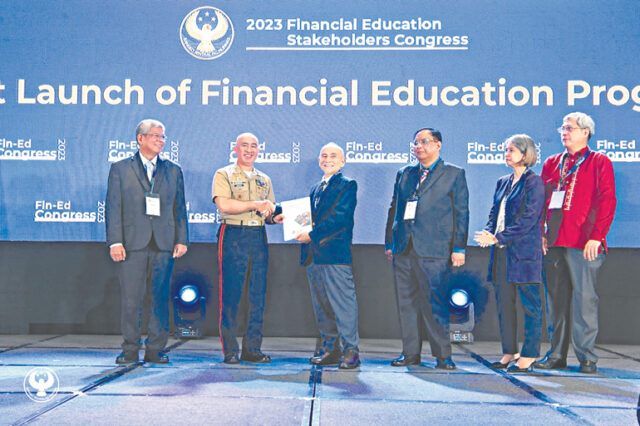

Tracking the BSP’s journey in embracing sustainable finance

For more than 30 years, the Bangko Sentral ng Pilipinas (BSP) has been the stronghold of the Philippine economy. Established pursuant the New Central Bank Act of 1993, the BSP promotes price stability, a strong financial system, and a safe and efficient payment and settlement system for Filipinos.

Since its establishment, the Philippines’ central bank has weathered several economic challenges over the decades including the Asian Financial Crisis in 1997, a global pandemic in 2020 and, in the past year, skyrocketing inflation rates. But with growing concerns and pressure to act on other looming problems such as climate change and growing social inequality, the BSP has started to embrace sustainable finance as a measure to ensure long-lasting progress.

The BSP refers to this process as “any form of financial product or service which integrates environmental, social, and governance criteria into business decisions that support economic growth” which may lead to long-term economic projects.

These considerations might include climate change mitigation and adaptation, issues of inequality and inclusiveness as well as management structures of public and private institutions that play a fundamental role in the decision-making process.

In this regard, the BSP has made a few steps to integrate sustainable finance into its policies and practices. A circular released in 2020 states that the BSP’s monetary board had approved a sustainable finance policy framework that set out the central bank’s expectations for financial institutions to embed these principles in their operations.

Circular 1085, Series of 2020, required banks in the country to disclose sustainability strategic objectives and risk appetites, overviews of environmental and social risk systems, products and services aligned with internationally recognized sustainability standards including the issuance of green, social, and sustainability bonds, and other initiatives that promote adherence to sustainable finance in their annual reports. Aside from the items above, the circular also mandates banks to report the progress of these initiatives to the BSP yearly.

In 2021, the BSP, along with other central banks, pledged to facilitate sustainable regulations that will respond to climate change through the collective declaration of the Central Banks and Supervisors’ Network for Greening the Financial System (NGFS) in their commitment to the 26th United Nations Climate Change Conference of Parties (COP26).

“Central banks and financial institutions should recognize their important role in contributing to the transition to a low-carbon economy. As stewards of the financial sector, we should all commit to act with urgency in achieving the desired emissions reduction targets and in promoting the sustainability agenda,” former BSP Governor Benjamin E. Diokno said in a statement.

A year later, the central bank released the Philippine Sustainable Finance Roadmap and Sustainable Finance Guiding Principles. Developed by the BSP’s “Green Force” in 2021, the road map and guiding principles aim to facilitate the mainstreaming of sustainable finance in the country and establish an understanding among stakeholders of economic activities considered “sustainable.”

The document laid out the BSP’s strategic plans to develop sustainable finance in the country. These initiatives seek to establish three pillars in the Philippine financial system that aim to create a conducive environment, mainstream sustainable finance, and develop a sustainable pipeline.

The BSP also launched its 11-point Sustainable Central Banking (SCB) Strategy in 2022. The points are: to conduct a comprehensive vulnerability assessment of the economy and financial system accounting for environmental risks; enhance mandatory disclosures of climate-related financial risks by all banks; issue guidance on mandatory climate stress testing for banks; explore the integration of environmental and social risk into prudential practices.

The 11-point SCB Strategy also includes for BSP to: incorporate macroeconomic effects of climate change into monetary policy analysis; consider incentive schemes for the promotion of green lending by banks; include sustainability considerations in its portfolio and risk management and sign the UN Principles for Responsible Investment (UN PRI); develop a task force for inclusive green finance; to include climate-related financial disclosures in its annual report; adopt sustainable practices for its facilities and operations; and to roll out a capacity-building program for all staff in relevant areas.

“Climate change and other environmental hazards impact the prices of goods and change the risk profile of financial institutions. We are doing what we have to do in line with our mandates of promoting price and financial stability,” then-Governor Felipe M. Medalla said in a press release.

Last year, in an effort to foster the transition toward a sustainable economy, the BSP approved additional incentives for financial institutions in the form of additional single borrower’s limit (SBL) for financing eligible projects and zero reserve requirement rates on sustainable bonds.

The introduction of this set of measures is part of the initiative under the BSP’s 11-point SCB Strategy to mainstream sustainable finance as well as support the achievement of the country’s climate commitments and sustainable development goals.

Recently, the BSP’s monetary board approved the adoption of the Philippines’ Sustainable Finance Taxonomy Guidelines (SFTG) for banks which aims to direct, accelerate, and increase capital flows to economic activities that promote sustainability objectives. The SFTG will use a “traffic light system” to classify bank activity: “Green” for an SFTG-aligned activity, “Amber” for partially aligned, and “Red” for not aligned.

This version of the SFTG focuses on climate change mitigation and climate change adaptation with future interactions expected to emphasize biodiversity and circular economy. The taxonomy provides a simplified approach to assessing the economic activities of micro, small, and medium enterprises (MSMEs).

“The issuance of a taxonomy is a crucial step in our sustainability journey. It provides high level guidance in determining the greenness of an investment. But this is just the first step to what I expect will be a long iterative process of calibrating the document to fully capture the conditions of the Philippine economy,” BSP Governor and Monetary Board Chairman Eli M. Remolona, Jr. said in a statement.

Throughout the years, the central bank has shown its commitment to the Filipino people by proactively responding to the financial crisis that they have faced. By adopting sustainable finance and integrating environmental, social, and governance criteria into its policies and practices, the BSP has paved the way to a more sustainable economy and future for the Philippines. — Jomarc Angelo M. Corpuz