More wealthy families want to make a positive impact through their fortune

By Mariel Alison L. Aguinaldo

According to experts from advisory firms, wealthy families are no longer content with just preserving and growing their assets.

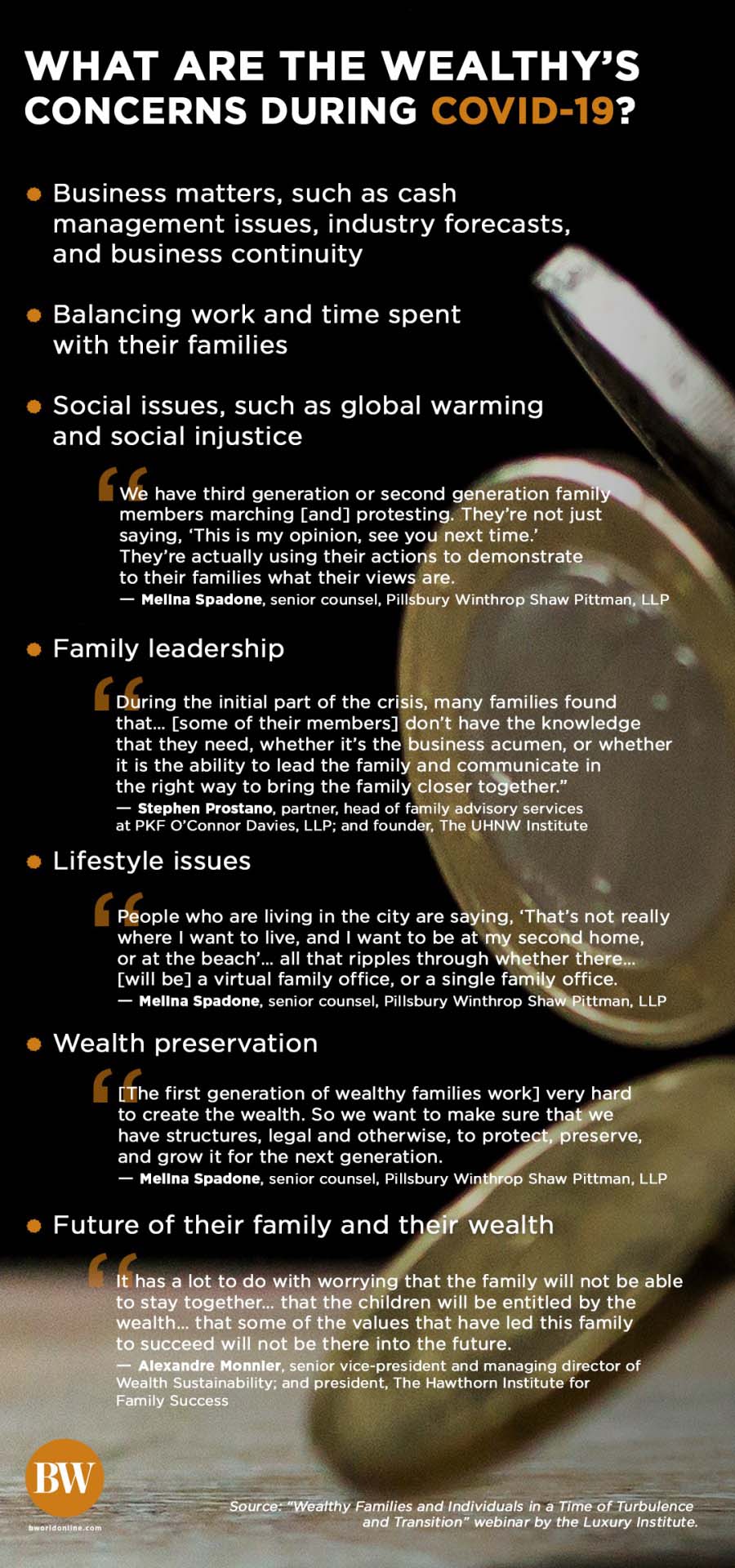

Alexandre Monnier, senior vice-president and managing director of Wealth Sustainability and president of The Hawthorn Institute for Family Success, has been keeping in touch with their clients during this pandemic. During their conversations, he said that many wealthy families have been contemplating how they can use their riches for good.

“[They’re] going away from the traditional wealth preservation model where a first generation would create wealth and the other family members would try to preserve it. [There’s] the desire to put the wealth to work, have an impact,” he said during “Wealthy Families and Individuals in a Time of Turbulence and Transition,” a webinar organized by the Luxury Institute.

Some members of these wealthy families have also been making their voices heard through other means.

“We have third-generation or second-generation family members marching [and] protesting. They’re not just saying, ‘This is my opinion, see you next time.’ They’re actually using their actions to demonstrate to their families what their views are,” said Melina Spadone, senior counsel at Pillsbury Winthrop Shaw Pittman, LLP, in the same webinar.

The wealthy are defined as individuals with a net worth of $100 million or more. Many of them are members of families which may either be first-generation or multigenerational.

Aside from social issues, wealthy families are thinking about their future, particularly the values and working mindset of the younger generations. They are also concerned about family leadership.

“During the initial part of the crisis, many families found that … [some of their members] don’t have the knowledge that they need, whether it’s the business acumen or whether it is the ability to lead the family and communicate in the right way to bring the family closer together,” said Stephen Prostano, partner and head of family advisory services at PKF O’Connor Davies, LLP and founder of The UHNW Institute, a non-profit think tank that addresses the needs of ultra-high-net-worth families.

These issues are on top of the business concerns that have cropped up during the pandemic, such as cash management issues, industry forecasts, and business continuity.

These issues are on top of the business concerns that have cropped up during the pandemic, such as cash management issues, industry forecasts, and business continuity.

Advisory firms have been helping wealthy families handle these issues by providing financial services. Mr. Prostano, for instance, mentioned that PKF O’Connor Davies, LLP can outsource finance officers to family businesses.

For relational problems, advisory firms have been facilitating discussions among family members, broaching topics that may be considered taboo or uncomfortable. By regularly holding such discussions, Mr. Monnier hopes to normalize them to the same level as finance-oriented talks.

“We’re trying to create an environment of making those discussions possible, allowing our clients to realize that this is not a sign of failure that they’re discussing these issues, that it’s par for the course for most families with wealth, and that there’s help out there, that there are resources that can actually help address these issues with the same level of rigor and professionalism as you did with financial issues,” he said.

These discussions are also important given that business is heavily influenced by family relations within wealthy families.

“There is no clear division between family issues and business issues and legal issues … So uniquely in family wealth and private wealth, decisions are not based on just the bottomline. You don’t look at a decision and say, ‘Is that going to make me money or not make me money?’ It’s always filtered through the lens of family values or family goals,” said Ms. Spadone. “There’s no pure — at least in my experience — legal issue, because it feeds into the financial issue, it feeds into the family dynamic, it feeds into succession and lifestyle.”

SIDEBAR | HOW TO ADVISE THE WEALTHY

Advising the wealthy is a tricky task layered with business concerns and family dynamics. So what essential steps must advisory firms keep in mind? Experts share tips in the webinar “Wealthy Families and Individuals in a Time of Turbulence and Transition” by the Luxury Institute.

• “[Have] courage to talk about the elephant in the room that everybody is avoiding, including other family members [and] family office executives… [when you] build a relationship on the real issues that matter that nobody has the courage to bring up, you build a relationship that suddenly becomes at a much higher level.” — Alexandre Monnier, senior vice-president and managing director of Wealth Sustainability; and president, The Hawthorn Institute for Family Success

• “The skills in family dynamics and emotional intelligence are, I think, a priority in terms of any advisor to families of wealth. And the ability to integrate your understanding of the interpersonal issues of a family with the financial questions and issues that they have in order to then deliver the right advice and hopefully help them develop the right plans for the future is absolutely critical.” — Stephen Prostano, partner, head of family advisory services at PKF O’Connor Davies, LLP; and founder, The UHNW Institute

• “The relationship of trust [between you and your clients] has to be built up over time. But once you’ve built it up, with one particular family or multiple families, it starts to spread. So not only are they trusting you, but they’re trusting you that if there’s something you don’t know or something you need to find out, that you’re going to use someone that you trust. — Melina Spadone, senior counsel, Pillsbury Winthrop Shaw Pittman, LLP