EXTREME weather episodes tend to erode banks’ deposit growth, loan quality, and profitability, the Bangko Sentral ng Pilipinas (BSP) said, citing the results of a study.

A BSP working paper, “Impact of Extreme Weather Episodes on the Philippine Banking Sector: Evidence Using Branch-level supervisory data,” found correlations between severe rainfall and branch-level income and balance sheet accounts.

“In particular, the results found savings and time deposit liabilities dropped while non-performing loans (NPLs) surged following extreme rainfall events from 2014 to 2018,” it said.

“The significant results on banking indicators suggest that there are indeed direct costs to the banks and when the indirect costs from clients and transaction partners are integrated, these can seriously affect the operations and health of the financial institutions,” it added.

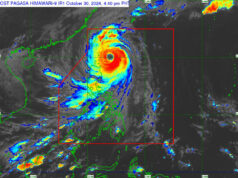

The Philippines is visited by an average of 20 typhoons in a year, five of which are classified as destructive, according to the Asian Disaster Reduction Center.

The BSP study said banks were thin on the ground in the Eastern Visayas and the Autonomous Region in Muslim Mindanao, which suffer from extreme weather conditions and security issues. It noted that areas with more banks, such as Metro Manila and the Central Visayas, also experience “generally favorable weather conditions” alongside a “manageable” security situation.

According to the study, the severity of rainfall had an impact on banks’ income and profit metrics including net interest income, operating income, and net profit.

“(The) deceleration in deposit growth and the subsequent rise in NPLs which feed into the banks’ net earnings, may have also contributed to the observed deterioration in bank profitability,” it said.

Meanwhile, the study also found that regulatory relief produced a significant improvement in bank profit and income despite a weakening in non-interest expenses and return on assets.

“Regulatory relief packages which in effect defer the recognition of NPLs, ease rediscounting rules as well as penalties for probable delays in the submission of supervisory reports are expected to cascade to indebted households through debt moratoria,” it said. — Luz Wendy T. Noble