ADB calls for stronger Asian integration as trade wars loom

ASIAN ECONOMIES must strengthen their cooperation and partnerships in the face of geopolitical tensions and global fragmentation, the Asian Development Bank (ADB) said.

“Rising geoeconomic fragmentation due to continuing global policy shifts, while posing growing challenges, nonetheless offers new opportunities for the region to strengthen integration by facilitating intraregional flows of goods and services, capital, people, and knowledge,” ADB Chief Economist Albert Park said in a report on Monday.

The Asian Economic Integration Report is an annual review of progress in various dimensions of economic integration, including trade, global value chains, cross-border investment, finance, migration and remittances, and tourism.

The ADB sees significant progress in Asia and the Pacific in terms of regional integration, surpassing other regions, although the pace remains uneven across subregions.

“Over the past two decades, Asia has significantly tightened its regional economic integration, surpassing other regions in foreign direct investment (FDI) and the movement of people,” it said.

The bank estimated that the degree of Asia’s trade integration is comparable to that of the European Union plus the United Kingdom.

Hong Kong University of Science and Technology Economics Associate Professor Yao Amber Li said geopolitical tensions also highlight the need for stronger integration.

“The second round of trade wars from Trump’s administration, I think, provides more incentive for Asian economies to build regional blocs and making deeper commitments to trade agreement,” she added.

The ADB noted the Philippine-South Korea free trade agreement that took effect in December as an example of the rise of preferential trade agreements in the region.

It also mentioned the Philippines as a major source of out-migrants from Asia and a major recipient of total remittances in 2024.

The Bangko Sentral ng Pilipinas reported that money sent home by migrant Filipinos rose 2.9% to $2.92 billion in January. — Aubrey Rose A. Inosante

EDC to release downgraded export targets next month

THE Export Development Council (EDC) said it is hoping to release downgraded targets for the Philippine Export Development Plan (PEDP) next month.

“We convened the EDC executive committee weeks ago, where we had presented our simulations, assumptions, and mitigating measures,” EDC Executive Director Bianca Pearl R. Sykimte said on the sidelines of the UK-Southeast Asia Tech Week in Manila.

“Unfortunately, we had a very long agenda, so we are soliciting comments from the executive committee members on the simulations. So, we cannot release the final figures yet,” she added.

She said that there were a lot of headwinds in the last few years, which the EDC thought should be considered in setting the new targets.

“Definitely, we are downgrading the target. It has to be approved by the council. I think by April, when we have comments from the committee, we will release some figures,” she said.

“But we will have to maintain our targets in the Philippine Development Plan (PDP), because that is our commitment,” she added.

The Bangko Sentral ng Pilipinas reported exports of $106.99 billion in 2024, up 3.3%.

Under the PDP, the target is for total exports to hit $107 billion in 2024. The PEDP, on the other hand, projects $143.4 billion.

“We have reached the $50 billion mark for services exports. I think we will have to factor that in,” Ms. Sykimte said, noting that services exports have been driving overall export growth amid the “erratic or dwindling” performance of merchandise exports.

She said that the EDC is also considering the protectionist policies of US President Donald J. Trump in setting the new targets.

“Those are included in our considerations. But in terms of these US policies, we are quite confident that (the Philippines) will be the least of their worries in terms of reciprocal tariffs,” she said.

“I think we are 30th in terms of their sources of trade deficits,” she added.

Ms. Sykimte, who is also the Export Marketing Bureau Director, said the bureau is no longer focused on the usual contact services exports but on game development, animation, software development, and healthcare information management systems.

“In goods, semiconductors play a big role in our export strategy, but since our electronics sector is investment-driven we really need to work with our investment promotion agencies to attract investment in those value chains,” she added.

Aside from semiconductors, she said that the other big exports are machinery and transport equipment, minerals, coconut, and bananas. — Justine Irish D. Tabile

Former Camp John Hay concession holder backs rights of condominium owners, golf shareholders

CJH DEVELOPMENT Corp. (CJHDevCo) urged the Bases Conversion and Development Authority (BCDA) to respect the rights of condominium unit owners and golf shareholders.

“There are about 400 (condo owners), and zero have signed up with BCDA. Why is it zero? Because BCDA is not offering them anything. They just want to take over the condominiums and hotels,” according to Robert John L. Sobrepeña, who chairs CJHDevCo, which formerly managed the Camp John Hay complex.

Speaking at the Money Talks with Cathy Yang program on One News Channel, Mr. Sobrepeña said there are three categories of ownership in Camp John Hay: estate lot owners, condo owners, and golf share buyers.

CJHDevCo said that there were about 400 condotel owners, 160 estate lot owners, and 1,900 golf club members affected by the BCDA takeover of Camp John Hay.

“In terms of investors, we have 1,900 golf shareholders, none of whom were given their rights to play in the golf course with their Securities and Exchange Commission-approved shares,” Mr. Sobrepeña said.

“None of the 400 condominium owners has been renewed or offered any kind of deal, and out of the 160 homeowners, I believe they have offered to 80-90 homeowners,” he added.

On March 10, BCDA President and Chief Executive Officer Joshua M. Bingcang said the government-owned corporation has signed fresh contracts with 95% of the estate lot owners.

For the hotel unit owners, he said that the BCDA is still studying what arrangements to make.

“I think the position of BCDA is they are not offering anything to the condominium and hotel owners; they are not offering any playing privileges to those who invested in golf shares many, many years ago,” Mr. Sobrepeña said.

He said that the golf shareholders and hotel unit owners have written to President Ferdinand J. Marcos, Jr.

“He has been silent; he has not replied,” he said. “So for CJHDevCo is about to write the President another letter, and hope for better luck than the homeowners and golf members.”

He said that the company’s letter to the President will ask for the government to respect the rights of the third parties in light of the Camp John Hay takeover.

“All these third parties have invested and trusted the public-private partnership of the government in Camp John Hay. They came in when the government enticed them to come in,” he said.

“Now that they are in, their homes are being taken away without due process, and that is something that is really unacceptable to a lot of homeowners and investors,” he added.

The BCDA took over the Camp John Hay property after the Office of the Baguio City Sheriff served CJHDevCo a notice to vacate following a Supreme Court ruling. — Justine Irish D. Tabile

Tourist VAT refund law touted for ‘multiplier effect’

FINANCE Secretary Ralph G. Recto said the law offering value-added tax (VAT) refunds for tourists will have a multiplier effect on the economy equivalent to nearly double actual visitor spending.

Mr. Recto made the remarks during the signing of the law’s implementing rules and regulations (IRR), according to a Department of Finance (DoF) statement on Monday.

The DoF said Mr. Recto, Customs Commissioner Bienvenido Y. Rubio, and Internal Revenue Deputy Commissioner Marissa O. Cabreros signed the IRR that day.

“With a multiplier effect of 1.97, every P100 spent by a tourist generates P197 in economic output. Imagine that. Halos doble ang balik sa ekonomiya (The economy will reap nearly double of what tourists spend),” Mr. Recto said in his speech at the ceremonial signing of the IRR.

The signing was witnessed by Tourism Secretary Christina Garcia-Frasco and Secretary Frederick D. Go, who heads the Office of the Special Assistant to the President for Investment and Economic Affairs.

President Ferdinand R. Marcos, Jr. in December signed the Act Creating a VAT Refund Mechanism for Non-Resident Tourists, which is designed to encourage visitors to spend more while travelling in the Philippines.

The law allows tourists to claim VAT refunds on purchases worth at least P3,000 from accredited stores.

“For this law to succeed, two things must happen: We need a fully functional VAT refund system and a surge in inbound tourism,” he said.

The Department of Tourism reported that the Philippines generated about P760.50 billion in revenue from inbound tourism expenditures in 2024.

Mr. Recto said the Philippines must have a simple, accessible, and culturally inclusive VAT refund process that allows businesses, and tourists to maximize its benefits.

“The IRR tasks the DoF with engaging the services of reputable and internationally recognized VAT refund operators to provide end-to-end solutions to the government. Such refunds may be made electronically or in cash to enhance the ease of doing business,” he said.

At a March 13 briefing, the Asian Consulting Group called for an automated refund mechanism. — Aubrey Rose A. Inosante

PEZA makes pitch to China manufacturers who could relocate to skirt Trump tariffs

THE Philippine Economic Zone Authority (PEZA) said is refocusing its efforts on attracting Chinese investment, betting that some companies there will try to sidestep US tariffs.

“PEZA counts Chinese investors, including those from Taiwan and Hong Kong, among our best bets for foreign direct investment attraction for this year and for succeeding years to come,” PEZA Director General Tereso O. Panga said.

He said PEZA recently concluded a week-long mission to China for investment presentations to Chinese and multinational corporations.

During his first term, US President Donald J. Trump sought to de-risk the global supply chain and decouple from China, which led many export manufacturers in China to shift production to Vietnam, he said.

“The resulting global supply chain diversification by global MNCs has become more pronounced with the recent imposition of additional import tariffs by the US government against China, Mexico, and Canada,” Mr. Panga said in a statement on Monday.

He added that this pressures export manufacturers in China to shift parts of their supply chains and production processes away from China to new investment hotspots in the region other than Vietnam and Mexico.

“Under the current Trump 2.0 trade regime, the C+1 (China +1) strategy seemingly has evolved into C+1+1 (or C+2) with the Philippines now being considered as the new ‘plus one’ preferred destination in ASEAN by relocating companies from China,” Mr. Panga said.

“This manifestation was made by some Chinese companies during our roundtable meeting with the leaders of the China Chamber of International Commerce-Dongguan (CCOIC-Dongguan),” he added.

In particular, he said that Aoxing group, an original equipment manufacturer for projector equipment, projector screens, and audio-visual products, chose the Philippines for its redundant manufacturing facility to serve the US export market.

“The Aoxing group, together with its supply chain providers, will join the upcoming CCOIC-Dongguan delegation’s visit to the Philippines,” he said.

Mr. Panga said the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act and talent pool of young, English-proficient workforce will be a draw for investors from China.

“We all have these favorable conditions that indeed can make the Philippines the new ‘plus one’ destination for China-based manufacturers wanting to export to the US and European Union,” he said.

“Our strong affinity with the US and being the economy in ASEAN with the smallest trade (imbalance) with the US are compelling factors and top-of-mind considerations for the Philippines by companies relocating from China vis-a-vis our ASEAN neighbors,” he added.

PEZA was in China between March 17 and 21 and met with 220 attendees at Philippine investment presentations in Xiamen, Chongqing, and Dongguan.

“A number of Chinese small and medium companies in various manufacturing industries have expressed their interest to locate in the PEZA zones,” Mr. Panga said.

“Other than exporting to the US, they want to sell their finished products to the domestic market. Moreover, some existing locators that participated in the forum or invited the Philippine delegation for factory visits have announced their additional expansion plans for the year,” he added.

These include global industry leader in connectors and cables for digital data networks TE Connectivity, Bocheng Rubber, steelmaker Panhua, and HYS Metal Plastic and Electronics.

According to Mr. Panga, the PEZA Board recently approved a P1.7-billion investment from TE Connectivity for the manufacture of electro-optical components, which is expected to generate 2,000 jobs.

“TE Connectivity has committed to undertaking more projects, including expanding its IT-BPM operations in the Philippines,” he said.

Meanwhile, a US-Irish company with 20 production facilities in China, as well as a number of MNCs, have transferred part of its operations.

He said PEZA continues to field inquiries from global industry leaders based in China, including companies producing vitamins and dietary supplements, solar cells, and TV monitors and projector screens.

To date, PEZA has registered 118 Mainland companies. These account for P28.7 billion in investments and 16,327 jobs. — Justine Irish D. Tabile

House bill backs ecozone on GSIS land in Marikina

A BILL that seeks to set up a special economic zone (ecozone) in Marikina City has been filed at the House of Representatives.

Filed on Feb. 20, House Bill (HB) No. 11465 proposes the creation of an economic zone at a site in Barangay Tumana, Marikina, according to a copy of the measure obtained by BusinessWorld.

“Marikina has historically been a center for micro, small, and medium enterprises (MSMEs), particularly in the footwear and leather industries. However, changes in global trade, shifting market dynamics, and infrastructure limitations have constrained its ability to compete on a larger industrial scale,” Marikina Rep. Stella Luz A. Quimbo, the bill’s author, said in the measure’s explanatory note.

Marikina City was home to 19,682 MSMEs in 2024, according to city data.

The measure also proposes the creation of a Marikina Ecozone Authority (MARECA) that would oversee the economic zone’s operations, which is expected to rise at a property owned by the Government Service Insurance System (GSIS).

Under the bill, MARECA will have authorized capital stock of P2 billion, with 60% of shares to be subscribed for and paid by the National Government and the GSIS.

Foreigners looking to invest in the Marikina economic zone will be eligible for an investor visa if they inject $200,000 into a registered enterprise, according to the bill.

Businesses within the economic zone are also exempt from paying income, donor’s, and documentary stamp duties, according to the measure.

“Business establishments operating within the Marikina ecozone… shall pay 5% final tax on special corporate income tax.”

“Under this measure, the Marikina ecozone will be developed as an industrial and commercial hub with access to modern infrastructure, streamlined regulatory processes, and targeted incentives designed to attract and retain investors,” according to the bill. — Kenneth Christiane L. Basilio

Onion crop losses attributed to fungus, fall armyworm by DoST

THE Department of Science and Technology (DoST) said fungal and worm diseases were largely behind losses in the onion crop of Nueva Ecija and other growing areas.

The DoST said the onion anthracnose fungal diseases caused “significant yield losses” in Nueva Ecija, a leading onion-producing province.

It said fall armyworm “continues to threaten corn and onion crops,” after it caused significant damage to sugarcane fields, particularly in Negros Occidental.

The DoST said the Philippine Council for Agriculture, Aquatic, and Natural Resources Research and Development (PCAARRD) is researching methods to combat pests and diseases affecting onion yields.

“These combined efforts aim to stabilize supply, support farmers’ productivity, and promote sustainable agricultural practices for long-term market resilience,” it said.

PCAARRD is funding a research project led by the College of Agriculture and Food Science’s National Crop Protection Center at the University of the Philippines Los Baños to develop sustainable chemical and biological management strategies for onion anthracnose.

“The project aims to assess current disease management practices, evaluate fungicides with different modes of action, identify biological control agents, and determine alternative hosts of anthracnose pathogens,” it said.

The project, set for completion in June 2026, will produce two fungicides and one biological control agent.

PCAARRD is also funding another research project under the Harnessing Adaptive Responses and Best Practices against Fall Armyworm using Science and Technology program to manage the fall armyworm in corn, onion, and sugarcane.

The project aims to train farmers in Nueva Ecija, Laguna, Batangas, and Negros Occidental and equip them with “science-based management approaches.” — Kyle Aristophere T. Atienza

OSAPIEA says pace of reforms picking up

THE Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA) said the swift signing of the implementing rules and regulations (IRR) of the value-added tax (VAT) refund for foreign tourists highlights the speed of recent economic reforms.

“We were just here a month ago to finish up the IRR of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, so it’s great that we are moving at excellent speed,” according to Secretary Frederick D. Go, the head of the OSAPIEA at the signing of the IRR.

“Travelling Filipinos have experienced the VAT refund process when we go to many other countries, and I am so happy to see this become a reality,” he added.

On Monday, the Department of Finance, Bureau of Customs, and Bureau of Internal Revenue signed the IRR for Republic Act No. 12079, or the VAT Refund for Non-Resident Tourists.

The signing ceremony was also witnessed by Mr. Go and Tourism Secretary Ma. Christina Garcia-Frasco.

Under the IRR, foreign passport holders may apply for a VAT refund from accredited stores for locally purchased goods equivalent to at least P3,000.

It applies to clothing, apparel, electronics, gadgets, jewelry, accessories, souvenirs, food or non-food consumables, and other retail and tangible goods.

“This measure responds to the calls of tourism groups, further demonstrating our government’s commitment to listening to and addressing the needs of our stakeholders,” Mr. Go said.

“This will encourage more tourist spending, which means more revenue for stores, more jobs, and more growth for our economy, especially our artisans and businesses,” he added.

In January, revenue from tourism activities, products, and services hit P65.3 billion, up 78.8% year on year. — Justine Irish D. Tabile

Visiting UK firms express interest in PHL analytics, cybersecurity tie-ups

TWELVE BRITISH companies have visited the Philippines to explore collaborations in data analytics, the internet of things (IoT), cybersecurity, and artificial intelligence (AI), a British official said.

“The Philippines is not only a rising force in digital innovation but also a market of immense opportunities for UK companies,” UK Trade Commissioner for Asia-Pacific Martin Kent said at the UK-Southeast Asia Tech Week in Manila on Monday.

“This year, we are exceptionally proud to bring 12 cutting-edge UK AI companies and partners to Manila, each offering world-class expertise, groundbreaking solutions, and a commitment to forging strong partnerships here,” he added.

British Ambassador to the Philippines Laure Beaufils said that the Philippines’ rapidly growing digital economy presents immense opportunities for collaboration, citing fields like digital identity verification.

“Companies such as Wise, known for making cross-border transactions faster and more affordable, and NCC Group, a global leader in cyber risk management, have already opened offices in the Philippines, ready to support the Philippines’ financial inclusion story and help local enterprises in fortifying their digital infrastructure,” she said.

“For this year’s UK-SEA Tech Week, we’ve brought 12 incredible UK companies offering cutting-edge solutions in data analytics, IoT, cybersecurity, consulting, and AI for enterprise,” she added.

The 12 companies are Content Guru, CyberQ Group, Encompass, Intelligent AI Solutions, Kraken IM, National Innovation Centre for Data, Open Data Institute, Smart, Summatic, Sumsub, Synetics, and Veracity Trust Network.

On Monday, the British Embassy Manila and the UK Department of Business and Trade also signed a partnership agreement with Fintech Alliance, which aims to advance fintech collaboration between the UK and the Philippines.

The British Embassy said that the partnership reaffirms the parties’ shared vision to strengthen cross-border cooperation, drive innovation, and enhance financial inclusion. — Justine Irish D. Tabile

Peso edges up before key US data

THE PESO inched higher against the dollar on Monday as market players preferred to stay on the sidelines before the release of key US economic data and as they await details on the Trump administration’s planned reciprocal tariffs.

The local unit closed at P57.32 per dollar on Monday, edging up by a centavo from its P57.33 finish on Friday, Bankers Association of the Philippines data showed.

The peso opened Monday’s session stronger at P57.30 against the dollar. Its worst showing was at P57.39, while its intraday best was at P57.285 versus the greenback.

Dollars exchanged went down to $1.098 billion from $1.37 billion on Friday.

“The dollar-peso closed almost flat as the market traded cautiously amid lingering geopolitical turmoil and while waiting for more data to provide more directional guidance,” a trader said in a phone interview.

US economic data to be released this week include the manufacturing purchasing managers’ index, the third and final estimate for fourth-quarter gross domestic product, as well as the February personal consumption expenditures price index report.

The dollar mostly moved sideways as markets digested recent comments from US Federal Reserve officials and amid uncertainty over US President Donald J. Trump’s policies.

For Tuesday, the trader expects the peso to move between P57.10 and P57.40 per dollar, while Mr. Ricafort sees it ranging from P57.20 to P57.40.

New York Federal Reserve President John Williams said on Friday the US central bank’s monetary policy is in the right place given the myriad of uncertainties facing the economy, noting that there’s no urgency to make any changes to interest rates, Reuters reported.

Chicago Fed President Austan Goolsbee echoed Williams’ monetary policy caution, telling CNBC on Friday that uncertainty argued for the Fed standing aside until more clarity emerged. Mr. Goolsbee said the economy was strong and that he’s waiting to see how President Donald J. Trump’s tariffs, which many economists expect to worsen a challenging inflation situation, play out.

Mr. Williams and Mr. Goolsbee weighed in two days after Fed policy makers left the central bank’s benchmark interest rate in the 4.25%-4.5% range and signaled they still expect to lower it at some point later this year.

At the same time, Fed officials acknowledged considerable uncertainty about the outlook amid the Trump administration’s dramatic and often chaotic policy changes, which they expect to help drive up inflation pressures, at least in the short term. — A.M.C. Sy with Reuters

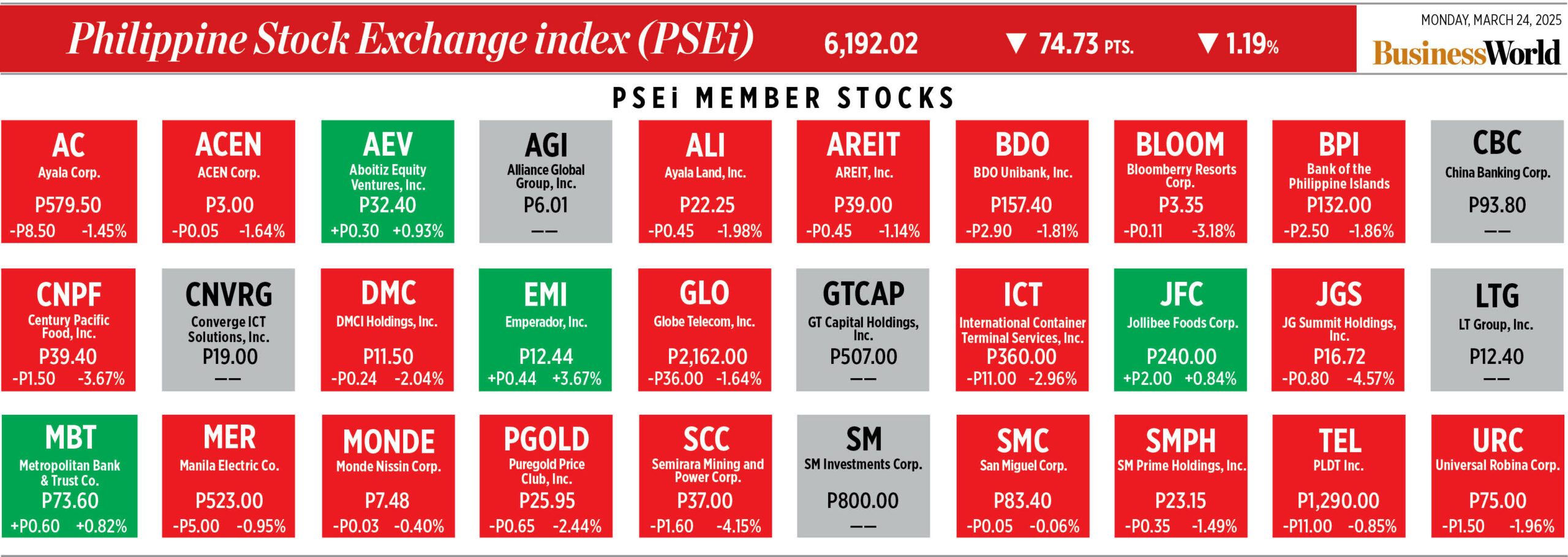

PSEi slides as market awaits tariff developments

PHILIPPINE SHARES slid on Monday as market sentiment was weighed down by continued uncertainty over US President Donald J. Trump’s plan to impose reciprocal tariffs by next week and as the shortened trading session affected value turnover.

The benchmark Philippine Stock Exchange index (PSEi) dropped by 1.19% or 74.73 points to close at 6,192.02 on Monday, while the broader all shares index went down by 0.96% or 35.81 points to 3,691.31.

“The local market extended its drop as investors worried over the US government’s planned reciprocal tariffs on April 2 and its consequences on the global economy,” Japhet Louis O. Tantiangco, senior research analyst at Philstocks Financial, Inc., said in a Viber message.

“Stocks dropped today on low value turnover… after a shortened trading day, as investors remain cautious ahead of Trump’s April 2 deadline for the implementation of reciprocal tariffs on trade partners,” Alfred Benjamin R. Garcia, research head at AP Securities, Inc., said in a Viber message.

Value turnover dropped to P4.63 billion on Monday with 630.53 million shares exchanged from the P11.77 billion with P1.58 billion shares traded on Friday.

The market’s opening was delayed to past 11 a.m. on Monday, which the PSE attributed to a system connectivity issue.

Rastine Mackie D. Mercado, research director at China Bank Securities Corp., said foreign selling also pulled the market down.

“The PSEi headed lower in a shorter session following a delay in market opening. Foreign funds turned net sellers, breaking their streak of net inflows last week. Moreover, trading volumes also edged lower, likely driven by the lack of catalysts,” Mr. Mercado said in an e-mail.

Net foreign selling stood at P240.82 million on Monday, a reversal of the P1.04 billion in net buying recorded on Friday.

All sectoral indices closed lower on Monday. Services fell by 2.31% or 47.39 points to 1,997.55; property declined by 1.38% or 30.92 points to 2,199.71; financials shed 1.07% or 25.99 points to 2,402.25; industrials decreased by 0.58% or 52.07 points to 8,792.47; holding firms sank by 0.53% or 27.63 points to 5,128.87; and mining and oil went down by 0.52% or 49.53 points to 9,446.63.

“Emperador, Inc. was the day’s top index gainer, climbing 3.67% to P12.44. JG Summit Holdings, Inc. was the day’s worst index performer, plunging 4.57% to P16.72,” Philstocks Financial’s Mr. Tantiangco said.

Market breadth was negative as decliners outnumbered advancers, 123 to 61, while 50 names closed unchanged.

“For [Tuesday’s] session, we think that a test of the 6,150 level is in play, and if successful, could mean a continuation in the range trade bound by 6,150 and 6,350,” China Bank Securities’ Mr. Mercado said. — S.J. Talavera