Yields mixed on inflation data, Powell comments

YIELDS on government securities (GS) traded at the secondary market ended mixed last week following slower February inflation, the movement of US Treasuries and hawkish statements from the US Federal Reserve chief.

YIELDS on government securities (GS) traded at the secondary market ended mixed last week following slower February inflation, the movement of US Treasuries and hawkish statements from the US Federal Reserve chief.

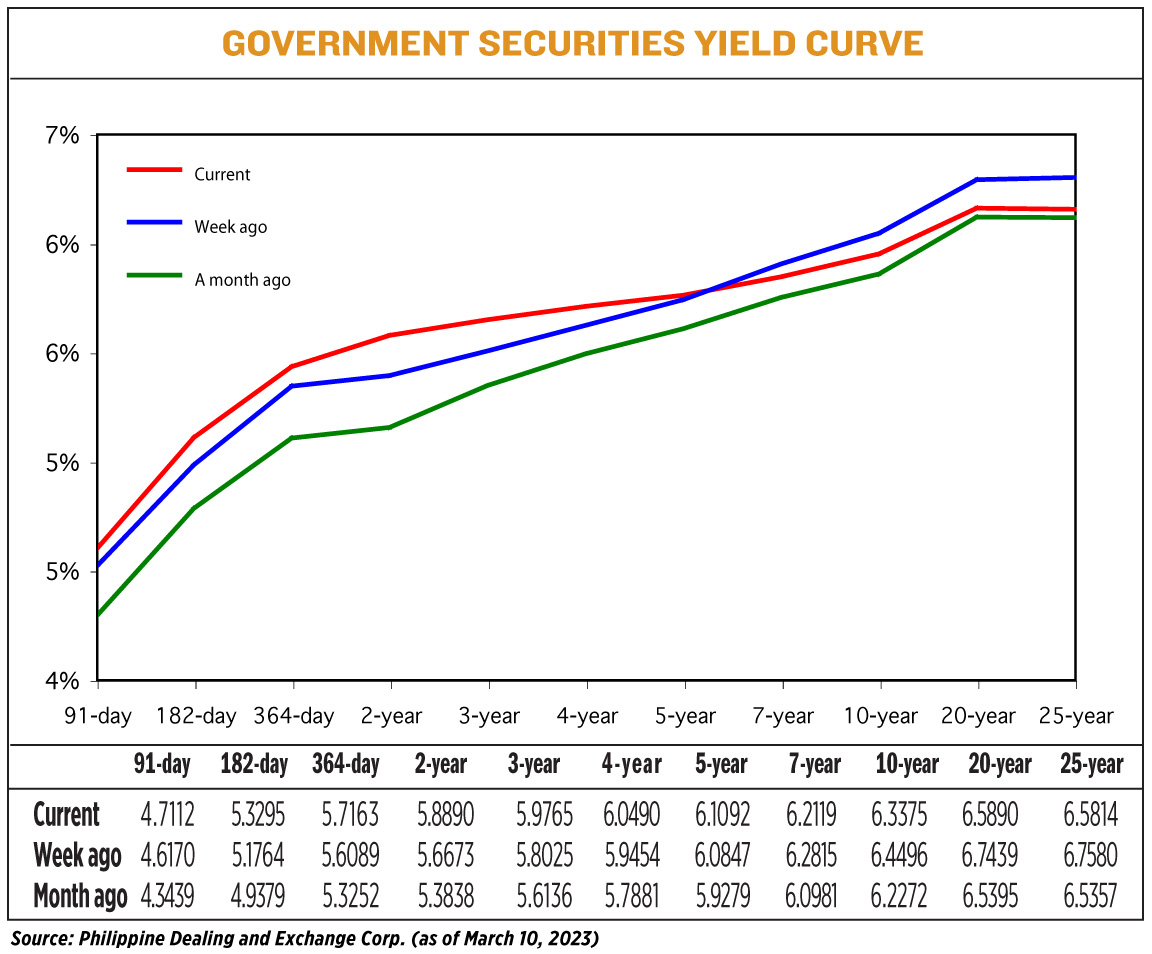

Debt yields, which move opposite to prices, went up by an average of 3.32 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of March 10 published on the Philippine Dealing System’s website.

At the short end of the curve, yields on the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 9.42 bps (to 4.7112%), 15.31 bps (5.3295%), and 10.74 bps (5.7163%), respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rose by 22.17 bps (to 5.889%), 17.40 bps (5.9765%), 10.36 bps (6.049%), and 2.45 bps (6.1092%), respectively.

On the other hand, the yield on the seven-year bond fell by 6.96 bps to (6.2119%).

At long end, rates of the 10-, 20- and 25-year T-bonds went down by 11.21 bps (to 6.3375%), 15.49 bps (6.589%), and 17.66 bps (6.5814%), respectively.

Total GS volume traded reached P14.60 billion on Friday, lower than the P7.77 billion on March 3.

The bond trader said last week was “eventful” for the local market.

“First, Philippine inflation data revealed a slowdown from the previous month and was lower than what was initially anticipated by the market. Following this, US Federal Reserve Chair Jerome Powell’s hawkish remarks led market players to adjust their peak rate expectations for the year,” the bond trader said in a Viber message.

These developments put pressure on yields at the front end of the curve, while tenors at the belly and the long end remained steady or fell slightly, the trader added.

Philippine headline inflation eased to 8.6% in February from the 14-year high 8.7% in January, preliminary data from the Philippine Statistics Authority showed. Still, this was faster than the 3% in February 2022.

February inflation was below the 8.9% median in a BusinessWorld poll, but within the Bangko Sentral ng Pilipinas’ (BSP) 8.5-9.3% projection for the month.

For the first two months of the year, inflation averaged 8.6%, well above the BSP’s 2-4% target and 6.1% forecast for 2023.

Meanwhile, Mr. Powell said to lawmakers last week that the US central bank is likely to raise rates more than previously expected and warned that the process of getting inflation back to 2% has “a long way to go.”

The Fed hiked its target interest rate by 25 bps at its Jan. 31 to Feb. 1 meeting to a range between 4.5% and 4.75%.

Since March 2022, the US central bank has raised rates by a total of 450 bps. Its next policy meeting is on March 21-22.

US yields also dropped due to risk-off sentiment following news regarding Silicon Valley Bank, the bond trader added.

Startup-focused lender SVB Financial Group became the largest US bank to fail since the 2008 financial crisis on Friday, in a sudden collapse that roiled global markets, left billions of dollars belonging to companies and investors stranded, Reuters reported.

California banking regulators closed the bank, which did business as Silicon Valley Bank (SVB), on Friday and appointed the Federal Deposit Insurance Corp. as receiver for later disposition of its assets.

Based in Santa Clara, the lender was ranked as the 16th biggest in the US at the end of last year, with about $209 billion in assets. Specifics of the tech-focused bank’s abrupt collapse were a jumble, but the Fed’s aggressive interest rate hikes in the last year, which had crimped financial conditions in the start-up space in which it was a notable player, seemed front and center.

Treasury yields extended their slide on Friday over fears of contagion in the financial sector and strong February employment data showing the economy added more jobs than expected.

Benchmark 10-year US notes last rose to yield 3.6892% from 3.923% late on Thursday. The 30-year bond last rose to 3.6899% from 3.87% late on Thursday.

“GS yields traded 2.5-5 bps lower today as it tracked overnight movements in US Treasuries while many still stayed on the sidelines waiting for nonfarm payroll data and US CPI (consumer price index) data,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in an e-mail on Friday.

The US economy added a more-than-expected 311,000 jobs last month, while the unemployment rate unexpectedly ticked higher, along with the labor market participation rate.

Meanwhile, February US CPI data will be released on March 14.

In January, consumer inflation increased 0.5% after gaining 0.1% in December.

On an annual basis, the CPI increased 6.4%. That was the smallest gain since October 2021 and followed a 6.5% rise in December.

“Looking ahead, the direction of the market will be largely influenced by two critical data points from the US the nonfarm payrolls and US inflation data. These data points may have a significant impact on the US Fed’s interest rate decision later this month,” the bond trader said.

“The market saw some buying interest and saw the 10-year and 13-year benchmark bonds taken at 6.26% and 6.40%. Lastly, there will be a 13-year auction this week with early indications of 6.35%-6.475%,” Mr. Asuncion said. — Lourdes O. Pilar with Reuters