Inflation uptick seen in Aug. — poll

By Keisha B. Ta-asan, Reporter

HEADLINE INFLATION may have seen an uptick in August, ending six months of steady decline due to rising prices of fuel and key food items.

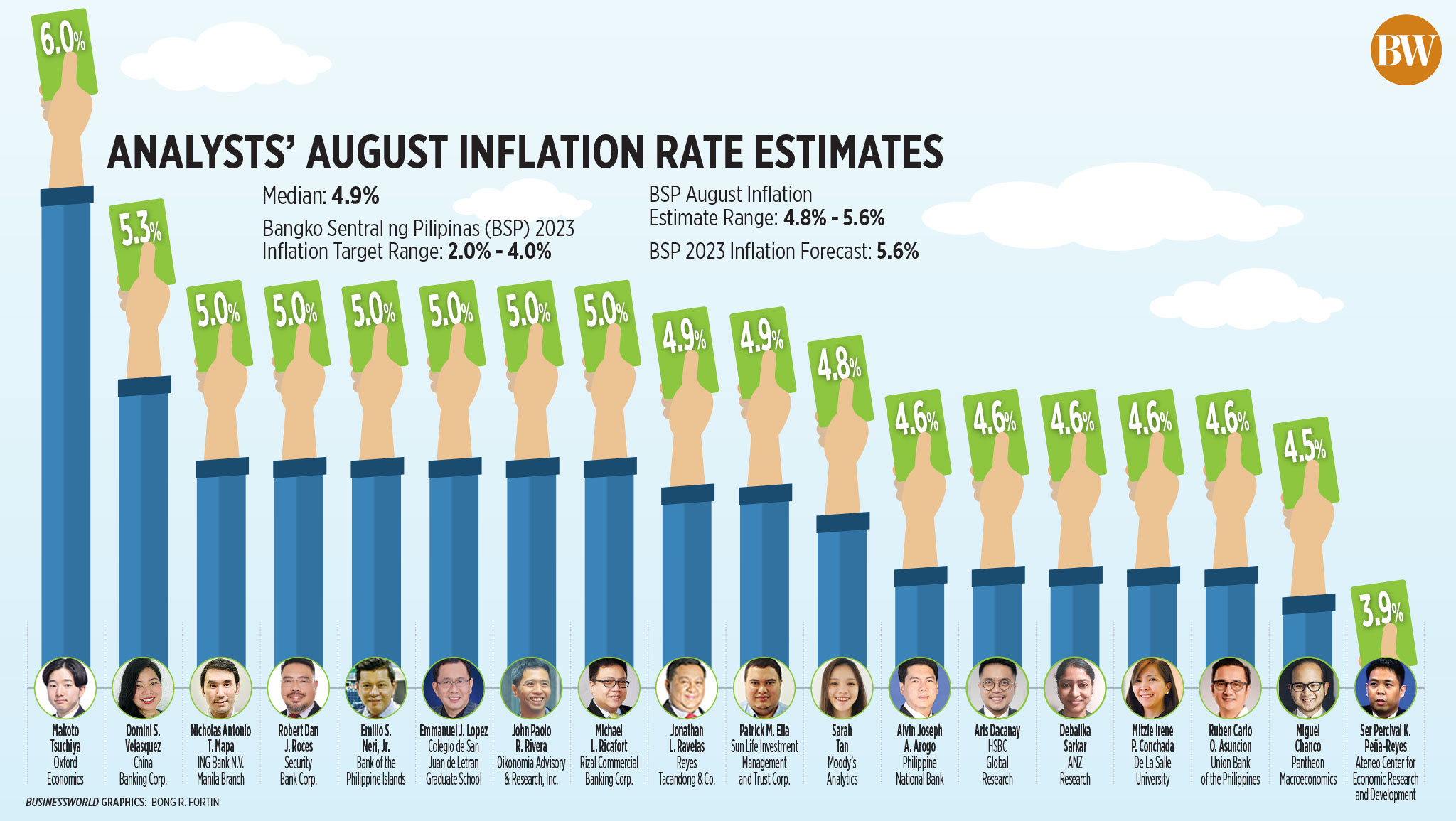

A BusinessWorld poll of 18 analysts yielded a median estimate of 4.9% for August inflation, settling within the 4.8% to 5.6% forecast by the Bangko Sentral ng Pilipinas (BSP).

If realized, this would be faster than the 4.7% in July, but slower than the 6.3% print in August 2022. It would also mark the 17th straight month of inflation exceeding the BSP’s 2-4% target.

August inflation data will be released on Sept. 5 (Tuesday).

Moody’s Analytics economist Sarah Tan said inflation likely inched up from July, reversing the downtrend seen in the last six months.

“For starters, prices of palay and rice have risen as local and global farmgate prices soared due to lower domestic harvests and rising import costs,” Ms. Tan said in an e-mail.

Rice is a staple food in the Philippines, accounting for a significant component in the country’s food inflation. Rice accounts for about 8.9% of the country’s consumer price index (CPI) basket.

Based on data from the Department of Agriculture (DA), the average price of a kilogram of local well-milled rice ranged from P47 to P56 as of Aug. 30, higher than the P41-P49 range as of Aug. 1.

“Adding to the pain, Super Typhoon Saola (local name: Goring) swept through much of the Northern provinces in late August and damaged agricultural produce such as rice and corn,” Ms. Tan said.

According to the DA, agricultural damage caused by Super Typhoon Goring was estimated at P898.4 million as of Sept. 2, with rice losses amounting to P751.5 million, while corn damage stood at P139.2 million.

“Sequential typhoons since the end of July pushed up food prices. Imported rice was also significantly higher due to India’s exports curbs and reported hoarding in Thailand,” China Banking Corp. Chief Economist Domini S. Velasquez said in an e-mail.

Global rice prices have jumped since India on July 20 banned the export of non-basmati white rice to curb the spike in local prices. The Philippines is one of the world’s biggest rice importers, with nearly 90% coming from Vietnam.

Ms. Velasquez said the peso depreciation could have also made rice imports more expensive.

Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., likewise said August inflation could “surprise to the upside” due to higher prices of rice and oil, as well as a weaker peso.

The peso closed at P56.595 on Aug. 31, depreciating by 3% or P1.715 from the P54.88 finish on July 31. Year to date, the peso depreciated by 1.5% or P0.84 from its P55.755 close on Dec. 29.

Makoto Tsuchiya, assistant economist from Oxford Economics Japan, noted that domestic pump prices have been rising since mid-July, and this will be reflected in the August inflation data.

In August alone, oil companies raised pump prices by P5.90 per liter for gasoline, P9.90 per liter for diesel and P10 per liter for kerosene.

“Although the current diesel pump price is significantly lower than the P75 per liter average recorded in June of the previous year, food and fuel prices continue to be the main drivers of inflation,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris Dacanay attributed the sharp increase in local pump prices to the supply output cuts done by the Organization of the Petroleum Exporting Countries (OPEC).

OPEC and its allies (OPEC+) earlier said it plans to extend its oil production cuts, with top exporter Saudi Arabia expected to extend its one-million-barrel-per-day voluntary supply cut for another month.

“Additionally, the price of LPG (liquefied petroleum gas) also ticked up in August,” Ms. Velasquez said.

Cooking gas prices rose by P4.55 per kilogram in August, while prices of AutoLPG were up by P2.54 per liter.

The implementation of higher toll fees in key expressways may have contributed to food inflation as these added to transport costs of agricultural commodities.

“Offsetting these increases was a sizeable 2.5% downward adjustment in electricity rates and a continued normalization of vegetable prices such as that of onions,” Mr. Dacanay said.

Manila Electric Co. lowered rates by P0.29 per kilowatt-hour (kWh) to P10.90 per kWh in August from P11.19 per kWh in July.

“Despite the projected higher headline rate in August, core inflation is expected to continue its downtrend to around 6% in August,” Ms. Velasquez said.

Core inflation, which excludes volatile items of food and fuel prices, slowed to 6.7% in July from 7.4% in June. For the first half, core inflation averaged 7.6%.

Mr. Roces also noted that the increase in August inflation is more moderate compared with the inflation spike from December 2022 to February 2023.

“While there is a noticeable increase in the price of rice, the overall inflation rate for August 2023 remains within a reasonable area and is significantly lower than the surge experienced earlier this year,” Mr. Roces said.

DISINFLATION TO RESUME

Despite the uptick in August, analysts expect consumer prices to continue easing for the rest of the year due to base effects.

“Beyond August, we expect disinflation to resume, reaching the BSP’s 2%-4% target by the end of the year. However, supply-side developments are highly uncertain, and so this outlook comes with risks,” Mr. Tsuchiya said.

According to Ms. Tan, El Niño is one of the key risks that could keep inflation higher for longer.

“Top of the list is the potential El Niño weather pattern which brings about a dry spell to the country and damage local agricultural produce. This will add stress to the already tight supply,” she said.

Pantheon Chief Emerging Asia Economist Miguel Chanco said inflation may return to the central bank’s 2-4% target in October, but downside risks are increasing due to the El Niño.

“The direct impact of this year’s hotter-than-expected temperatures is still unclear, but governments around the region are already taking preemptive measures to secure food supplies — largely by restricting exports of key foods — posing an indirect inflation risk to net food importers like the Philippines,” he said.

If inflation rose in August from its 4.7% clip in July, the Monetary Board may not immediately react with higher policy rates, Ms. Velasquez said.

“Shocks for the month of August were largely supply side but has not, so far, detailed the inflation path towards the target range in the fourth quarter. We still expect inflation to fall within the BSP’s target by November,” she said.

The BSP currently sees inflation returning to the 2-4% target band by the fourth quarter. It sees inflation averaging 5.6% in 2023 before easing to 3.2% in 2024.

“Looking ahead, we still see that inflation will fall into the BSP’s target range of 2-4% by the fourth quarter of this year, barring sustained spikes in rice and fuel in the remaining months of 2023; these remain considerable upside risks to the inflation projections,” Mr. Roces said.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said any sharp upticks in rice, electricity, and transport could “spell a renewed flareup for Philippine inflation.”

“We had originally penciled in a BSP rate cut by the first quarter of next year given the disappointing second-quarter GDP (gross domestic product) report,” Mr. Mapa said.

The Philippine economy grew by 4.3% in the second quarter, weaker than the 6.4% growth in the first quarter and 7.5% a year ago.

“However, if we continue to see rice and energy prices tick higher in the coming months, we could see BSP delaying its planned easing to mid-2024,” Mr. Mapa said.

To tame inflation, the BSP hiked benchmark interest rates by 425 basis points from May 2022 to March 2023. This brought the key policy rate to 6.25%, its highest level in nearly 16 years.

The Monetary Board will have its next policy review on Sept. 21.