Yields on gov’t debt slip on Fed, BSP

YIELDS on government securities (GS) slipped last week after both the US Federal Reserve and the Bangko Sentral ng Pilipinas raised benchmark interest rates by 50 basis points (bps).

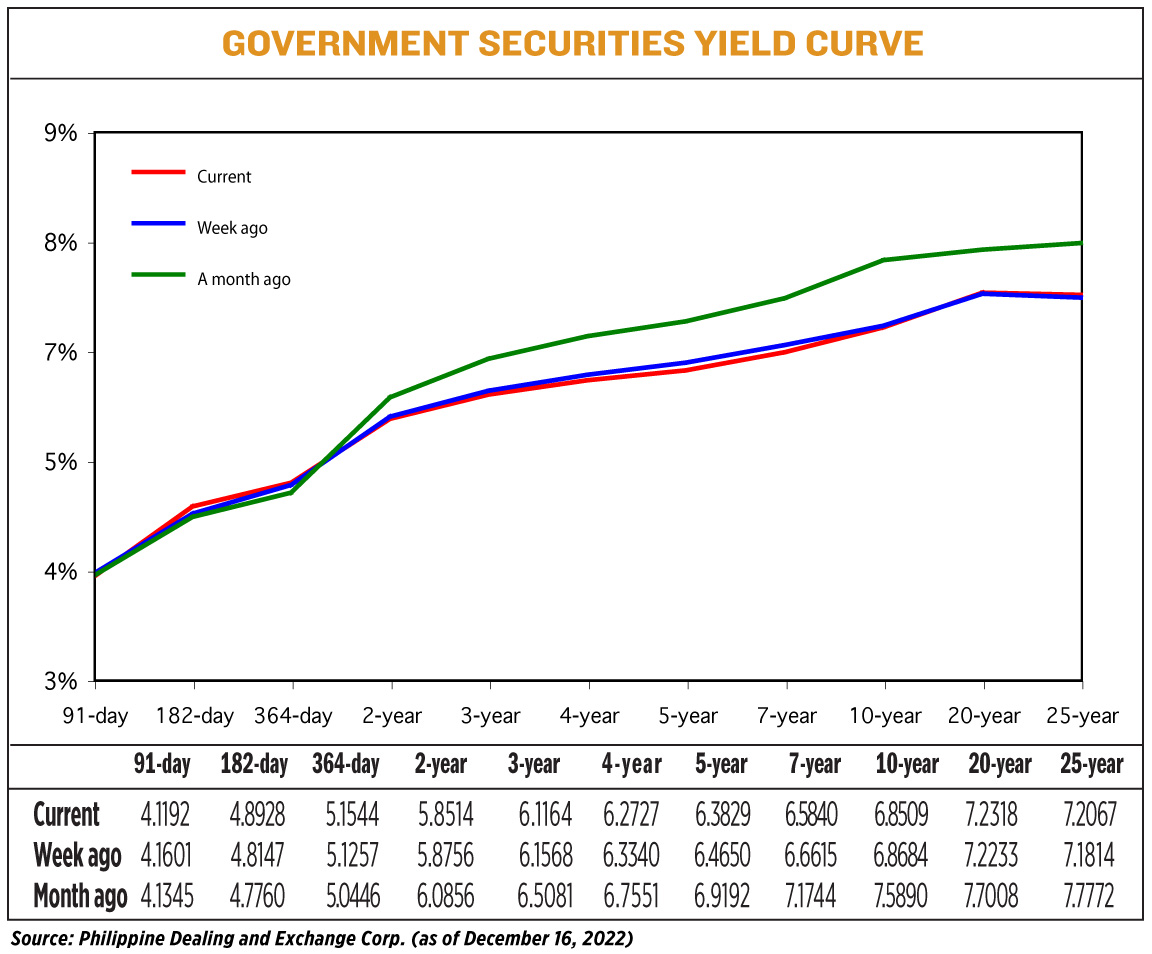

GS yield in the secondary market went down by an average of 1.85 bps week on week, according to the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of Dec. 16 published on the Philippine Dealing System’s website.

Yields on the 182- and 364-day Treasury bills (T-bill) went up by 7.81 bps and 2.87 bps to 4.8928% and 5.1544%, respectively.

However, the rate of the 91-day T-bill fell by 4.09 bps to 4.1192%.

Meanwhile, papers at the belly of the curve dropped across the board. Yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) went down by 2.42 bps (to 5.8154%), 4.04 bps (6.1164%), 6.13 bps (6.2727%), 8.21 bps (6.3829%), and 7.75 bps (6.584%), respectively.

At the long end of the curve, yields on the 20- and 25-year T-bonds increased by 0.85 bp and 2.53 bps to 7.2318% and 7.2067%, respectively.

On the other hand, the rate of the 10-year T-bond fell by 1.75 bps to 6.8509%.

Total GS volume traded reached P7.744 billion on Friday, lower than the P11.147 billion recorded on Dec. 9.

“The main focus [last] week was on the projected 50-bp hikes of the US Fed as well as the BSP and the corresponding statements that accompanied both meetings,” a bond trader said in a text message. “Yields initially rallied to start the week on client demand and with the canceled bills and bond auctions, but the statements of both central banks that tightening will likely continue grounded expectations somewhat and yields closed lower but off the lows.”

“The [BSP] governor’s statement that inflation will peak in December instead of the previous expectation of a November peak reinforced the reality that tightening isn’t over. However, we should also see investors realigning their expectations as central banks have begun slowing down the pace of their tightening which indicates that the end of the tightening cycle is in sight and any overshoots of forecasts will have to be adjusted,” the trader added.

The BSP raised benchmark interest rates by 50 bps at its meeting on Thursday, bringing its policy rate to 5.5%. Rates on the central bank’s overnight deposit and lending facilities were likewise raised to 5% and 6%, respectively.

The Philippine central bank has now raised rates by 350 bps since May.

Meanwhile, the Fed hiked its benchmark overnight interest rate by 50 bps to the 4.25%-4.5% range and projected it could go up to 5%-5.25% next year.

The Fed has now raised borrowing costs by 425 bps since March.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said yields continued to move at a slower pace as US consumer inflation improved.

“PHP BVAL yields eased further week on week, though slightly, after the lower-/better-than-expected US inflation at 7.1%, new 11-month lows or since November 2021 and further down from the new 40-year high of 9.1% in June 2022,” Mr. Ricafort said in a Viber message.

Yields also dropped “as global crude oil prices eased to near one-year lows alongside lower prices of other major global commodities recently amid risk of recession in the US, which is the world’s largest economy. [and] after aggressive Fed rate hikes to help sustain the easing of elevated US inflation and some continued lockdowns in China,” he added.

For this week, the bond trader said the market will likely move sideways “with mostly last-minute demand driving the market.”

Mr. Ricafort said “short-term PHP BVAL yields could still go up and long-term PHP BVAL yields could still ease amid the latest signals on possible further hike/s in local policy rates that could match any future, though recently smaller, Fed rate hikes to help stabilize the peso and help ease inflationary pressures.”

“Local policy rates could still match any future Fed rate hikes to help maintain healthy interest rate differentials with the US and also support the peso exchange rate versus the dollar and help ease import prices and overall inflation, thereby also supporting the healthy downward correction in long-term PHP BVAL yields recently,” he added. — M.I.U. Catilogo