SEIPI sees slower growth this year

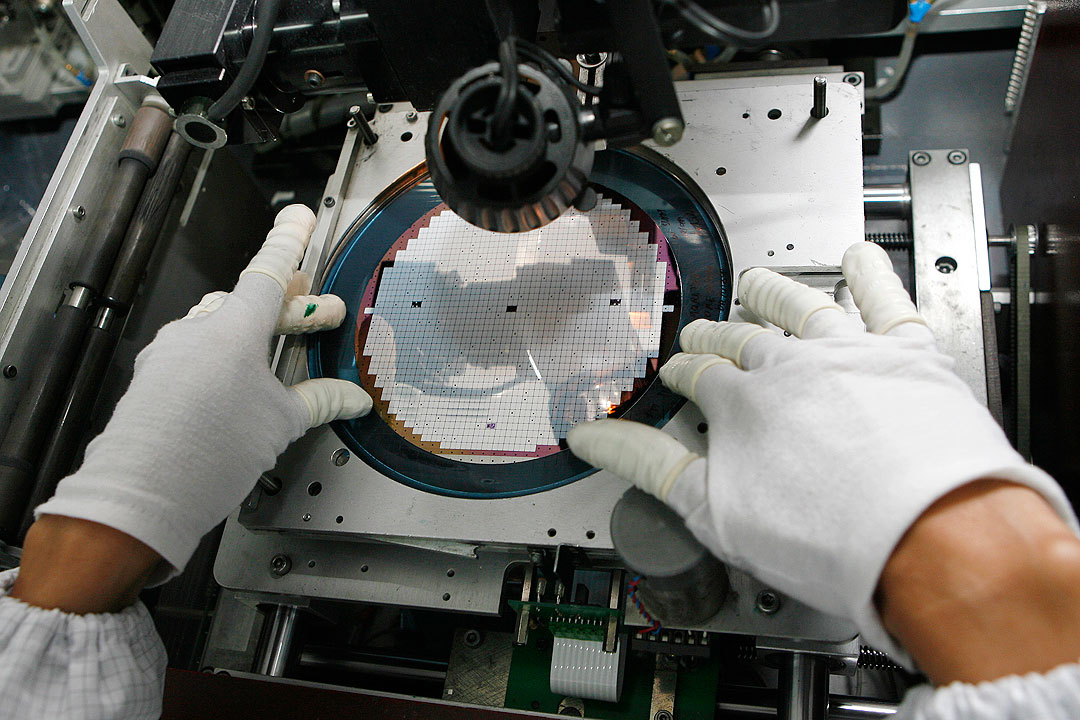

PHILIPPINE electronics exports are expected to grow at a slightly slower pace this year amid weaker global demand, the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. (SEIPI) said.

SEIPI President Danilo C. Lachica said the industry group is targeting 9% growth for Philippine electronics exports this year, slightly lower than the 10% growth goal in 2022.

“We are hoping we reach $50 billion (worth exports) by the end of the year, combined of semiconductor and electronics. It is equivalent to around 9% growth,” he told reporters at the sidelines of the US Trade and Development Agency forum in Makati City last week.

In a separate Viber message to BusinessWorld, Mr. Lachica said the lower growth target takes into account the expected slowdown in global demand this year.

He previously said SEIPI is eyeing a more “conservative” export growth target this year amid economic uncertainties and more modest demand compared to 2022.

The Philippine Statistics Authority (PSA) is scheduled to release the full-year 2022 international merchandise trade statistics data on Jan. 26.

Preliminary PSA data showed electronics exports increased by 9.2% to $42.41 billion in the January to November period, from $38.82 billon in the same period in 2021.

Data from SEIPI showed total electronics exports rose 12.9% to $45.92 billion in 2021, from $40.67 billion in 2020 due to higher demand for new technologies.

The sector accounted for 61.5% of the country’s total exports in 2021.

Meanwhile, Mr. Lachica urged the Fiscal Incentives Review Board (FIRB) to allow exporters and manufacturers to implement work-from-home arrangements (WFH).

“They have this wrong idea that because (we are in) manufacturing, no one is doing WFH, and that everybody is involved in the production line. This is not true. We are asking the FIRB to reconsider that,” Mr. Lachica said.

Last year, the FIRB allowed registered information technology and business process management firms to transfer their registration to the Board of Investments from the Philippine Economic Zone Authority to be able to continue 100% WFH arrangements without losing their incentives.

Mr. Lachica said he was disappointed the FIRB did not extend such policy for exporters.

IMPROVING COMPETITIVENESS

Meanwhile, Congress is looking at legislative measures that will help boost the competitiveness of the semiconductor manufacturing sector, House ways and means committee chairman and Albay Rep. Jose Ma. Clemente S. Salceda said.

“We are trying to solve the issue of input value-added tax (VAT) for indirect exporters, since this will be among the biggest compliance and friction costs. We are also exploring ringfencing for excised industries and for re-exporters, so that we can be looser with input VAT enforcement with semicons,” Mr. Salceda said during the Indo-Pacific Business Forum on Jan. 12, according to a statement.

The House committee on ways and means has also directed the Trade department to create a comprehensive list of Strategic Investment Priority Plan-eligible industries under the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law, he added.

“We are also recommending the guidelines for the super-incentives package under CREATE,” Mr. Salceda said.

Mr. Salceda said that the Philippines will likely benefit from the United States’ Creating Helpful Incentives to Produce Semiconductors Act, as well as “fostering closer ties” with Taiwan.

“The Philippines has the following going for it. Geostrategic location, because among Indo-Pacific countries, we are the closest to Taiwan, which makes 90% of advanced chips,” he said.

“Our workforce is highly trainable, Western-predisposed workforce with high educational attainment — good for product testing, assembly, packaging, and research and development in chips.”

Mr. Salceda also noted the Philippines has “one of the most attractive tax incentives regimes in the region.”

The manufacturing sector, which consists of electronics, electrical products, and semiconductors, enjoyed P364.3-billion tax incentives in 2021, according to a report by the Congressional Policy and Budget Research Department. — Revin Mikhael D. Ochave and Beatriz Marie D. Cruz