Stocks close flat on foreigners’ window dressing

THE MAIN INDEX closed flat at the start of the third quarter amid a 142% jump in value turnover and month-end window dressing by foreign investors.

The 30-member Philippine Stock Exchange index (PSEi) picked up 1.99 points or 0.03% to end at 6,209.71 on Wednesday, while the broader all shares index gained 5.58 points or 0.15 to close at 3,650.75.

Philstocks Financial, Inc. Research Associate Piper Chaucer E. Tan said in a text message that “the significant amount in value turnover came from the First Gen tender offer,” referring to the P9.6-billion tender offer of Lopez-led First Gen Corp.

Valorous Asia Holdings Pte. Ltd., a company under global investment firm KKR & Co., Inc., completed buying 11.9% of First Gen’s outstanding common shares through a tender offer on Monday. Shares in First Gen increased 2.04% at the end of Wednesday’s session.

Value turnover at the PSE jumped to P15.66 billion from P6.47 billion the previous day. Some 1.45 billion issues switched hands.

Mr. Tan said the net foreign buying of P6.24 billion seen on Wednesday, which was a turnaround from the net selling of P833 million seen the previous day, also helped push the PSEi up.

“We think that this is brought by the month-end window dressing,” he said.

For Regina Capital Development Corp. Head of Sales Luis A. Limlingan, the rally of Philippine shares is due to a good start for the third quarter, citing investor optimism over “positive trends in the virus, reopening of economies and a hope of a vaccine.”

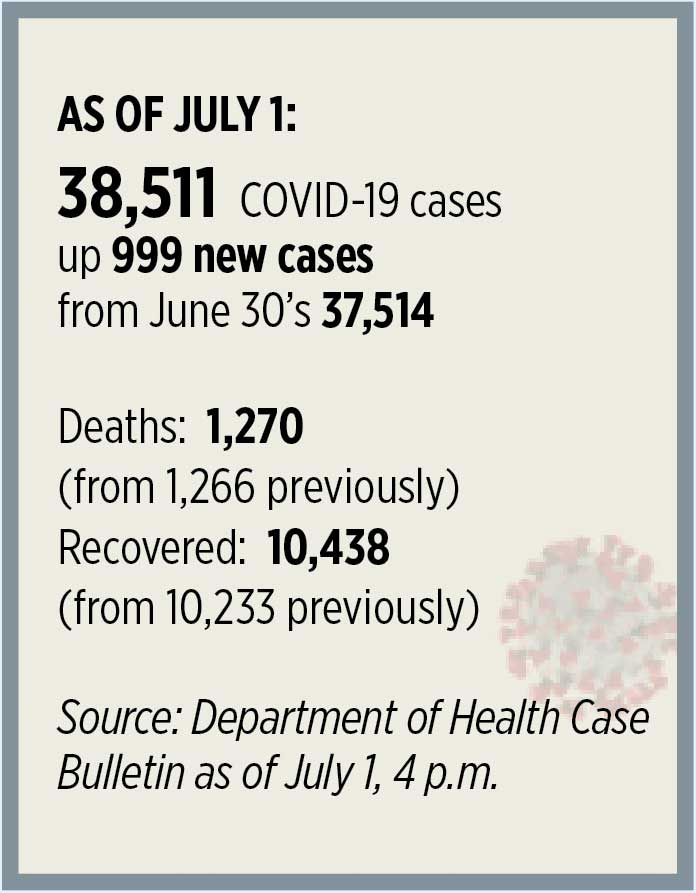

Despite the continued rise in coronavirus disease 2019 (COVID-19) cases across the world, governments continue to allow the resumption of business activities in favor of an economic rebound.

Mr. Tan said this might also be spurring optimism in the Philippines, as the government decided Wednesday night to extend the relaxed lockdown in Metro Manila.

“I think that investors are somehow optimistic that the National Capital Region is not reverted back to (a strict lockdown),… and we think that investors are somehow positive about the COVID-19 cases,” he said.

Most sectoral indices at the PSE closed in green territory on Wednesday. Industrials rose 111.75 points or 1.45% to 7,814.16; property increased 21.79 points or 0.71% to 3,072.24; mining and oil improved 9.10 points or 0.17% to 5,219.37; and financials climbed 1.90 point or 0.15% to 1,235.86.

On the other hand, holding firms erased 39.79 points or 0.61% to 6,413.55; and services shed 6.31 points or 0.45% to 1,397.37.

Decliners beat advancers by three, 98 against 95, while 47 names ended unchanged.

Meanwhile, on Wall Street, the Dow Jones Industrial Average rose 217.08 points or 0.85% to 25,812.88; the S&P 500 gained 47.05 points or 1.54% to 3,100.29; and the Nasdaq Composite added 184.61 points or 1.87% to 10,058.77. — Denise A. Valdez with Reuters