and hard infrastructure spending is efficient, the overall productivity of the economy will increase, revenues will improve, and the need for new borrowing will also decline. Continue this path, Madame Secretary.

Finance Secretary Ralph G. Recto reiterated this in his Keynote speech during the Philippine Dialogue in Washington DC on April 17, saying, “In 2023, our fiscal deficit continued to narrow down to 6.2% of GDP from its peak of 8.6% at the height of the pandemic… attributed to the consistently higher government revenue collections and improved expenditure management, which prioritizes massive infrastructure projects and social services.”

HIGH REVENUES/GDP RATIO

Last week, this column presented data on government expenditures as a percentage of gross domestic product (G/GDP ratio) across countries from 2004 to 2023. Today I will present government revenues as percentage of GDP (R/GDP ratio).

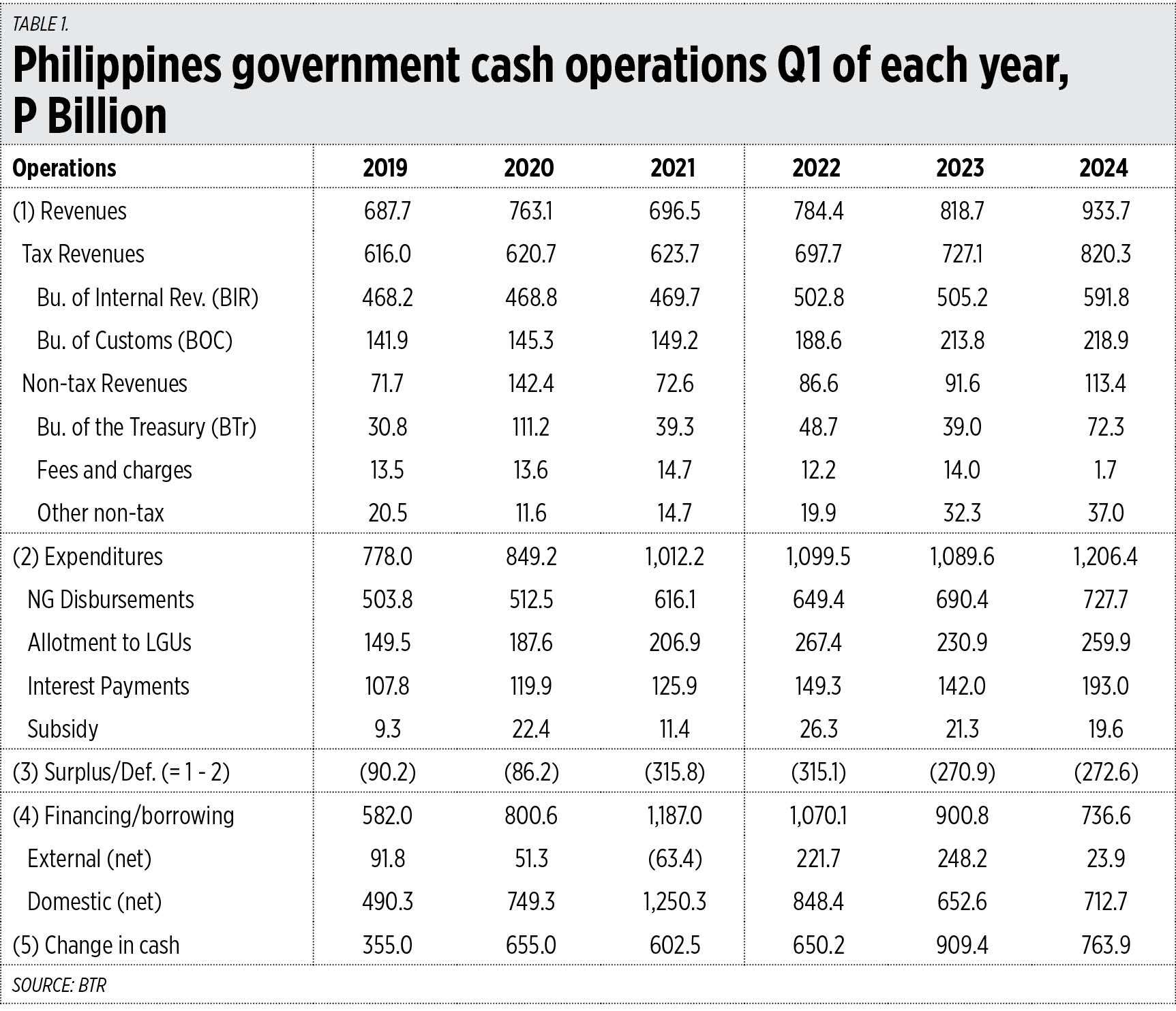

The Philippines has a high R/GDP ratio of 20%, considering National Government revenues alone. If revenues by local government units (local business taxes, fees and charges) are added, this will increase to about 23%. Meanwhile, Hong Kong, Taiwan, Singapore, Vietnam, Malaysia, and Indonesia have R/GDP ratios of below 19% (see Table 2).

HIGH TAX/PROFIT RATIO

Table 2’s data for the Philippines may not look good for investors, local and foreign. Recall the World Bank’s annual Doing Business (DB) reports, especially on “Paying Taxes.” The Philippines has a high total tax and contributions as percentage of profit, 47% in the DB 2006 report and 41% in the DB 2020 report. Meanwhile, Vietnam and Malaysia have 38%, and Hong Kong and Singapore have only 16% and 19% respectively in the DB 2020 report (see Table 3).

The WB discontinued this project in 2021 after reports of data irregularities for DB 2018 and DB 2020 and they reviewed the audits and methodology. Nonetheless, the trend is there to see so that despite reported data irregularities in the 2018 and 2020 reports, there is consistency in the numbers. This will guide the current Philippines economic team on how to further improve the ease of paying taxes, and the President to discipline tax-hungry LGUs that discourage instead of encourage more business competition and dynamism in their localities.

In his first 100 days review as Finance Secretary, Mr. Recto highlighted that “Together with the Development Budget Coordination Committee (DBCC) economic managers, we recalibrated the government’s medium-term macroeconomic assumptions, fiscal program, and growth targets… the government’s revenue performance will continuously increase from P4.27 trillion (16.1% of GDP) in 2024 to P6.08 trillion (16.4% of GDP) in 2028… the fiscal deficit will decrease (from) 5.6% of GDP in 2024 to only 3.7% in 2028.”

Push for the privatization of some large government assets and corporations too, Mr. Recto. While higher revenues from higher GDP growth and more business activities will do this, revenues from privatization will greatly help and should be used entirely to reduce the public debt. Then tax revenues can be devoted to infrastructure instead of debt servicing for principal plus interest payments.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.