BBM’s Infrastructure Complex

Speaking at a Palace briefing last Tuesday, Transportation Secretary Jaime J. Bautista said the first full Cabinet meeting of the year tackled the 16 flagship infrastructure projects that need the government’s immediate attention, with the goal of achieving at least partial operations before the government steps down in 2028.

The 16 flagship projects include the North-South Commuter Railway, the Metro Manila Subway Project, the Metro Rail Transit (MRT) Line 4, MRT Line 7, Light Rail Transit Line 1 Extension, the New Cebu International Container Port, the Philippine National Railways South Long Haul, Mindanao Railway, and the New Dumaguete Airport.

President Ferdinand “Bongbong” Marcos, Jr. is focusing on rail projects, especially the proposed North-South Commuter Railway, a 147-kilometer line connecting Clark Airport to Calamba, Laguna.

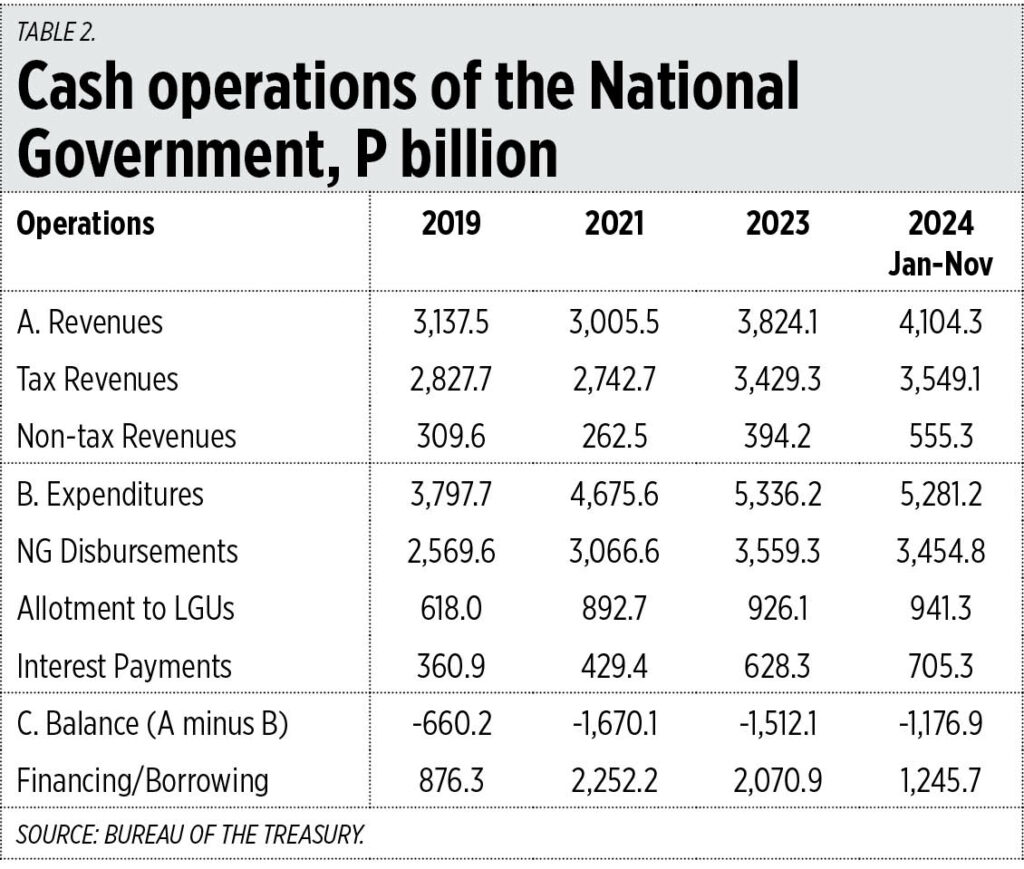

The total cost of the Marcos administration’s Build Better More program is P9 trillion. He said this is crucial for improving standards of living and attracting more investments in the Philippines. Boosting infrastructure investments will likewise aid in accelerating economic recovery and resiliency while maintaining the country’s debt sustainability.

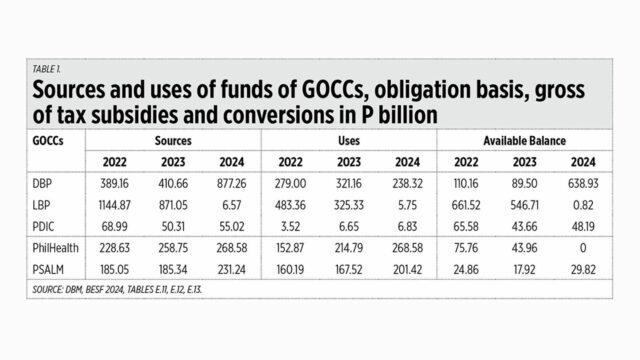

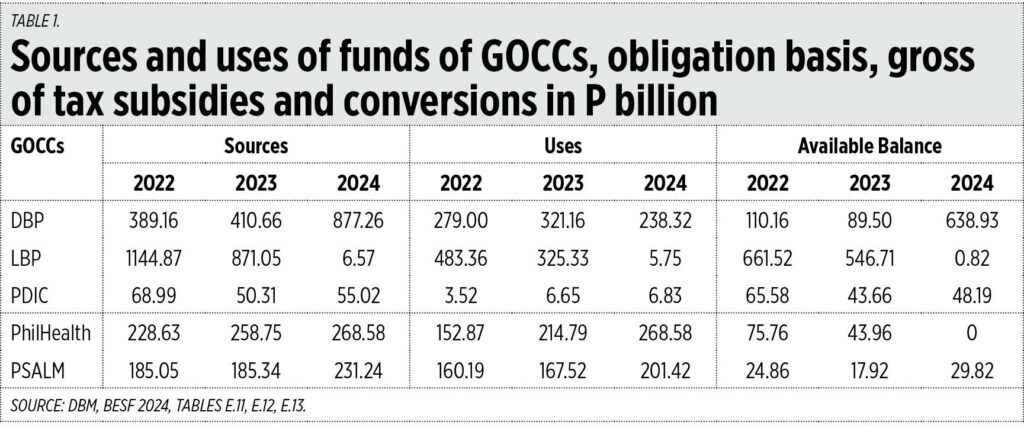

However, the national budget continues to be criticized for its deep cuts for social services, which include education, health, and social security. It is very likely that the 2025 budget would be challenged in the courts because of the alleged violation of the constitutional provision that the education sector should get the biggest share of the annual budget, and the brazen violation of Republic Act No. 11223 or the Universal Health Care Act that mandates subsidizing PhilHealth (Philippine Health Insurance Corp.) to provide healthcare benefits to the underprivileged.

It will be recalled that Bongbong Marcos’ campaign slogan during his run for the presidency in 2022 was “Babangon muli” (will rise again). It was intended to evoke a memory of the Golden Era of booming economy and golden infrastructure that was supposed to have been his father’s presidency.

It worked. He was elected president. As he said right after he was sworn in as president, “The campaigns have run, and have taken me here where I stand today.”

Addressing the Filipino people, he said, “My father built more and better roads. Much has been built and so well that the economic dogma of dispersing industry to develop the least likely places has been upturned. Development was brought to them. Investors are now setting up industries along the promising routes built. And yet, the potential of this country is not exhausted.

“Following these giants’ steps, we will continue to build on the success that’s already happening. We will be presenting the public with a comprehensive infrastructure plan, six years could be just about enough time. No part of our country will be neglected. Progress will be made wherever there are Filipinos so, no investment is wasted.”

In his first State of the Nation Address, he said the backbone of an economy is its infrastructure. “We shall confidently build on this firm foundation established by my predecessor. As it is in building an edifice. We must keep the momentum and aspire to build better more.

“It is clear in my mind that railways offer great potential as it continues to be the cheapest way of transporting goods and passengers. We can build upon already existing lines by modernizing these old railway systems. There are dozens of railway projects — on the ground, above the ground, below ground, not just in Manila, but in other regions — at various stages of implementation, and with a combined cost of P1.9 trillion.

“My order to the Department of Transportation is really very simple: FULL SPEED AHEAD!”

In his second State of the Nation Address, he said, “One of the keys to continuing economic growth is infrastructure development. So, we will build better, and more. Our P8.3-trillion ‘Build Better More’ Program is currently in progress and being vigorously implemented.

“The underlying logic to our infrastructure development is economic efficiency. We are opening up all gateways to mobilize goods and services at less cost and in less time, and ultimately, to drive the economy forward. Our road network plans must link not only our three major islands, but all prospective sites of economic development.

“The 1,200-kilometer Luzon Spine Expressway Network Program will effectively connect Ilocos to Bicol, from 20 hours to just nine hours of travel. Under the Mega-Bridge Program, 12 bridges totaling 90 kilometers will be constructed, connecting islands and areas separated by waters.

“To improve capacity for specialized medical treatment, specialty centers in various fields are being established and integrated into our government hospitals.”

In his third State of the Nation Address, he bannered two new specialty hospitals that aim to decongest public hospitals and galvanize the “nation’s fight against cancer.” These are the UP-PGH Cancer Center, the first Public-Private Partnership project to be approved under Marcos, and the Philippine Cancer Center of the Department of Health, which broke ground in March.

His defenders’ counter to the criticism that his infrastructure program had syphoned funds from the Health department is that the infrastructure program includes centers for specialized medical treatment.

But as I wrote in my Aug. 14, 2023 column in reaction to his second SONA, where he said that the estimated cost of the multi-specialty center being built in Clark is P10 billion, “There goes the budget for the universal healthcare (UHC) for the next five years. The full implementation of UHC will be set back by five more years. That huge sum of money can build thousands of 20- to 30-bed primary care hospitals in congressional districts with no healthcare facility. The Universal Health Care Act or Republic Act No. 11223, which was enacted in 2016, mandated that all Filipinos get the healthcare they need, when they need it.”

RA 11223 was meant for people whose lives can be saved or whose good health can be maintained if they receive timely medical attention without ruining them financially. Complications of the leading diseases in the Philippines like bronchitis, influenza, chicken pox, diarrhea, and respiratory tract infection can be prevented if the patient receives preventive, curative, rehabilitative, and palliative health services. But the rural and poor Filipinos cannot avail themselves of those services because there are no facilities that render those services in their area.

When the Philippine Heart Center was built under President Ferdinand Marcos, Sr.’s Decree No. 673, Senator Jose W. Diokno commented that the government can spend 50% of the health budget for the “designer hospital.” “While around the country, Filipinos were dying of curable illnesses like tuberculosis, whooping cough, and dysentery.”

The hospital, designed by architect Jorge Ramos, was finished reportedly to heed First Lady Imelda Romualdez Marcos’ request that the building be inaugurated on Valentine’s Day 1975, so that the First Lady could refer to it as “The Monument to the Heart.”

That “monument” was one of the many “monuments” built by Mrs. Marcos by which she is remembered. The others are the Cultural Center of the Philippines, the Manila Film Center, the Folk Arts Theater, the Coconut Palace, the Makiling Center for the Arts, the National Kidney and Transplant Institute, and the Lung Center of the Philippines. They are identified with what is referred to as the former First Lady’s “Edifice Complex,” for her obsession of building grandiose edifices with public funds.

Bongbong Marcos does not have an Edifice Complex. His obsession is with railways. As he said in his third SONA, “There are dozens of railway projects — on the ground, above the ground, below ground, not just in Manila, but in other regions — at various stages of implementation, and with a combined cost of P1.9 trillion.”

It should be noted that not one of the edifices identified with Imelda Marcos is named Imelda. But there were avenues re-named Imelda when she was First Lady — the major east-west route in Makati and Taguig now known as Kalayaan Avenue, and the four-lane major road in Cainta that connects Marcos Highway to Ortigas Avenue Extension that is now called F.P. Felix Avenue.

There were highways named after President Ferdinand Marcos, Sr. that have been renamed after the People Power Revolution but still referred to as Marcos Highway, among them the one in Cainta and the road from Agoo, La Union to Baguio City.

There are Quezon Boulevard, Osmeña Highway, Roxas Boulevard, Quirino Avenue, Magsaysay Boulevard, Carlos P. Garcia Avenue, Diosdado Macapagal Boulevard, various Marcos roads and highways — all named after former presidents. Maybe Bongbong Marcos wants to be remembered by his railway system, or maybe even by the national road network as his 1,200-kilometer Luzon Spine Expressway will not only connect Ilocos to Bicol but his 90-kilometer Mega-Bridge Program, will connect Luzon to Mindanao via the major Visayan islands.

Oscar P. Lagman, Jr. has been a keen observer of Philippine politics since the late 1950s.