By Marissa Mae M. Ramos

Researcher

THE Philippine economy shrank for the second consecutive quarter, plunging into a recession for the first time in nearly three decades, data of the Philippine Statistics Authority (PSA) showed.

Gross domestic product (GDP) slumped by 16.5% in the second quarter, the PSA said on Thursday.

This was the economy’s biggest contraction on record based on available government quarterly data dating back to 1981. The second-largest drop was in the third quarter of 1984 when GDP dropped by 10.7%.

The preliminary figure was lower than the 0.7% decline in the previous quarter and a reversal from the 5.4% growth in the second quarter of 2019. It is also worse than the median decline of 11% in a BusinessWorld poll of 17 economists conducted last week.

The second-quarter result also put the Philippines into a technical recession — defined as the economy’s GDP posting two straight quarters of decline — for the first time since 1991.

The country’s first-half GDP performance stood at -9%, lower compared to the government’s initial expected contraction of 2%-3.4% this year, as well as the later-revised 5.5% decline.

In a mobile message to BusinessWorld, PSA chief Claire Dennis S. Mapa said the decline in the second half should not exceed 2.2% for the economy to at least meet the revised target this year.

In an online press briefing on Thursday, Acting Socioeconomic Planning Secretary Karl Kendrick T. Chua said growth drivers household consumption and investment “have significantly declined” given the closures of businesses and losses in income during one of the world’s strictest lockdowns to arrest the spread of the coronavirus disease 2019 (COVID-19) in the country.

“Fully aware of the impact of the ECQ (enhanced community quarantine) on businesses and livelihoods, the government ramped up spending to protect, among others, some 18 million low-income households and 3.1 million workers of small businesses… by providing them the biggest-ever income support and wage subsidy program,” said Mr. Chua, who also heads the National Economic and Development Authority (NEDA) as director-general.

Government spending grew 22.1%, faster than the 6.8% expansion in the same three months last year. The latest figure was also the fastest since the 24.8% logged in the first quarter of 2012.

Meanwhile, household spending contracted by 15.5% compared to the 5.6% growth in the second quarter of 2019. Prior to this, the biggest year-on-year decline recorded by this segment in a quarter was 2.8% in the third quarter of 1985. Private investment, which is represented in the data as capital formation, posted a 53.5% decline — the worst since the 54.6% slump in the first quarter of 1985.

The exports and imports of goods and services shrank by record-lows of 37% and 40%, respectively.

“Capital formation… went into freefall with construction down 32.9% and investment in durable equipment plunging 62.1% as investor sentiment evaporated amidst the pandemic and 17.7% unemployment,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in a note to reporters.

Mr. Mapa also said in a separate note that the unemployment level worsened the probability of Filipino households engaging in discretionary spending as disposable incomes dwindled.

In another note, HSBC Global Research Economist Noelan C. Arbis said the magnitude of the decline seen in household spending and fixed investment is “unprecedented.”

“Net exports and government expenditures contributed positively to growth [with eight percentage points (ppt)] as a result of reduced import demand and increased social safety net spending. But these were nowhere near enough to offset the impact of the lockdown on private consumption and fixed investment — the Philippines’ two main drivers of growth over the past decade,” Mr. Arbis said.

“These two components, which account for over 90% of GDP, contributed to a 20.6-ppt drop in economic activity. This magnitude is unprecedented, as both components registered their biggest contraction on record,” he added.

Among the major economic sectors, industry posted the largest annual decline in the second quarter at 22.9% — a turnaround from the 2.5% expansion logged in the same period last year.

Likewise, services declined by 15.8%, a reversal of last year’s 7.5%.

Both slumps were largest on PSA’s record.

On the other hand, agriculture posted a 1.6% growth rate, faster than the 0.7% in the same period last year.

Gross national income — the sum of the nation’s GDP and net income received from overseas — posted a 17% decline in the April-June period compared to 4.9% growth in the 2019’s comparable three months.

DIM OUTLOOK

A few days before the GDP results were released, President Rodrigo R. Duterte put Metro Manila, Laguna, Cavite, Rizal and Bulacan back under modified ECQ (MECQ) to slow the rise in COVID-19 cases. The new lockdown began on Aug. 4 and will last until Aug. 18 after exhausted health workers asked for a “timeout” to ease the pressure on the healthcare sector.

NEDA’s Mr. Chua said reverting to MECQ “may be one step back” for economic recovery and an opportunity to address new challenges brought about by COVID-19.

He also noted that through enacting economic, social, and institutional reforms, the country is “now in a stronger position” to address the crisis unlike in previous ones.

Mr. Chua also mentioned House Bill No. 6953 or the proposed Bayanihan to Recover as One Act (Bayanihan II), which recently passed on second reading in the House of Representatives on Wednesday, as one instrument in economic recovery, along with the acceleration of the “Build, Build, Build” infrastructure program, and the 2021 national budget. “For the time being, the economic team will be providing the necessary fiscal support, as far as available resources can afford,” Mr. Chua said.

In a phone interview, Ernesto M. Pernia, Professor Emeritus of the University of the Philippines School of Economics and former Socioeconomic Planning Secretary, said GDP performance in the third quarter “would probably be just slightly better” compared to that in the second quarter.

The former Cabinet Official also noted the country’s relatively lower COVID-19-related spending such as tests and subsidies compared with neighboring countries such as Singapore, Vietnam and Indonesia. “If you compare the Philippines with ASEAN countries, we have the worst second-quarter growth rate… So the two aspects seem correlated,” he said.

“Higher spending especially for health system capacity (testing, contact tracing, isolation, and treatment, etc.) much earlier on matters a lot, as it would mean we don’t need as long and hard a lockdown as we’ve had,” Mr. Pernia added.

Bangko Sentral ng Pilipinas Governor Benjamin E. Diokno said the economy has seen the worst of COVID-19’s impact on the economy in the second quarter, but cautioned that the country is “not out of the woods yet.”

“No doubt, given the sharp drop of the economy in the second quarter, I am convinced that the [GDP performance] third quarter will be better than the second quarter and that the fourth quarter will be much better than the third quarter,” Mr. Diokno said in a Viber message to reporters.

However, the MECQ in Metro Manila and nearby areas have dimmed prospects for recovery.

“Recent reimposition of mobility restrictions on back of surging infections will impede growth recovery. Real time indicators signal a very modest improvement. Private investment is likely to remain weak as well on the back of subdued business sentiment and excess capacity,” ANZ Research Economists Kanika Bhatnagar and Sanjay Mathur said in a note sent to reporters.

For HSBC’s Mr. Arbis, the reimposition of strict lockdown measures “is likely to further curtail private consumption in the months ahead and hamper any expected recovery in the second half.”

For Capital Economics’ Asia Economist Alex Holmes: “The economic costs of trying to contain the virus is leaving large scars to household and corporate balance sheets, which will weigh heavily on demand for many months to come,” he said in a research note.

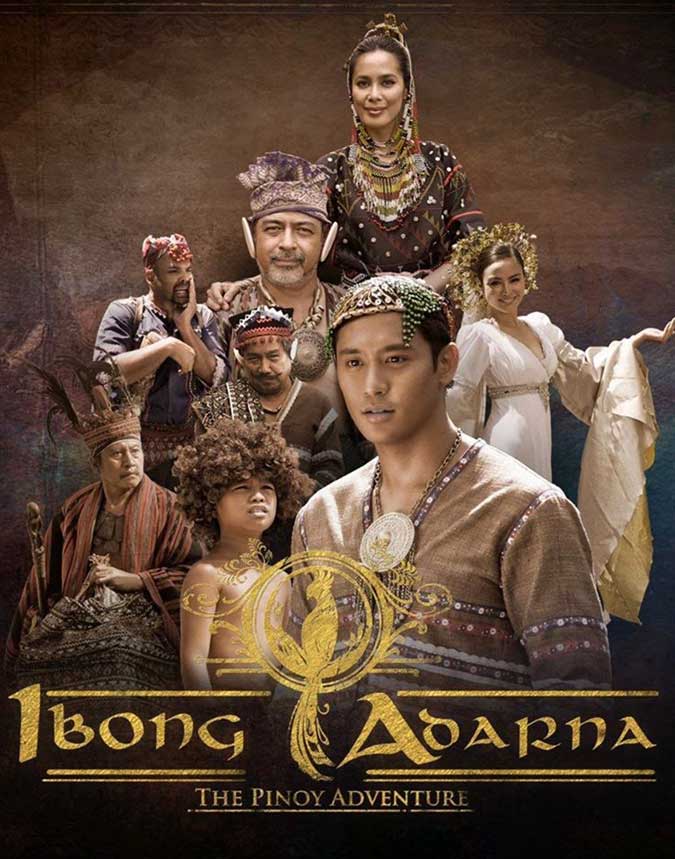

Ibong Adarna: The Pinoy Adventure

Ibong Adarna: The Pinoy Adventure