(Second of two parts)

As we discussed in the first part of this article, the tax system in the Philippines has been significantly affected by the strict implementation of the enhanced community quarantine (ECQ) and social distancing measures imposed by the Government to address the COVID-19 crisis.

With the extension of deadlines for 2019 annual income tax returns (ITRs) and other tax filings, the Bureau of Internal Revenue (BIR) also relaxed the deadlines for other tax reportorial requirements. The BIR also introduced and implemented new policies to ensure continuous operations and for duties to be fulfilled despite the ECQ and in the spirit of service to the community.

More recently, Finance Secretary Carlos G. Dominguez III, with the recommendation of BIR Commissioner Caesar R. Dulay, promulgated Revenue Regulations (RR) No. 7-2020, implementing Section 4 (z) of Republic Act (RA) No. 11469, otherwise known as the Bayanihan to Heal as One Act, particularly on the extension of statutory deadlines and timelines for the filing and submission of any document and the payment of taxes.

Note that the deadline extensions mentioned in the first part of this article are consistent with the recently issued RR except for the following:

• The required submission of attachments to e-filed annual ITR was moved to June 1

• The provision qualifying the application of the tax filing extensions to certain jurisdiction was not mentioned

In the second part of this article, we discuss these additional BIR initiatives during the ECQ.

FILING AND SUBMISSION OF TAX ASSESSMENT CORRESPONDENCE:

In view of the suspension of offices under the Executive Branch, the BIR issued Revenue Memorandum Circular (RMC) No. 31-2020 on March 23 that gives taxpayers 30 days from the date of the lifting of the ECQ to submit the following documents:

• Letter Answer to Notice of Informal Conference (NIC)

• Response to the Preliminary Assessment Notice (PAN), Protest Letter to Final Assessment Notice (FAN)/Formal Letter of Demand (FLD)

• Submission of relevant supporting documents to support the requirements for re-investigation of audit cases with FAN/FLD

• Appeal/Request for Reconsideration to the Commissioner on the Final Decision on Disputed Assessment (FDDA) and other similar letters and correspondences with due dates

The extension applies to taxpayers whose response to the revised NIC, PAN, FAN, FLD, FDDA, and other similar notices fall due within the ECQ period. The extension also applies to other jurisdictions where concerned Local Government Units (LGUs) have adopted and implemented the ECQ measures.

We should note that the deadline extension is consistent with RR No. 7-2020. However, it does not provide for any qualification on the jurisdictions to which such extension shall apply.

Consequently, target collection from covered tax assessments by the concerned jurisdictions may be delayed, potentially adding to the expected shortfall in tax collections from 2019 annual income tax filings.

FILING OF CERTIFICATE OF RESIDENCE FOR TAX TREATY RELIEF (CORTT) FORMS:

A deadline extension was also given to parties concerned with the filing of the CORTT Form through the issuance of RMC No. 32-2020, dated March 20, and RR No. 7-2020.

As a brief background, on March 28, the BIR issued Revenue Memorandum Order (RMO) No. 8-2017 to modify the procedure for availing of tax treaty benefits on the payments of dividends, interest, and royalties to non-residents. It provides that, in lieu of the tax treaty relief application (TTRA) required by RMO No.72-2010, preferential treaty rates for dividends, interests and royalties shall be applied and used outright. Under the procedure, non-residents claiming tax treaty relief shall submit a duly accomplished CORTT Form to the International Tax Division (ITAD) and Revenue District Office (RDO) within 30 days after payment of withholding taxes due on the dividend, interest and royalty income of non-residents based on the applicable tax treaty.

Previously, the filing of COURT Forms for final withholding taxes on said income types paid on or before March 10 were to be made on or before April 13. This has been extended to April 30 without penalty.

AVAILING TAX AMNESTY ON DELINQUENCY:

Also extended is the period to avail of the tax amnesty on delinquency covering the taxable year 2017 and prior years.

President Duterte signed Republic Act (RA) No. 11213, which includes the Tax Amnesty on Delinquency. The BIR then issued Revenue Regulations (RR) No. 4-2019 to implement the rules on tax amnesty on delinquency effective April 24, 2019.ÊThe provisions of RR No. 4-2019 were further amended by RR No. 5-2020, particularly on the duration that it may be availed of given current conditions.

Most recently, the BIR issued RMC No. 33-2020 dated March 24, extending the deadline on availing of tax amnesty on delinquencies under RR 4-2019, as amended by RR No. 5-2020, to May 23.ÊSuch extension was also consistent with RR No. 7-2020.

ACCEPTING TAX RETURNS:

The BIR implemented policies in relation to accepting 2019 annual ITR and other tax returns with due dates that fall within the ECQ.

On March 23, the BIR issued Bank Bulletin No. 2020-03 to reiterate the relevant responsibilities of authorized agent banks (AABs) in connection with the “file and pay anywhere” rule provided by the BIR under RMC No. 28-2020 to ease the process of filing and paying the 2019 annual ITR. It authorizes all AABs to accept payments of 2019 annual income tax until May 15 without imposing penalties. The same 30-day extension applies to payments of tax returns with due dates that fall within the ECQ, including out-of-district returns.

LGU INITIATIVES:

Certain LGU offices in the National Capital Region announced the deadline extension for real property taxes and other local business taxes. Hopefully, other LGUs nationwide will follow suit.

WHAT TO EXPECT:

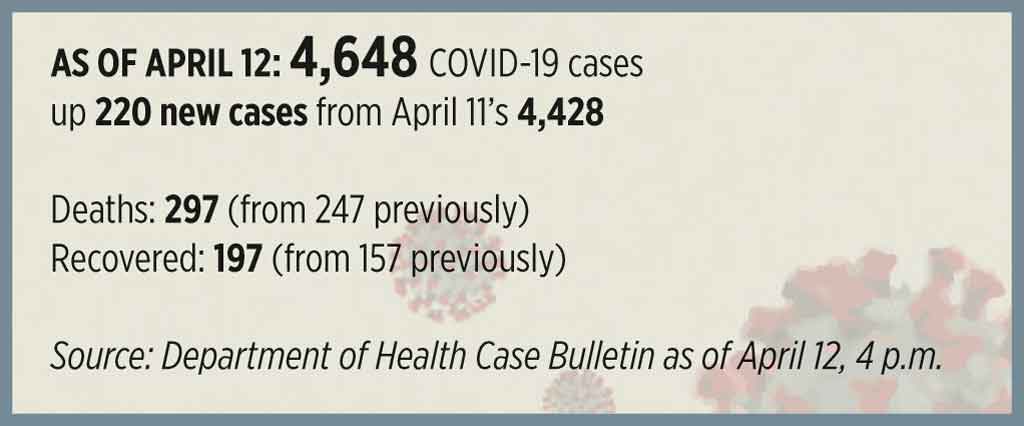

With the rising number of positive COVID-19 cases in the country, government may become more stringent in implementing ECQ measures. Despite this, the tax authorities are doing their share to help ease the burden on taxpayers.

We cannot tell where this pandemic will take us or when it will inevitably end. What we do know is that in the middle of this uncertainty, we are all reminded of one enduring Filipino value — solidarity. Given the very limited options that taxpayers have during the ECQ, one of our best expressions of solidarity would be to comply with our tax obligations that will provide the government with the much-needed resources to overcome this adversity and for the good of the nation.

The deadlines and timelines mentioned in this article are pursuant to the Author’s understanding of the existing administrative issuances of the BIR as of the date of writing. These may be subject to change in light of the recently passed RA No. 11469 or the Bayanihan to Heal as One Act, which authorizes the President to move statutory deadlines and timelines for the submission of documents and payment of taxes, fees, and other charges required by law, among others.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views reflected in this article are the views of the author and do not necessarily reflect the views of SGV, the global EY organization or its member firms. EYG no. 001665-20Gbl

Noel Andro D. Bico is a Senior Associate from the Global Compliance & Reporting Sub-Service Line of SGV & Co.