Philippines’ growth outlook clouded by inflation risks

By Luisa Maria Jacinta C. Jocson, Reporter

THE Philippines is likely to continue its stable growth trajectory in the medium term, although inflation and elevated interest rates remain major risks to this outlook, analysts said.

“First, inflation remains one of the main downside risks to growth for the year,” Gonzalo Varela, World Bank lead economist and program leader of the Equitable Growth, Finance and Institutions Practice Group for Philippines, Malaysia, and Brunei Darussalam, said in an e-mail.

“While inflation is back to within the Bangko Sentral ng Pilipinas’ (BSP) target, inflation for key commodities, such as rice, remains high.”

Since 2022, the Philippines has faced rising inflation due to a spike in global commodity prices and supply chain disruptions. Inflation averaged 5.8% in 2022 and 6% in 2023, well-above the BSP’s 2-4% target range.

The BSP expects inflation to average 3.4% this year.

To tame persistent inflation, the government has employed various monetary and non-monetary measures such as raising interest rates and lowering tariffs on certain commodities.

“Our (economic) performance would have been even better if not for the high inflation, particularly in food. But we expect those inflation pressures to diminish, allowing us to go back to the 2-4% inflation target,” National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan told BusinessWorld.

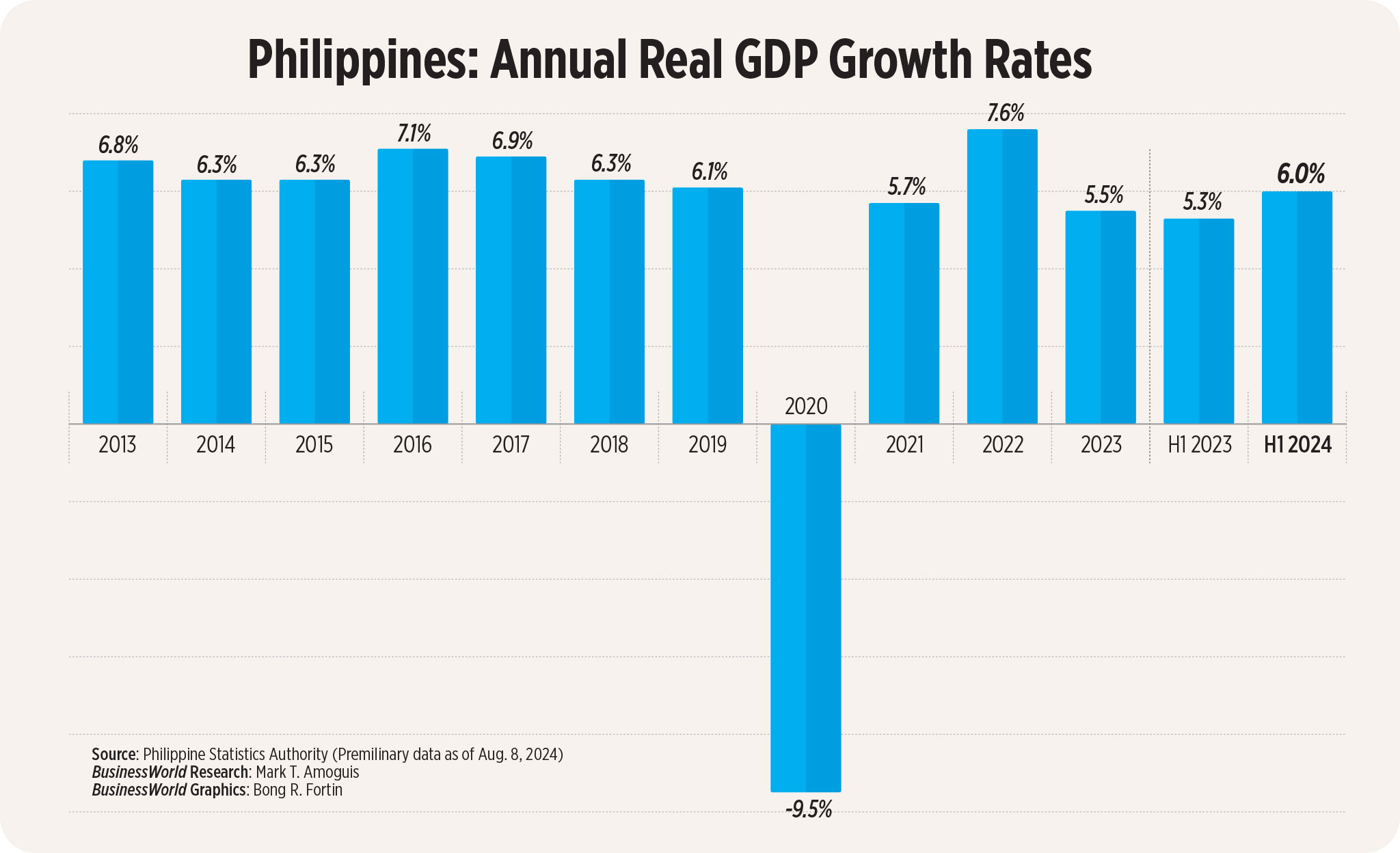

The Philippine economy grew by 7.6% in 2022 but slowed to 5.5% in 2023.

The Development Budget Coordination Committee (DBCC) has set the country’s gross domestic product (GDP) growth at 6-7% this year, 6.5-7.5% next year, and 6.5-8% from 2026 to 2028.

Over the past months, the DBCC has trimmed its growth targets due to external headwinds.

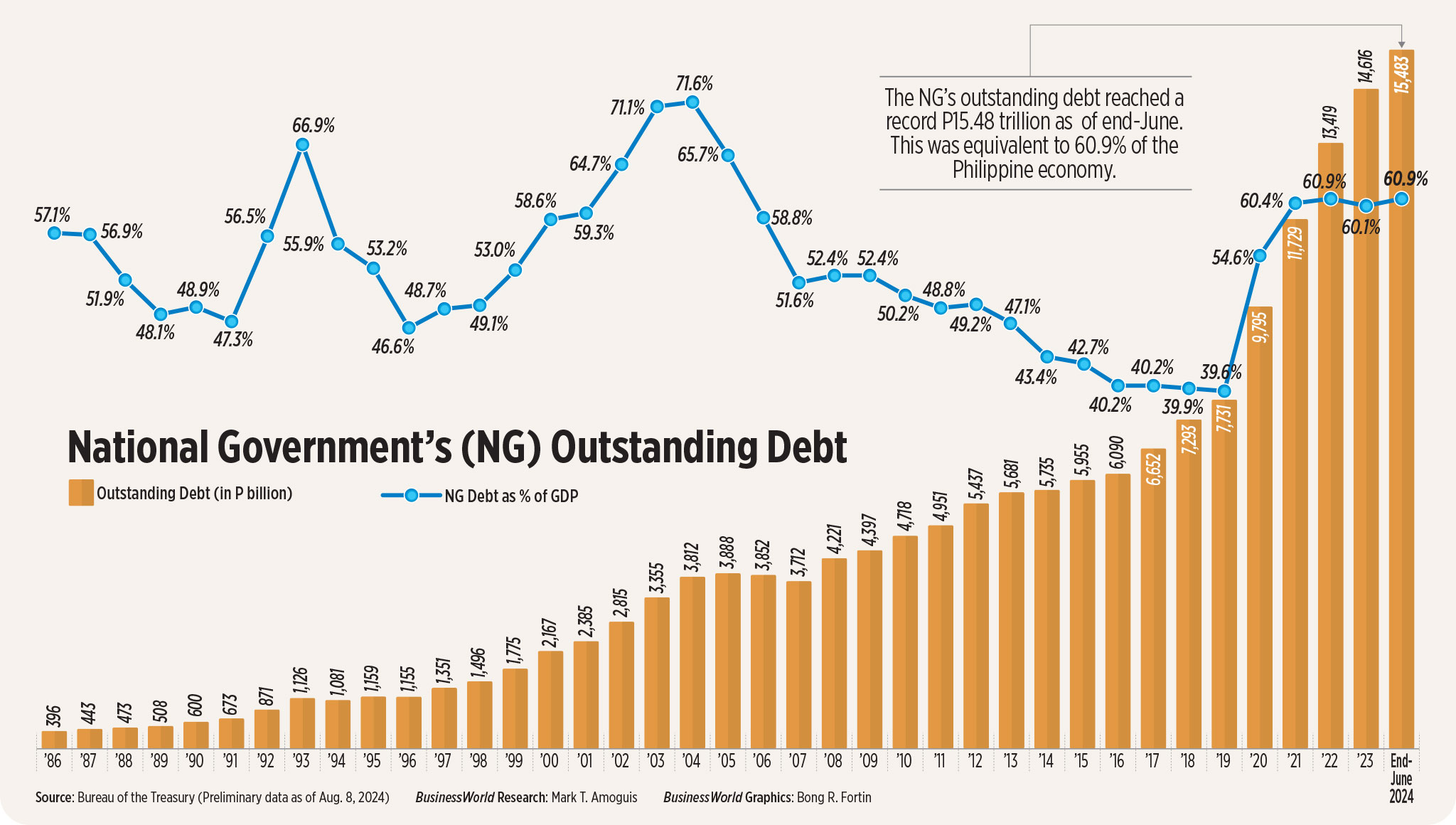

“We stick to that (targets), and we have our fiscal consolidation program to ensure that even as we aim for high growth, we remain fiscally sound, externally sound, so that you can sustain the growth momentum even beyond the administration,” Mr. Balisacan said.

Many multilateral institutions’ Philippine GDP forecasts either fall short or settle at the low end of the government’s growth target.

ASEAN+3 Macroeconomic Research Office (AMRO) Senior Economist Andrew Tsang said that the Philippine government’s medium-term targets are “ambitious as they are higher than the trend growth rate.”

“My general sense is that the GDP growth targets in recent and in coming years are overly optimistic considering a few key factors,” Pantheon Chief Emerging Asia Economist Miguel Chanco said.

“The damage caused by COVID-19 (coronavirus disease 2019) and the cost-of-living crisis to household balance sheets in the Philippines is quite substantial and will take many years to repair,” he added.

PANDEMIC IMPACT

Mr. Balisacan admitted the economy is still reeling from the pandemic due to the “extraordinarily” long lockdowns.

“The pandemic and (the government’s) response to it, caused the sharp contraction of the economy. That easily wiped out three years of economic growth,” he said, referring to the 9.6% GDP contraction in 2020.

“Nonetheless, for the past two years, the objective was to restore the economy to pre-pandemic levels and to recover many of the losses. Many of these losses, like learning losses, take many years to recover.”

Despite expectations of below-target growth, most multilateral institutions’ forecasts still place the country among the fastest-growing economies in Southeast Asia or even the Asia-Pacific region.

The World Bank expects the country to grow by an average of 5.9% from this year until 2026. It sees GDP growth averaging 5.8% in 2024.

“This level of growth puts the Philippines as one of the top growth performers in the East Asia Pacific region (close to Cambodia’s 6.1% average and Vietnam’s 6% average,” Mr. Varela said.

AMRO sees Philippine growth averaging 6-6.2% from 2026 to 2028. This year, it projects GDP growth averaging 6.1%, which places it as the second-fastest expected growth in the ASEAN+3 region, after Vietnam.

“The Philippines will register one of the fastest growth in the ASEAN+3 region during 2024-2025 and will continue to grow steadily in the medium term,” Mr. Tsang said.

“The Philippines’ economy will outperform many of its regional peers in terms of growth. That is largely a catch-up following its long and deep downturn during the pandemic,” Sarah Tan, an economist from Moody’s Analytics, said in an e-mail.

However, Ms. Tan noted that economic output is still below around 10% of its pre-pandemic levels, which is much lower than the average 6-7% seen in other Association of Southeast Asian Nations (ASEAN) countries.

“We expect the economy to narrowly miss the government’s growth target of 6-7% as high borrowing costs keep a lid on private consumption — its main engine of growth.”

“Likewise, high interest rates will also slow private investment growth,” Ms. Tan added, as Moody’s expects GDP growth to average 5.9% this year.

Meanwhile, the International Monetary Fund (IMF) expects GDP to settle at 6% this year.

IMF Representative to the Philippines Ragnar Gudmundsson said this will be driven by a “recovery in exports and accelerate further to 6.2% in 2025 amid declining inflation and lower interest rates.”

“GDP growth is expected to remain at around 6-6.5% over the medium term, in line with the economy’s potential growth. This would make the Philippines one of the fastest-growing economies in the region, reflecting recent strong performance,” he added.

Aris D. Dacanay, economist for ASEAN at HSBC Global Research, said the country’s growth trajectory is “promising” but there is still much to be done.

“The odds are in the Philippines’ favor, and we expect that despite a backdrop of weak global growth, the Philippines’ medium-term outlook for growth is a promising one,” he said.

“The country has re-achieved stability. And in truth, the country will still grow respectably even when the status quo is maintained. But stability is different from prosperity, and to achieve prosperity requires going the extra mile,” Mr. Dacanay added.

INFLATION RISKS

Mr. Balisacan said that inflation is one of the primary concerns that the government must address.

“Inflation is linked with or breeds other problems. High inflation prompted the BSP to raise the policy rate, which is not good for business and not good for consumers,” the NEDA chief said.

“So, if you are able to reduce that, reduce the inflation, then there’s a lower likelihood that you’ll have your interest rates rising in the future,” he said.

The BSP at its Aug. 15 meeting reduced the target reverse repurchase (RRP) rate by 25 basis points (bps) to 6.25% from the over 17-year high of 6.5%. This was the first time the central bank cut rates since November 2020.

BSP Governor Eli M. Remolona, Jr. has also signaled the possibility of another 25-bp cut in the fourth quarter.

Managing inflation will continue to be crucial, Mr. Varela said. “Keeping inflation in check is important to ensure that the process of monetary policy normalization, or the reduction in the key interest rate by the BSP, is not delayed,” he said.

In the short term, Mr. Tsang said that the country’s growth prospects may be dampened by high inflation, particularly due to possible supply shocks which could stoke food prices.

“Inflation is still one of the main concerns given how private consumption is the largest contributor to GDP by expenditure. While we expect inflation to recede through the year and stabilize in the next, elevated food inflation threatens to slow the deceleration,” Ms. Tan said.

“That’s partly a function of poor food supply as the country is vulnerable to natural disasters like droughts and floods,” she added.

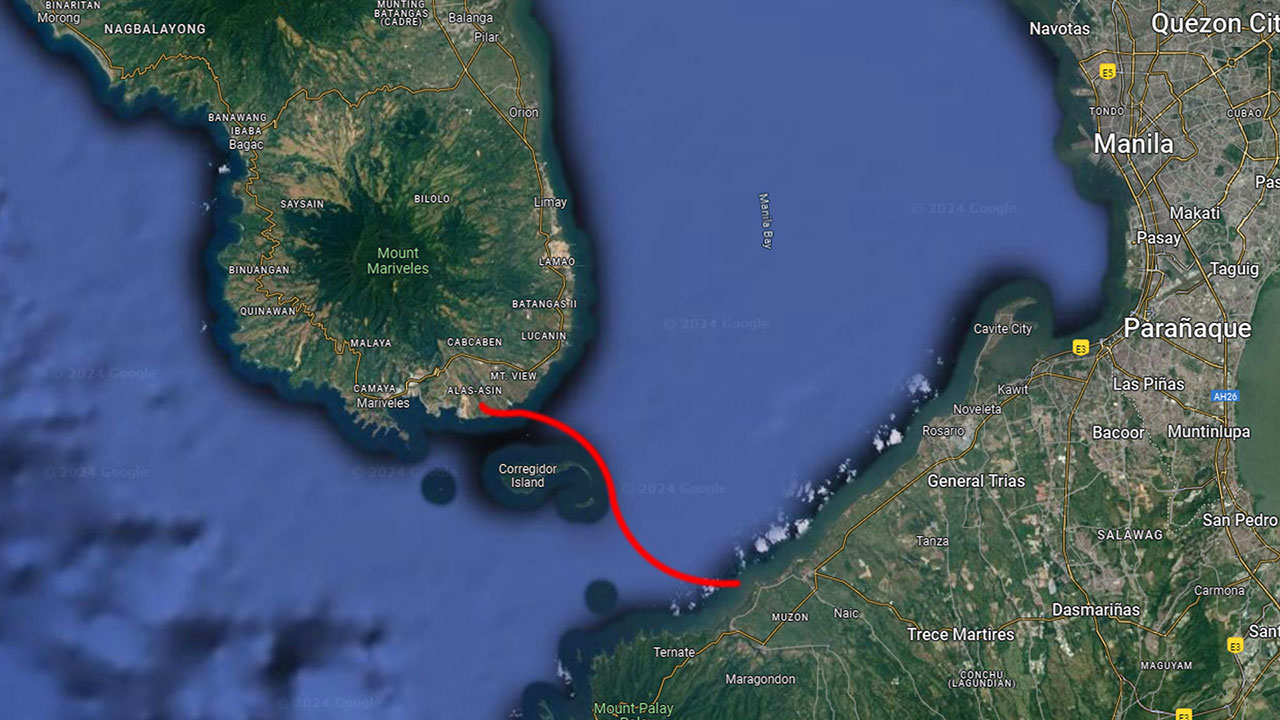

The Philippines is one of the countries most affected by storms, with an average of 20 typhoons per year.

The agriculture sector is still recovering from the impact of the El Niño, which caused P15.3 billion in total farm damage from June 2023 to August 2024.

“A key downside risk stems from the threat of climate and extreme weather-related events. For example, a stronger-than-expected La Niña and more destructive storms could cause disruptions to business activity and damage to farm output which could put pressure on food prices,” Mr. Varela said.

IMF’s Mr. Gudmundsson said that the balance of risks to the near-term growth outlook has improved but remains tilted to the downside.

“On the downside, higher-for-longer interest rates or spillovers from fiscal risks in the United States could result in tighter financial conditions than expected in the Philippines and larger-than-expected capital outflows,” he said.

Barring these risks, inflation is widely expected to begin easing for the rest of the year and in 2025.

“Inflation is expected to stay within the target range in the second half of 2024 and 2025, benefiting from the continued easing of international commodity prices and reduction in tariffs on imports, although the upside risks, such as peso depreciation, and wage increases, remain,” Mr. Tsang said.

The tariff cut is also widely expected to boost household consumption, Mr. Dacanay said.

“Households in the Philippines usually spend 9% of their budgets on rice so potentially lowering rice prices by a fifth can help lower the pressure on household budgets and unleash as much as 1.1% of GDP. That’s a lot of potential growth waiting on the sidelines.”

In June, President Ferdinand R. Marcos, Jr. approved a reduction on tariffs on rice imports to 15% from 35% previously, until 2028.

OTHER RISKS

Apart from inflation, analysts also cited other factors that could derail the country’s growth path.

Mr. Varela noted delays in the implementation of key investment and productivity-enhancing reforms, which could hinder the entry of foreign investments.

“Greater investment in physical infrastructure and human capital is still needed, while the Philippines has a lot of catching up to do in terms of signing and joining major free trade agreements with the world’s largest markets,” Mr. Chanco said.

In the long term, Mr. Tsang said that lagged effects from the pandemic could continue to constrain growth amid the “slow upgrading of the labor force and weak recovery in private investment.”

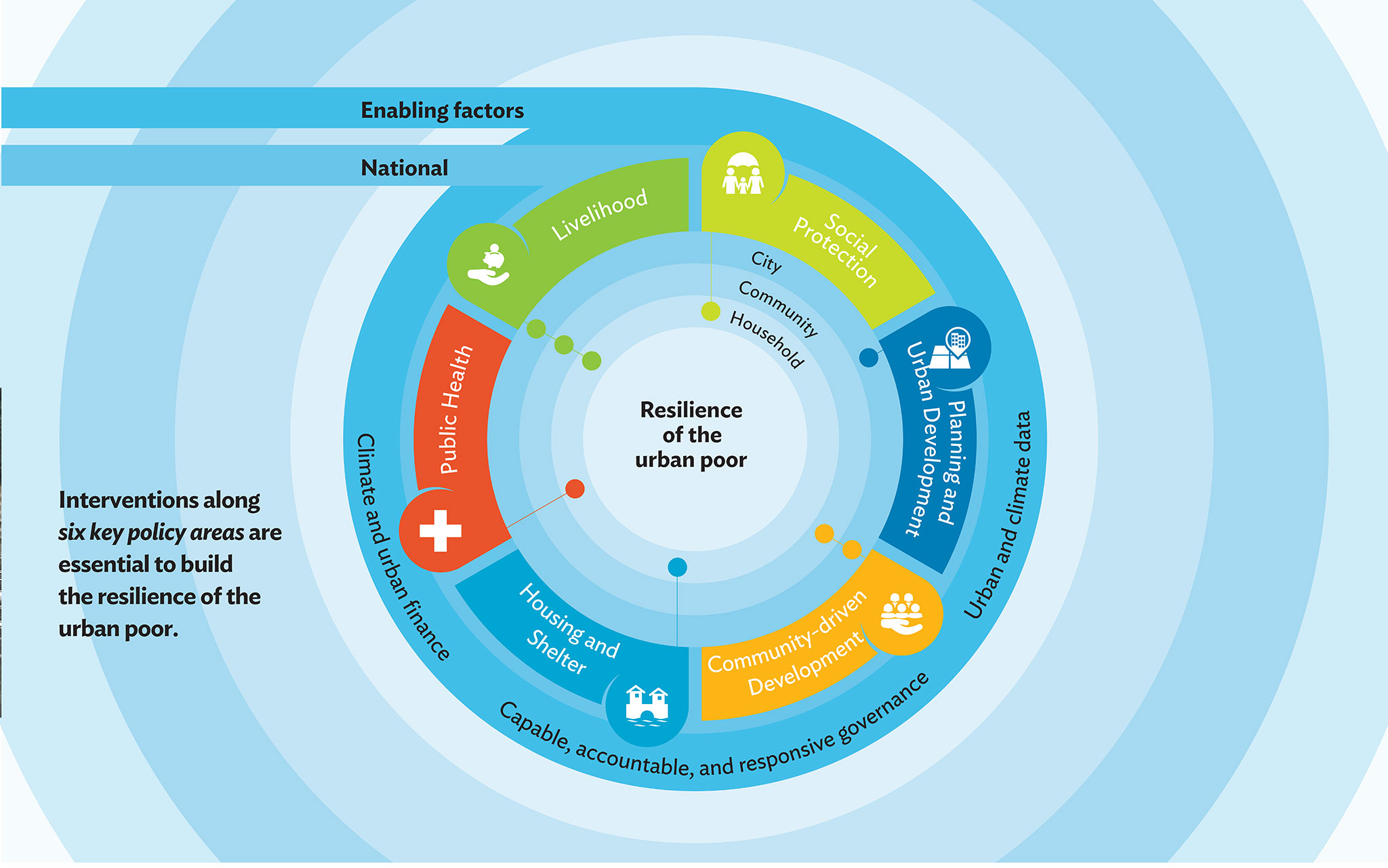

“Meanwhile, the potential growth is also affected by the pace of infrastructure development, prolonged geopolitical risks, and natural disasters caused by climate change. These factors underscore an urgent need for action to foster resilient, sustainable, and inclusive long-term growth,” he added.

To achieve higher growth, Mr. Tsang said the economy should address the scarring effects of the pandemic “by implementing human capital policy and investment policy in a timely manner and continue to embark on infrastructure development.”

Mr. Gudmundsson also noted that an escalation in geopolitical tensions could “disrupt trade and put pressure on the peso.”

GROWTH DRIVERS

Meanwhile, the NEDA secretary said that the government is ensuring that growth will be felt across all sectors.

“In the meantime, we are pushing every policy lever that we can use that ensures growth is not just high, but also inclusive. Despite the inflation pressure, growth has been broadly inclusive,” Mr. Balisacan said.

Mr. Varela said the economic growth potential for the Philippines remains high over the medium and long term.

“If the government commits to a combination of fiscal prudence and ambitious investment and productivity-enhancing reforms, the economy could be growing at higher rates than the already high rates at which it is growing today,” he said.

The government must also ensure the timely implementation of reforms to strengthen competition and boost productivity, Mr. Varela said.

“In an increasingly competitive environment, further efforts to attract FDIs (foreign direct investments) and measures to ensure knowledge transfer will be needed,” Mr. Tsang said.

Infrastructure development will also be key to supporting robust growth.

“The pace of infrastructure development is one of the key challenges facing the Philippine economy. Infrastructure investment should be stepped up through strategic prioritization among different sectors and effective utilization of various funding sources,” Mr. Tsang said.

The Marcos administration plans to spend 5-6% of GDP on infrastructure annually.

Mr. Dacanay noted that infrastructure must be well-planned and well-designed to “prioritize the overall mobility and welfare of all Filipinos, regardless of income.”

He said infrastructure development must also incorporate climate mitigation to make sure Filipinos become more resilient in the face of stronger typhoons.

“Looking forward, accelerating reforms to raise productivity, reduce infrastructure and education gaps, and harness benefits from the digital economy and demographic dividends could boost the country’s potential growth,” Mr. Gudmundsson said.

Policies must also strengthen social protection schemes and address climate issues, Mr. Gudmundsson added.

“In addition, policies that aim to close the physical and human capital investment gaps for the country will be important to boost our long-term growth prospects. This will allow the Philippines to continue to expand its potential growth,” Mr. Varela said.

UPSKILLING

The government must also focus on upskilling the labor force, analysts said.

“Overcoming the scarring effects of the pandemic mandates a sustained focus on upgrading and upskilling the workforce to embrace a more technology-driven economy,” Mr. Tsang said.

“In particular, the government should closely collaborate with the industries and training providers to formulate action plans and implement the plans to ensure that the supply of skilled labor is matched with industries’ demand,” he added.

Robust investments to generate quality employment is one of the priorities of the administration, Mr. Balisacan said.

“Our push is for investments, massive investments that we need to do because then the returns of labor will be higher in those places where there are investments.”

Mr. Balisacan said the government should address Filipino students’ learning losses from the pandemic as its effect will be felt when they join the workforce in a few years.

The NEDA in 2021 said that the lack of face-to-face schooling for one year during the pandemic may result in over P11 trillion in productivity losses over the next four decades.

Mr. Dacanay noted that skills training must also incorporate emerging technologies such as artificial intelligence (AI).

“Skills training needs to be prioritized, particularly in AI, to maintain the momentum seen in the country’s digital space,” he said.

By sector, the services industry is seen to continue being a key driver of growth. It is typically the biggest contributor to the economy among major industries.

“Within services, growth will be led by wholesale and retail trade as monetary policy easing reduces pressure on households’ budgets, giving consumer spending a lift,” Ms. Tan said.

Mr. Tsang said that the business process outsourcing (BPO) industry will “expand robustly going forward.”

“The BPO sector will continue to grow given the ongoing trend of digitalization and steady rise in external demand for IT-BPM services for cost optimization.”

Tourism is also seen as a bright spot for the Philippines, Mr. Tsang said.

“In the coming years, there is potential in the tourism industry with strong domestic tourism, and the level of international tourists is expected to surpass the pre-pandemic level,” he said.

In 2023, tourism accounted for 8.6% of GDP, up from 6.4% a year ago. The industry’s direct gross value added, which measures the value generated from various tourism-related activities, was P2.09 trillion.

The country should also continue to enhance the manufacturing of semiconductors, its top export.

“Over the near to medium term, the Philippine semiconductor industry is expected to benefit from the upturn of the global semiconductor cycle (it is expected to last until mid-2025) and the US semiconductor diversification strategy,” Mr. Tsang said.

Ms. Tan said that enhancing semiconductor production to move up the value chain will “attract investment and talent, improving the sector’s competitiveness.”

“Rising factory output is crucial to maintaining economic expansion; since the end of the pandemic, manufacturing output growth has lagged service-providing industries by half,” she added.