July inflation likely eased below 5%

By Keisha B. Ta-asan, Reporter

INFLATION likely further eased to below the 5% level in July, as base effects and lower power rates may have tempered higher food costs and pump prices, a BusinessWorld poll showed.

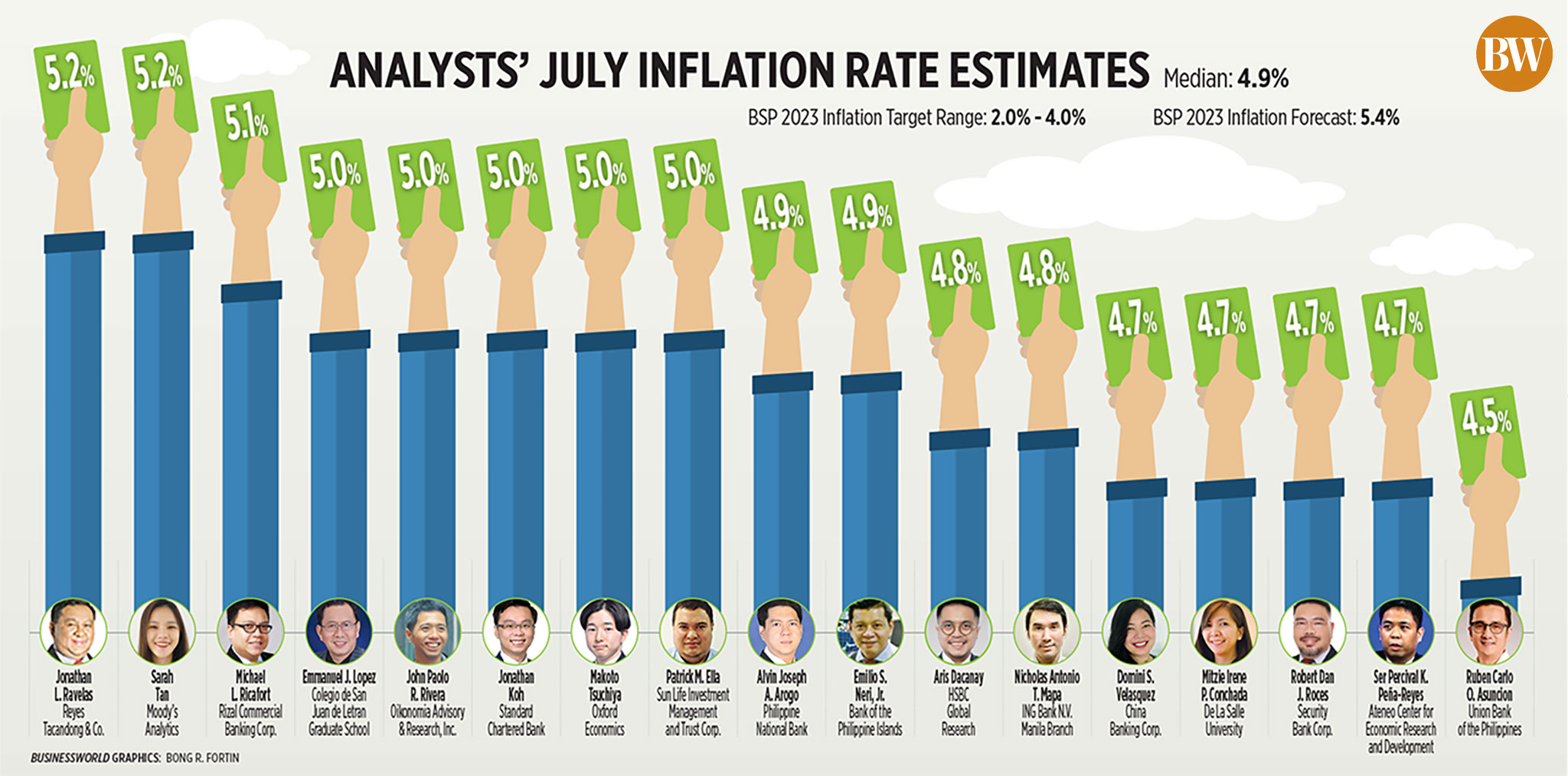

A BusinessWorld poll of 17 analysts yielded a median estimate of 4.9% for July inflation, which would be slower than the 5.4% print seen in June and the 6.4% print in July 2022.

If realized, July would mark the sixth straight month of slowing inflation and the first time that inflation fell below 5% since 4.9% in April 2022.

July inflation would also likely exceed the central bank’s annual 2-4% target range for the 16th straight month.

The Bangko Sentral ng Pilipinas (BSP) will release its inflation forecast today (July 31).

The Philippine Statistics Authority is scheduled to release the latest consumer price index data on Aug. 4 (Friday).

According to analysts, inflation likely decelerated further in July as lower utility rates offset the rising prices of food and oil.

“Electricity rates in all regions fell substantially from the previous month, especially in Mindanao and Batangas. This likely resulted in a negative month-on-month inflation rate for non-food items,” China Banking Corp. Chief Economist Domini S. Velasquez said.

Residential customers in areas served by Manila Electric Co. saw lower electricity bills in July after the overall rate went down by P0.72 to P11.18 per kilowatt-hour.

“Electricity prices decreased during the month while the peso strengthened against the dollar, making imports more affordable,” HSBC Global Research ASEAN economist Aris Dacanay said.

The peso closed at P54.91 on Friday, strengthening by 0.52% or 29 centavos from its P55.2 finish on June 30.

Ms. Velasquez noted prices of key food items such as rice, fish, fruits, and vegetables may have increased during the month.

“This was likely brought about by the warmer weather in July. Recent typhoons could also negatively impact food prices in the coming months, especially rice and corn in the north due to Typhoon Egay,” she said.

The estimated damage to agriculture brought by Typhoon Egay (international name: Doksuri) was valued at P1.5 billion, the latest data from the National Disaster Risk Reduction and Management Council showed.

According to Security Bank Corp. Chief Economist Robert Dan J. Roces, there may be a 0.8% month-on-month increase in food inflation due to the higher price of rice, fish, and vegetables.

“This suggests that the food sector may continue to experience volatility, which could influence inflation dynamics in the coming months, and indeed still provides significant upside risks,” Mr. Roces said.

He also noted that weather-related disruptions, supply chain issues, or changes in consumer demand may add to the volatility.

At the same time, Mr. Roces said recent pump price hikes have also added to inflationary pressures in July.

During the month, pump price adjustments stood at a net increase of P2.35 per liter for gasoline, P2.60 per liter for diesel, and P1.80 per liter for kerosene.

“Fluctuations in energy prices can significantly influence overall inflation, and any developments in the global energy market may impact domestic inflation trends,” Mr. Roces said.

Philippine National Bank economist Alvin Joseph A. Arogo said consumer prices may have increased month on month in July due to the recent wage hike in Metro Manila.

A P40 minimum wage hike in the National Capital Region took effect on July 16. There are also pending wage hike petitions in other regions such as Central Luzon, Calabarzon, Western Visayas and Central Visayas which will likely be resolved by September.

“We think the price pressures from higher wages will be more pronounced in the months ahead,” Mr. Dacanay said.

He noted India’s recent decision to ban exports of non-basmati white rice is another upside risk to inflation.

The Philippines is one of the world’s biggest rice importers, although it usually buys from Vietnam.

President Ferdinand R. Marcos, Jr. on Saturday said the Philippines should boost rice stocks and may consider a supply deal with India in preparation for the impact of El Niño.

Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, said the ongoing conflict in Ukraine and the El Niño weather event may lead to more supply chain constraints in the coming months.

Last week, Russia decided to withdraw from a grain agreement that blocks Ukrainian grain exports in the Black Sea.

“The government must ensure timely importation of important food items to keep supply chains well-oiled and functioning efficiently,” Mr. Mapa said.

“Given the immense power at the disposal of the President, who holds the concurrent position of Agriculture secretary, we believe that prices should continue to go down if all measures to ensure food security are carried out effectively and immediately,” he added.

Mr. Arogo noted that despite the emerging risks, base effects will continue to bring year-on-year inflation towards the 2-4% target range in the fourth quarter this year.

POLICY OUTLOOK

Analysts said that the Monetary Board may extend its policy hold next month, as inflation is on track to hit the target before the year ends.

The Monetary Board has raised borrowing costs by 425 basis points (bps) from May 2022 to March 2023. This brought the policy rate to 6.25%, a near 16-year high.

“Sticking to this data-driven mantra, monetary policy will be flexible enough to carry out rate hikes when warranted, pause when needed, and cut when necessary. As of now, the bias is still to hike rates, if needed, given that inflation remains above target and growth above 6%,” Mr. Mapa said.

The Philippine economy grew by 6.4% in the first quarter, its slowest in two years.

“In the coming months, should inflation fall comfortably within target and growth slows considerably, BSP Governor [Eli M.] Remolona indicated that he can talk about rate cuts and consider them to insulate the economy, if need be,” Mr. Mapa added.

Makoto Tsuchiya, an assistant economist from Oxford Economics, said easing inflation gives the BSP some comfort in pausing at its August meeting despite the latest rate hike by the US Federal Reserve.

“The peso is unlikely to weaken to the extent seen last year as the domestic economic recovery is more advanced. On top of this, with much lower domestic inflation, the central bank can be more tolerant of currency depreciation,” Mr. Tsuchiya said.

The US Federal Reserve raised the federal funds rate target range by 25 bps to 5.25-5.5% last week, the highest level in 22 years.

“If the exchange rate sharply weakens due to the lower BSP-Fed interest rate differential, however, then we believe that BSP will act fast. This can be in the form of a clear advance guidance or even an unscheduled meeting,” Mr. Arogo said.

Mr. Dacanay noted that the BSP may only cut rates after the US Fed starts its policy easing.

The Monetary Board’s next policy review is scheduled on Aug. 17.