Q2 GDP growth likely slowed further

By Mariedel Irish U. Catilogo, Researcher

PHILIPPINE ECONOMIC GROWTH likely moderated in the second quarter as still-elevated inflation and high borrowing costs continued to dampen consumption.

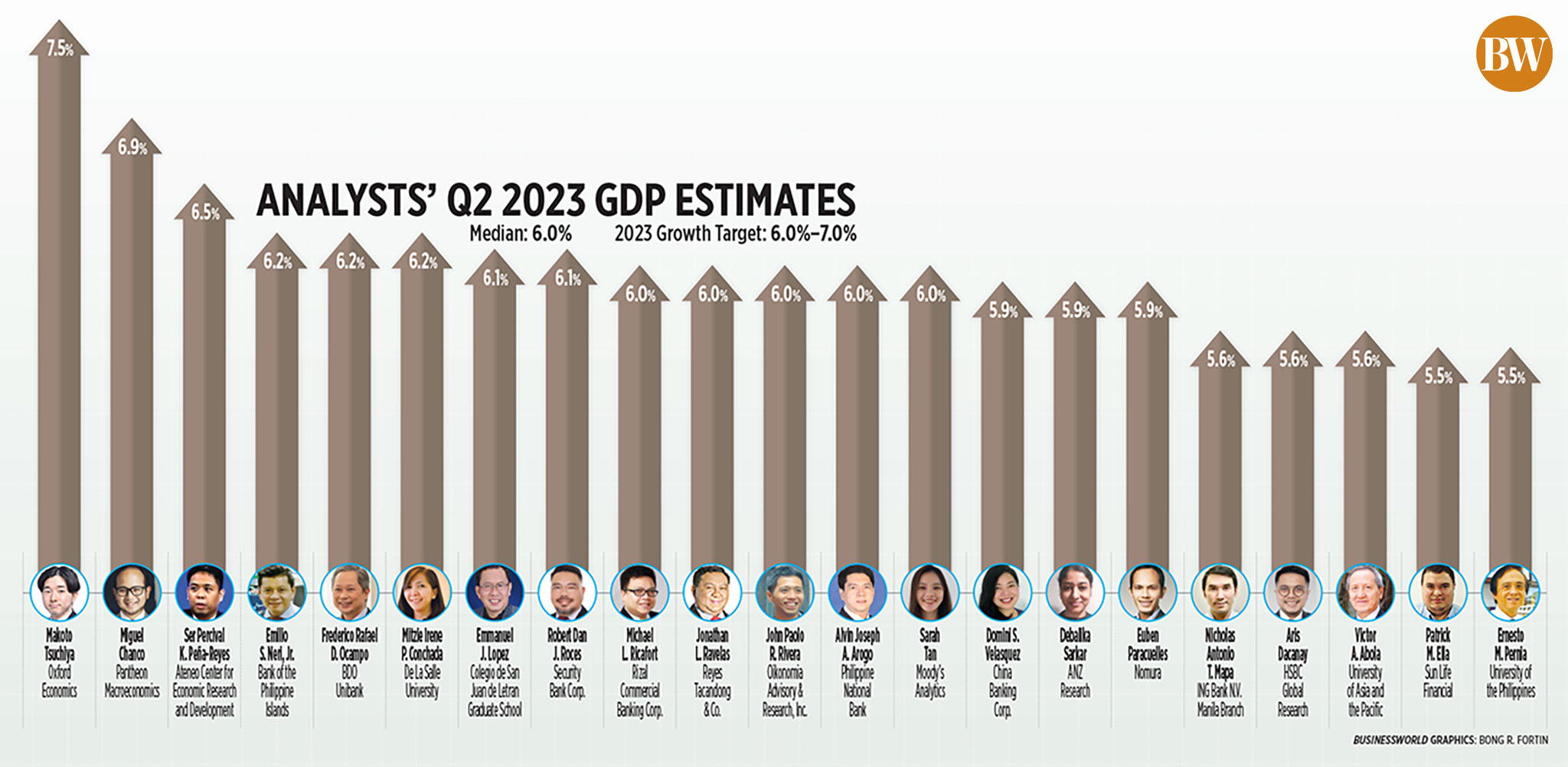

A BusinessWorld poll of 21 economists conducted last week yielded a median estimate of 6% gross domestic product (GDP) growth for the April-to-June period.

If realized, this would be slower than the 6.4% growth in the first quarter and the 7.5% expansion in the same period in 2022.

This would bring the average GDP growth to 6.2% in the first half, still within the government’s 6%-7% full-year target.

The Philippine Statistics Authority (PSA) is set to report the second-quarter GDP growth data on Aug. 10.

“We believe that high inflation and elevated interest rates dampened household spending and capital formation, respectively, (in the second quarter),” Philippine National Bank economist Alvin Joseph A. Arogo said.

Since peaking at a 14-year high of 8.7% in January, headline inflation has been on a downtrend and eased to 5.4% in June, bringing the six-month average to 7.2%.

However, this is still above the Bangko Sentral ng Pilipinas’ (BSP) 2%-4% target range, and 5.4% full-year forecast.

The BSP has hiked borrowing costs by a total of 425 basis points from May 2022 to March 2023 to tame inflation, bringing the key rate to a near 16-year high of 6.25%.

“We expect private consumption to have slowed. Household credit growth has plateaued while the outstanding quantum of time deposits reached an all-time high level in May, thanks to elevated interest rates,” ANZ Research economist Debalika Sarkar said in an e-mail.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said second- quarter economic growth may have been supported by higher remittances, rising vehicle sales, a lower unemployment rate and easing inflation.

“Downside risks to our forecast include the slowdown in government spending and the contraction in imports,” Mr. Neri said in an e-mail.

Pantheon Macroeconomics Chief Emerging Asia economist Miguel Chanco said there would have been a further slowdown on quarter-on-quarter GDP growth in the second quarter “due to broad-based slowdown in domestic demand (i.e. consumption, government spending and investment).”

State spending reached P2.41 trillion in the first half, 6.6% below the P2.58-trillion expenditure program for the period.

“Another reason for the moderation is the slowing global growth which continues to be a heavy weight on merchandise exports. Further, a slower-than-expected return of Chinese tourists will keep service exports soft,” Moody’s Analytics Associate Economist Sarah Tan said in an e-mail.

Makoto Tsuchiya, assistant economist at Oxford Economics, said he expects the economy grew by 7.5% year on year in the second quarter “largely due to base effects as sequential momentum slowed.”

“While the IT cycle likely hit bottom, we don’t expect a swift rebound in electronics exports, and general external demand likely remained modest. On the domestic front, a waning reopening boost led to a sequential slowdown in household spending,” Mr. Tsuchiya said in an e-mail.

Despite the slower growth in the second quarter, Philippine economic output was still likely the fastest among Southeast Asian countries, according to Aris Dacanay, ASEAN economist at HSBC Global Research.

“We think growth remained resilient as labor grew above the demographic trend, which means there were more hands on deck to support the economy. Furthermore, government surveys show that consumption may have been sustained as households continue to save less than pre-pandemic levels,” Mr. Dacanay said in an e-mail.

OUTLOOK

Economists expect growth to further moderate for the rest of the year, as a global slowdown remains a downside risk.

“We expect further moderation in year-on-year GDP growth in the third quarter. Given that policy rates are unlikely to be trimmed this year, this means that households have to cope with high borrowing costs for the rest of the year… Further, the slowing global growth is expected to linger through the rest of the year; that will hurt demand for the country’s goods and weaken the current account deficit,” Ms. Tan said.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said the “worrying” trends in imports and bank lending support his expectation that the 6.4% first-quarter GDP growth was likely the peak for the year.

“Slowing growth momentum in tandem with mounting headwinds on the global front suggests growth will slow over the coming quarters, with 2023 growth likely settling at 5.6% year on year in our view,” he said.

The lagged impact of the BSP’s aggressive monetary tightening is expected to be felt in the next few months, which would further slow economic growth.

“Domestic demand has been resilient so far but will run out of steam as the effect of monetary tightening kicks in and the reopening boost fades, resulting in a more normalized spending pattern,” Oxford Economics’ Mr. Tsuchiya said.