Gov’t debt yields end mixed on BSP, Fed bets

YIELDS on government debt traded on the secondary market ended mixed last week amid expectations of further monetary easing by the Bangko Sentral ng Pilipinas (BSP) and with the US Federal Reserve staying cautious.

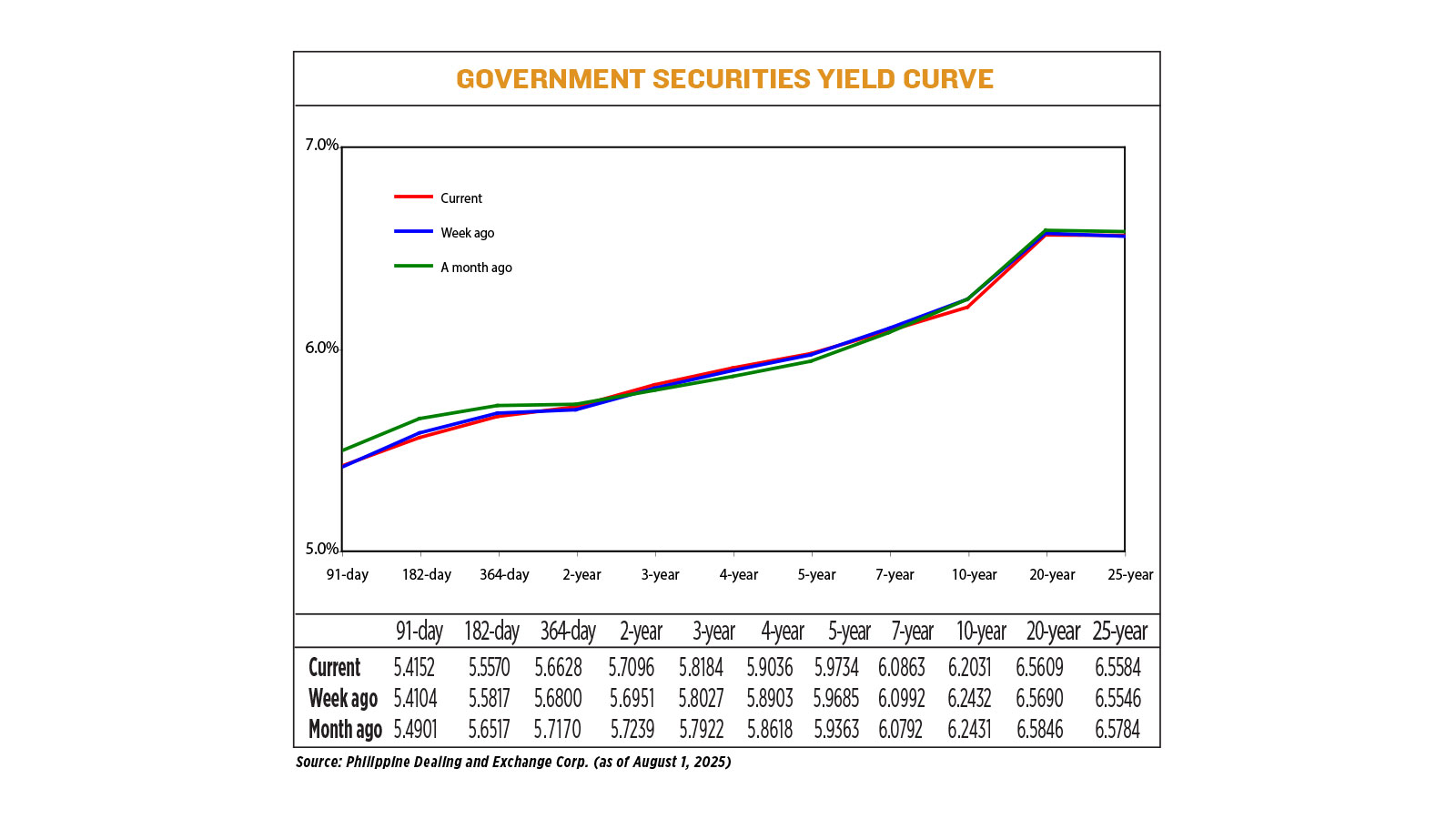

Yields on government securities (GS), which move opposite to prices, inched down by an average of 0.42 basis point (bp) week on week, according to data from the PHP Bloomberg Valuation System Reference Rates as of Aug. 1 published on the Philippine Dealing System’s website.

At the short end of the curve, the 91-day Treasury bill (T-bill) inched up by 0.48 bp to fetch 5.4152%. Meanwhile, yields on the 182- and 364-day T-bills dropped by 2.47 bps and 1.72 bps to 5.557% and 5.6628%, respectively.

At the belly, GS rates mostly went up. Yields on the two- three-, four-, and five-year Treasury bonds (T-bonds) climbed by 1.45 bps (5.7096%), 1.57 bps (5.8184%), 1.33 bps (5.9036%), and 0.49 bp (5.9734%), respectively. On the other hand, the seven-year bond declined by 1.29 bps to fetch 6.0863%.

Lastly, at the long end of the curve, the rates of the 10- and 20-year notes dropped by 4.01 bps and 0.81 bp to 6.2031% and 6.5609%, respectively. Meanwhile, 25-year T-bond inched up by 0.38 bp to yield 6.5584%.

GS volume traded slid to P26.1 billion on Friday from the P64.31 billion the week prior.

Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said GS yields were mostly lower earlier in the week on prospects of further policy easing from the BSP, but tempered Fed cut bets affected the market.

“The Fed’s decision to maintain its policy rate at the 4.25%–4.5% range signaled a continued ‘wait-and-see’ approach amid still-resilient US economic data. This cautious stance, coupled with a stronger US dollar and firmer Treasury yields, prompted local fixed income investors to turn defensive. As a result, Philippine government bond yields saw a slight upward bias, particularly in the belly and long end of the curve, as participants reassessed risk premiums amid the global rate uncertainty,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in a Viber message.

BSP Governor Eli M. Remolona, Jr. said on Wednesday that a rate cut is “on the table” at the Monetary Board’s Aug. 28 review. If realized, this would mark the BSP’s third straight easing move since April.

The BSP has so far reduced borrowing costs by a total of 125 basis points since it began its easing cycle in August last year. Mr. Remolona added that he is keeping his outlook for two more rate cuts this year. After this month’s review, the Monetary Board has two remaining meetings scheduled in October and December.

Meanwhile, the Fed on Wednesday left its benchmark interest rate in the 4.25%-4.5% range as policymakers stayed on the sidelines to see how US President Donald J. Trump’s aggressive regime of large import tax increases will affect the economy and inflation pressures, Reuters reported.

Fed Chair Jerome H. Powell’s comments after the decision undercut confidence the central bank would resume its policy easing in September as had been widely anticipated by financial markets and some economists.

Two Fed officials opposed that stance and wanted a rate cut, worried that risks to the job market are rising and that the inflation threat posed by tariffs is transient.

The Fed’s dissenters found some support for their concerns in the Friday release of weaker-than-expected jobs data that was particularly notable for downward revisions to prior month’s job gains. Some Fed officials who spoke on Friday noted the report with concern but said they need to see more evidence the job market is running into trouble before changing their views on monetary policy.

Mr. Trump reacted to the jobs data with a double-barreled attack, hitting the Fed for not cutting rates while directing his staff to fire the commissioner of the Labor department’s Bureau of Labor Statistics, claiming without evidence the hiring numbers had been rigged. Mr. Trump’s move rattled markets and raised questions about the future integrity of one of the most important statistical reports financial markets rely upon.

Late on Friday, traders were betting on an 87.5% probability for a September rate cut compared with 37.7% on Thursday, according to CME Group’s FedWatch tool.

Mr. Ulpo added that the upcoming retail Treasury bond (RTB) offering this week also led to a “cautious tone” in the bond market.

“Yields reflected this defensive positioning, especially on the medium to long tenor rates. Investors anticipated this issuance would help the government refinance near-term maturities while also addressing budgetary needs,” he said.

The Bureau of the Treasury is holding the rate-setting auction for its offer of five-year RTBs on Tuesday and wants to raise at least P30 billion from the issuance. The public offer period will run from Aug. 5 to Aug. 15, unless ended earlier by the Treasury.

“Globally, the uptick in US Treasury yields, driven by stronger-than-expected economic prints, added upward pressure on local rates,” Mr. Ulpo added.

For this week, Mr. Ravelas said yields may move sideways as the market awaits the release of July inflation data on Tuesday (Aug. 5).

A BusinessWorld poll of 17 analysts yielded a median estimate of 1.2% for the July consumer price index, within the central bank’s 0.5%-to-1.3% forecast for the month.

If realized, the July print would be slower than the 1.4% in June and 4.4% clip in the same month a year ago.

“The pricing and demand for the upcoming RTB issuance will set the tone for local bond trading [this] week. Investors are expected to position around expected term premiums, with secondary market yields adjusting depending on the pricing level and bid strength of the RTB auction,” Mr. Ulpo said.

“A strong showing could anchor rates, while a tepid response may push yields higher across the curve. Investors should monitor bid award volume, allocation trends, and overall participation dynamics during the RTB offer period.” — Matthew Miguel L. Castillo with Reuters