‘Sustainable mining’ is not an oxymoron

(Part 1)

There are extremists among environmentalists who mouth the slogan “Sustainable mining is an oxymoron.” They cannot imagine a mining operation that is compatible with the protection of the physical environment. They can only picture denuded forests and devastated watersheds as a result of mining. They can see the loss of livelihoods of indigenous peoples and other rural folks.

Well, I have news for these anti-mining advocates.

I just visited Semirara Island that hosts Semirara Mining and Power Corp. (SMPC), the largest coal producer in the Philippines, accounting for 96% of domestic production till 2022. I saw an island planted with more than one million trees that rehabilitated 400 hectares of a mined-out area that in its 16 years of mine life generated P60.1 billion in royalties for the government and the host communities.

It took 11.5 million man-hours to fill the pit with over 452 million bank cubic meters (bcm) of earth material, which is enough to fill 217,000 Olympic-size swimming pools. The afforestation of this part of the island, called Panian, which used to be a barren grassland, formed part of SMPC’s restoration beyond compliance program toward a Net Positive Impact (NPI) target on biodiversity.

The step-by-step transformation of this once barren part of the island can be described as follows, as we were informed in a briefing:

2016: The Panian pit was declared totally mined out, and an accelerated rehabilitation program begins;

2017: The Department of Energy (DoE) orders the expedited backfilling of the South Panian mine to serve as a model of open pit mine rehabilitation in the Philippines;

2018: More than one million trees are planted within the mining complex;

2019: The South Panian mine rehabilitation is completed in two years versus the five to 10 years mandated by the DoE;

2021: The ASEAN Energy Award (special submission category) is conferred on SMPC for its accelerated South Panian Rehabilitation program;

2022: North Panian is fully covered six years ahead of the 10-year plan.

All these impressive accomplishments were very visible to the eye as we flew over the forested areas in the private plane we took from Manila to Semirara.

Before I continue to describe the many other signs of responsible mining that brought untold benefits to the original settlers of the island, as well as the thousands of families who migrated to Semirara from other parts of Antique — the province to which it belongs — because of the many employment and livelihood opportunities coming from the continued operations of the coal mine, let me digress to comment on a breaking news as we were flying to the island.

I read an item brought up by the algorithm on my phone about Secretary of Energy Rafael Lotilla being charged by some cause-oriented groups for allegedly violating the coal moratorium policy by approving the Aboitiz-owned Therma Visayas, Inc. (TVI) Unit 3 expansion of the coal-powered power plant in Toledo, Cebu. The response of the business community to the actions of the misguided environmentalists has made it clear that coal-powered plants will be with us for a long time if we are to truly promote the common good of Philippine society. Nine business and professional groups, led by the Philippine Chamber of Commerce and Industry, supported Secretary Lotilla in the direction he is taking to achieve energy security and affordability for the country, the two key components needed to attract investments (both domestic and foreign), expand domestic enterprise, and enhance our productivity and competitiveness. As a case in point, Vietnam has been attracting practically all the manufacturing enterprises leaving China because of its lower energy costs compared to us.

The PCCI supports the need to decarbonize but “we must do so in a careful manner without prejudicing the country’s economic progress.”

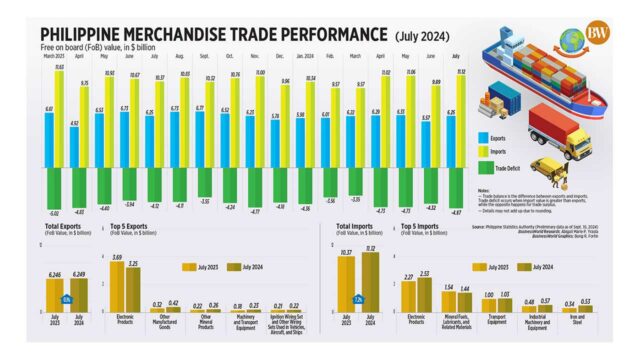

The Philippines has no alternative but to rely on its existing coal-fired plants to ensure a stable and reliable electricity supply. Coal remains the dominant source of power in the country’s energy mix, accounting for 62% vs. 22% renewable energy, below the target of 35% renewable by 2030.

When EPIRA (the Electric Power Industry Reform Act of 2001) was first legislated, the exclusive concern was energy security. Today EPIRA has to be amended to take into account that the paramount need is to bring down the cost of energy in the Philippines, which is the highest in the ASEAN region. This expensive energy hurts the poor most because it is the cause of high inflation, especially food inflation. It is also the reason why the Philippines is having a hard time attracting much needed Foreign Direct Investment (FDIs), especially in job-generating manufacturing enterprises. We have to consider even the extreme step of removing the moratorium on building coal-powered plants.

Also coinciding with my trip to Semirara Island was the release of an article appearing in a leading daily by Bjorn Lomborg, president of the Copenhagen Consensus, an influential group in the area of energy policy and sustainable development. Entitled “Myth of Green Energy Transition,” its thesis is that the much-vaunted green energy transition away from fossil fuels is not happening. It recommends drastically changing policy direction because shifting to green energy from fossil fuels is unaffordably costly and is harming poor nations and the poor in rich nations. The harsh truth is that despite global expenditures of almost $2 trillion annually to move towards green energy, with the use of solar and wind energy rising to their highest levels, there has been no reduction in the use of fossil fuels. In fact, over the same period of time, the world has added even more fossil fuels.

It is useful to learn from the history of energy source transition over time.

Research showed that there have been 14 shifts in energy use over the past five centuries, like when farmers went from plowing fields with animals to using fossil fuel-powered tractors. The main drivers of change have always been that the new energy service is either better or cheaper. Unfortunately for the advocates of “green energy,” solar and wind fail on both counts. They are not better because unlike fossil fuels that can produce electricity whenever needed, they can produce energy according to the vagaries of daylight and weather. This means that solar and wind are not cheaper, either. At best, they are only cheaper when the sun is shining or the wind is blowing at just the right speed. The rest of the time they are mostly useless and infinitely costly. When we consider the cost of just four hours of storage, wind and solar energy solutions become uncompetitive compared to fossil fuels, especially coal. Achieving a real, sustainable transition to solar or wind would require orders of magnitude of more storage, making these options incredibly unaffordable, especially to the poor.

Those who favor a moratorium on fossil fuels, especially coal, also ignore a major fact that solar and wind only address a small part of a vast challenge. These renewables are almost entirely deployed in the electricity sector, which makes up just one-fifth of global energy use. There are still the difficulties of finding green solutions for most transport, and we have not even begun with the vast energy needs of heating, manufacturing, or agriculture. Furthermore, we are failing to consider the energy needs of the hardest and most crucial factors like steel, cement, plastics, and fertilizers. By unrealistically banning fossil fuels, we are making it more difficult for us to increase the role of manufacturing in our industrialization efforts.

Now that our huge domestic market has reached a level that allows us to implement an authentic import-substitution strategy (which was not economically feasible at the start of our development process in the last century), it is important to make sure that high energy costs will not spoil this second chance for a thorough going inward-looking industrialization.

(To be continued.)

Bernardo M. Villegas has a Ph.D. in Economics from Harvard, is professor emeritus at the University of Asia and the Pacific, and a visiting professor at the IESE Business School in Barcelona, Spain. He was a member of the 1986 Constitutional Commission.