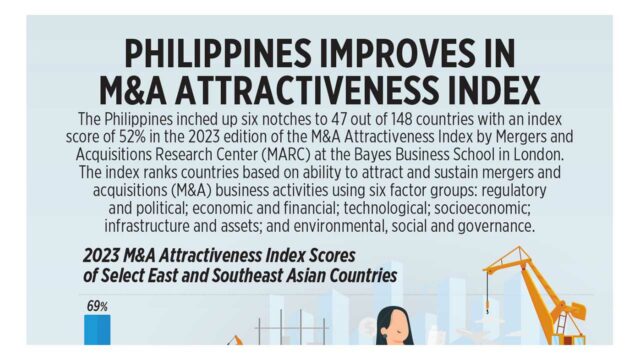

Recently, the Philippines has grappled with a range of challenges in the field of immigration. Grabbing the headlines are news of a purported foreign individual unlawfully assuming a public office, and the alleged involvement of undesirable aliens in criminal activities. On a positive note, the rise in visa applications and extensions, has boosted revenue for the government. These developments prompted the Bureau of Immigration (BI) to issue two transformative policies: one that fortifies the law with newfound rigor, and another that smoothens the path with refined ease.

For the first matter, the BI issued Memorandum No. IRD-2024-024 on July 26, calling for a thorough assessment of applications for temporary visitor’s/tourist visa extension. The BI enumerated a non-exclusive list of strict assessment measures aligning with the thrust to bolster national security.

The BI’s Tourist Visa Section, Student Visa Section, and all Alien Control officers are mandated to conduct an in-depth interview of the applicants for visa extension to verify their reasons; confirm details such as the itineraries, full addresses, and activities of the applicants; document the findings in the application forms duly signed by the evaluator; conduct a careful document review, ensuring that all submitted documents are authentic and complete; and ensure that all applicants properly fill the application forms and provide in writing their justifications for their extension requests.

Another measure is to perform a records check to uncover any evidence of fraud or inconsistencies in the applications. Instances of foreign nationals exhibiting suspicious motives for extending their temporary visitor’s/tourist visa or indicating suspicious intent to stay, must be immediately reported to the BI Commissioner, through proper channels. Finally, the officers shall regularly submit the name, address, passport copy, and other relevant details of all foreign nationals who have extended their temporary visitor’s/tourist visa for more than one year.

In contrast, and in consonance with RA 110232 or the Ease of Doing Business and Efficient Government Service Delivery Act of 2018, the BI approved Resolution No. 2024-001, published on July 12, which streamlined the conditions and requirements for promoted Section 9(g) commercial visa (9(g) visa) holders. This illustrates a dynamic shift from rigidity to refinement and efficiency of immigration policies.

Under the said Resolution, a holder of a valid 9(g) visa who is promoted in rank in the same company shall no longer be required to downgrade the 9(g) visa to a temporary visitor’s/tourist visa, and thereafter apply for conversion of the latter visa to another 9(g) visa. The new policy optimized the process by requiring the company to first formally deliver a Notice of Promotion to the BI, and within 30 days from the BI’s receipt, file for the extension of the applicant’s existing and valid 9(g) visa. The duplicate original or certified true copy of the applicant’s appointment or election to the new position must be attached to the Notice to the BI.

The existing Alien Certificate of Registration Identification Card (ACR I-Card) must also be surrendered for cancellation, and a new one must be applied for with the applicant’s new position.

The validity of the period of extension of the new 9(g) visa shall be co-terminus with the validity of the new Alien Employment Permit reflecting the new position.

Among the documentary requirements include the duly accomplished Consolidated General Application Form (CGAF), the new Employment Contract, Secretary’s Certificate of Election, Appointment, Assignment, or any similar document under the promoted position, reflecting details such as the exact compensation, employment duration, and a comprehensive description of the nature and scope of the applicant’s new position.

The applicant is required to submit a copy of his/her valid passport bio page and latest admission with valid authorized stay, as well as a copy of the AEP or Certificate of Exclusion or Exemption issued by the Department of Labor and Employment which corresponds to the new position.

Meanwhile, the petitioning-company/employer must submit a BI Clearance Certificate, its current Mayor’s Permit, latest and updated General Information Sheet duly filed with the Securities and Exchange Commission, and latest Income Tax Return with corresponding proof of payment. A sworn statement on the number of foreign and Filipino employees must also be submitted.

For applicants practicing a regulated profession under the Professional Regulations Commission or for an offshore gaming operator or company, their Special Temporary Permit or a copy of their Philippine Amusement and Gaming Corp.-issued Gaming License must be presented, respectively.

Non-compliance with the above conditions shall result in the denial or disapproval of the extension applied for, and the cancellation of the applicant’s existing Section 9(g) visa, coupled with an Order to Leave.

These BI issuances underscore a fair approach when it comes to immigration policies, highlighting that heightened enforcement can coexist with efforts to enhance procedural efficiency. These issuances show that there is room for balancing rigor with refinement, as policies can be made more effective and accessible even without necessarily compromising strict standards.

The views and opinions expressed in this article are those of the author. This article is for general informational and educational purposes only and not offered as and does not constitute legal advice or legal opinion.

Jewel M. Culala is an associate of the Immigration department of the Angara Abello Concepcion Regala & Cruz Law Offices (ACCRALAW).

jmculala@accralaw.com

(632) 8830-8000