Gov’t yields end mixed amid BSP rate cut bets

YIELDS on government securities were mixed last week as the curve steepened due to anticipation of further rate cuts by the Philippine central bank and US tariff concerns.

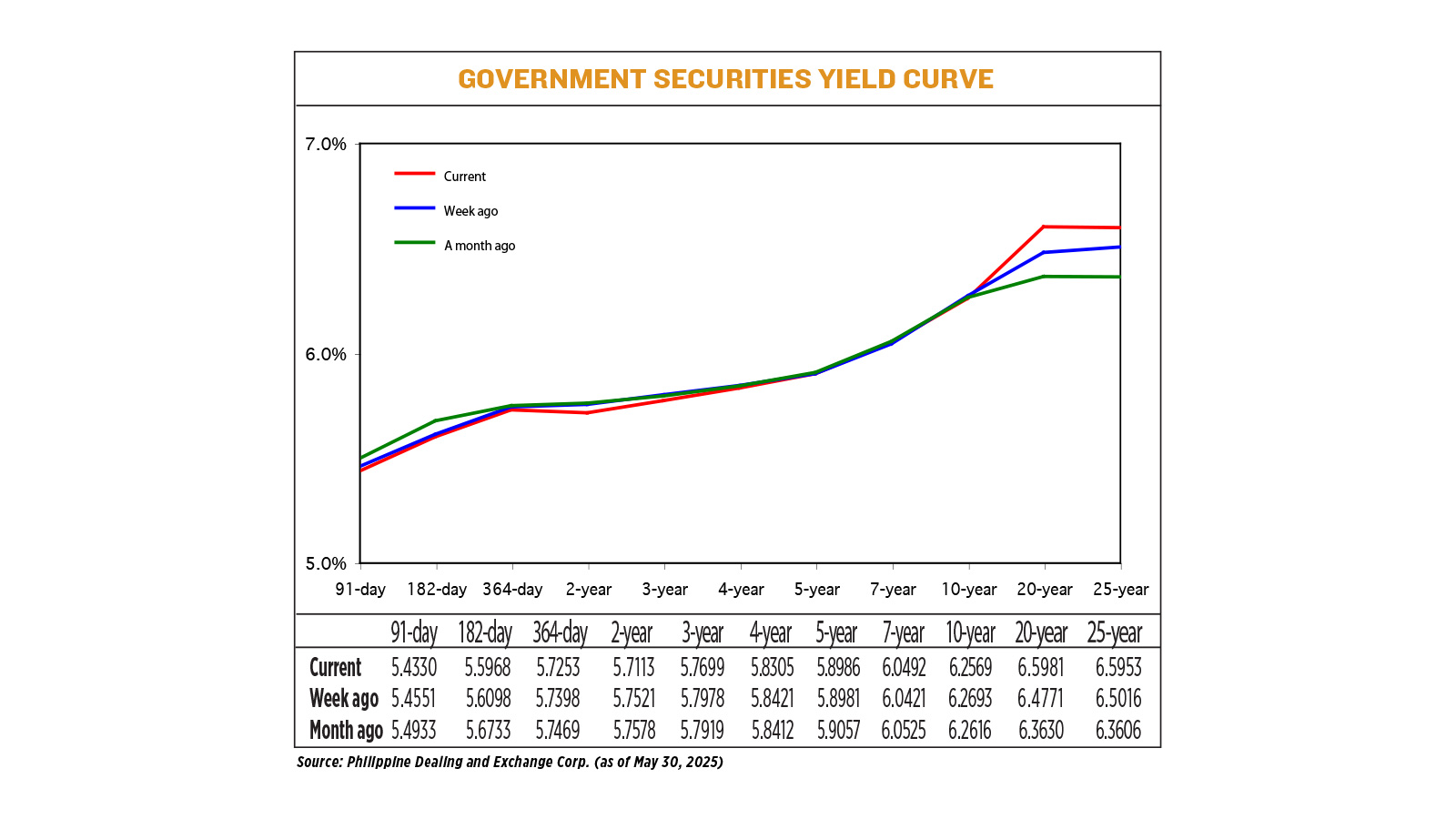

Yields, which move opposite prices, rose by an average of 0.73 basis point (bp) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of May 30 posted on the Philippine Dealing System website.

At the short end, rates for the 91-, 182- and 364-day Treasury bills (T-bills) fell by 2.21 bps, 1.3 bps and 1.45 bps, respectively.

At the belly of the curve, rates for the two-, three-, and four-year Treasury bonds (T-bonds) slipped by 4.08 bps, 2.79 bps and 1.16 bps, respectively. On the other hand, rates of the five- and seven-year debt rose by 0.05 bp and 0.71 bp.

The 10-year bond at the long end fell 1.24 bps, yields on the 20- and 25-year T-bonds rose 12.1 bps and 9.37 bps.

Volume rose to P43.42 billion on Friday from P36.79 billion a week earlier.

“The domestic yield curve is rapidly steepening from the compounded impact of anticipation of more aggressive rate cuts this year and increasing inflationary concerns,” a bond trader said in an e-mailed reply to questions.

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. on May 23 signaled two more “baby-step” rate cuts in 25-bp increments this year.

The central bank has delivered 100 bps in rate cuts since the start of its easing cycle in August last year, bringing the policy rate down to 5.5%.

The next Monetary Board meeting is scheduled for June 19, with further meetings slated for August, October and December.

Meanwhile, headline inflation in April eased to its lowest level in five years at 1.4%, cooling down from 1.8% in March, preliminary data from the Philippine Statistics Authority (PSA) showed.

The central bank last week said inflation for May would probably stay within 0.9%-1.7%, driven by a strong peso and lower rice, fish, oil and electricity prices.

The local statistics agency will release May inflation data on Thursday.

“The PSA is set to release the May inflation report, which could confirm expectations toward a BSP policy rate cut for June,” the bond trader said.

Noel S. Reyes, chief investment officer for the Security Bank Corp.’s Trust and Asset Management Group, said the bond market “had a strong start to the week with focus on shorter maturities, with the T-bill auction getting oversubscribed and steepening the curve.”

“However, thereafter, the market traded in a range till the end of the week with no significant swings in yields but with decent volume exchanged again, favoring shorter bond tenors,” he said in a Viber message.

The Bureau of the Treasury awarded only P19.758 billion of the planned P30 billion in 20-year bond reissuance on Tuesday after receiving bids worth P34.469 billion.

Mr. Reyes said much of the attention is still on US tariffs, adding that the market is waiting for further clarity on US tariff developments despite expectations of more BSP rate cuts — “hence, the favored shorter maturities.”

A US trade court blocked most of President Donald J. Trump’s tariffs on Wednesday, as it ruled the President had overstepped his authority by imposing across-the-board duties on imports from US trading partners, Reuters reported.

The court also ordered the Trump administration to issue new orders reflecting the permanent injunction within 10 days. The government quickly appealed the decision.

“Local fundamentals are clearly driving the short-term rates, while mid- and long-term yields are being influenced by concerns about the US economy and global policy uncertainty,” the bond trader said.

“Traders are also likely to closely await US employment reports for any cues that could compel the US Federal Reserve to deliver rate cuts earlier this year.”

The US Bureau of Labor Statistics is set to release its employment situation report for May on June 6. — Pierce Oel A. Montalvo