Arts & Culture (08/06/25)

Shoe exhibit opens at Yuchengco Museum

AVANT-GARDE footwear designer and art provocateur Joel Wijangco unveiled his latest exhibit at the Yuchengco Museum, blurring the line between fashion, sculpture, and social commentary. The exhibit showcases over 25 handcrafted shoes, each one acting as a sculptural narrative. From Bo-ho (Body Horror), a twisted stiletto exploring body dysmorphia, to Palengkera No. 1, inspired by the fishwife Amazons of Malabon’s wet markets, Mr. Wijangco’s work straddles art, fashion, and emotional archaeology. Blending surrealism, pop culture, Filipino folklore, and personal memory, Mr. Wijangco’s work playfully looks into identity, memory, and the absurdities of beauty. The exhibit at Yuchengco Museum, G/F RCBC Plaza, Ayala Ave. Corner Gil Puyat Ave., Makati City, is ongoing until Oct. 15. Admission is free.

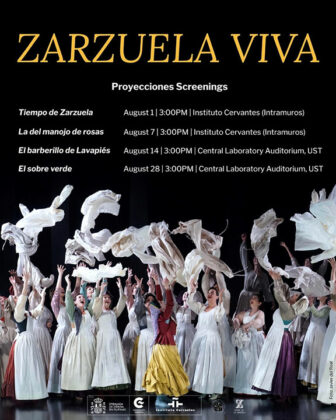

Zarzuela the focus on Instituto Cervantes in Aug.

TO BE screened on Aug. 7, 3 p.m., at the Intramuros branch of Instituto Cervantes is a production by Teatro de la Zarzuela of the classic La del manojo de rosas by Pablo Sorozábal. This is part of a month-long cultural program highlighting the shared legacy of zarzuela in the Philippines, presented by the Instituto Cervantes, the Embassy of Spain, and the University of Santo Tomas (UST). From Aug. 1 to 28, the cultural celebration, entitled Zarzuela Viva, will feature weekly zarzuela screenings, a zarzuela workshop, and a zarzuela recital. Up next will be a screening of Alfredo Sanzol’s production of El barberillo de Lavapiés by Francisco Asenjo Barbieri, on Aug. 14, and a screening of El sobre verde by Jacinto Guerrero on Aug. 28. These last two screenings will take place at 3 p.m. at the Central Laboratory Auditorium of the University of Santo Tomas. From Aug. 18 to 22, a four-day Zarzuela Workshop will be conducted by Spanish pianist Ramón Grau from Teatro de La Zarzuela in Madrid, at the Conservatory of Music of UST. On Aug. 26, the zarzuela workshop participants and Mr. Grau will present a concert, Zarzuela-Sarswela, at the Education Auditorium, UST. This event is open to public, but they should register early through this link: https://forms.office.com/e/gqQYWUHzSb. For more information about Zarzuela Viva, visit Instituto Cervantes’ website at www.manila.cervantes.es, or follow it on Facebook at https://www.facebook.com/InstitutoCervantesManila/.

New group presents Sopranong Kalbo

A NEW theater company, Teatro Meron, presents Rolando Tinio’s translation of Eugene Ionesco’s Sopranong Kalbo (The Bald Soprano), a classic of the Theater of the Absurd. Directed by Ron Capinding, it will have performances on Aug. 8 to 10 at the Rizal Minitheater of the Ateneo de Manila University in Quezon City. It stars Joel Macabenta, Miren Alvarez-Fabregas, Joseph dela Cruz, Pickles Leonidas, Goldie Soon, and Yam Yuzon. Tickets come in different categories, priced from P700 to P800 and are available at Ticket2Me.

Areté presents translation of Joaquin’s Portrait of the Artist

ARETÉ ATENEO is producing a Filipino translation of Nick Joaquin’s classic A Portrait of the Artist as Filipino, entitled Quomodo Desolata Es? The translation was written by Jerry Respeto and Guelan Varela-Luarca who is also the director. The play is set in Intramuros just before World War II and follows two sisters as they see the world change around them. It stars Gan Pangilinan, Delphine Buencamino, Omar Uddin, Vino Mabalat, and John Sanchez. There will be performances from Aug. 8 to 17 at the Hyundai Hall, Areté, Ateneo de Manila University in Quezon City. Tickets range in price from P999 to P1,499 and are available via Helixpay.

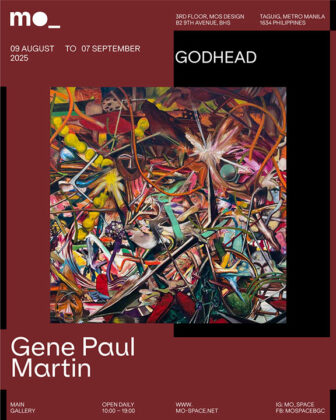

Gene Paul Martin, Is Jumalon shows at MO_Space

STARTING Aug. 9, visual artists Gene Paul Martin and Is Jumalon will have solo exhibitions at MO_Space. At the main gallery is Mr. Martin’s Godhead, where his paintings are dense islands of color and abstraction. At Gallery 2 is Ms. Jumalon’s A Garden in the Chest, where she explores invented landscapes as spaces of retreat and recognition, creating images as places of personal refuge and geographies of commonality. Both exhibits run until Sept. 7 at MO_Space in Bonifacio Global City, Taguig.

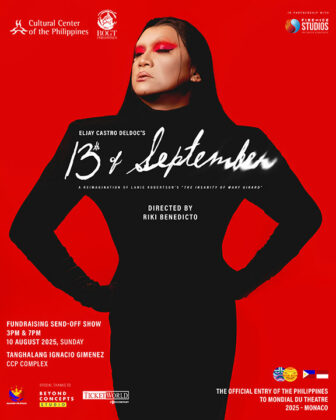

Fundraising shows before play goes to theater fest

THE Cultural Center of the Philippines (CCP) and BOGT Philippines present fundraising performances of 13th of September on Aug. 10, before the show is brought to Monaco to represent the Philippines at the Mondial du Théâtre. BOGT Philippines has said that the critically acclaimed production has received its third invitation to an international theater festival, this after joining the festivals in Canada (2019) and Germany (2021, 2022). The 18th Mondial du Théâtre in Monaco will run from Aug. 20-27. The fundraising send-off performances (to help cover essential expenses for the delegation) will be on Aug. 10, 3 and 7 p.m., at the Tanghalang Ignacio Gimenez, Cultural Center of the Philippines, Pasay City. The tickets cost P1,000 and P800 and are available on Ticketworld.com. The 13th of September is an adaptation by three-time Palanca awardee Eljay Castro Deldoc from Lanie Robertson’s The Insanity of Mary Girard, about a woman who is committed to an asylum by her husband after she becomes pregnant by another man. It is directed by Riki Benedicto and star Andoy Ranay as Mary Girard, together with Lao Rodriguez and Drew Espenocilla.

Side Show: The Musical ongoing at Power Mac

ONGOING until Aug. 17 at Circuit Makati’s Power Mac Center Spotlight is the Sandbox Collective’s production of Side Show: The Musical, which revolves around the life of conjoined twins and their fellow “freaks” who live in a carnival in 1930s America. The cast features Jon Santos, Tanya Manalang, Molly Langley, and Marvin Ong. Tickets are available through Ticket2me.

Raco Ruiz mounts 4th exhibit at Secret Fresh

VISUAL ARTIST Raco Ruiz has his fourth solo exhibit, NO WORRYS, running until Aug. 8 at Secret Fresh Gallery, Ronac Art Center, Ortigas Ave., San Juan City. Known for his signature blend of pop culture and personal storytelling, Mr. Raco is introducing a new series anchored by his original character, Razzl the Clown, now joined by a dopamine-dependent dalmatian named Dopa.

Saturday Group holds 57th anniversary exhibit

ARTISTS collective Saturday Group has marked their 57th anniversary with a major exhibit, 57, at Gallery Big at Shangri-La Plaza mall in Mandaluyong City. It is running until Aug. 9. The Saturday Group members who are part of the show include Ronnie Bercero, Franklin Caña, Daisy Carlos, Salvador Ching, Buds Convocar, Nida Cranbourne, Jonathan Dangue, Anna De Leon, Robert Deniega, Ysa Gernale, Maryrose Gisbert, Amado Hidalgo, Celeste Lecaroz, Francis Nacion, Roel Obemio, Carlo Ongchangco, Anthony Palo, Tessie Picaña, Omi Reyes, Joy Rojas, Eman Santos, Aner Sebastian, Sheila Tiangco, Magoo Valencia, Lydia Velasco, Joseph Villamar, Jik Villanueva, Migs Villanueva, Gene Artango-Villasper, Inna Nanep-Vitasa, Chewy Yap, and Melissa Yeung Yap.

Dance students critique Martial Law in performance

THE DANCE production Alimuom sa Takip-Silim, based on research-driven choreography, will highlight the social injustices of the Martial Law era. The four-act drama will be staged beginning Aug. 15. It is presented by Unfolding Productions, a group of young artists from the dance program of the De La Salle-College of Saint Benilde (DLS-CSB). The public can see the production on Aug. 15 at 4 p.m. and Aug. 16 at 1 p.m. It will be staged at the 5th Floor Theater of the Benilde Design + Arts Campus, 950 Pablo Ocampo St., Malate, Manila.

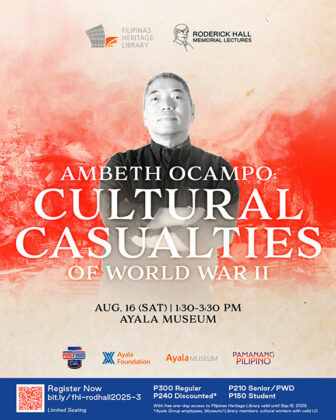

Ayala Museum hosts Ambeth Ocampo lecture on WWII

THE Filipinas Heritage Library, in partnership with Purefoods Deli, presents “Cultural Casualties of World War II,” a lecture by historian and scholar Dr. Ambeth R. Ocampo. The 1945 Battle for Manila left deep scars not only on its people but also on the city’s cultural fabric. Historic sites and structures were reduced to rubble. Irreplaceable works of art, rare books, manuscripts, and invaluable records of the past were lost forever. In this lecture, Mr. Ocampo explores the cultural cost of war, examining both tangible and intangible losses. These include those captured in the poignant postwar paintings of National Artist Fernando Amorsolo. The lecture will be held on Aug. 16, 1:30-3:30 p.m., at the Ayala Museum, Makati Ave., Makati. This is one of The Roderick Hall Memorial Lectures 2025. Tickets range in price from P150 for students to P300 for regular tickets. They come with free one-day access to the Filipinas Heritage Library valid until Sept. 16.

Richard Arimado exhibits at Galerie Joaquin

RICHARD ARIMADO has used his stylized, rotund figures and vibrant palette, to focus on scenes of communal life in his paintings. Titled Chronicles, his latest exhibition presents scenic vignettes of rural life that feel less like fixed images and more like living memory. Chronicles is on view at Galerie Joaquin until Aug. 17. The gallery is located at the R3 Level of Power Plant Mall, Rockwell Center, Makati.