Globe services and assistance package for COVID-19 reaches P1.3 billion

During the first three months of the pandemic, Globe Telecom was able to come up with over P1.3 billion in combined services and assistance package for COVID-19. This consists of support for Globe employees and vendor partners, services and promos, external fund-raising efforts, monetary and in-kind donations.

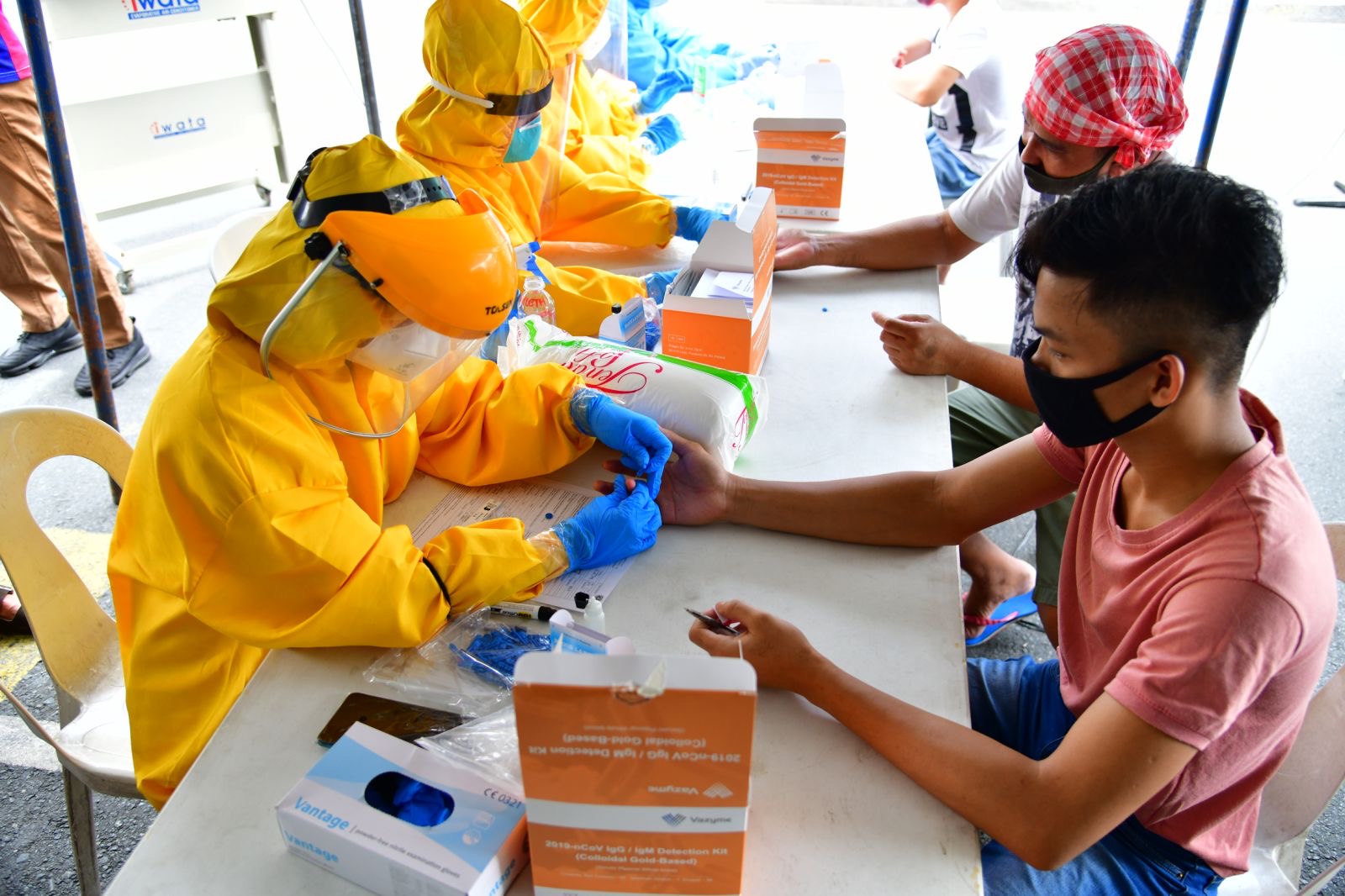

The bulk of the amount went to salaries and benefits which Globe continued to provide even to managed service partners and vendor employees to help ensure their safety, health, and well-being as well as their families. Globe currently holds weekly rapid antibody testing of all its frontliners and has contributed to the AC Health COVID-19 facility to accommodate its workforce and their families who may contract the virus.

The company has also provided food allowance, transportation, accommodation, insurance, and medical expense assistance to its critical skeletal workforce who kept back end operating systems including the Globe network fully operational during the enhanced community quarantine.

There were also numerous services and promos offered by Globe to assist both the government and its customers, ranging from toll-free hotlines and zero-rated access to select government websites and relevant apps, increased data allocation to customers, free unlimited WiFi services to hospitals, airports, and supermarkets, free or discounted access to work-from-home tools for businesses, free telehealth and mental health services, free preloaded mobile phones for hospital and government frontliners, and free SMS broadcast, among others.

In solidarity with its external and internal stakeholders, Globe launched donation drives to help frontliners, hospitals, and relevant government and non-government organizations. Millions of pesos were raised to purchase rapid antibody testing kits and personal protective equipment including face shields and face masks. Likewise, the company provided financial assistance for the conversion of the World Trade Center into a temporary healthcare facility and for the provision of relief packs for underprivileged communities.

“The impact of the pandemic to the world has been unprecedented. Yet we were able to test our resilience as an organization. Our digital-first, agile mindset and collaborative culture has helped us quickly overcome the initial shock from the community quarantine. Today we see a lot of Filipinos adopting to digital. This brings Globe at the forefront again, and our challenge this time is to make connectivity and consistent quality of experience as pervasive as possible,” said Ernest Cu, Globe President and CEO.

As restrictions ease up, Globe continuously looks for ways to make life easier for Filipinos who are still adjusting to the new normal. The company is making inroads with 917 Ventures, its wholly-owned subsidiary and the largest corporate incubator in the Philippines that provides services beyond connectivity. For instance, KonsultaMD telehealth services are now offered both through calls and video for medical consultation anytime and anywhere. For financial inclusion, GCash has extended its services to cater not only to online payments but also providing better than bank rate savings and lending facilities all in the same app.

Globe aligns its actions with United Nations Sustainable Development Goals No. 3 on good health and well-being, No. 8 on decent work and economic growth, No. 9 on industry, innovation and infrastructure, and No. 17 on partnerships for the goals.

For more information about Globe, visit www.globe.com.ph.