By Aubrey Rose A. Inosante and Justine Irish D. Tabile, Reporters

US PRESIDENT Donald J. Trump is imposing a bigger-than-expected tariff on Philippine exports to the United States, as part of a broader reciprocal tariff plan that will apply to all its trading partners.

However, Philippine government officials downplayed its impact, saying this was still lower than tariffs imposed on the rest of Southeast Asia.

Finance Secretary Ralph G. Recto said on Thursday that the Philippine economy, which is mainly driven by domestic demand, is “relatively resilient” against trade wars.

“However, as with all countries, we are not spared from the impact of the expected decline in international trade and possible slowdown of global growth due to supply-chain disruptions, higher interest rates, and higher inflation,” Mr. Recto said in a statement.

Trade Secretary Cristina A. Roque said the reciprocal tariffs can provide opportunities for the Philippines as regional competitors will be subjected to higher tariffs.

“We view with guarded optimism that the recent US imposition of reciprocal tariffs will provide strategic opportunities for the Philippines to improve its economic relationship with the US,” she said in a statement.

Ms. Roque said she will request a meeting with her US counterpart to discuss “strengthening” trade relations between the two countries.

On Wednesday, Mr. Trump announced a 10% tariff on all its trading partners, which will take effect on April 5. (See related story “Trump’s tariffs stoke global trade war as China, EU hit back”).

The US will also slap individualized higher reciprocal tariffs on major trading partners including the European Union, China, Japan, South Korea and the Philippines, starting April 9.

“Foreign nations will finally be asked to pay for the privilege of access to our market — the biggest market in the world,” Mr. Trump said.

According to an infographic posted by the White House on X, the Philippines will be slapped with a 17% “discounted reciprocal tariff” as the Philippines charges a 34% tariff on the US.

However, an annex document to the executive order on reciprocal tariffs showed the adjusted reciprocal tariff for the Philippines is at 18%.

It was not immediately clear why there was a discrepancy in the tariff rates in the infographic posted on X and the annex document posted on The White House website.

Nonetheless, Philippine officials cited the 17% tariff rate in their press statements.

Among Southeast Asian countries, Cambodia faces the steepest tariff at 49%, followed by Laos (48%), Vietnam (46%), Myanmar (45%), Thailand (37%), Indonesia (32%), Malaysia (24%) and Brunei (24%). Singapore will be imposed a baseline tariff of 10%.

“The imposition of the 17% tariff, which is the second lowest, is not so bad in our opinion. We still see it as somewhat favorable,” Presidential Communications Office Undersecretary Clarissa A. Castro said at a Palace briefing in mixed English and Filipino.

Agriculture Secretary Francisco P. Tiu Laurel, Jr. said the Philippines could take advantage of the relatively lower tariff rate compared with its neighbors to “push for more sales to the US of our products.”

“The new tariffs also put the Philippines in a more advantageous position, more specifically for certain export products like coconuts. With lower tariffs than Thailand, Philippine coconut exports can be more competitive,” Ms. Roque said.

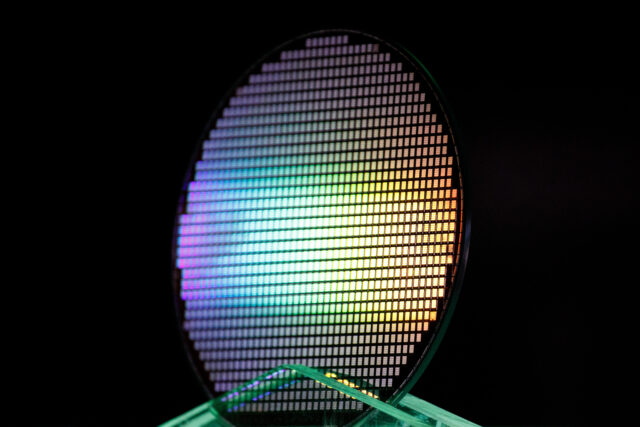

Ms. Roque noted that there are Philippine products that will be exempted from reciprocal tariffs, including copper ores and concentrates and integrated circuits.

According to a White House fact sheet, the reciprocal tariffs will not apply to certain goods, such as semiconductors, copper, pharmaceuticals, gold, and “certain minerals that are not available in the US.”

However, agri-based products, particularly food exports, are not exempted from reciprocal tariffs.

“The recent US measure has made US imports more expensive so that their domestic manufacturers can compete. Equally important for the US is to improve its access to rapidly growing economies such as the Philippines,” Ms. Roque said.

“In this regard, the Philippines aims to actively engage the US in a discussion to facilitate enhanced market access for its key export interests, such as automobiles, dairy products, frozen meat, and soybeans, within the framework of a bilateral free trade agreement.”

Special Assistant to the President for Investment and Economic Affairs Frederick D. Go said some investors may relocate and set up manufacturing facilities in the Philippines, given the relatively lower tariffs on Philippine exports to the US.

Trade Undersecretary Allan B. Gepty said it is important to maintain “good relations” with the US. “It would be good to see how we can seize opportunities from the possible trade diversion and recalibration of some investments in the region,” he said.

‘GAME CHANGER’

Fitch Ratings Head of US Economic Research Olu Sonola said Mr. Trump’s aggressive tariffs are a “game changer, not only for the US economy but for the global economy.”

“Many countries will likely end up in a recession. You can throw most forecasts out the door, if this tariff rate stays on for an extended period of time,” Mr. Sonola said.

Higher tariffs may also drive up prices and hurt demand for Philippine-made goods in the US.

“The US is the biggest export market of the Philippines, so this will have a drag on Philippine growth,” former commissioner of the Philippines Tariff Commission George N. Manzano said in a Viber message.

In 2024, the US was the top destination for Philippine exports, accounting for 17% of the total.

“US importers will put on all these additional tariffs to the selling price in the US,” Foreign Buyers Association of the Philippines President Robert M. Young told BusinessWorld.

“The end result of this is that the Philippines will have difficulties in getting export orders due to lesser or no demand,” he added.

Asked if the Philippines could benefit from the higher tariffs imposed on other countries, Mr. Young pointed out that Philippines has higher costs.

“To start with, the Philippines was selling at a higher price than Vietnam, India, and Cambodia. Meaning, Philippine goods will be the last to be picked up from the shelves,” he said. “Also, Vietnam acted swiftly by reducing their tariff on US goods coming into Vietnam.”

The Philippines exported $12.14 billion worth of commodities to the US in 2024. Of the total, 53% or $6.43 billion were electronic products.

“Electronics and semiconductors, which comprise the bulk of Philippine exports to the US will be vulnerable. Apparel, footwear, and textile products, which rely on preferential trade agreements, may also face competitiveness issues,” Philippine Institute for Development Studies Senior Research Fellow John Paolo R. Rivera said.

“Agricultural exports, such as coconut oil, processed fruits, and seafood, could see a decline in demand due to price sensitivity in the US market,” Mr. Rivera said.

Mr. Rivera noted the direct impact on Philippine gross domestic product (GDP) may not be “immediately severe.”

“It’s a prolonged tariff war could dampen investment sentiment and export growth. If businesses pass on higher costs to consumers, inflation may spike,” he said.

The Development Budget Coordination Committee is targeting 6-8% GDP growth this year. It is also projecting 6% and 5% growth in exports and imports, respectively, this year.

In a report, ANZ Research said it estimated that the reciprocal tariffs could have a “milder impact” on the Philippines, along with Indonesia and India, due to their lower reliance on exports.

“Our understanding is that these tariffs are not final and can be negotiated lower, depending on the extent of reduction in the bilateral trade surplus with the US,” ANZ said.

Data from the Office of the US Trade Representative showed that bilateral trade between the Philippines and the US reached $23.5 billion in 2024 — comprising $9.3 billion in US exports and $14.2 billion in imports.

The US goods trade deficit with the Philippines was $4.9 billion in 2024, up 21.8% from last year.

To mitigate the negative effects of the tariffs, Mr. Young said that “there should be a joint best effort from the Philippine government and private sector to turn their heads to other potential export markets.”

Department of Trade and Industry-Export Marketing Bureau Director Bianca Pearl R. Sykimte said that the department is already looking at new export markets such as in the Middle East and Africa.

Confederation of Wearables Exporters of the Philippines Executive Director Ma. Teresita Jocson-Agoncillo said that the reciprocal tariffs will be imposed on top of the most favored nation (MFN) apparel rates.

“It’s better for us to wait for the US side to publish guidelines. As it looks the reciprocal tariff will be MFN rates plus 17%,” she said in a Viber message. “There is still an advantage, as the Philippines has the lowest (tariff) now, against ASEAN (Association of Southeast Asian Nations) counterparts but note that in the end it can still impact global sourcing and supply chain movement.”

The PSA defines “basic literacy” as the ability of a person to read and write a simple message in any language or dialect with understanding, and to compute or perform basic mathematical operations.

The PSA defines “basic literacy” as the ability of a person to read and write a simple message in any language or dialect with understanding, and to compute or perform basic mathematical operations.