One of the most concrete pieces of evidence of humanity’s progress is the advancement of healthcare and medicine. According to the World Health Organization, since 1990, the global under-five mortality rate has decreased by over 50%, saving approximately 17,000 children’s lives daily. Globally, life expectancy has increased by approximately six years since 2000, from 66.8 years in 2000 to 73.4 years in 2019.

As technology continues to develop and pervade every aspect of daily life, this is only expected to get better. In the Philippines, for instance, the healthcare sector is undergoing a revolutionary transformation.

It was only in 2018 that the Philippines’ Universal Health Care (UHC) Act was enacted into law. It acted as a significant reform aimed at improving healthcare access and affordability for all Filipinos, and since then, progress in the field of health and medicine continued unabated towards the pursuit of inclusive and affordable healthcare for all Filipinos.

The UHC law automatically enrolls all citizens in the National Health Insurance Program (PhilHealth), expanding the scope of covered services to include preventive, curative, and rehabilitative care. This prioritizes protecting Filipinos from financial hardship due to medical costs, while strengthening the nation’s primary care system through efficient use of resources.

Further towards that goal, the Marcos administration recently announced an increase in this year’s budget for the improvement of the health facilities in the country — to the tune of more than P28.58 billion. The funds have been allocated under the 2024 General Appropriations Act for the Department of Health’s implementation of the Health Facilities Enhancement Program (HFEP).

According to the Department of Budget and Management, this is higher by 6.6% from the P26.81 billion earmarked in 2023. The allocation, according to Budget Secretary Amenah Pangandaman, is evidence of President Ferdinand R. Marcos, Jr.’s administration’s steadfast commitment to healthcare reform.

She underlined that realizing Mr. Marcos’ goal of turning the nation into a “Bagong Pilipinas” where Filipinos have access to first-rate primary healthcare depends on sustained support for the HFEP.

“As the President said in his last SONA, we are increasing our public health facilities both in number and in capability. And so, we will ensure that this program will get a much-needed support,” Ms. Pangandaman said.

“We understand that many Filipinos depend on public hospitals and centers, that’s why it’s important that our health facilities are prepared and equipped to cater to the needs of our fellow countrymen,” she added.

The HFEP’s entire funding allotment will go toward building, modernizing, or growing government healthcare facilities around the country. Additionally, the budget will be utilized to buy medical transport trucks and hospital equipment.

Program priorities include Geographically Isolated and Disadvantaged Areas and Universal Health Care sites.

In addition, the HFEP seeks to equip and facilitate ongoing project building while modernizing critical facilities for effective response to the coronavirus disease 2019 and other potential public health emergencies in the future.

Healthcare will only continue to get more sophisticated as more innovations on the digital front emerge. From telemedicine to integrated digital health platforms, technology is not only bridging the gap between urban and rural healthcare services but also enhancing the efficiency and accessibility of medical care.

Telemedicine has emerged as a vital component of the healthcare landscape in the Philippines, especially accelerated by the pandemic. According to the Department of Science and Technology-Philippine Council for Health Research and Development (DoST-PCHRD), the future of digital healthcare in the country involves widespread adoption of telehealth services.

These services enable remote consultations, reducing the need for physical visits and allowing patients, particularly those in remote and underserved areas, to access medical advice and treatment without the challenges of travel.

“Right now, we have 77% of our country covered with internet connectivity, but 85% of our population is on the internet. Meaning, we at the DICT (Department of Information and Communication Technology) have to make sure to close that gap, where the remaining 23% who are mostly in the geographically isolated and disadvantaged areas where healthcare solutions are much needed are reached,” DICT Undersecretary Jocelle Batapa-Sigue said during a discussion hosted by the PCHRD.

Digital health platforms are also being developed to integrate various health services. These platforms aim to provide comprehensive healthcare solutions, including electronic medical records, appointment scheduling, and teleconsultations, thereby streamlining operations and improving patient outcomes. The integration of artificial intelligence (AI) in these platforms helps in predictive analytics, enabling healthcare providers to offer personalized care and early intervention strategies.

Towards affordable universal healthcare

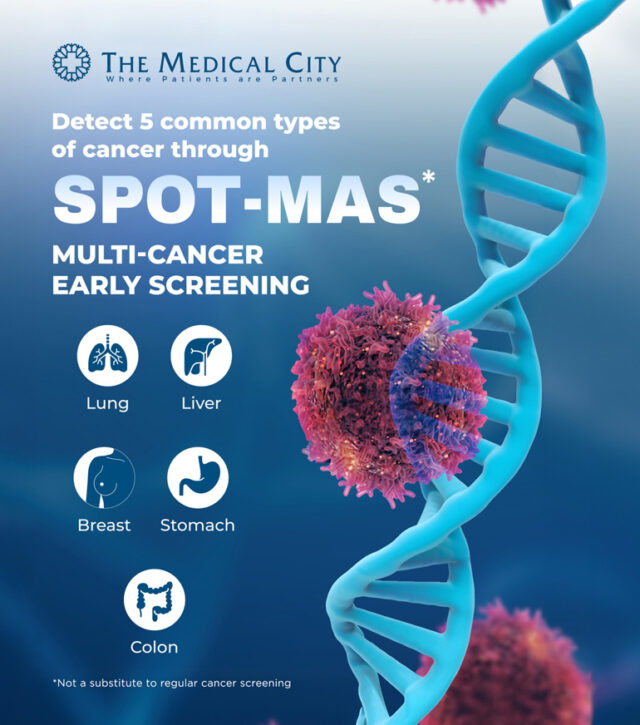

Recently, the Department of Health and the World Health Organization (WHO) have launched the 2024-2028 National Integrated Cancer Control Program (NICCP) Strategic Framework that reemphasizes how crucial it is to establish priorities and build capacities in order to meet the strategic objectives of cancer control.

The goal is to keep improving access to cancer centers, providing financial support, and establishing a multi-sectoral council for policy-making, planning, and coordination in cancer prevention and control in the Philippines.

“Universal health coverage and strong primary healthcare are the keys to addressing broader health system factors that influence equitable access to affordable, high-quality cancer care. The WHO will continue to support the country in ensuring that the cancer control program is built on an effective health system,” Dr. Rui Paulo de Jesus, WHO representative to the Philippines, said.

Similarly, the Philippine Health Insurance Corp. (PhilHealth) and the Philippine Information Agency (PIA) have intensified their partnership to promote universal healthcare.

In particular, a strategic collaboration between the PIA and PhilHealth will focus on simplifying member registration and educating the masses with regard to PhilHealth’s “Konsultasyong Sulit at Tama (Konsulta)” Program, which aims to promote preventive health through the availment of free outpatient care services for early detection.

These include health risk assessment, laboratory and diagnostic tests, and medicines for select conditions such as asthma, diabetes, and hypertension.

“PhilHealth’s Konsultasyong Sulit at Tama, or Konsulta benefit package, seeks to address persisting health conditions and emerging diseases that could possibly lead to financial difficulties should they be left unattended. This program aims to prevent worsening conditions that often lead to hospitalization or expensive medical treatments,” said PhilHealth President and Chief Executive Officer (PCEO) Emmanuel R. Ledesma, Jr.

“Maintaining a healthy lifestyle and practicing good health habits that help us in preventing or avoiding illnesses are vital to our overall well-being, especially in these times when medical care costs are constantly increasing,” he added, urging the public to give priority to preventive healthcare.

As the Philippines continues to embrace the future of healthcare, consistent and continuous development is essential. These efforts, as well as similar investments in infrastructure and capacity-building, are crucial to ensure that healthcare providers are equipped with the necessary skills and tools to effectively use digital technologies. Additionally, such policies and regulations must be updated to support the integration of digital health solutions while safeguarding patient information and promoting ethical practices.

Technology will no doubt play a bigger transformative role in the Philippine healthcare system of the future, driving improvements in access, quality, and efficiency. With continued investment and collaboration, digital health initiatives have the potential to significantly enhance healthcare delivery and outcomes for all Filipinos, paving the way for a more equitable and sustainable healthcare system. — Bjorn Biel M. Beltran