By Chloe Mari A. Hufana, Reporter

Philippine President Ferdinand R. Marcos, Jr. on Monday asked his fellow Southeast Asian leaders to adopt a legally binding code of conduct (CoC) in the South China Sea, warning that rising sea tensions and uncertainty threaten hard-won regional gains.

Speaking at the 46th Association of Southeast Asian Nations (ASEAN) Summit plenary in Kuala Lumpur, Mr. Marcos said the code, which has languished in negotiations for over two decades, should be finalized amid growing risks of miscalculation in contested waters.

“We underscore the urgent need to accelerate the adoption of a legally binding code of conduct to safeguard maritime rights, promote stability and prevent miscalculations at sea,” he said.

As Southeast Asia grapples with rising geopolitical tensions, trade disruptions and the intensifying impact of climate change, Mr. Marcos also urged fellow leaders to embrace inclusive development and accelerate climate action.

He said inclusivity should be the foundation of sustainable growth, adding that ASEAN should boost cooperation to withstand economic and environmental shocks.

“In this increasingly interconnected world, we find ourselves, and our gains, at risk when our current stability is challenged,” he said.

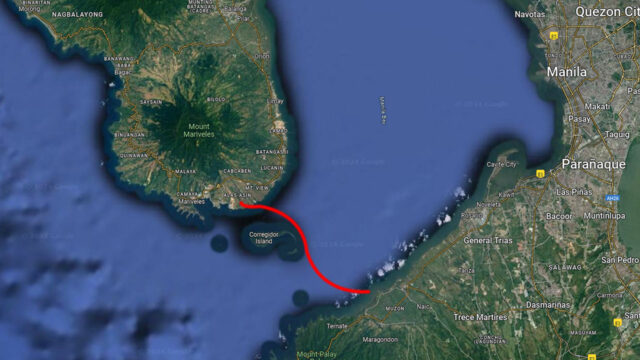

The South China Sea remains one of the region’s most volatile flashpoints, with overlapping sea claims from China, the Philippines, Vietnam, Malaysia, Brunei, Indonesia and Taiwan.

While ASEAN and China agreed on a Declaration of Conduct in 2002, progress toward a binding framework has been repeatedly delayed by legal, political and strategic differences.

Josue Raphael J. Cortez, an ASEAN Studies lecturer at the De La Salle-College of St. Benilde, said among the legal and geopolitical obstacles that prevented ASEAN and China from signing the code was the United Nations Convention on the Law of the Sea (UNCLOS), as Beijing remained wary of it during its early years.

“China was pretty new in the United Nations when negotiations for the convention commenced, and during that period, China had already seen how the negotiations themselves were veering more towards the [benefit] of developed and powerful countries,” he said in a Facebook Messenger chat.

“This mistrust of the power of UNCLOS has been reflected in the Permanent Court of Arbitration’s (PCA) ruling, hence the continuous action of China to exhibit that the disputed waters are theirs and not the Philippines’,” he added.

Apart from UNCLOS, Mr. Cortez said the fact that Vietnam, Indonesia and Brunei are also claiming parts of the area hinders the formal CoC.

“The stark difference between us and our neighbors, though, is the fact that we decided to bring it up to the Permanent Court of Arbitration,” he said. “Indonesia, on the one hand, given its vibrant ties with China, recognizes implicitly that they are also a state party to this, yet it has never become a subject of discussion between the two countries.”

Mr. Marcos’s call for a legally binding CoC is a powerful message, Mr. Cortez said, noting that it might be an implicit hint of what may come during the Philippines’ tenure as ASEAN chairman in 2026.

“The discussion for [a code of conduct] will be at the forefront of discussions between Southeast Asian leaders,” Mr. Cortez said. “Despite the pragmatism of this move, it still shows that diplomacy is the primary tool we are utilizing in addressing the issue we are facing currently with China.”

He added that the Philippine government is still more than ready to enter a dialogue and fast-track the much-delayed CoC.

‘FUTURE OF WORK’

Meanwhile, Mr. Marcos called for deeper private-sector collaboration and investments to drive the ASEAN transition to a future-ready, digitally integrated economic hub, emphasizing human capital development, responsible artificial intelligence (AI) and trade facilitation.

During his address to the ASEAN Business Advisory Council (BAC) meeting, Mr. Marcos cited the critical role of upskilling and digital literacy in preparing ASEAN’s labor force for the future, adding that boosting human capital would position it as a competitive, innovation-driven economic bloc.

“Preparing our people for the future of work is essential,” he said in a separate speech. “By prioritizing digital literacy, student mobility and upskilling, this initiative will help strengthen our region’s human capital.”

Mr. Marcos also backed efforts to streamline the ASEAN Trade in Goods Agreement while urging balanced regulation through strategic trade management to keep regional trade both open and secure.

Also on Monday, Speaker Ferdinand Martin G. Romualdez called on lawmakers across ASEAN to unite in defending maritime sovereignty, empowering citizens and leading their transformation through progressive legislation.

Speaking at the 14th ASEAN Leaders’ Interface with Representatives of the ASEAN Inter-Parliamentary Assembly at the Kuala Lumpur Convention Center, the presidential cousin cited the critical role of legislative institutions in upholding peace, prosperity and a rules-based international order.

“We must move as one — translating ASEAN’s collective aspirations into concrete policies that empower our workers, farmers and fisherfolk, protect our seas, connect our digital economies and defend the rules-based international order,” he said.

Central to his message was a strong endorsement of UNCLOS, which he said should be upheld to guarantee peace, security and sovereignty across the region, especially amid rising global tensions and maritime threats.

Mr. Romualdez also urged ASEAN lawmakers to embrace their role as bridge-builders, fostering collaboration across nations, cultures and generations.