Debt yields decline on below-target inflation

YIELDS on government securities (GS) traded at the secondary market fell last week on data showing that Philippine inflation was below target last year and as market players continue to adjust their positions.

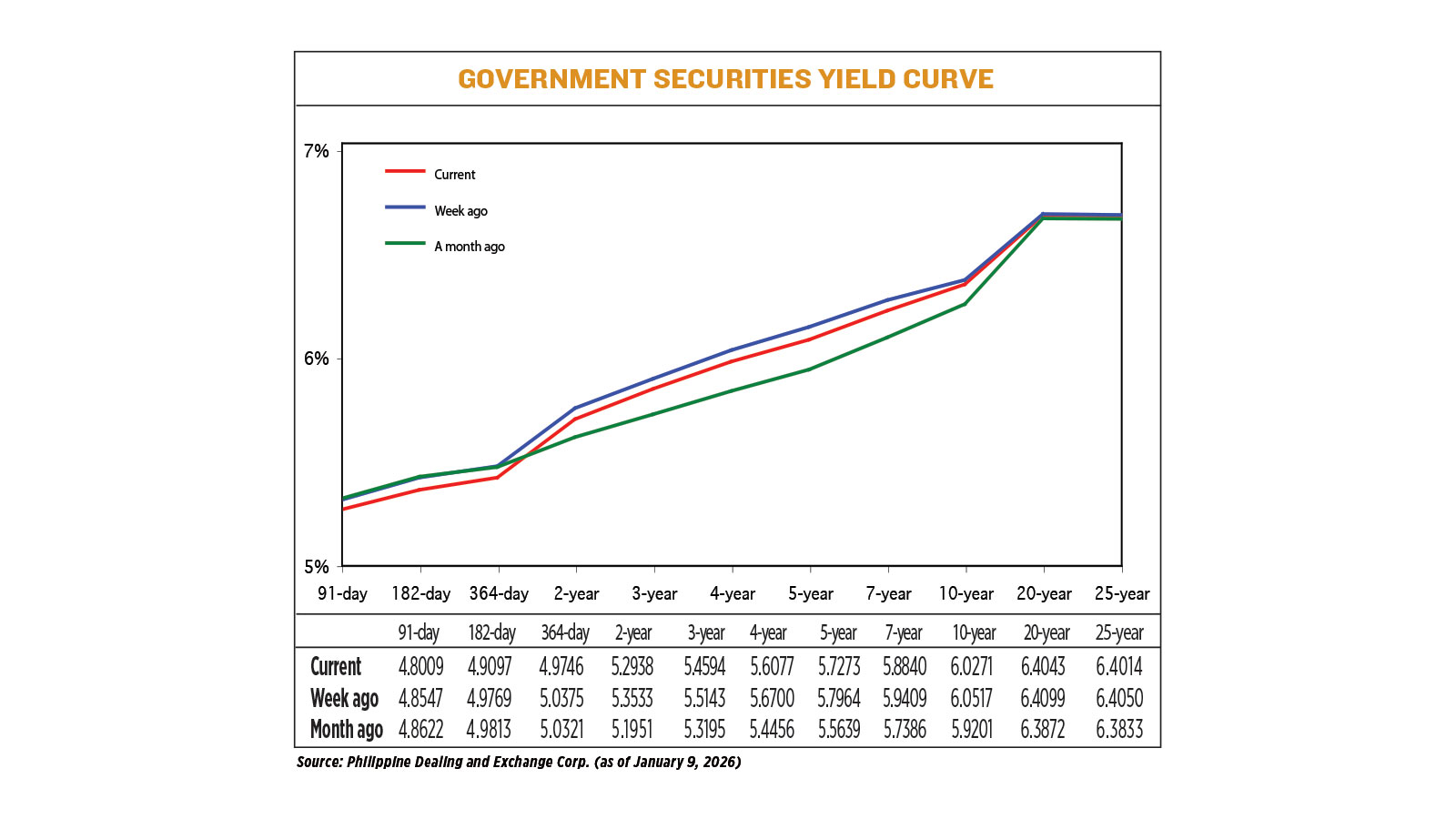

GS yields, which move opposite to prices, declined by an average of 4.73 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Jan. 9 published on the Philippine Dealing System’s website.

Rates went down across all tenors. At the short end of the curve, yields on the 91-, 182-, and 364-day Treasury bills (T-bills) dropped by 5.38 bps (to 4.8009%), 6.72 bps (4.9097%), and 6.29 bps (4.9746%), respectively.

At the belly, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) declined by 5.95 bps (to 5.2938%), 5.49 bps (5.4594%), 6.23 bps (5.6077%), 6.91 bps (5.7273%), and 5.69 bps (5.8840%), respectively.

At the long end of the curve, the 10-, 20-, and 25-year notes went down by 2.46 bps, 0.56 bp, and 0.36 bp to yield 6.0271%, 6.4043%, and 6.4014%, respectively.

GS volume traded increased to P55.42 billion on Friday from P12.18 billion a week prior.

“The uptick inflation rates seem to have influenced the curve to flatten and yields to move lower overall throughout the week. This is likely due to the tempering expectations for further near-term monetary easing by the BSP (Bangko Sentral ng Pilipinas),” the first bond trader said.

“Beyond inflation data, domestic monetary policy signals played a key role. BSP Governor Eli M. Remolona, Jr.’s statements suggesting a cautious approach to further easing reinforced the idea of a policy pause, supporting yields, particularly at shorter maturities. Additionally, the behavior of market players, including positioning ahead of auctions and portfolio rebalancing, at the start of the year, also influenced yield movements.”

The second bond trader said the market remains “awash with cash,” which helped bring yields down.

“The weaker peso, however, capped yields from moving lower after the local pair breached the 59.30 handles.”

Philippine headline inflation picked up to 1.8% in December from 1.5% in November, the government reported last week.

For 2025, the consumer price index (CPI) averaged 1.7% in 2025, easing from 3.2% in 2024. This was the slowest rate in nine years or since the 1.3% clip in 2016.

This was also below the BSP’s 2%-4% target but a tad higher than its full-year forecast of 1.6%.

Mr. Remolona said last week that they could consider a sixth straight cut at the Monetary Board’s Feb. 19 review, but noted that the current policy rate of 4.5% is already “very close” to where they want it to be, signaling an imminent end to their easing cycle.

The Monetary Board has lowered benchmark borrowing costs by a total of 200 bps since its rate-cut cycle began in August 2024.

Meanwhile, the peso closed at a new all-time low of P59.355 against the dollar on Jan. 7, eclipsing the previous record set in December.

The first trader added that US yield movements also affected the local market last week.

“The typical movements in US Treasury yields continued to guide the direction of the yields. Likewise, relevant US data (jobless claims, employment change, consumer confidence, etc.) had an impact on US Treasury yields and local GS yields as well.”

For this week, both traders said the market could react to key US jobs data released over the weekend.

“For the coming week, I expect GS yields to trade within a narrow range in a sideways manner, with a slight upward bias overall. Absent major domestic data surprises, yield movements are likely to be driven by external developments, particularly US economic releases and global bond market trends. Any risk-off sentiment could support demand for longer-dated GS and cap yields, while stronger global data may push yields modestly higher,” the first trader said.

“The market will likely take its cue from the release of the US nonfarm payrolls data and unemployment rate surveys… Local rates will likely move in sympathy with US rate moves after the data prints out of the US,” the second trader said.

The result of the Bureau of the Treasury’s bond auction on Tuesday could also drive yield movements, with the trader added, with the reissued seven-year papers on offer likely to fetch rates of 5.65%-5.75%. — Heather Caitlin P. Mañago