Easing inflation, index inclusion hopes boost foreign flows into PHL gov’t bonds

SLOWING INFLATION and the country’s potential inclusion in the JPMorgan Chase & Co.’s emerging market government bond index have boosted foreign inflows into Philippine bonds, Nomura Global Markets Research said.

“Foreign inflows into government bonds have increased materially, reflecting a combination of factors, and authorities seem comfortable with a further rise in the share of foreign holdings,” Nomura said in a Sept. 19 note authored by research analysts Euben Paracuelles and Nabila Amani.

Bureau of the Treasury (BTr) data cited by Nomura showed that the share of foreign holdings in Philippine government securities rose to 6% at end-August, equivalent to P728.8 billion, from just 4.2% in 2024 (P454.1 billion) and around 2% in 2020 to 2023.

“We believe this pickup was driven by a combination of factors, such as declining inflation, which has allowed BSP (Bangko Sentral ng Pilipinas) to lower its policy rate substantially, as well as prospects of bond index inclusion,” Nomura said.

“Based on our discussions with authorities, we believe they would welcome a gradual rise in foreign participation to around 10%.”

Philippine headline inflation averaged 1.7% in the first eight months, below the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target.

In 2024, the consumer price index averaged 3.2%, down from 6% in 2023, when prices spiked amid higher global commodity costs and supply chain disruptions following the coronavirus pandemic.

Slowing inflation since last year has allowed the BSP to shift to a more accommodative policy stance. It has lowered benchmark borrowing costs by a cumulative 150 basis points (bps) since August 2024, with the policy rate now at 5% following a third straight 25-bp cut last month.

BSP Governor Eli M. Remolona, Jr. has signaled that this round of policy loosening is nearing its end, with one more reduction possible within this year to support the economy if needed as global uncertainties linger.

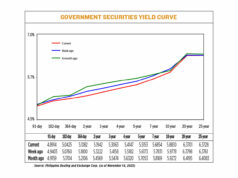

Easing inflation and prospects of more rate cuts here and in the United States have helped bring down domestic bond yields, pushing up prices.

Nomura said it expects one more 25-bp cut from the BSP next month and further reductions in big banks’ reserve requirement ratio, which would support market activity.

Meanwhile, JPMorgan this month tagged Philippine peso-denominated government bonds as “Index Watch Positive,” which is final review phase for inclusion in its Government Bond Index for Emerging Markets (GBI-EM) series.

The Philippines would have a weight of about 1% of the GBI-EM Global Diversified Index if included, according to the bank.

National Treasurer Sharon P. Almanza earlier said they expect foreign fund inflows to rise by about one percentage point or around P100 billion if the country successfully reenters the GBI-EM index.

“Steps taken to support GBI-EM index inclusion include the tax treaty enrollment process, as well as focusing on benchmark building through regular issuances of three-, five- and 10-year bonds to improve liquidity,” Nomura said.

It added that expectations of reduced bond issuances by the BTr this quarter following its large issues earlier this year could also support market conditions. “The government remains committed to its fiscal consolidation plan, although it has slowed the pace to support growth.”

Officials have said they are unlikely to launch more jumbo bond offerings this year as they have already raised most of their borrowing requirements and want to ensure a steady supply of debt instruments via its weekly auctions of securities for the remainder of the year.

In January, the National Government raised $3.29 billion from its sale of US dollar and euro bonds, almost filling its $3.5-billion commercial borrowing program for this year. The BTr also sold P300 billion in new 10-year fixed-rate benchmark Treasury notes in April and P507.16 billion in retail Treasury bonds in August.

The Development Budget Coordination Committee (DBCC) in June revised its medium-term fiscal program amid global uncertainties.

Under the new plan, the DBCC now expects the budget deficit as a share of gross domestic product (GDP) to end at 5.5% this year from 5.3% previously. In 2024, the government’s budget gap was at P1.506 trillion or 5.7% of GDP. — K.K. Chan