THE VALUATION of the initial public offering (IPO) of west zone concessionaire Maynilad Water Services, Inc. remains subject to adjustments, according to its chairman.

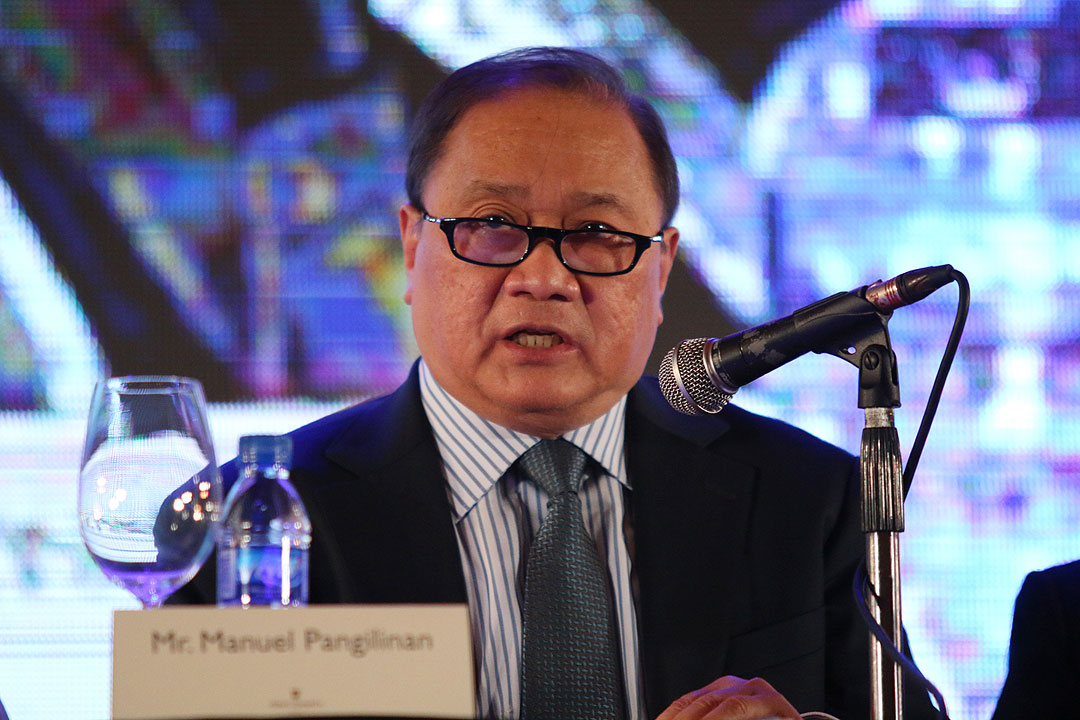

“The initial numbers are tentative. So, don’t be surprised if they adjust it. But they’re close to make a final determination,” Maynilad Chairman Manuel V. Pangilinan said on the sidelines of Manila Electric Co.’s annual stockholders’ meeting on Tuesday.

Mr. Pangilinan said the number of shares may still change as “some of the shareholders might decide to sell down a bit.”

He added that the pricing at which the shares will be offered may be finalized by June.

“So, just watch for that space. We want to launch within the year, para matapos na ang obligasyon to offer 30%,” the executive said.

Based on its latest prospectus draft dated May 14, Maynilad has reduced the size of its planned IPO to P45.8 billion, slightly lower than the up-to-P49 billion indicated in its initial prospectus.

The revised IPO comprises up to 2.29 billion common shares, down from the earlier maximum of 2.46 billion shares. The indicative maximum price remains at P20 per share.

The updated prospectus includes a primary offer of up to 1.66 billion common shares, an overallotment option of up to 249.05 million primary common shares, an upsize option of up to 354.7 million secondary common shares, and 24.9 million primary common shares to be offered to Hong Kong-based investment holding firm First Pacific Co. Ltd., which is also led by Mr. Pangilinan.

This compares with the previous allocation of up to 1.78 billion primary common shares, an overallotment option of up to 266.31 million primary common shares, an upsize option of up to 379.29 million primary common shares, and 36.31 million primary common shares for First Pacific.

The latest timetable shows that the listing date has been moved to July 17 from the earlier target of July 10.

The notice of final offer price to regulators is scheduled for July 1, while the offer period will run from July 3 to 9.

Net proceeds from the IPO will be used to fund Maynilad’s capital expenditure requirements for its water, wastewater, and customer service and information system projects through 2026. A portion of the proceeds will also be allocated for general corporate purposes.

Maynilad operates under a 25-year legislative franchise granted by Republic Act No. 11600, signed into law on December 10, 2021.

The law requires Maynilad to offer at least 30% of its outstanding capital stock within five years from the grant of the franchise.

Metro Pacific Investments Corp., which holds a majority stake in Maynilad, is one of three Philippine subsidiaries of First Pacific Co. Ltd., alongside Philex Mining Corp. and PLDT Inc.

Hastings Holdings, Inc., a unit of PLDT Beneficial Trust Fund subsidiary MediaQuest Holdings, Inc., has an interest in BusinessWorld through the Philippine Star Group, which it controls. — Sheldeen Joy Talavera