Yields on gov’t debt move sideways on renewed Trump tariff concerns

YIELDS on government securities (GS) traded at the secondary market ended mixed last week due to fresh trade jitters as the Trump administration’s higher import tariffs on metals took effect.

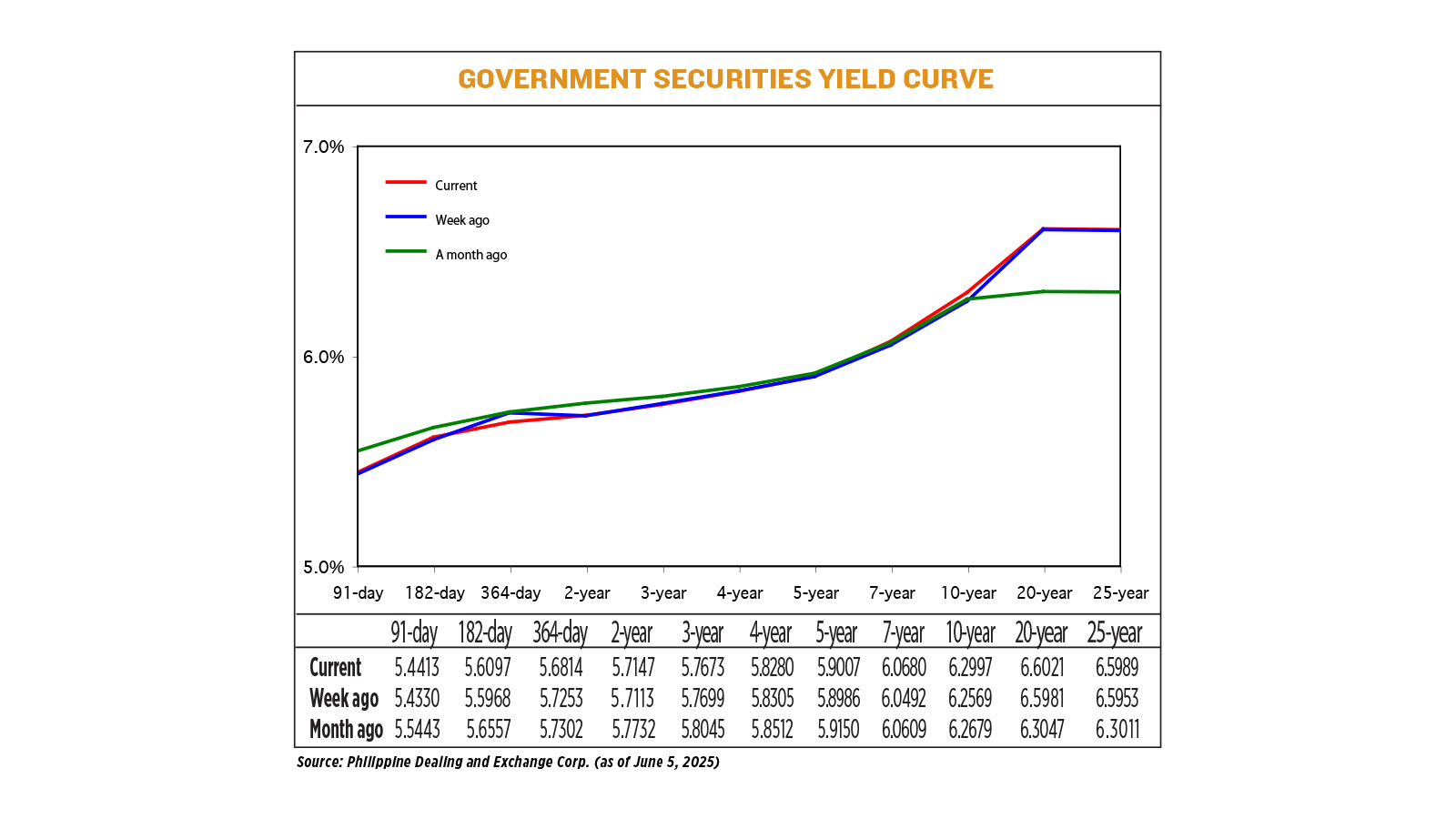

GS yields, which move opposite to prices, edged up by an average of 0.43 basis point (bp) week on week, according to PHP Bloomberg Valuation Service Rates data as of June 5 published on the Philippine Dealing System’s website.

Philippine financial markets were closed on Friday (June 6) for a holiday in observance of Eid al-Adha.

Movements at the short end of the curve were mixed as the 91- and 182-day Treasury bills (T-bills) inched up by 0.83 bp and 1.29 bps week on week to 5.4413% and 5.6097%, respectively, while the 364-day tenor dropped by 4.39 bps to 5.6814%.

The same trend was seen at the belly. The two-, five-, and seven-year Treasury bonds (T-bonds) inched up by 0.34 bp (to 5.7147%), 0.21 bp (5.9007%) and 1.88 bps (6.068%), respectively. On the other hand, the three- and four-year debt slipped by 0.26 bp (to 5.7673%) and 0.25 bp (5.8280%), respectively.

At the long end, yields on the 10-, 20-, 25-year T-bonds went up by 4.28 bps (to 6.2997%), 0.4 bp (6.6012%), and 0.36 bp (6.5989%), respectively.

GS volume traded amounted to P50.43 billion as of June 5 compared with the previous week’s P44.23 billion.

“The US tariff announcement dampened investor confidence, leading yields to rise on the same day,” a bond trader said in a text message on Thursday.

Canada prepared possible reprisals while the European Union (EU) reported progress in trade talks on Wednesday as new US metals tariffs triggered more disruption in the global economy and added urgency to negotiations with Washington, Reuters reported.

President Donald J. Trump’s doubling of tariffs on steel and aluminum imports kicked in on Wednesday, the same day his administration sought “best offers” from trading partners to avoid other punishing import levies from taking effect in July.

The move will hit the closest US trading partners — Canada and Mexico — especially hard. Canada is the top exporter of both steel and aluminum to the United States.

Prime Minister Mark Carney said Canada is prepared to strike back against the United States if talks with Washington to remove Mr. Trump’s tariffs did not succeed.

The US tariff hike on the two metals to 50% from the 25% rate introduced in March took effect at 12:01 a.m. (0401 GMT) on Wednesday. It applies to all trading partners except Britain, the only country so far to strike a preliminary trade agreement with the US during a 90-day pause on a wider array of Trump tariffs that ends on July 8.

The 27-nation EU’s trade negotiator, Maros Sefcovic, and US Trade Representative Jamieson Greer said their meeting in Paris was constructive.

About a quarter of all steel used in the US is imported.

The bond trader added that the slower Philippine May inflation print reported last week has been largely priced in by the market, along with expectations of a Bangko Sentral ng Pilipinas (BSP) cut as early as this month, which was why GS yields barely moved after the data.

“The market was pretty much steady with an upward bias ahead of the inflation data because of the Trump policy announcement,” the trader said.

“With a rate cut already expected, the market will likely be more concerned on hints as to when the next rate cut may be implemented.”

Headline inflation eased to 1.3% in May from 1.4% in April and 3.9% in the same month a year ago, the government reported on Thursday. The May print was the lowest in five-and-a-half years or since the 1.2% posted in November 2019.

For the first five months, inflation averaged 1.9%, a tad below the low end of the BSP’s annual target.

For this week, the trader said the market will likely continue to monitor external developments, particularly trade policy announcements from the Trump administration, as well as US economic data “to give clarity on the direction of yields.”

The trader said GS yields could move sideways with a downward bias.

“The downside may be limited for government securities given ongoing bond issuances of some banks and this week’s seven-year T-bond auction.”

The Bureau of the Treasury is offering P30 billion in reissued 10-year bonds on Tuesday, which have a remaining life of seven years and three months. — M.M.L. Castillo with Reuters