By Charles Worren E. Laureta

LISTED BANKS grew in the second quarter as bank lending continued to grow despite high interest rates.

Loans might even grow more thanks to lower borrowing costs, but banks’ net interest margins could potentially take a hit in the medium term, analysts said.

The Philippine Stock Exchange index (PSEi) dropped by 7.1% quarter-on-quarter basis at the end of the second quarter of 2024, a turnaround from the 7% growth in the first quarter. Year on year, PSEi slipped by 0.9%.

This was reflected by the financials subindex, which included the banks, as it inched down by 5.4% last April-to-June period. This was a reversal from the 17% growth in the previous quarter.

Year on year, the subindex increased by 4.2%.

Despite this, the second quarter saw nine out of 15 listed banks’ stock prices grow on a quarter-on-quarter basis. The Philippine Trust Co. led with a 39.8% increase in its share price from P85.00 in the first quarter, followed by Philippine National Bank (PNB, 11.4%), Asia United Bank (10.2%), and China Banking Corp. (9.6%)

On the other hand, five listed banks saw their share prices decrease in the second quarter.

Union Bank of the Philippines led the losers with a 23.7% decline in its share price quarter on quarter, followed by BDO Unibank, Inc. (-17%), Philippine Bank of Communication (-16.8%), Security Bank Corp. (SECB, -8.3%), and Rizal Commercial Banking Corp. (-1.1%).

Moreover, the share price of the Philippine Business Bank steadied at P8.90 apiece in the second quarter.

“The performance of listed banks in second quarter was shaped by a high-interest rate environment that supported net interest margins (NIMs), modest loan growth, stable asset quality, ongoing digital transformation efforts, and external factors like currency fluctuations,” Luis A. Limlingan, head of sales at Regina Capital Development Corp., said in an e-mail.

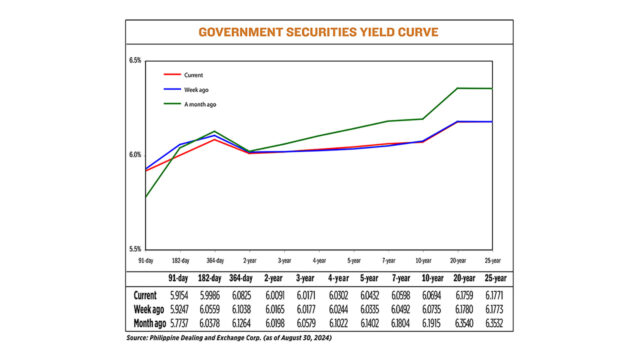

Last August, the Bangko Sentral ng Pilipinas (BSP) cut the interest rates by 25 basis point (bps) to 6.25% for the first time in nearly four years, marking the start of what BSP Governor Eli M. Remolona, Jr. referred to as “calibrated” easing cycle amid an improving inflation and economic outlook.

Prior to the cut, the central bank kept its policy rate at an over 17-year high of 6.5% for six straight meetings following cumulative hikes worth 450 bps between May 2022 and October 2023 to combat inflation.

PNB Research traced the listed bank’s performance during the second quarter to loan growth.

“Compared to the single-digit expansion that they saw last year, the big 3 banks all posted loan growth in the low to mid-teens. This allowed them to keep net interest income growth at double digits despite stable NIM,” PNB said in an e-mail.

Outstanding loans by universal and commercial banks, net of reverse repurchase (RRP) placement with the central bank, climbed by 10.1% year on year to P12.09 trillion in June, latest data from the BSP showed.

This was the fastest loan growth expansion since the 10.2% growth in March 2023.

Likewise, the gross total loan portfolio of these big lenders increased by 11.9% to P13.25 trillion as of end-June from P11.84 trillion a year ago.

As of end-June, interest income of the big banks grew by a fifth to P645.47 billion from P538.34 billion last year.

The aggregate net income of universal and commercial banks, meanwhile, increased by 5.3% to P178.91 billion as of end-June from P169.92 billion last year.

Provision for credit losses by these big banks reached P42.84 billion in the first half, up by 26.7% from P33.81 billion a year ago.

The big banks’ NIM — a ratio that measure banks’ efficiency in investing their fund by dividing annualized net interest income to average earning asset — increased to 4.04% in the second quarter from 3.74% recorded in the same period a year ago.

BANK STOCK PICKS

Analysts said that market players should track the developments in banks loans’ growth of the listed banks in the near term amid the policy rate cut of the BSP.

“Investors should continue to monitor banks’ loan growth amid the policy rate decisions of the BSP. Although the central bank recently cut the RRP (reverse repurchase) rate by 25 bps, the banks are confident that they can maintain stable NIM. Moreover, the relative lower cost of borrowing can spur additional loan growth,” PNB Research said.

Meanwhile, Japhet Louis O. Tantiangco, research manager at Philstocks Financial, Inc., said that market players should look into how the banks would capitalize on the lowered borrowing cost.

“While the policy easing will bring interest rates down, it would also make borrowing more enticing which would mean more transaction volumes for the banks, all other things being equal. The lower interest rates will also mean easier debt servicing which in turn could lower our banks’ nonperforming loans,” Mr. Tantiangco said in an e-mail.

“BPI and SECB stood out amongst other banks after reporting very high loans growth of 18-19% which is faster than industry loan growth and their peers,” Kervin Laurence Sisayan, head of research at Maybank Securities Research-Philippines, said in an e-mail.

For Mr. Limlingan, BDO excelled with robust growth in interest and non-interest income, which is supported by its broad branch network and digital strengths, while BPI benefited from small medium enterprises loans and strong corporate banking.

RATE CUT

With the recent reduction of the interest rate, analysts said it may lower the lending margins and interest income.

Mr. Remolona already signaled that they could cut the policy rates by 25 bps again within the year. The Monetary Board’s remaining policy-setting meetings this year are scheduled on Oct. 17 and Dec. 19.

BDO Securities Corp. First Vice-President and Head of Research Abigail Kathryn L. Chiw said that rate cuts are seen to potentially limit net interest income growth and trim lending margins, which may incite some profit taking in banking stocks.

“The impact of rate cuts to margins may also be compensated for by stronger loan growth and lower provisioning costs, as borrowing costs and nonperforming loans risks go down,” she said in an e-mail.

On the other hand, Mr. Limlingan said that while lower rates might reduce interest income, banks diversified revenue, solid digital platforms, and strong retail focus could mitigate its impact.

“Expected BSP rate cuts could compress NIMs but may boost loan demand, particularly in interest-sensitive sectors,” he said.

On the other hand, PNB Research said that if the central bank decides to implement further rate cuts in the future, it may start affecting the banks’ NIMs.

“For the rest of the year, we expect that those banks that are able to continually grow their business while controlling expenses would be the ones more favored by investors,” PNB Research said.